MNI ASIA OPEN: Fed Powell on Larger Than Expected Tariffs

EXECUTIVE SUMMARY

- MNI BOC: Holds Rate At 2.75%, Cautious And Less Forward Looking Amid Trade War

- MNI FED: Powell Remains Concerned By "Larger Than Anticipated" Tariff Impact

- MNI US: Moderate GOP Reps Won't Back Reconcilliation Bill Including Medicaid Cuts

- MNI US DATA: Strong First Quarter For US Industry, But Slowdown Looming

- MNI US DATA: Autos Drive Overall March Retail Gains As Restaurants Recover

- MNI US DATA: Homebuilder Sentiment Remains Subdued

US

MNI BRIEF: Fed's Powell - Tariffs Stymie Dual Mandate Goals

Federal Reserve Chair Jerome Powell said Wednesday tariffs are likely to raise both unemployment and inflation, which will either move the central bank away from its goals or at least prevent it from making fresh progress toward achieving them. “We’ll be moving away from those goals for the balance of this year, at least not making any progress, and then we’ll resume that progress," he said. "Our role is to make sure this will be a one-time increase in prices."

MNI FED: Powell Remains Concerned By "Larger Than Anticipated" Tariff Impact

Fed Chair Powell's speech text on the "Economic Outlook" is here (link). It doesn't sound like there is much new here, though note he is repeating his assessment from April 4 that the tariffs and their likely effects are "significantly larger than anticipated" - so that in itself may be construed as a slightly hawkish signal as he doesn't seem swayed by the subsequent April 9th 90-day tariff "pause", or market dislocations in the interim. He certainly isn't changing his mind on being patient before moving on rates.

NEWS

MNI BOC: Holds Rate At 2.75%, Cautious And Less Forward Looking Amid Trade War

Bank of Canada holds benchmark interest rate at 2.75% after seven prior consecutive cuts. "Governing Council will proceed carefully, with particular attention to the risks. That means being less forward-looking than usual until the situation is clearer. It also means we are prepared to act decisively if incoming information points clearly in one direction."

MNI US: Moderate GOP Reps Won't Back Reconcilliation Bill Including Medicaid Cuts

A dozen moderate House Republicans have issued a letter to GOP leadership warning they won’t back a reconciliation package that includes major cuts to Medicaid. The letter is the opening salvo in what is expected to be a bitter dispute between Republican moderates and deficit hawks over how deeply to cut government spending to fund President Donald Trump’s tax agenda. Punchbowl notes: “Remember, House Republicans’ reconciliation plan includes cutting $880 billion under the House Energy and Commerce Committee’s purview, much of which will likely have to come from Medicaid.”

MNI SECURITY: Rubio And Witkoff To Hold Ukraine Talks With European Counterparts

The US State Department confirmed that Secretary of State Marco Rubio and President Donald Trump's Middle East Envoy Steve Witkoff will travel to Paris today for Ukraine meetings with European counterparts. Statement: "[Rubio] and [Witkoff] will travel to Paris, France, April 16-18 for talks with European counterparts to advance President Trump’s goal to end the Russia-Ukraine war and stop the bloodshed. While in Paris, he will also discuss ways to advance shared interests in the region.

MNI TARIFFS: Meloni To Probe Trump For Solution To Tariff Standoff

On Thursday, Italian Prime Minister Giorgia Meloni will become the first European leader to sit for a face-to-face meeting with US President Donald Trump since he imposed his 'Liberation Day' tariffs. On Friday, Meloni will return to Rome to host Vice President JD Vance for a state visit. Politico notes: “Meloni’s personal engagement with Trump has set nerves jangling in other EU capitals. But as the bloc faces up to a potentially ruinous trade war, even her wariest counterparts are coming round to the idea that she may be the only European leader he is willing to listen to.”

MNI US TSYS: Persistent Inflation Concerns on Larger Than Expected Tariffs

- Treasuries look to finish near late session highs Wednesday, gathering risk-off support as Fed Chair Powell discussed his outlook at the Chicago Economics Club, stocks extended lows (but drew some buying late). Chairman Powell warned inflation may be more persistent due to larger than expected tariffs, exacerbated by policy uncertainty.

- "I do think we'll be moving away from" the dual mandate goals "probably for the balance of this year. Or at least not making any progress, and then we'll resume that progress as we can," Powell said.

- Treasury Jun'25 10Y futures trade +11 at 111-13.5 after the bell vs. 111-17.5 high, just off technical resistance at 111-25 (50.0% retracement of the Apr 7 - 11 bear leg), 10Y yield at 4.2806% (-.0524). Curves are steeper but off first half highs: 2s10s +1.691 at 50.081, 5s30s +4.769 at 83.808.

- The NY Fed services business activity index was weaker than expected in April as it failed to bounce and instead dipped to -19.8 (cons -12.1, 4 responses) after -19.3 in March. Other important details within the report were notably glum, with the current business climate falling further to -60.7 from -51.7 (-21.8 in Jan having averaged -24.5 in 2024 for example) to its lowest since Feb 2021.

- March industrial production was largely as expected, with headline IP growing contracting by 0.3% M/M (-0.2% survey) but prior upwardly revised by 0.1pp (+0.8%). Manufacturing production rose by 0.3% (0.2% survey 1.0% prior upwardly revised from 0.9%). Capacity utilization fell slightly (77.8% vs 78.2% prior).

OVERNIGHT DATA

MNI US DATA: Homebuilder Sentiment Remains Subdued

The NAHB/Wells Fargo Housing Market Index was slightly stronger than expected in April but didn’t materially alter an outlook that suggests the current rebound in residential construction is likely to be subdued.

- The housing market index ticked up to 40 (cons 38) in April after 39 in March, seeing some stabilization for a third month running at the lower end of a 39-51 range seen since early 2024.

- There were mixed drivers for April specifically: the heavily weighted present sales category increased for the first time since Jan (+2 to 45) whilst there was a small increase for prospective buyer traffic after two sizeable deadlines (+1 to 25) but six-month ahead sales expectations dropped further to 43 (-4) for the lowest since Nov 2023.

- Similar pace of home price declines: “The latest HMI survey also revealed that 29% of builders cut home prices in April, unchanged from March. Meanwhile, the average price reduction was 5% in April, the same rate as the previous month. The use of sales incentives was 61% in April, up from 59% in March.”

- Homebuilder sentiment remains more bearish on a relative historical basis than the price to book ratio of S&P 500 homebuilders although the latter has seen a significant correction since the US election.

MNI US DATA: Strong First Quarter For US Industry, But Slowdown Looming

March industrial production was largely as expected, with headline IP growing contracting by 0.3% M/M (-0.2% survey) but prior upwardly revised by 0.1pp (+0.8%). Manufacturing production rose by 0.3% (0.2% survey 1.0% prior upwardly revised from 0.9%). Capacity utilization fell slightly (77.8% vs 78.2% prior).

- Dragging on IP was the utilities sector's 5.8% drop in output, "as temperatures were warmer than is typical for the month" (per the Fed report), a second consecutive month of contraction (-1.5% prior) - but this volatile category still posted 4.4% growth on a Y/Y basis (compared with 1.3% for IP as a whole). Mining also slowed in March, to 0.6% after 1.7% prior.

- Within the major final products categories, consumer goods saw a strong pullback (-1.0% M/M after 0.5% prior), and has barely grown in the past year (0.3% Y/Y), though business equipment fared better (1.7% M/M after 1.8%).

- Despite the March contraction, IP posted annualized growth of 5.5% in the first quarter of the year, the best 3M reading since May 2022. Overall manufacturing rose 5.1% for the quarter (annualized), led by durables (7.9%). There were some idiosyncrasies here, with motor vehicles and parts production jumping by 9.2% in February (likely tariff front-running) with the aerospace index rising 65% after contractions in previous quarters, potentially reflecting the end of a work stoppage at Boeing in Q4.

- Looking ahead to Q2, core durable goods orders have slowed since late last year while ISM Manufacturing has returned to contractionary territory (joining multiple other indicators in pointing to a tariff-related retrenchment), suggesting that the best may be behind the sector which could a pullback in activity in Q2.

MNI US DATA: Autos Drive Overall March Retail Gains As Restaurants Recover

March retail sales largely met expectations, with the headline growth figure of 1.4% M/M in-line and up from 0.2% prior. The core categories were more mixed, but this was more than offset by very strong revisions, particularly for the GDP-input Control Group which rose by 0.4% (0.6% consensus) after an upward revision to prior to 1.3% (was 1.0%). Overall this will probably be viewed as a positive report in terms of upward revisions to GDP estimates for Q1.

- The first thing that was being eyed in this report was the degree of tariff front-running pre-"Liberation Day" (Apr 2). We saw it in some areas but perhaps not as much as we might have expected in others.

- Most prominent in front-running was vehicle sales (which are ex-control group) seeing a 5.7% M/M rise, a 26-month best, following two months of contraction (the overall motor vehicles/parts category rose 5.3%). This was well-flagged by industry sales data as buyers rushed to dealerships to beat tariff-related price hikes, and as the largest category in retail sales easily drove the overall retail sales advance (and is why ex-auto sales slowed to 0.5% M/M vs 0.7% prior).

- Elsewhere, electronics/appliance stores saw 0.8% growth, fastest in 5 months. Clothing purchases and sporting goods picked up 0.4% and 2.4% M/M respectively - each, again, after a couple of months of contraction. Building materials/gardening (also ex-control group) jumping 3.3% M/M after 5 consecutive monthly contractions, though that may have been partly related to improving weather after a tough start to the year.

- On that note, food services and drinking places (the 3rd-largest retail category) saw a sharp rebound to 1.8% M/M, the best rate in 26 months - from -0.8% prior (which reflected a substantial upward revision from -1.5%). There had been some concern that this category's weakness in February was a sign of sharply weakening discretionary spending in a category that isn't directly impacted by tariff front-running, but conditions here don't appear as recessionary as previously thought.

- But we did see slower growth in many categories in March vs Feb: these included non-store retailers, ie online shopping (0.1% after 3.2% for what is the 2nd largest retail sales category), with miscellaneous store retailers, furniture, and health/personal care sales also slower. Food and beverage sales growth was steady at 0.2%, while gasoline sales 2.5% though that was primarily a price effect (gas CPI fell 6+% in the month).

MNI US DATA: NY Fed Services Outlook Weakest Since Pandemic Depths Or 2009

The headline NY Fed services activity index was weaker than expected in April as it failed to bounce, suggesting little upside to ISM Services after the weaker than expected 50.8 for March. However, the expectations components are particularly negative and suggest the rare pessimism in Tuesday’s manufacturing counterpart was no anomaly.

- The NY Fed services business activity index was weaker than expected in April as it failed to bounce and instead dipped to -19.8 (cons -12.1, 4 responses) after -19.3 in March.

- Other important details within the report were notably glum, with the current business climate falling further to -60.7 from -51.7 (-21.8 in Jan having averaged -24.5 in 2024 for example) to its lowest since Feb 2021.

- The six-month ahead readings broadly echo the sharp decline seen in its manufacturing counterpart released yesterday with its weakest outlook since Sep 2001.

- Here, six-month ahead business activity fell from -3.3 to -26.6 (vs 30.3 in Jan and 21.1 in 2024) for its lowest since Apr 2020 and before that Feb 2009.

- Expectations of the business climate six-months ahead meanwhile fell from -26.9 to -50.0 (vs 13.2 in Jan, 4.6 in 2024) for the lowest since Mar 2009.

- From the press release (in full here): “The future employment index turned negative. The future supply availability index dropped to -36.1, with 44 percent of firms expecting supply availability to be worse in six months. Capital spending plans turned sharply negative.”

- As with the manufacturing report, survey responses were collected between Apr 2-9 and therefore captured initial fallout from Apr 2 “Liberation Day” tariff announcements and the various changes since then.

MNI US DATA: Mortgage Applications Pull Back, Likely More Volatility Ahead

US mortgage activity pulled back last week as mortgage rates unsurprisingly lurched higher again in response to higher swap rates. Expect more volatility ahead considering swings in US rate markets.

- Composite applications fell a seasonally adjusted -8.5% last week after jumping 20% the week prior.

- It was led by refis (-12.4% after 35.3%) whilst new purchase applications saw a less volatile version of the move (-4.9% after 9.2%).

- Relative levels: composite at 57% of 2019 average, new purchases 63% and refis 48%.

- The 30Y conforming rate increased 20bp to 6.81% after a 9bp decline the week prior to 6.61% for the lowest since Oct 2024 after a recent high of 7.09% in January.

- Expect further swings in mortgage activity ahead as volatility in rates markets continues. 10Y swap rates averaged 6bp higher last week than the week prior (3.67% vs 3.61%) but included a huge range of 3.32-3.96% last week which will have complicated mortgage deals. The 10Y swap rate is currently 3.77%.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 699.57 points (-1.73%) at 39669.39

S&P E-Mini Future down 115.5 points (-2.13%) at 5314.25

Nasdaq down 516 points (-3.1%) at 16307.16

US 10-Yr yield is down 4.5 bps at 4.2884%

US Jun 10-Yr futures are up 9/32 at 111-11.5

EURUSD up 0.0104 (0.92%) at 1.1385

USDJPY down 1.04 (-0.73%) at 142.19

WTI Crude Oil (front-month) up $1.4 (2.28%) at $62.73

Gold is up $104.63 (3.24%) at $3335.35

European bourses closing levels:

EuroStoxx 50 down 3.93 points (-0.08%) at 4966.5

FTSE 100 up 26.48 points (0.32%) at 8275.6

French CAC 40 down 5.43 points (-0.07%) at 7329.97

US TREASURY FUTURES CLOSE

3M10Y -5.642, -3.571 (L: -5.822 / H: 4.122)

2Y10Y +2.046, 50.436 (L: 47.445 / H: 53.324)

2Y30Y +4.297, 96.962 (L: 93.244 / H: 99.062)

5Y30Y +4.395, 83.434 (L: 80.189 / H: 84.63)

Current futures levels:

Jun 2-Yr futures up 2.875/32 at 103-26.375 (L: 103-22.125 / H: 103-27.125)

Jun 5-Yr futures up 6.75/32 at 108-14.75 (L: 108-04.5 / H: 108-18.75)

Jun 10-Yr futures up 9/32 at 111-11.5 (L: 110-29 / H: 111-17.5)

Jun 30-Yr futures up 10/32 at 115-5 (L: 114-12 / H: 115-15)

Jun Ultra futures up 13/32 at 119-18 (L: 118-17 / H: 119-31)

MNI US 10YR FUTURE TECHS: (M5) Retracement Mode

- RES 4: 113-04 76.4% retracement of the Apr 7 - 11 bear leg

- RES 3: 112-12 61.8% retracement of the Apr 7 - 11 bear leg

- RES 2: 111-25 50.0% retracement of the Apr 7 - 11 bear leg

- RES 1: 111-09+ Intraday high

- PRICE: 110-31+ @ 11:20 BST Apr 16

- SUP 1: 110-15+/109-08 Low Apr 14 / 11 and the bear trigger

- SUP 2: 108-26+ 76.4% retracement of the Jan 13 - Apr 7 bull cycle

- SUP 3: 108-21 Low Feb 19

- SUP 4: 108-03+ Low Dec 12 ‘24 and a key support

Treasury futures have traded higher so far this week. The climb has resulted in a breach of both the 20- and 50-day EMAs. For now, the latest bounce is considered corrective and the contract is retracing the steep sell-off between Apr 7 - 11. The next resistance to watch is 111-25, 50.0% of the Apr 7 - 11 bear leg. A resumption of weakness would refocus attention on 109-08, the Apr 11 low. A break of this level would resume the downtrend.

SOFR FUTURES CLOSE

Jun 25 steady00 at 95.925

Sep 25 +0.025 at 96.30

Dec 25 +0.045 at 96.560

Mar 26 +0.060 at 96.715

Red Pack (Jun 26-Mar 27) +0.060 to +0.065

Green Pack (Jun 27-Mar 28) +0.060 to +0.065

Blue Pack (Jun 28-Mar 29) +0.050 to +0.065

Gold Pack (Jun 29-Mar 30) +0.035 to +0.050

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00819 to 4.31994 (-0.00192/wk)

- 3M -0.01032 to 4.26947 (+0.01337/wk)

- 6M -0.01496 to 4.12728 (+0.02928/wk)

- 12M -0.02539 to 3.87643 (+0.02513/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.36% (+0.03), volume: $2.526T

- Broad General Collateral Rate (BGCR): 4.35% (+0.02), volume: $1.039T

- Tri-Party General Collateral Rate (TCR): 4.35% (+0.02), volume: $999B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $242B

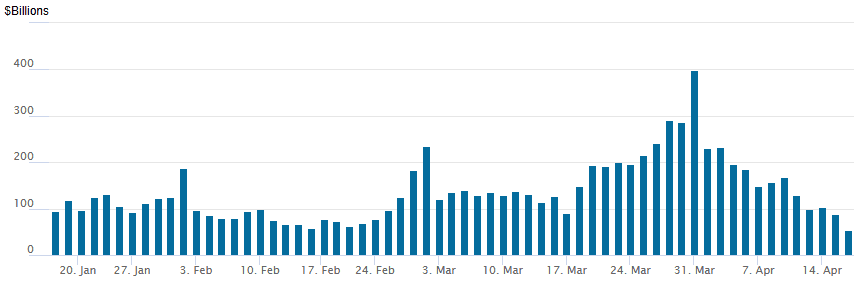

FED Reverse Repo Operation

RRP usage falls to $54.772B -- the lowest level since April 2021 this afternoon from $88.878B on Tuesday. Usage had surged to the highest level since December 31, 2024 last Monday, March 31: $399.167B. The number of counterparties rises to 30 from 23 prior.

MNI PIPELINE: Corporate Bond Update: $1B Molex 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/16 $1B #Molex Electronic Technologies $600M 3Y +100, $400M 7Y +120

- $20.8B Priced Tuesday, $38.9B/wk

- 04/15 $8B *Wells Fargo $2.25B 4NC3 +113, $500M 4NC3 SOFR+137, $2.25B 6NC5 +118, $3B 11NC10+128

- 04/15 $6B *Goldman Sachs $2.5B 3NC2 +110, $500M 3NC2 SOFR+129, $3B 6NC5 +125

- 04/15 $3B *MUFG $1B 6NC5 +117, $500M 6NC5 SOFR+128, $1.5B 11NC10 +127

- 04/15 $3.8B *Colombia $1.9B 5Y 7.5%, $1.9B 10Y 8.75%

MNI BONDS: EGBs-GILTS CASH CLOSE: Bund Yields Pull Back Ahead Of ECB

German instruments outperformed UK counterparts at the short end, but vice versa at the long end Wednesday.

- European core instruments gained in initial morning trade, due in part fo softer-than-expected UK CPI data and some concerns over China-US trade tensions.

- However, risk assets recovered following the publication of a Bloomberg sources piece casting more soothing tones ("China Open to Talks If US Shows Respect"), pushing Bunds and Gilts to the weakest levels of the day.

- Bunds and Gilts would retrace higher, and close near the middle of the session's ranges. On the day, the German curve bull flattened to through the 10Y tenor (a poor auction weighed on the 30Y segment), with the UK's twist flattening.

- Periphery / semi-core EGB spreads were mixed.

- Thursday's highlight is the ECB decision - MNI's preview is here. The ECB is widely expected to cut its three key rates by 25bp this week, taking its deposit rate to 2.25%. As MNI reported in a sources piece today, the Statement could adjust its statement to emphasise that rates are at the upper end of its range of estimates of neutral ("MNI SOURCES: ECB Likely To Adjust Or Remove 'Restrictive'")

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 1.748%, 5-Yr is down 2.9bps at 2.061%, 10-Yr is down 2.5bps at 2.509%, and 30-Yr is down 0.1bps at 2.914%.

- UK: The 2-Yr yield is up 1.2bps at 3.974%, 5-Yr is down 1.7bps at 4.093%, 10-Yr is down 4.5bps at 4.603%, and 30-Yr is down 6.7bps at 5.36%.

- Italian BTP spread up 0.5bps at 118.7bps / Spanish down 0.5bps at 70.1bps

MNI FOREX: Greenback Consolidates Early Decline, CHF & SEK Outperform

- Wednesday’s US session has witnessed relatively tight ranges in G10 currency markets, allowing the USD index to consolidate its initial move lower across APAC and early European trade. The ICE dollar index currently tracks at 99.35, just 35 pips from the 99.01 cycle lows that were printed last Friday.

- Weakness has been broad based against G10 peers, although the Swiss Franc and Swedish Krona have outperformed. For USDCHF specifically, the pair erased the entirety of the prior session’s bounce and leaves the pair vulnerable to a break below the 0.8100 mark, which would place the pair at fresh ten-year lows. A softer risk backdrop across global markets appears to have resumed the souring sentiment towards the dollar, and USDSEK’s 1% move lower has no idiosyncratic driver behind the move.

- The likes of EUR, AUD and NZD are all rising in line with the adjustment for the greenback, with EURUSD pushing back towards 1.14 and keeping bullish conditions firmly intact. Key focus remains on 1.1495, the Feb 10 2022 high. For AUDUSD, spot continues to edge back towards 0.6400, and a breach of 0.6409 (Feb 21 high) would likely prompt some further short covering for the pair. This may signal scope for a stronger recovery towards the US election highs at 0.6550.

- The Bank of Canada kept rates unchanged at 2.75%, in line with a slender majority of analysts. Together with higher crude prices, the CAD has been a beneficiary which has allowed USDCAD to edge back towards its recent lows. It is worth noting that Monday’s low came within 7 pips of the US election lows, located at 1.3822, a level of key short-term significance. Moving average studies are in a bear -mode position, highlighting a dominant downtrend. Below here, 1.3744 marks the next target, a Fibonacci retracement.

- GBP remains a relative underperformer on Wednesday, reflective of a softer-than-expected set of March inflation data. Although GBPUSD hovers around unchanged on the session, spot remains above the prior breakout level of 1.3207, an important bull trigger for the pair.

- Thursday’s data highlights include New Zealand CPI and Australian unemployment, before the focus turns to the ECB decision, where a 25bp cut of its three key rates is widely expected.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 17/04/2025 | 0600/0800 | ** | PPI | |

| 17/04/2025 | 1100/0700 | *** | Turkey Benchmark Rate | |

| 17/04/2025 | 1215/1415 | *** | ECB Deposit Rate | |

| 17/04/2025 | 1215/1415 | *** | ECB Main Refi Rate | |

| 17/04/2025 | 1215/1415 | *** | ECB Marginal Lending Rate | |

| 17/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 17/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 17/04/2025 | 1230/0830 | * | International Canadian Transaction in Securities | |

| 17/04/2025 | 1230/0830 | *** | Housing Starts | |

| 17/04/2025 | 1230/0830 | ** | Philadelphia Fed Manufacturing Index | |

| 17/04/2025 | 1245/1445 | ECB Monetary Policy press conference | ||

| 17/04/2025 | 1400/1000 | * | US Bill 08 Week Treasury Auction Result | |

| 17/04/2025 | 1400/1000 | ** | US Bill 04 Week Treasury Auction Result | |

| 17/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 17/04/2025 | 1530/1130 | ** | US Treasury Auction Result for TIPS 5 Year Note | |

| 17/04/2025 | 1545/1145 | Fed Governor Michael Barr | ||

| 17/04/2025 | 1700/1300 | ** | US Treasury Auction Result for TIPS 5 Year Note | |

| 18/04/2025 | 2330/0830 | *** | CPI |