MNI ASIA OPEN: Inflation Expectations Rise, Tariff Date Nears

EXECUTIVE SUMMARY

- MNI BRIEF: Carney, Trump Poised For Tariffs After Trade Call

- MNI FED SF's Daly: Two 2025 Cuts Still "Reasonable", "No Reason To Rush" - RTRS

- MNI US DATA: A Wide Range To Inflation Expectations By Party

- MNI US DATA: Atlanta Fed GDPNow Sees Large Downgrade To Q1 After Trade, PCE Data

- MNI US DATA: Consumer Sentiment Slides As Inflation Expectations Climb Further

US

MNI FED SF's Daly: Two 2025 Cuts Still "Reasonable", "No Reason To Rush" - RTRS

San Francisco Fed President Daly (non-FOMC voter in 2025/26, dove) tells Reuters in an interview that she continues to expect two rate cuts in 2025, calling that a "reasonable" projection and unchanged from her view late last year. As such she's one of 9 (of 19) FOMC members to make up the 2025 median of 3.9% in the March projections (2 cuts), with only 2 more dovish than that (at 3.6%).

NEWS

MNI BRIEF: Carney, Trump Poised For Tariffs After Trade Call

Canadian Prime Minister Mark Carney said Friday he had a "very constructive" call with U.S. President Donald Trump though both leaders signaled more tariffs and counter-tariffs between two of the world's largest trade partners are coming next week. "The Prime Minister informed the President that his government will implement retaliatory tariffs to protect Canadian workers and our economy, following the announcement of additional U.S. trade actions on April 2," according to a statement. Carney is running for election Apr. 28 and said he and Trump "agreed to begin comprehensive negotiations about a new economic and security relationship immediately following the election."

MNI US-RUSSIA: BBG-Putin 'Testing' Trump With Sanctions Relief Demands

Bloomberg reports that Russia's demands for one of its largest state-run banks to be reconnected to the SWIFT financial system are part of a "deliberate strategy to test how far US President Donald Trump is willing to go in pressing Europe to ease sanctions, according to people familiar with the situation." The selection of the banking sanctions as a focus "was to see if Trump would firstly engage with the idea and then whether he could bring the European Union on board".

MNI Ukraine Can't Accept Deal That Threatens Its EU Integration - Zelenskyy

Reuters reporting comments from Ukrainian President Volodymyr Zelenskyy appearing to suggest that Kyiv considers a revised mineral sharing agreement proposed by the United States as insufficiently favourable to Ukraine's interests and has the potential to derail Kyiv's long-term plans for EU accession. Zelenskyy says, "Kyiv received draft of new minerals deal from US," noting that the revised deal is "entirely different" to a previous framework that Kyiv was prepared to sign.

MNI ISRAEL: PM-'We Will Attack Anywhere In Lebanon Against Any Threat To Israel'

Prime Minister Benjamin Netanyahu has made his first comments following the IDF airstrikes on Beirut earlier today. Netanyahu said, "Those who have not yet internalized the new situation in Lebanon received today another example of our determination. The equation has changed - what happened before the October 7 attacks will not be repeated. We will not allow firing on our communities, not even a drizzle. We will continue to vigorously enforce the ceasefire, we will attack everywhere in Lebanon against any threat to the State of Israel, and we will ensure that all our residents in the north return to their homes safely"

MNI ISRAEL: Tensions Spike As IDF Says Beirut Strikes Targeted Hezbollah Drones

Reuters reports comments from the Israeli military claiming that its missile strikes earlier today on the southern suburbs of the Lebanese capital Beirut were targeting infrastructure allegedly used by Hezbollah to store drones. The strikes on Beirut and southern Lebanon come after two rockets were fired towards northern Israel from Lebanese territory earlier on 28 March. The strikes are the first to hit Beirut since the November ceasefire came into effect. Lebanon's President Joseph Aoun, who is currently in Paris, has told French President Emmanuel Macron that the strikes on Beirut are a "continuation of Israeli violations [of the] ceasefire agreement."

MNI TURKEY: Erdogan Talks w/Putin On Black Sea Truce & Syria Security

President Recep Tayyip Erdogan has held a call with Russian President Vladimir Putin. Says that Erdogan told Putin Turkey is following the efforts to end the war in Ukraine, and that it can host peace talks if needed. Erdogan told Putin that the "steps for safety of navigation in the Black Sea can contribute to peace" and that Turkey is willing to contribute. As the US and Russia continue talks on a possible peace plan for Ukraine, while Ukraine and its allies in Europe separately organise the 'coalition of the willing' to support Kyiv with a 'reassurance force' in the event of a ceasefire, Turkey remains one of the few NATO countries that Russia might countenance allowing to take part in such efforts.

MNI GERMANY: Leader-Level Coalition Negotiation Group Meets For 1st Time

The 19-member main negotiating group will meet for the first time this afternoon as the centre-right Christian Democratic Union/Christian Social Union (CDU/CSU) and centre-left Social Democratic Party (SPD) continue efforts to try and reach a coalition agreement. Following weeks of work in smaller issue and department-specific working groups, these will be leader-level talks and include chancellor-in-waiting Friedrich Merz (CDU), Markus Söder (CSU), and Lars Klingbeil and Saskia Esken for the SPD.

BBG: US VP VANCE: NO IMMEDIATE PLANS TO EXPAND US MILITARY IN GREENLAND; OUR ARGUMENT IS WITH DENMARK, NOT WITH GREENLAND; WE CAN'T IGNORE RUSSIAN, CHINESE ENCROACHMENT.

MNI US TSYS: Risk Sentiment Retreats Ahead April 2 Liberation Day, NFP Next Friday

- A strong risk-off tone gathered momentum after this morning's drop in Consumer Sentiment and rising inflation expectations as reported by the University of Michigan, accounts squaring positions ahead of next week's "liberation Day" Trump tariff rollout on April 2, not to mention next Friday's employment data for March.

- Jun'25 10Y futures have breached initial technical resistance of 110-26 (Mar 25 high) marking session high of 111-07.5 (+26) -- medium-term trend condition is bullish, the first key resistance is located at 111-17+, the Mar 20 high.

- While curves have scaled off steepest levels since early Jan'22 (short end lagging), projected rate cuts through mid-2025 have gained significantly vs. early morning levels (*) as follows: May'25 at -5.2bp (-3.9bp), Jun'25 at -21.8bp (-17.2bp), Jul'25 at -36.5bp (-28.5bp), Sep'25 -52bp (-43.5bp).

- Cross asset update: CBOE's VIX volatility index has climbed to 22.18 (+3.49) recedes to 21.34 in late trade, Gold near highs of 3086.09 at 3080.45, Bbg US$ index weaker at 1271.92 (-1.38) is off low of 1270.18.

- Fading risk appetite on Friday worked heavily in favour of the Japanese Yen, USDJPY, has extended its pull lower, oscillating around 150.00 as we approach the close, and notably 120 pips off the overnight session highs. Price action suggests the breach of 150.95 resistance earlier in the week appears to have been a false break.

OVERNIGHT DATA

MNI US DATA: Consumer Sentiment Slides As Inflation Expectations Climb Further

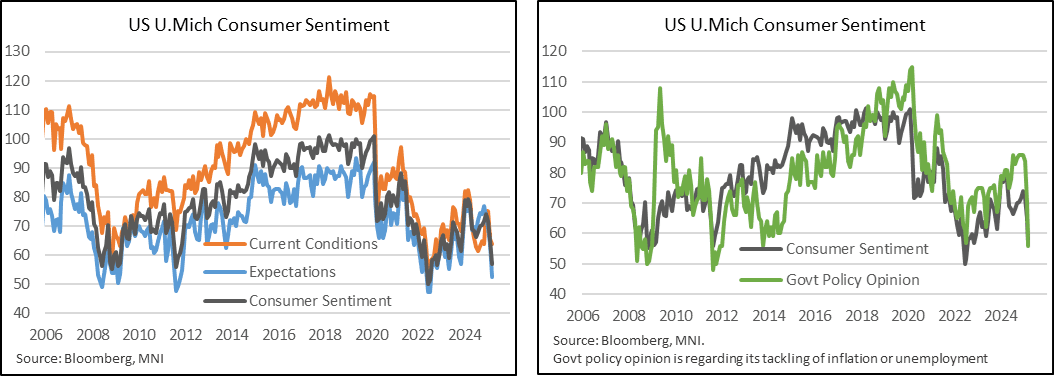

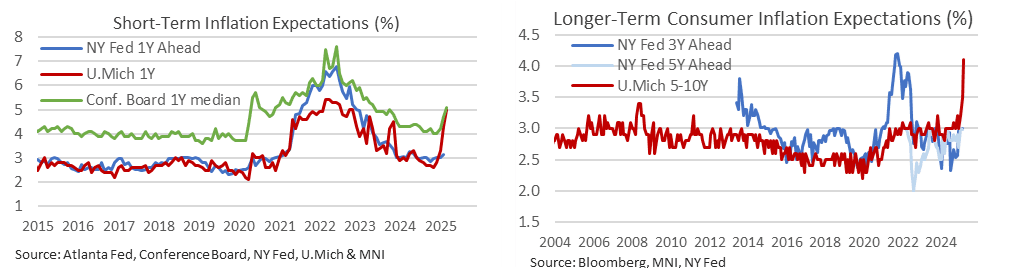

U.Mich consumer inflation expectations were surprisingly revised even higher in the final March report which helped further trim consumer sentiment. Long-run inflation expectations were marked 0.2pps higher than what was already a 32-year high and sentiment was lowered slightly to 57.0 (prelim 57.9) for a heavy drop from 64.7 in Feb and 71.7 in Jan - it’s the lowest since Nov 2022.

- 1Y inflation expectations: 5.0% (flash & cons 4.9%) in March final after 4.3% in Feb and 3.3% in Jan.

- 5-10Y inflation expectations: 4.1% (flash & cons 3.9) after 3.5% in Feb and 3.2% in Jan.

- Within consumer sentiment details, democrats saw another heavy decline to just 41.3 (-10pts), independents another solid 4.3pt decline to 63.7 (-4.3pts) whilst republicans inched to new recent highs of 87.4 (+0.7pts).

- For a more direct take on perceptions of government policy, the question that tackles the government’s attempts at fighting inflation or unemployment saw its balance slide to 56 in March from 70 in Feb. It’s an abrupt deterioration for this index, having averaged joint recent highs of 86 a month either side of the presidential election in November. It’s now at its joint lowest since Oct 2013 and before that 2012.

MNI US DATA: A Wide Range To Inflation Expectations By Party

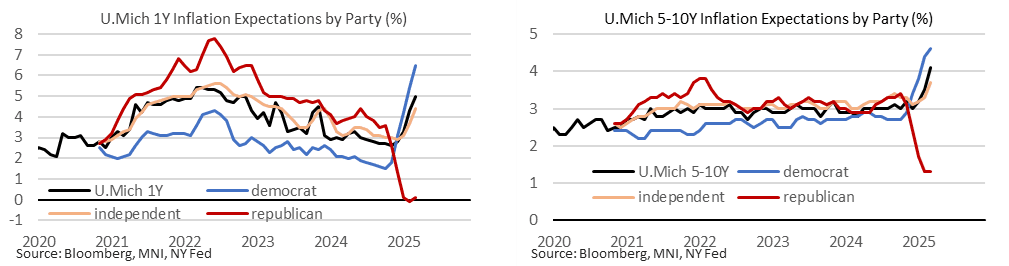

- We may revert on the breakdown of inflation expectations by political leaning later. The values we see from Bloomberg are currently unrevised from the preliminary release despite the upward revisions for overall measures.

- Should those lack of revisions be correct (for instance if there were more democrats completing the survey since the preliminary cut-off), the preliminary distribution showed democrats expecting 1Y inflation at 6.5% vs just 0.1% for republicans, or 4.6% and 1.3% respectively for 5-10Y expectations.

- Recall that independents were notable in the preliminary release as well, with the 1Y at 4.4% after 3.7% in Feb and 3.1% in Jan, and the 5-10Y at 3.7% after 3.3% in Feb and 3.2% in Jan.

- Values by political leaning from the March preliminary report (possibly still unrevised with today's final release):

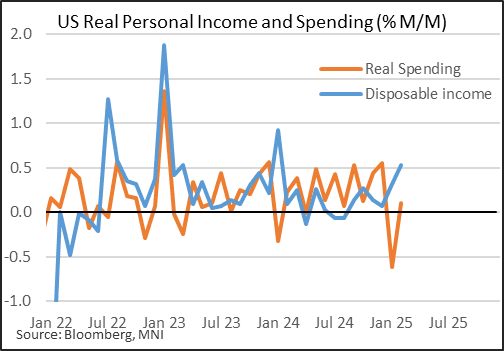

MNI US DATA: PCE Warns That Poor Confidence Is Spilling Over Into "Hard" Data

All of the aggregate spending figures in February's PCE report disappointed, with lower revisions, in what is overall a cautionary set of data that suggests that consumer confidence is waning. Personal income printed 0.8% (0.4% expected, 07% prior rev down 0.2pp), while personal spending rebounded less than expected to +0.4% (0.5% expected) after a lower revision to January (-0.3%, down 0.1pp from the prior estimate).

- We take each of these one-by-one, but start with the household savings ratio which rose to an 8-month high 4.6%, up 1.3pp in just 2 months. These are subject to huge revisions so would take with a grain of salt. But it is a hint that sentiment is turning more cautious amid policy uncertainty (especially tariffs?), and this is also seen in the rest of the report.

- Income growth had one of its best months in years at 0.8% M/M (a 13-month high) in February, with disposable income growth similarly at a 13-month high (0.9%), but that only translated into 0.4% nominal spending growth, a poor rebound from -0.3% in January.

- In terms of real spending growth, this was really soft, at 0.1% M/M, which after January's 0.6% decline (rev lower by 0.1pp) means that real spending was only marginally higher in February than it was in November 2024. Real spending is now running at just a 2.1% 3M/3M annualized rate, which is a 10-month low. That leaves core PCE tracking for its worst quarter since Q1 2024, and half the rate of Q4.

- Even more worrying: services spending was outright negative in real terms, -0.1%, almost rounding to -0.2%, the first drop in this category since January 2022. Real goods purchases rebounded to 0.7% after -2.1%, but this means real goods consumption remains at a lower level than it was in November.

- Putting this together: while consumers have more money to spend, they are choosing to save and not spend it - an increasingly clear sign that weakening confidence in the "soft" data is starting to translate into the "hard" data. As such it will be key to see any rebound in confidence in coming months, as consumers still appear to have the ability if not the willingness to spend.

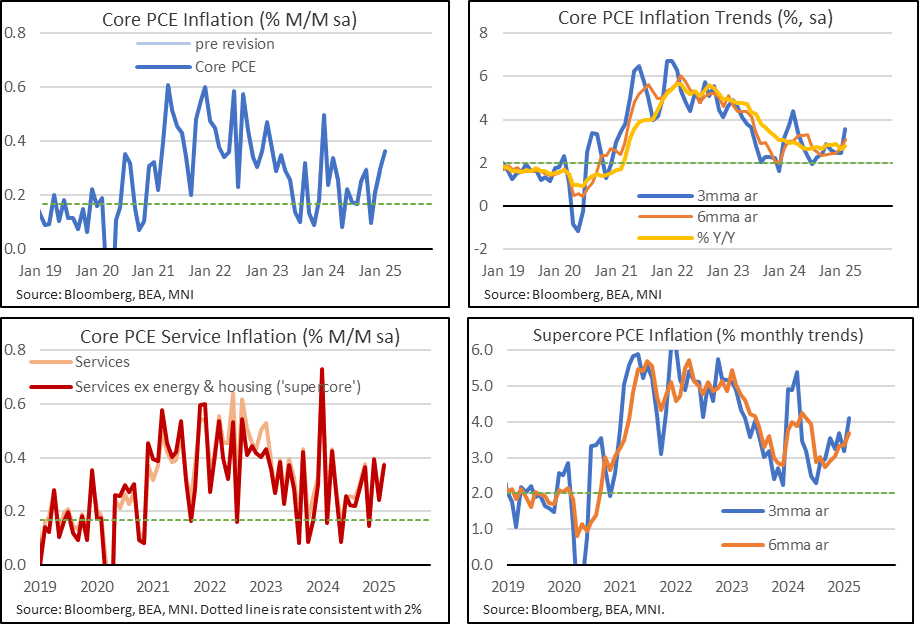

MNI US DATA: Core PCE Run Rates Accelerate More Clearly Above Y/Y

- Core PCE saw a small beat of unrounded estimates, printing 0.365% M/M in Feb (average unrounded seen at 0.34%).

- It’s after some mild upward revisions which left a solid 0.30% M/M in Jan and 0.21% in Dec.

- The Y/Y accelerated from 2.66% to 2.78% Y/Y to limit moderation from the 2.84% averaged in Q4.

- Run rates are hotter: the three-month accelerated from 2.5% to 3.6% annualized (highest since Mar 2024) and the six-month from 2.7% to 3.1% (highest since Jun 2024).

- As above, core services ex-housing saw a solid 0.37% M/M in Feb after 0.24% in Jan and 0.395% in Dec.

- It accelerated from 3.12% to 3.34% Y/Y, still softer than the 3.56% averaged in Q4 but again with some notably hotter recent run rates.

- The supercore three-month run rate increased from 3.2% to 4.1% annualized (highest since Mar 2024) and the six-month from 3.4% to 3.7% (highest since Jun 2024).

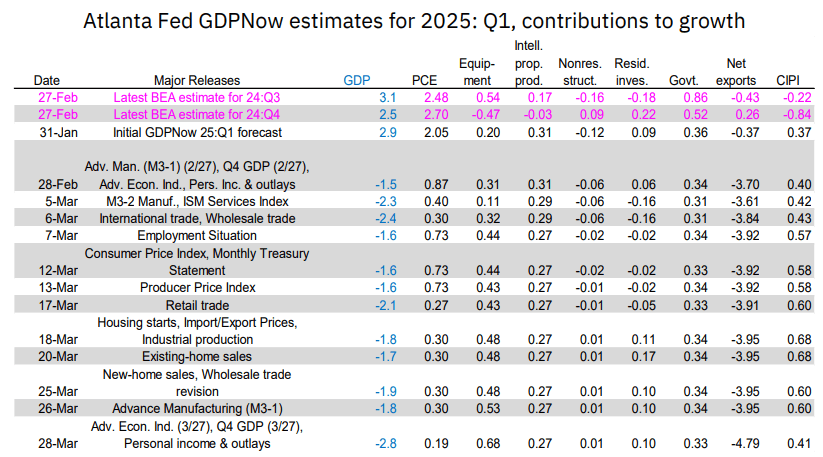

MNI US DATA: Atlanta Fed GDPNow Sees Large Downgrade To Q1 After Trade, PCE Data

Note while it may have been missed just before the Michigan data was released, Atlanta GDPNow posted a big downward revision to Q1 growth: now -2.8% (was -1.8% two days ago), and -0.5% "gold adjusted" (was +0.2% two days ago).

- The downgrade - which takes into account the impact of the final Q4 GDP estimates as well - was led by the larger-than-expected February trade deficit, though we also saw pullbacks in estimates for inventories and PCE after the latest data. Equipment investment is seen a little stronger, however.

- The gold-adjusted figure's differential to the non-adjusted reading widened to 2.3pp, vs 2.0pp prior to the February release. (Recall, this adjustment is being made because a surge in monetary gold imports driving up the trade deficit and thus drag from net exports is not seen as a measure of underlying real activity).

MNI US DATA: KC Fed Services Activity Declines Only Slightly, Defying Broader Trend

The Kansas City Fed's services sector survey showed a small pullback in the composite index to 0 in March from 2 prior, suggesting flat activity on the month - though this was still better than the 13-month low -4 in January.

- The moderate decline contrasts with other regional Fed services surveys (NY, Philly) that saw much sharper drops in March amid tariff-related uncertainty.

- The internals of the KC report were mixed: "Activity in tourism & hotels grew and declines eased in the wholesale, real estate, and professional services, and education sectors. Healthcare and retail activity fell further. The month-over-month indexes were mixed. General revenue/sales picked up from -1 to 4, while employment decreased from 3 to -5. Employee hours worked decreased to its lowest reading since May 2020 at -10. The year-over-year composite index cooled further from 6 to 2, as growth in the business sector eased and consumer activity remained flat. Revenues were steady, but employment fell from the previous year’s levels for the first time since April 2024. Capital expenditures and access to credit fell only slightly."

- Expectations pulled back to 12.0 from 17.0 prior, still positive but "with firms expecting lower sales and employment growth in the coming six months."

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 685.06 points (-1.62%) at 41614.69

S&P E-Mini Future down 109.5 points (-1.91%) at 5629.5

Nasdaq down 465.9 points (-2.6%) at 17338.84

US 10-Yr yield is down 10.1 bps at 4.259%

US Jun 10-Yr futures are up 24/32 at 111-5.5

EURUSD up 0.0026 (0.24%) at 1.0827

USDJPY down 1.11 (-0.73%) at 149.94

WTI Crude Oil (front-month) down $0.61 (-0.87%) at $69.31

Gold is up $23.03 (0.75%) at $3080.35

European bourses closing levels:

EuroStoxx 50 down 49.68 points (-0.92%) at 5331.4

FTSE 100 down 7.27 points (-0.08%) at 8658.85

German DAX down 217.22 points (-0.96%) at 22461.52

French CAC 40 down 74.03 points (-0.93%) at 7916.08

US TSY FUTURES CLOSE

3M10Y -9.903, -3.783 (L: -5.002 / H: 5.15)

2Y10Y -2.255, 34.3 (L: 32.352 / H: 35.95)

2Y30Y -0.449, 72.036 (L: 67.428 / H: 72.672)

5Y30Y +2.036, 64.853 (L: 60.36 / H: 65.471)

Current futures levels:

Jun 2-Yr futures up 5.25/32 at 103-18.5 (L: 103-13 / H: 103-19.25)

Jun 5-Yr futures up 15.25/32 at 108-4.75 (L: 107-22.25 / H: 108-06.5)

Jun 10-Yr futures up 24/32 at 111-5.5 (L: 110-15 / H: 111-07.5)

Jun 30-Yr futures up 1-13/32 at 117-2 (L: 115-21 / H: 117-06)

Jun Ultra futures up 1-25/32 at 121-24 (L: 120-00 / H: 121-30)

MNI US 10YR FUTURE TECHS: (M5) Support Holding For Now

- RES 4: 112-13 1.500 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 3: 112-01 High Mar 4 and a bull trigger

- RES 2: 111-17+/25 High Mar 20 / 11

- RES 1: 110-26 High Mar 25

- PRICE: 110-19+ @ 10:15 GMT Mar 28

- SUP 1: 110-07/06 50-day EMA / Low Mar 27

- SUP 2: 110-00 High Feb 7 and a key support

- SUP 3: 109-17+ Trendline support drawn from the Jan 13 low

- SUP 4: 109-19 50.0% retracement of the Jan - Mar bull cycle

Treasury futures are trading closer to their recent lows. Price remains above 110-07, the 50-day EMA. This average represents a key S/T pivot level - a clear break of it would signal scope for a deeper retracement. This would expose an equally important support at 110-00, the Feb 7 high. Clearance of both levels would be bearish. The medium-term trend condition is bullish, the first key resistance is located at 111-17+, the Mar 20 high.

SOFR FUTURES CLOSE

Jun 25 +0.055 at 95.925

Sep 25 +0.090 at 96.185

Dec 25 +0.10 at 96.365

Mar 26 +0.105 at 96.485

Red Pack (Jun 26-Mar 27) +0.105 to +0.110

Green Pack (Jun 27-Mar 28) +0.110 to +0.115

Blue Pack (Jun 28-Mar 29) +0.115 to +0.120

Gold Pack (Jun 29-Mar 30) +0.115 to +0.120

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00127 to 4.32365 (+0.00354/wk)

- 3M -0.00156 to 4.29761 (-0.00022/wk)

- 6M -0.00099 to 4.21561 (+0.01095/wk)

- 12M -0.00594 to 4.05286 (+0.02948/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.36% (+0.01), volume: $2.468T

- Broad General Collateral Rate (BGCR): 4.34% (+0.00), volume: $962B

- Tri-Party General Collateral Rate (TCR): 4.34% (+0.00), volume: $926B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $109B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $276B

FED Reverse Repo Operation

RRP usage retreats to $286.575B this afternoon from $291.785B Thursday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 45.

MNI BONDS: EGBs-GILTS CASH CLOSE: Core FI Gains On Tariff And Growth Concerns

European yields fell sharply Friday, with tariff concerns weighing on risk appetite and Eurozone inflation data coming in on the low side.

- French and Spanish flash March inflation readings were softer than expected, resulting in Bunds hitting what would be their richest levels of the session.

- The rest of the day proved more mixed, with tariff headlines again the main driver. Core FI pulled back on reports that the EU was considering some trade concessions to the US, and later on positive US-Canada trade tones.

- But risk aversion would pick up again toward the cash close, with equities falling to 2-week lows on poor US consumption data and Atlanta Fed GDP nowcast, as well as Trump confirming that the US would follow through on tariffs to Canada.

- On the day, Gilts outperformed Bunds, with bellies outperforming in both the German and UK curves.

- For the week, both the UK (2s10s +5.2bp) and German (2s10s +7.4bp) bull steepened.

- Periphery EGB spreads widened alongside the equity drawdown, with BTPs underperforming.

- Next week's early highlights include German and Italian inflation, with Wednesday's US tariff announcements in focus globally.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.9bps at 2.02%, 5-Yr is down 5.3bps at 2.32%, 10-Yr is down 4.6bps at 2.727%, and 30-Yr is down 3.2bps at 3.102%.

- UK: The 2-Yr yield is down 7.8bps at 4.195%, 5-Yr is down 9.4bps at 4.298%, 10-Yr is down 8.9bps at 4.694%, and 30-Yr is down 8bps at 5.288%.

- Italian BTP spread up 1.6bps at 112.2bps / Spanish up 1bps at 63.3bps

MNI FOREX: USDJPY Extends Decline Amid Renewed Pessimism for US Equities

- Fading risk appetite on Friday worked heavily in favour of the Japanese Yen, as slippage for US equities puts the e-mini S&P (-2.08%) below 5625 and the e-mini Nasdaq (-2.7%) below 19,500. As such USDJPY, has extended its pull lower, oscillating around 150.00 as we approach the close, and notably 120 pips off the overnight session highs. Price action suggests the breach of 150.95 resistance earlier in the week appears to have been a false break.

- While the USD index remains 0.25% softer on the session, it is the risk sensitive currencies such as AUD and NZD that have suffered equally, as the market reignites its concern around US stagflation. The Atlanta GDPNow posted a big downward revision to Q1 growth: now -2.8% (was -1.8% two days ago).

- AUDJPY downside has continued to pick up, declining over 1% on the day, also marking a failure to break the key resistance we noted this week at the 50-dma (today at 95.30), which has failed to break on several occasions across this year.

- NZD remains the weakest in G10 Friday, following weaker ANZ consumer confidence, along with barely positive filled jobs growth. NZDJPY has declined 1.1% swiftly erasing the bulk of the week’s advance.

- We noted that spot vol here is supporting the front-end of the implied curve: EUR/USD one-week vols capturing 'Liberation Day' on Wednesday now clear 9 points, bucking the trend of slipping vol over the course of the month. The Euro has stood out in G10 today, shrugging off the waning risk sentiment and rising back above 1.0820. Overall, recent weakness in EURUSD has appeared technically corrective. On the topside, focus will be on 1.0861, the March 21 high, followed by 1.0955, the Mar 18 high and bull trigger.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 31/03/2025 | 0600/0800 | ** | Import/Export Prices | |

| 31/03/2025 | 0600/0800 | ** | Retail Sales | |

| 31/03/2025 | 0800/1000 | *** | Bavaria CPI | |

| 31/03/2025 | 0800/1000 | *** | North Rhine Westphalia CPI | |

| 31/03/2025 | 0800/1000 | *** | Baden Wuerttemberg CPI | |

| 31/03/2025 | 0830/0930 | ** | BOE Lending to Individuals | |

| 31/03/2025 | 0830/0930 | ** | BOE M4 | |

| 31/03/2025 | 0900/1100 | *** | HICP (p) | |

| 31/03/2025 | - | DMO Quarterly Investors/GEMM consultation | ||

| 31/03/2025 | 1200/1400 | *** | HICP (p) | |

| 31/03/2025 | 1345/0945 | *** | MNI Chicago PMI | |

| 31/03/2025 | 1430/1030 | ** | Dallas Fed manufacturing survey | |

| 31/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 31/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 31/03/2025 | 1600/1200 | ** | USDA GrainStock - NASS | |

| 31/03/2025 | 1600/1200 | *** | USDA PROSPECTIVE PLANTINGS - NASS | |

| 01/04/2025 | 2200/0900 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 01/04/2025 | 2330/0830 | * | Labor Force Survey | |

| 01/04/2025 | 2350/0850 | *** | Tankan | |

| 01/04/2025 | 0030/1130 | ** | Retail Trade | |

| 01/04/2025 | 0030/0930 | ** | S&P Global Final Japan Manufacturing PMI | |

| 01/04/2025 | 0145/0945 | ** | S&P Global Final China Manufacturing PMI | |

| 01/04/2025 | 0330/1430 | *** | RBA Rate Decision |