MNI ASIA OPEN: China Ups Tariffs on US, Inflation Exp Rising

EXECUTIVE SUMMARY

- MNI FED BRIEF: Fed Right To Stay Modestly Restrictive - Williams

- MNI FED BRIEF: Fed's Musalem Sees Risks In Tariff Look-Through

- MNI TARIFFS: China Raises Tariffs On US Goods To 125%

- MNI US-JAPAN: Econ Min To Meet w/Treasury Sec & USTR 17 Apr For Tariff Talks -NHK

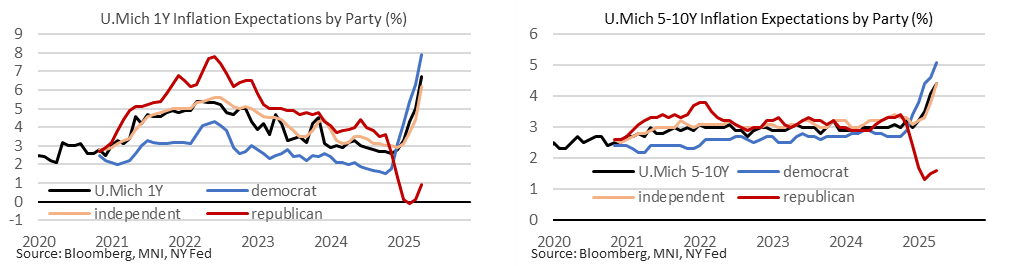

- MNI US DATA: Back To The Early 80s For L-T Inflation Expectations...Sentiment Worse

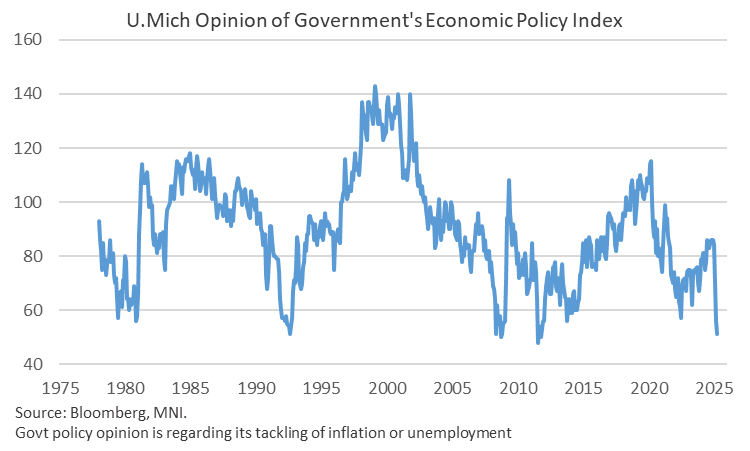

- MNI US DATA: Consumer Opinion Of Govt Policy Nears Lowest On Record

- MNI US DATA: Another Lurch Higher In Consumer Inflation Expectations

US

MNI BRIEF: Fed Right To Stay Modestly Restrictive - Williams

The Federal Reserve's modestly restrictive stance of monetary policy is the right stance for an economy marked by strong employment and above target inflation, New York Fed President John Williams said Friday. "The current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still above our 2% goal," he said in prepared remarks. He thinks tariffs will both boost inflation and create a drag for economic growth. "I expect increased tariffs to boost inflation this year to somewhere between 3.5 and 4%," said Williams.

MNI BRIEF: Fed's Musalem Sees Risks In Tariff Look-Through

St. Louis Fed President Alberto Musalem said Friday the current state of policy is well-positioned to deal with risks, but sounded a hawkish note in warning that a look-through strategy with regards to tariffs may not end up being appropriate this time. "Monetary policy is currently well positioned, given the state of the economy and the balance of risks. Uncertainty about the net effects and timing of new trade, immigration, fiscal and regulatory policies on prices, employment and economic activity is high, and a scenario in which inflation rises while at the same time the labor market softens, is a distinct possibility that must be considered at this time," he said.

NEWS

MNI TARIFFS: US Conveyed That Xi Should Request w/Trump Call After Tariff Hike - CNN

CNN reporting that the Trump administration officials spoke privately with Chinese officials shortly before Beijing announced retaliatory tariffs this morning, warning their Chinese counterparts against such a move and conveying that Chinese President Xi Jinping should request a call with US President Donald Trump. CNN: "Two senior White House officials tell CNN that the US will not reach out to China first. Trump has told his team that China must be the first to make the move, as the White House believes it is Beijing that has chosen to retaliate and further escalate the trade war.

MNI TARIFFS: China Raises Tariffs On US Goods To 125%

The Chinese State Council Tariff Commission has confirmed that China will impose additional tariffs on US goods from 12 April, with the rate increasing from 84% to 125%. This puts it level with the US's 'reciprocal' tariff, although below the total US tariff rate of 145% due to the additional 20% fentanyl-related tariff. Statement here. Excerpts: "The US's imposition of abnormally high tariffs on China seriously violates international economic and trade rules, basic economic laws and common sense, and is completely a unilateral bullying and coercion."

MNI US-RUSSIA: Trump-"Russia Has To Get Moving"

US President Donald Trump posts on Truth Social: "Russia has to get moving. Too many people [are] DYING, thousands a week, in a terrible and senseless war - A war that should have never happened, and wouldn’t have happened, if I were President!!!"

MNI US-RUSSIA: US Envoy Witkoff In Russia Ahead Of Putin Meeting

Kremlin spox Dmitry Peskov has confirmed that US Middle East envoy Steven Witkoff has arrived in Moscow ahead of an anticipated meeting with Russian President Vladimir Putin. Axios first reported on the meeting earlier this morning. It will be the third time that the two have held in-person conversations amid ongoing talks between US and Russian officials aimed at restoring embassy operations.

MNI US-JAPAN: Econ Min To Meet w/Treasury Sec & USTR 17 Apr For Tariff Talks -NHK

Following a Cabinet meeting earlier today, Japanese Finance Minister Katsunobu Kato said that he also intends to hold "a forum for discussion" with Bessent later this month. The US Treasury Sec has highlighted exchange rate practice as one of his key areas of focus, and while Akazawa - a close ally of PM Shigeru Ishiba - has been designated as the main trade negotiator on behalf of the Japanese gov't, it is Kato that holds the brief for foreign exchange.

MNI UKRAINE: German Defence Min-We Must Concede Peace Appears Out Of Reach For Now

Speaking at a meeting of the Ukraine Defence Contact Group in Brussels, German Defence Minister Boris Pistorius says that "Russia is still not interested in peace", and that "Given Russia's ongoing aggression against Ukraine, we must concede [that] peace appears out of reach for now". Pistorius' comments come as the US continues its solo diplomatic overtures towards Russia.

MNI US TSYS: Fed Holds Right Stance, Modestly Restrictive: NY Fed Williams

- Treasuries look to finish weaker Friday, off late morning lows after the bell, curves bear flattening after posting steeper levels on the open.

- Tsy Jun'25 10Y futures currently trade 109-24 (-27) -- after breaching a couple levels of support to mark a session low ofg 109-08, curves flatter/off early highs: 2s10s currently -2.061 at 53.192 (65.521 high), 5s30s -8.343 at 71.171 (86.760 high). 10Y yield at 4.4797% +.0548 vs. 4.5864% high.

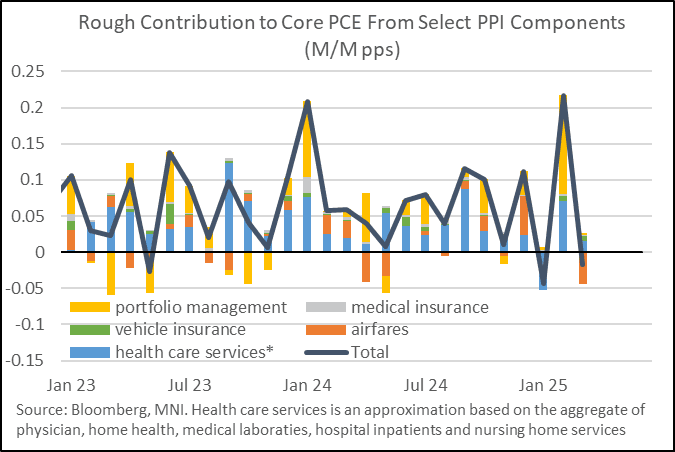

- Treasury futures moving off lows after lower than expected PPI (prior up-revised slightly): PPI readthrough for core PCE looked fairly neutral on net vs expectations - core PCE will likely come in slightly higher than core CPI as expected but there won't be a huge margin (0.06% M/M core CPI vs ~0.11% core PCE consensus pre-PPI, either way a pullback from 0.365% M/M core PCE in Feb)

- Treasury futures holding near lows after lower than expected UofM sentiment & higher than anticipated inflation expectations. To put April's UMich consumer sentiment and inflation expectations into long-term perspective: we're back to the early 80s for 5-10Y inflation expectations (6.7%), but overall consumer sentiment is even worse now than it was then (around record lows at 47.2 in April).

- Cross asset: Stocks hold moderate gains (SPX eminis 100.0 at 5401.0), Gold climbed to a new high of 3244.39, Bbg US$ index lower at 1234.71 (-11.55).

US DATA

MNI US DATA: Back To The Early 80s For L-T Inflation Expectations...Sentiment Worse

To put April's UMich consumer sentiment and inflation expectations into long-term perspective: we're back to the early 80s for 5-10Y inflation expectations (6.7%), but overall consumer sentiment is even worse now than it was then (around record lows at 47.2 in April). Chart:

MNI US DATA: Another Lurch Higher In Consumer Inflation Expectations

U.Mich consumer inflation expectations were far stronger than expected for the 1Y and also saw the 5-10Y figure surpass expectations for an already sizeable further increase. Whilst the survey has had its split by political party questioned, there has also been a rapid acceleration in inflation expectations for those identifying as independent.

Some excerpts from the press release (found here):

- "Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month. "

- "The share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009."

- "Year-ahead inflation expectations surged from 5.0% last month to 6.7% this month, the highest reading since 1981 and marking four consecutive months of unusually large increases of 0.5 percentage points or more. This month’s rise was seen across all three political affiliations. Long-run inflation expectations climbed from 4.1% in March to 4.4% in April, reflecting a particularly large jump among independents."

- "Note that interviews for this release were conducted between March 25 and April 8, closing prior to the April 9 tariff partial reversal."

MNI US DATA: Consumer Opinion Of Govt Policy Nears Lowest On Record

- The U.Mich has a series that isolates consumer perception of US government policy and whether it’s doing a good job of tackling inflation or unemployment.

- The 51 in the preliminary April reading (down from 56 in Mar, 70 in Feb and 84 in Jan) has only been lower in three months since the question started in 1978: Oct 2011, Aug 2011 and Oct 2008.

- There isn’t a breakdown by political allegiance.

- As the press release notes, “interviews for this release were conducted between March 25 and April 8, closing prior to the April 9 tariff partial reversal."

MNI US DATA: Scope For Sizeable Upward Revision To Core PCE In February

- As noted in our first take on PPI, some of the key components that feed through to core PCE look fairly neutral this month with a core PCE contribution on a M/M basis worth just -0.02pps.

- It follows a particularly strong 0.22pp back in February after a large upward revision. Portfolio management on its own was worth an upward revision of circa 0.13pp for a contribution of 0.14pp within the 0.22pp (when it was revised up to 8.1% from a first reported 0.5%).

- There are sizeable error bands with these calcs but it could imply upwards of a 0.1pp positive revision to what was already a strong 0.365% M/M for core PCE back in February.

- CPI readthrough had already pointed to a sizeable moderation in March though, with initial analyst core PCE estimates averaging 0.11% M/M.

- Portfolio management fees are likely to see sizeable declines in April considering equity losses.

MNI US DATA: PCE Readthrough From PPI Looks Neutral Vs Expectations At First Glance

At first glance the PPI readthrough for March core PCE looks fairly neutral on net vs expectations - core PCE will likely come in slightly higher than core CPI as expected but there won't be a huge margin (0.06% M/M core CPI vs ~0.11% core PCE consensus pre-PPI, either way a pullback from 0.365% M/M core PCE in Feb):

- Airline passenger services -4.0% (from 0.0%), not quite as negative as CPI airfares (-5.3%) but still a drag on PCE

- Portfolio management 0.2% (from 8.1% which was upwardly revised from just 0.5% - and this category should pull back in April due to being imputed in part from equity moves)

- All PCE relevant categories of healthcare flat/decelerating M/M except for slight uptick in nursing home care

- The big exception is auto insurance: +1.2% in PPI, a nine-month high (was -0.8% in CPI so large divergence)

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA up 632.94 points (1.6%) at 40236.58

S&P E-Mini Future up 93 points (1.75%) at 5394.75

Nasdaq up 309.7 points (1.9%) at 16698.44

US 10-Yr yield is up 4.3 bps at 4.4679%

US Jun 10-Yr futures are down 23/32 at 109-28

EURUSD up 0.0131 (1.17%) at 1.1332

USDJPY down 0.82 (-0.57%) at 143.63

WTI Crude Oil (front-month) up $1.66 (2.76%) at $61.72

Gold is up $54.47 (1.71%) at $3230.60

European bourses closing levels:

EuroStoxx 50 down 31.69 points (-0.66%) at 4787.23

FTSE 100 up 50.93 points (0.64%) at 7964.18

German DAX down 188.63 points (-0.92%) at 20374.1

French CAC 40 down 21.22 points (-0.3%) at 7104.8

US TREASURY FUTURES CLOSE

3M10Y +3.677, 13.743 (L: 5.454 / H: 25.858)

2Y10Y -3.622, 51.631 (L: 51.409 / H: 65.521)

2Y30Y -10.48, 89.307 (L: 89.195 / H: 112.442)

5Y30Y -9.257, 70.257 (L: 69.433 / H: 86.76)

Current futures levels:

Jun 2-Yr futures down 6.375/32 at 103-15.875 (L: 103-15 / H: 103-25.375)

Jun 5-Yr futures down 15.5/32 at 107-15 (L: 107-04.5 / H: 108-01.5)

Jun 10-Yr futures down 23/32 at 109-28 (L: 109-08 / H: 110-21)

Jun 30-Yr futures down 13/32 at 113-15 (L: 111-21 / H: 114-04)

Jun Ultra futures up 3/32 at 117-29 (L: 115-13 / H: 118-16)

MNI US 10YR FUTURE TECHS: (M5) Trades Through Trendline Support

- RES 4: 114-10 High Apr 7 and the bull trigger

- RES 3: 113-00 Round number support

- RES 2: 112-08 High Apr 8

- RES 1: 111-20 High Apr 9

- PRICE: 109-28 @ 1508 ET Apr 12

- SUP 1: 109-13+ Low Feb 24

- SUP 2: 108-26+ 76.4% of the Jan 13 - Apr 7 bull cycle

- SUP 3: 108-21 Low Feb 19

- SUP 4: 108-03+ Low Dec 12 ‘24 and a key support

Treasury futures maintain a softer tone and the contract is again trading lower, today. Price has breached an important support - a trendline at 110-00 drawn from the Jan 13 low. A clear break of this line would strengthen a bearish threat and signal scope for a deeper retracement. This would open 109-13+, the Feb 24 low, and 108-26+ further out, a Fibonacci retracement. On the upside, initial resistance to watch is 111-20, the Apr 9 high.

SOFR FUTURES CLOSE

Jun 25 -0.060 at 95.935

Sep 25 -0.090 at 96.230

Dec 25 -0.095 at 96.420

Mar 26 -0.110 at 96.525

Red Pack (Jun 26-Mar 27) -0.125 to -0.12

Green Pack (Jun 27-Mar 28) -0.12 to -0.115

Blue Pack (Jun 28-Mar 29) -0.125 to -0.12

Gold Pack (Jun 29-Mar 30) -0.12 to -0.115

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00788 to 4.32880 (+0.00896/wk)

- 3M +0.01206 to 4.24171 (-0.01727/wk)

- 6M +0.01705 to 4.06999 (-0.05553/wk)

- 12M +0.01736 to 3.82210 (-0.04113/Wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.37% (-0.05), volume: $2.657T

- Broad General Collateral Rate (BGCR): 4.36% (-0.04), volume: $1.061T

- Tri-Party General Collateral Rate (TCR): 4.36% (-0.04), volume: $1.020T

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $92B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $241B

FED Reverse Repo Operation

RRP usage retreats below $100B to $98.531B this afternoon from $129.950B on Thursday. Usage had surged to the highest level since December 31, 2024 last Monday, March 31: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 30.

PIPELINE

No new corporate bond issuance Friday, tariff-tied uncertainty keeping issuers on the sidelines, only $16.6B issued in April so far. Also keeping a lid on issuance as the latest earning cycle kicked off in earnest this morning with Bank of NY Mellon, Wells Fargo, JP Morgan out already, Morgan Stanley expected before the open.

MNI BONDS: EGBs-GILTS CASH CLOSE: Bund Outperformance Caps Bull Steepening Week

European yields reversed most of the prior session's moves Friday, with Bunds outperforming.

- Spillover from a renewed rise in US Treasury yields saw Bunds/Gilts soften in early trade, but a flight to quality and a modest recovery in USTs helped yields edge lower.

- Indeed Bunds appeared to be the beneficiary of a global rotation out of US assets as tariff uncertainty lingered, suggested by higher Treasury yields and a weaker dollar.

- A multi-decade high in US consumer inflation expectations helped bring the rally to an end, however.

- Gilts badly underperformed Bunds in a reversal of Thursday's strength: at one point the 10-Year gilt/Bund spread was on track for its first close above 220bp since mid-January.

- For the week, the UK curve bear steepened (2s +11bp, 10Y +30bp), with Germany's bull steepening (2s -4bp, 10s -1bp).

- Periphery/semi-core EGB spreads were mixed but largely wider, with OATs underperforming.

- Next week's schedule includes UK Feb/Mar Labour Market and Mar Inflation Data, and the ECB meeting.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.3bps at 1.789%, 5-Yr is up 1.9bps at 2.132%, 10-Yr is down 1bps at 2.57%, and 30-Yr is down 6.9bps at 2.891%.

- UK: The 2-Yr yield is up 14.5bps at 4.048%, 5-Yr is up 13.2bps at 4.21%, 10-Yr is up 11bps at 4.753%, and 30-Yr is up 8.8bps at 5.516%.

- Italian BTP spread down 0.1bps at 124.2bps / French up 3.6bps at 80bps

MNI FOREX: Higher US Yields Provide Greenback Reprieve

- Friday’s FX session was very volatile on Friday and was a tale of two halves for the US dollar. Initially, the greenback continued to come under pressure, culminating in a further 1.7% depreciation for the US dollar index to 99.01 lows, the lowest level since April 2022. Price action had been exacerbated by China announcing additional tariffs on US goods, reaching 125%.

- The euro was the main beneficiary of this dynamic, and EURUSD narrowed the gap to the 1.15 handle substantially, reaching a 1.1473 high. However, the low yielding safe haven also made strong advances against the dollar.

- However, as the US session developed, selling of treasuries became the main theme which provided a bottom for the waning dollar. The US 10 year yield rose as high 4.58%, prompting a strong reversal higher for USDJPY specifically. USDJPY rose from 142.07 lows to trade closer to 144 ahead of the close. The pair was also supported by a solid recovery for major US equity benchmarks, but does remain down 0.4% on the session.

- The reprieve for the dollar helped EURUSD back below 1.13, also roughly 200 pips off the prior session highs. In tandem USDCHF headed back towards 0.8200, however the earlier 0.8099 low matched perfectly with touted support, the 76.4% retracement of the Jan 15 '15 - Dec 15 '16 recovery. SNB domestic sight deposits data out Monday will give indication on any potential intervention this week.

- Other major currencies such as GBP, AUD and CAD have all strengthened in line with the dollar index adjustment, however, NZD remains an outperformer. Nothing stands out in the newsflow to explain this, however, NZDUSD did reverse the entirety of the post-liberation day selloff which may have triggered some additional short covering above the 0.5800 mark.

- China trade data and FOMC speech highlights Monday’s session, before the focus will turn to central bank decisions in Canada and ECB later in the week.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 14/04/2025 | - | *** | Trade | |

| 14/04/2025 | - | *** | Money Supply | |

| 14/04/2025 | - | *** | New Loans | |

| 14/04/2025 | - | *** | Social Financing | |

| 14/04/2025 | 1230/0830 | ** | Wholesale Trade | |

| 14/04/2025 | 1500/1100 | ** | NY Fed Survey of Consumer Expectations | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 14/04/2025 | 1700/1300 | Fed Governor Christopher Waller | ||

| 14/04/2025 | 2200/1800 | Philly Fed's Pat Harker | ||

| 15/04/2025 | 2301/0001 | * | BRC-KPMG Shop Sales Monitor | |

| 14/04/2025 | 2340/1940 | Atlanta Fed's Raphael Bostic | ||

| 15/04/2025 | 0130/1130 | RBA Meeting Minutes |