MNI ASIA OPEN: Confidence Wanes as Uncertainty Reins

EXECUTIVE SUMMARY

- MNI: Fed's Barkin Waiting For Policy Uncertainty To Abate

- MNI US: House To Vote On Budget Resolution At 18:30 ET 23:30 GMT

- MNI US-RUSSIA: Kremlin Talks Up Cooperation w/US, EU Enters UKR Minerals Discussion

- MNI UK: PM Commits To 2.5% Of GDP On Defense By 2027

- MNI US DATA: New Highs For House Prices At End-2025, But Price Discovery Limited

- MNI US DATA: Philly Fed Services Outlook Deteriorates, With Disinflationary Signals

- MNI US DATA: Consumer Confidence Drops With Inflation Expectations Jumping

US

MNI: Fed's Barkin Waiting For Policy Uncertainty To Abate

The prospect of tariffs and other policy changes from Washington is clouding the outlook in a way that makes it best for Federal Reserve officials to take their time before making any further moves on interest rates, Richmond Fed President Thomas Barkin said Tuesday. "It’s hard to make significant monetary policy changes amid such uncertainty. So, I prefer to wait and see how this uncertainty plays out and how the economy responds," he said in prepared remarks. Barkin says he is encouraged by progress on inflation despite recent bumpiness in the data.

NEWS

MNI US: House To Vote On Budget Resolution At 18:30 ET 23:30 GMT

House Republican leadership has posted a note confirming that the House of Representatives is scheduled to vote at 18:30 ET 23:30 GMT on a budget blueprint that will underpin a multi-trillion-dollar reconciliation package. The vote comes as House Speaker Mike Johnson (R-LA) struggles to corral support for the blueprint. Johnson’s razor-thin one-seat majority leaves him vulnerable to both the fiscal hawks - who don’t believe Johnson’s budget does enough to address the deficit - and the moderates and frontline Republicans - who fear cuts to programmes like Medicaid, SNAP, and Pell Grants will endanger their re-election in 2026.

MNI US-RUSSIA: Kremlin Talks Up Cooperation w/US, EU Enters UKR Minerals Discussion

Reuters reporting comments from Kremlin spokesperson Dmitri Peskov - speaking at his daily presser. Peskov said, addressing remarks from Russian President Vladimir Putin yesterday, hinting that Russia could work with US companies to mine rare-earth minerals in Ukraine: “Russia says it has its own plans to develop them but is open to cooperation.”

- Putin said, in an apparent reference to Ukraine yesterday: “Russia is one of the leading countries when it comes to rare metal reserves... as for new territories, we are also ready to attract foreign partners – there are certain reserves there too,” Putin's comments came after US President Donald Trump issued a statement on Truth Social claiming he is in “serious discussions” with Putin on “major Economic Development transactions”.

MNI GERMANY: CDU/CSU Figures Voice Unease At Decisions Being Made By Outgoing Parl't

Late on 24 Feb reports suggested that leader of the centre-right Christian Democratic Union (CDU) and presumptive next chancellor Friedrich Merz could look to use the current Bundestag, rather than the new chamber elected on 23 Feb, to pass reform to the constitutional debt brake. Thorsten Frei, CDU leader in the Bundestag said to Deutschlandfunk "Very quick decisions are needed, quite specifically in security and foreign policy". Frei called the prospect of the swift establishment of a fund for Ukraine aid "feasible", but sought to argue that any wider constitutional changes would not be rushed.

MNI UK: PM Commits To 2.5% Of GDP On Defense By 2027

Prime Minister Sir Keir Starmer is delivering a statement in the House of Commons regarding UK defence and security. Livestream here. The PM confirms a commitment to increase UK defence spending to 2.5% of GDP by 2027 as the European security outlook shifts amid the re-alignment of the US. This will be a GBP13.4B increase. Alongside intel security services Starmer claims this will equate to 2.6% of GDP by 2027. Sets 'clear ambition' of 3.0% of GDP in the next parliament.

MNI EU: Costa Convenes Leaders' Call On 26 Feb For Macron-Trump Talks Debrief

European Council President António Costa has confirmed a videoconference of member state leaders on the morning of 26 Feb to hear a debrief from French President Emmanuel Macron following his meetings with US President Donald Trump at the White House on 24 Feb. This videoconference comes ahead of the special European Council summit that has been called for 6 March to discuss Ukraine and the EU's defence and security in the wake of major shifts in regional geopolitics in recent weeks.

MNI US TSYS: Trade Policy Uncertainty, Lower Consumer Confidence Buoys Rates

- Treasuries continued to grind higher Tuesday, carry-over risk-off support helping Mar'25 10Y futures climb back to mid-December highs in the first half as Trump Admin trade policy increased uncertainty and weighed on sentiment.

- Heavy volumes in Tsy futures tied to Mar'25/Jun'25 rolling, both Mar'25 5Y and 10Y contracts well over 5M after the bell. TYH5 trades 110-17 after the bell (+21) vs.110-20 high, just below initial technical resistance at 110-25 (High Dec 12 ‘24). Initial firm support well below at 109-09, the 50-day EMA. A move below this average is required to highlight a potential reversal.

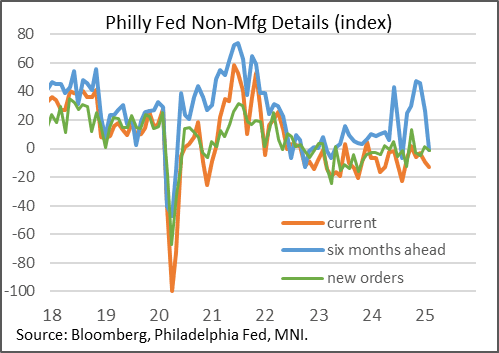

- Data underpinned rates: Conference Board's consumer confidence composite fell to 98.3 from 105.3 prior (102.5 expected), led by a drop in expectations to 72.9 from 82.2. February's Philadelphia Fed Non-Manufacturing survey showed a deterioration in current regional activity to a 6-month low -13.1 from -9.1 prior (no consensus).

- Tsys remained well bid after $70B 5Y note auction (91282CMQ1) stops 0.9bp through (fourth consecutive stop since June): drawing 4.123% high yield vs. 4.134% WI.

- Lower core yields and pressure on major equity indices on Tuesday have boosted the likes of JPY and CHF, while risk sensitive currencies such as AUD, NZD and CAD have all underperformed.

- Wednesday data includes New Home Sales and building permits. Main focus on GDP and PCE data this Thursday. US Treasury auctions $44B 7Y notes at 1300ET.

OVERNIGHT DATA

MNI US DATA: Consumer Confidence Drops With Inflation Expectations Jumping

Yet another survey conducted in February shows a deterioration in private sector confidence: the Conference Board's consumer confidence composite fell to 98.3 from 105.3 prior (102.5 expected), led by a drop in expectations to 72.9 from 82.2. The "present situation" composite edged lower for a 2nd consecutive month, to 136.5 (139.9 prior).

- This was the 4th-worst monthly composite reading since the start of 2021, and represented the largest monthly decline since Aug 2021. According to the report, the Expectations index "was below the threshold of 80 that usually signals a recession ahead" (though we would note that this index was below 80 through most of 2022-2024 without recession hitting).

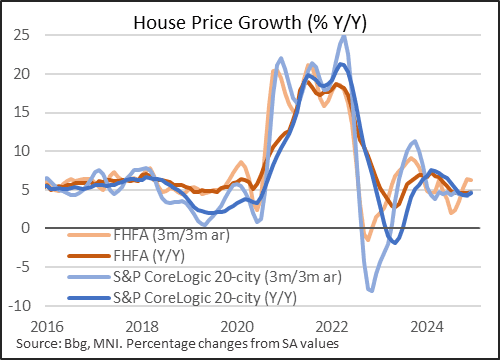

MNI US DATA: New Highs For House Prices At End-2025, But Price Discovery Limited

House price gains were steady-to-strong at the end of 2024 according to two of the major aggregate indices. The FHFA's index was up 4.7% Y/Y (SA) in December, roughly within the range of the previous five months, albeit with some sign of momentum picking up toward year-end (6.3% 3M/3M annualized).

- The S&P CoreLogic 20-city index showed similar dynamics, up 4.5% Y/Y in December, putting the 3M/3M annual rate at 4.7%.

- As such prices ended 2024 at fresh seasonally-adjusted highs, up over 50% from pre-pandemic levels.

- Of course, this comes alongside some of the lowest transaction volumes for decades for existing home sales, with no imminent sign of activity turning higher.

- That means that price discovery in the housing market has been limited. That could change if unemployment picks up sharply or if mortgage rates start coming down.

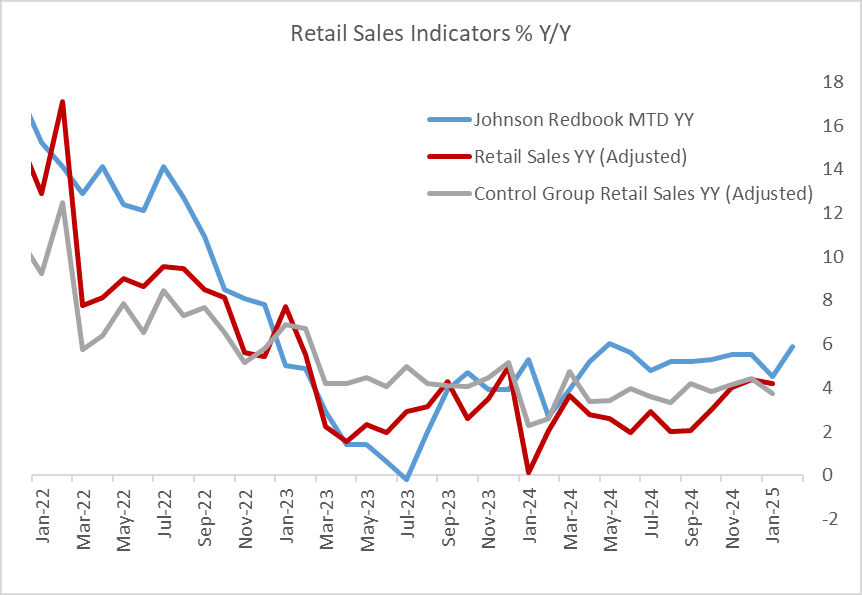

MNI US DATA: Johnson Redbook Sales Still Point To Steady Consumer Growth

February month-to-date Johnson Redbook Retail Sales were up 5.9% Y/Y (week ending Feb 22), which while below retailers' target of 6.3% growth remains relatively elevated. It continues to point to solid overall retail sales (and represents 80% of the equivalent Census Bureau retail sales series) through February, roughly consistent with the previous 9 months with nominal Y/Y retail sales in the "official" monthly series of between 2-4% and perhaps at the high end of that range for control group retail sales.

MNI US DATA: Philly Fed Services Outlook Deteriorates, With Disinflationary Signals

February's Philadelphia Fed Non-Manufacturing survey showed a deterioration in current regional activity to a 6-month low -13.1 from -9.1 prior (no consensus). As with other February private sector and consumer surveys, including the manufacturing counterpart to the Philly Fed services survey, there has been a clear deterioration in both confidence and activity since the turn of the year (as policy uncertainty has picked up) - though unlike those surveys, price pressures in this one aren't nearly as acute.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA up 221.8 points (0.51%) at 43689.32

S&P E-Mini Future down 19 points (-0.32%) at 5982.75

Nasdaq down 203 points (-1.1%) at 19088.68

US 10-Yr yield is down 10.8 bps at 4.2926%

US Mar 10-Yr futures are up 21.5/32 at 110-17.5

EURUSD up 0.0047 (0.45%) at 1.0515

USDJPY down 0.7 (-0.47%) at 149.03

WTI Crude Oil (front-month) down $1.55 (-2.19%) at $69.15

Gold is down $39.63 (-1.34%) at $2912.14

European bourses closing levels:

EuroStoxx 50 down 5.86 points (-0.11%) at 5447.9

FTSE 100 up 9.69 points (0.11%) at 8668.67

German DAX down 15.66 points (-0.07%) at 22410.27

French CAC 40 down 39.92 points (-0.49%) at 8051.07

US TREASURY FUTURES CLOSE

3M10Y -9.972, -0.092 (L: -1.375 / H: 7.49)

2Y10Y -2.908, 19.442 (L: 19.251 / H: 23.133)

2Y30Y -2.545, 45.281 (L: 44.936 / H: 49.459)

5Y30Y +0.36, 42.166 (L: 41.39 / H: 44.163)

Current futures levels:

Mar 2-Yr futures up 4/32 at 103-1.875 (L: 102-29.375 / H: 103-03.25)

Mar 5-Yr futures up 13/32 at 107-11.25 (L: 106-28.75 / H: 107-13.5)

Mar 10-Yr futures up 21.5/32 at 110-17.5 (L: 109-26 / H: 110-20)

Mar 30-Yr futures up 1-12/32 at 117-23 (L: 116-06 / H: 117-27)

Mar Ultra futures up 2-01/32 at 123-21 (L: 121-13 / H: 123-21)

MNI US 10YR FUTURE TECHS: (H5) Bull Cycle Extension

- RES 4: 111-20+ High Dec 6 ‘24

- RES 3: 111-07 High Dec 11 ‘24

- RES 2: 110-25 High Dec 12 ‘24

- RES 1: 110-20 High Feb 25

- PRICE: 110-15 @ 15:56 GMT Feb 25

- SUP 1: 109-26 Intraday low

- SUP 2: 109-09 50-day EMA and a key near-term support

- SUP 3: 108-21+ Low Feb 19

- SUP 4: 108-04 Low Dec 12 and a bear trigger

Treasury futures added to a recent rally Tuesday, tipping prices briefly through first resistance at the 76.4% retracement of the Dec 6 - Jan 13 bear leg at 110-19. This broadens the bullish recovery and prompts targets to shift higher - with 110-25 the next modest resistance before more serious levels come into play at the December highs of 111-20+. Initial firm support to monitor is 109-09, the 50-day EMA. A move below this average is required to highlight a potential reversal.

SOFR FUTURES CLOSE

Mar 25 +0.003 at 95.705

Jun 25 +0.025 at 95.890

Sep 25 +0.055 at 96.080

Dec 25 +0.075 at 96.205

Red Pack (Mar 26-Dec 26) +0.095 to +0.120

Green Pack (Mar 27-Dec 27) +0.125 to +0.140

Blue Pack (Mar 28-Dec 28) +0.140 to +0.140

Gold Pack (Mar 29-Dec 29) +0.135 to +0.140

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00007 to 4.32352 (+0.00422/wk)

- 3M +0.00048 to 4.31852 (-0.00301/wk)

- 6M -0.00474 to 4.27042 (-0.02034/wk)

- 12M -0.01978 to 4.17208 (-0.05134/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.34% (+0.00), volume: $2.425T

- Broad General Collateral Rate (BGCR): 4.32% (+0.00), volume: $936B

- Tri-Party General Collateral Rate (TCR): 4.32% (+0.00), volume: $912B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $292B

FED Reverse Repo Operation

RRP usage rebounds to an even $96.0B this afternoon from $76.818B on Monday. Compares to Friday, February 14 low of $58.770B - the lowest level since mid-April 2021. The number of counterparties at 36 from 30 prior.

MNI PIPELINE: Late Corporate Bond Roundup: $14.7B to Price, $34.4B on Week

$14.7B to Price Tuesday, $34.4B total on week

- Date $MM Issuer (Priced *, Launch #)

- 02/25 $5B #Citigroup $2.25B 4NC3 +70, $750M 4NC3 SOFR, $2B 31NC30 +105

- 02/25 $2.75B #State Street Corp $1.35B 3Y +45, $650M 5Y +60, $750M 11NC10 +85

- 02/25 $1.8B #Southern Co 30NC10 6.375%

- 02/25 $1.25B #200 Park Funding Trust 30Y +120

- 02/25 $1B #Dow Chemical $400M 10Y +105, $600M 30Y +140

- 02/25 $900M #Caterpillar $450M 3Y +33, $450M 3Y SOFR+52

- 02/25 $750M #Ameriprise 10Y +95

- 02/25 $750M #KeyCorp 6NC5 +98

- 02/25 $500M *Emerson Electric WNG 10Y +70

- 02/25 $Benchmark Kenya 11Y investor calls

MNI BONDS: EGBs-GILTS CASH CLOSE: Rally Fuelled By US Risk-Off

European yields dropped Tuesday, following the lead set by US Treasuries.

- US tariff and growth concerns continued to set the tone overnight. Another pullback in US equities and more soft US data (including consumer confidence) helped fuel the bid in Treasuries, which spilled over into Europe.

- EGBs were also aided by a pullback in European gas prices.

- ECB implied cut pricing extended 4bp for 2025 (83bp) / BOE 5bp (58bp).

- In data, the ECB's negotiated wage tracker softened to 4.1% Y/Y in Q4 (5.4% prior), with final Q4 German GDP confirming the flash estimate.

- Gilts outperformed Bunds, with both the German and UK curves leaning bull steeper.

- Despite the US-led risk-off safe haven bid, periphery/semi-core EGB spreads closed tighter on the day (European equity futures were up), albeit off the session's tightest levels.

- Wednesday's schedule includes German andFrench consumer confidence; the week's data highlights commence Thursday with Spanish flash Feb inflation (Italy, France, Germany to follow Friday - MNI's preview will be out Wednesday).

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.065%, 5-Yr is down 2.1bps at 2.215%, 10-Yr is down 1.9bps at 2.458%, and 30-Yr is down 3bps at 2.723%.

- UK: The 2-Yr yield is down 5.4bps at 4.174%, 5-Yr is down 6.3bps at 4.182%, 10-Yr is down 5.5bps at 4.509%, and 30-Yr is down 5.8bps at 5.102%.

- Italian BTP spread down 1.2bps at 113bps / Greek down 1.5bps at 82.5bps

MNI FOREX: JPY and CHF Extend Topside Momentum amid Souring Risk Sentiment

- US sentiment surveys have surprised to the downside consecutively during the last weeks (February consumer confidence below expectations today), bolstering the chances of further Fed rate cuts this year. Combining this with US tariff threats becoming more concrete, headwinds for both the dollar and global sentiment have been building.

- Lower core yields and pressure on major equity indices on Tuesday have boosted the likes of JPY and CHF, while risk sensitive currencies such as AUD, NZD and CAD have all underperformed. Treasury outperformance in today’s session has weighed on the dollar index overall, which shows a moderate 0.18% intra-day decline as we approach the APAC crossover.

- USDCHF (-0.50%) printed a fresh 2-month low at 0.8912, and broader market dynamics pose risks for a deeper correction lower for the pair. In recent sessions, both 20- and 50-day exponential moving averages have moved into a bear-mode position, underpinning the bearish threat. Support levels remain scant, with Fibonacci retracement points (drawn from 2024 low – 2025 high) at 0.8885 and 0.8788, the immediate technical levels of note.

- USDJPY briefly pierced key technical support, located at 148.65. Souring risk sentiment is weighing specifically on AUDJPY, which at one point extended its intra-day decline to around 1%, extending the 2025 lows and registering a 5-month low for the cross.

- Additionally, soft trendline support (drawn from the August 06 low) is being breached which underpins the bearish theme, and moving average indicators remain in a bear-mode position.

- AUDJPY should remain in focus this week, as Australia and Tokyo CPI are scheduled over the next two sessions. For Australia inflation due overnight, the market expects headline CPI to increase from 2.5% y/y to 2.6% y/y.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 26/02/2025 | 0700/0800 | ** | PPI | |

| 26/02/2025 | 0700/0800 | * | GFK Consumer Climate | |

| 26/02/2025 | 0700/1500 | ** | MNI China Money Market Index (MMI) | |

| 26/02/2025 | 0745/0845 | ** | Consumer Sentiment | |

| 26/02/2025 | 0800/0900 | ** | PPI | |

| 26/02/2025 | 1200/0700 | ** | MBA Weekly Applications Index | |

| 26/02/2025 | - | ECB's Lagarde and Cipollone in G20 FMs and CB Governors meeting | ||

| 26/02/2025 | 1330/0830 | * | Capital and repair expenditure survey | |

| 26/02/2025 | 1330/0830 | Richmond Fed's Tom Barkin | ||

| 26/02/2025 | 1500/1000 | *** | New Home Sales | |

| 26/02/2025 | 1530/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 26/02/2025 | 1630/1630 | BOE's Dhingra lecture on Trade fragmentation and monetary policy | ||

| 26/02/2025 | 1630/1130 | ** | US Treasury Auction Result for 2 Year Floating Rate Note | |

| 26/02/2025 | 1700/1200 | Atlanta Fed's Raphael Bostic | ||

| 26/02/2025 | 1800/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 27/02/2025 | 0030/1130 | * | Private New Capex and Expected Expenditure |