MNI ASIA OPEN: More Clarity on Tariff Policies Needed

EXECUTIVE SUMMARY

- MNI FED BRIEF: Daly Says Policy In Good Place, Need Clarity

- MNI FED Goolsbee: Pushes Uncertainty Angle, Not Waiting For Hard Data

- MNI EGBS: Trump Post On Tariff Negotiations W/ South Korea and China Adds Pressure

- MNI ITALY: BBG-Meloni To Visit D.C., In Effort To Gain Tariff Concessions

- MNI US DATA: Small Business Optimism Reverses Further, Price Plans Drifting Higher

US

MNI FED BRIEF: Daly Says Policy In Good Place, Need Clarity

The Federal Reserve will need more clarity on Washington's tariff policies to better understand the economic outlook and the landscape that businesses face before the central bank can make policy changes, San Francisco Fed President Mary Daly said Tuesday. "Overall, solid growth, solid labor market, inflation starting to edge down but a little concerned that it might pick back up again at least temporarily, from tariffs," she said at Brigham Young University in Utah. "We've got policy in a very good place right now. We've cut the interest rate by 100 basis points last year. That puts policy in a good place to stay modestly restrictive, keep inflation coming down, but not so restrictive that the economy is vulnerable. So with growth good and policy in a good place, we have built a time and the ability to just be tread slowly and tread carefully."

MNI FED Goolsbee: Pushes Uncertainty Angle, Not Waiting For Hard Data

Chicago Fed’s Goolsbee (’25 voter, dove) pushes the uncertainty angle under US trade policy in an appearance on public radio. "You just tell us what the conditions are going to be, and then we'll figure out what jacket to put on, right? And the thing is, now what jacket to put on is not clear”. He also noted that some Trump administration policymakers are saying that tariffs are not going to last and some saying tariffs will be put in place forever.

NEWS

MNI EGBS: Trump Post On Tariff Negotiations W/ South Korea and China Adds Pressure

Bund futures remain under pressure alongside USTs, with US President Trump’s latest post around tariff negotiations with South Korea and China helping the sell-off extend a little. Today’s FI weakness appears to be tied to the stabilisation in risk sentiment given the lack of further escalation in trade tensions, in contrast to yesterday’s more aggressive US long-end led sell-off. According to Reuters sources, the ECB has been reassured by bank feedback on market funding/liquidity conditions. They also view recent EGB spread widening as “under control”.

MNI US-RUSSIA: TASS: US-Russia Talks To Focus On Normalising Work Of Embassies

State-run TASS giving more details on earlier Kremlin comments confirming that talks will resume in Istanbul on 10 April between Russian and US delegations. The talks "will be devoted to normalizing the work of embassies" according to the Russian Foreign Ministry. The talks will be led by Russia's ambassador to the US Alexander Darchiev and US Assistant Secretary of State Sonata Coulter. President Vladimir Putin’s foreign policy aide, Kirill Dmitriev, was in Washington last week for talks with senior US officials and indicated afterwards that another round of talks could take place in the near future.

MNI ITALY: BBG-Meloni To Visit D.C., In Effort To Gain Tariff Concessions

Bloomberg reports that PM Giorgia Meloni will visit Washington, D.C., as early as next week in an effort to press the Trump administration to offer concessions on tariffs. The Italian leadership "will propose eliminating tariffs on bilateral trade between the EU and the US," given that "About 10% of Italy’s exports go to the US, with some of its most important sectors such as pharmaceuticals, automakers, and the food and wine industries heavily affected by the levies."

MNI US TSYS: Trade Tensions Reverse Early Stock Gains, Curves Twist to New Highs

- Treasuries look to finish mostly weaker late Tuesday - off lows as tariff headlines continued to rattle markets, curves twisting to the steepest levels in over three years (2s10s tap 55.157 high) while stocks failed to hold onto midmorning gains (SPX emins slipped below 5,000 to 4,988.0 low after marking a session high of 5305.25 at midmorning).

- Treasury futures climbing off lows after Trump officials confirmed 104% added tariff on China went into effect at noon, WH press sec Leavitt adds additional tariff to be collected starting tomorrow.

- Heavy short end buying partially swap-tied as spreads narrowed sharply, projected rate cut pricing rebounded vs. morning's levels - back to pricing in a full point by year end. Current levels vs. early morning (*) as follows: May'25 at -14bp (-8.2bp), Jun'25 at -38.2bp (-28.3bp), Jul'25 at -61.6bp (-49.1bp), Sep'25 -79.3bp (-65.7bp).

- Initial equity optimism boosting the higher beta currencies in G10, before a sharp souring of sentiment prompted a significant turnaround for the likes of AUD & NZD. Overall, the dollar index remains close to unchanged, with a lot of the focus remaining on the JPY and CHF crosses, given they remain a strong barometer for global risk sentiment.

- Focus turns to March FOMC minute release at 1400ET tomorrow, CPI Thursday. PPI Friday morning. Reminder, banks kick off the latest earnings cycle this Friday with Bank of New York Mellon, Wells Fargo & Co, JPMorgan Chase and Morgan Stanley reporting.

OVERNIGHT DATA

MNI US DATA: Small Business Optimism Reverses Further, Price Plans Drifting Higher

- The NFIB small business optimism index fell by more than expected in March, to 97.4 (cons 99.0) from 100.7 as it continues to unwind gains seen since the presidential election in November.

- It’s still above the 93.7 in October and readings around the 90 mark since mid-2022 prior to the election, but it’s nevertheless the sharpest monthly drop since Jun 2022. Further, it’s a marked contrast to small business confidence under the first Trump administration which held onto its surge higher following the 2016 election results.

- The share expecting better business conditions in the next six months fell 16pts (sharpest since Dec 2020) for its third monthly decline.

- The uncertainty index meanwhile pulled back to 96 from 104 after what had been its second highest reading in the series history (the highest being 110 in Oct ahead of the presidential election).

- Within the price details, whilst somewhat stale as they ‘only’ capture the initial China tariffs and steel & aluminum more broadly (stopping before Apr 2 “Liberation Day tariffs”), the share who increased prices compared to three months ago fell back to 26% from 32% in Feb (highest since May 2023).

- The share expecting to increase prices over the next three months meanwhile edged 1pp higher to 30% for a fresh high since Mar 2024. It steadily pulls further away from pre-pandemic averages of 21/22 readings and offers a continued headwind against a full returning to the 2% inflation target even prior to larger tariffs in the pipeline.

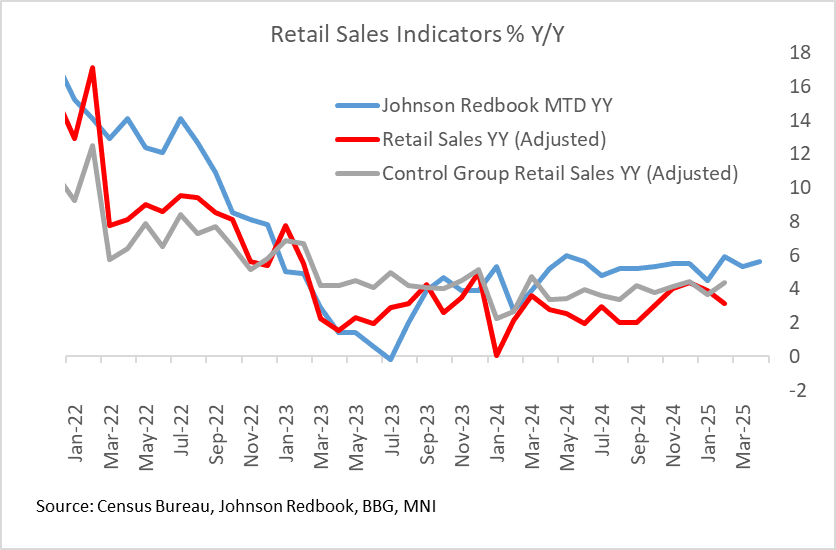

MNI US DATA: Solid Redbook Retail Sales; Some Tariff Front-Running Noted

Johnson Redbook retail sales for the week ending April 5 were up 7.2% Y/Y, up from 4.8% in the prior week. For the 5-week March retail month as a whole (in which the Apr 5 week is technically included), sales were up 5.6% Y/Y.

- While the latest weekly reading was very strong, there were a few mitigating factors. One was a calendar effect: there were 7 full shopping days in the week, versus 6 last year for many retailers, due to Easter Sunday falling in the week in 2024. Another was a tariff front-running effect: "some shoppers hurried to purchase goods ahead of Trump's tariffs".

- The report has been warning that in order to get a better read on underlying retail dynamics, one should combine March's and April's reports due to the Easter holiday calendar shift. March's 5.6% was a little soft vs expectations, reflecting the later holiday, but "we expect April to reflect an upward bias" with a Y/Y growth target of 6.4%. "Retailers are officially set to report March sales on Thursday, and we will, as usual, release our Johnson Redbook Same-store Sales Index on that day."

- A combined retail sales reading of 5-6% for the months would still be robust and suggest that March "official" retail sales (of which Johnson Redbook data reflects around 80%) should be fairly robust as well.

- Whether that's reflective of sustainable retail demand, versus a degree of front-running of tariffs, is a good question - though we note that control retail sales have been steady-to-trending-higher since the middle of 2024 on a Y/Y basis, similar to Redbook.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 804.84 points (-2.12%) at 37170.1

S&P E-Mini Future down 149 points (-2.92%) at 4950.5

Nasdaq down 533.1 points (-3.4%) at 15075.66

US 10-Yr yield is up 5.4 bps at 4.237%

US Jun 10-Yr futures are down 11/32 at 111-23

EURUSD up 0.0041 (0.38%) at 1.0953

USDJPY down 1.7 (-1.15%) at 146.14

WTI Crude Oil (front-month) down $2.54 (-4.18%) at $58.15

Gold is down $0.34 (-0.01%) at $2983.16

European bourses closing levels:

EuroStoxx 50 up 117.24 points (2.52%) at 4773.65

FTSE 100 up 208.45 points (2.71%) at 7910.53

German DAX up 490.64 points (2.48%) at 20280.26

French CAC 40 up 173.3 points (2.5%) at 7100.42

US TREASURY FUTURES CLOSE

3M10Y +3.307, -6.49 (L: -15.949 / H: -2.702)

2Y10Y +14.461, 55.897 (L: 38.775 / H: 56.295)

2Y30Y +18.107, 103.077 (L: 80.731 / H: 103.588)

5Y30Y +9.735, 84.691 (L: 70.269 / H: 84.964)

Current futures levels:

Jun 2-Yr futures up 3.875/32 at 104-2 (L: 103-22 / H: 104-02.375)

Jun 5-Yr futures down 1.25/32 at 108-24.75 (L: 108-07.25 / H: 108-30.75)

Jun 10-Yr futures down 11.5/32 at 111-22.5 (L: 111-08 / H: 112-08)

Jun 30-Yr futures down -1-28/32 at 115-24 (L: 115-16 / H: 118-00)

Jun Ultra futures down 2-07/32 at 120-17 (L: 119-30 / H: 123-13)

MNI US 10YR FUTURE TECHS: (M5) Testing Support

- RES 4: 115-00+ High Oct 1 ‘24

- RES 3: 114-29+ 2.000 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 2: 114-16 2.000 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 1: 112-29/114-10 50.0% of Apr 7 high-low range / High Apr 7

- PRICE: 111-15 @ 1544 ET Apr 8

- SUP 1: 111-10+/110-08 20-day EMA

- SUP 2: 111-10+ 20-day EMA

- SUP 3: 110-20+ 50-day EMA

- SUP 4: 110-06 Low Mar 27

The strong sell-off from yesterday’s high in Treasury futures is considered corrective - for now - and this is allowing an overbought condition to unwind. Recent gains resulted in the break of resistance at 112-01, the Mar 4 high, to confirm a resumption of the uptrend. The move higher opens 114-16 next, a Fibonacci projection. On the downside, support at 111-10+, the 20-day EMA, has been pierced. A clear break of it would open 110-20+, the 50 day EMA

SOFR FUTURES CLOSE

Jun 25 +0.095 at 96.180

Sep 25 +0.120 at 96.535

Dec 25 +0.125 at 96.750

Mar 26 +0.130 at 96.890

Red Pack (Jun 26-Mar 27) +0.090 to +0.130

Green Pack (Jun 27-Mar 28) +0.015 to +0.070

Blue Pack (Jun 28-Mar 29) -0.02 to +0.005

Gold Pack (Jun 29-Mar 30) -0.045 to -0.0

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00898 to 4.29181 (-0.02803/wk)

- 3M +0.00263 to 4.21022 (-0.04876/wk)

- 6M +0.02251 to 4.03528 (-0.09024/wk)

- 12M +0.06547 to 3.77353 (-0.08990/Wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.33% (-0.02), volume: $2.630T

- Broad General Collateral Rate (BGCR): 4.31% (-0.02), volume: $1.029T

- Tri-Party General Collateral Rate (TCR): 4.31% (-0.02), volume: $997B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $266B

FED Reverse Repo Operation

RRP usage bounces to $156.911B this afternoon from $148.146B on Monday. Usage had surged to the highest level since December 31, 2024 last Monday, March 31: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 34.

MNI PIPELINE: Corporate Bond Roundup: $4.2B Paychex 3Pt Launched

First corporate bond issuance since last Wednesday:

- Date $MM Issuer (Priced *, Launch #)

- 04/08 $4.2B #Paychex Inc $1.5B 5Y +125, $1.5B 7Y +135, $1.2B 10Y +145

MNI FOREX: Sharp Swings for AUD Persist amid China Tariff Turmoil

- Today’s session was categorised by a tale of two halves, with initial equity optimism boosting the higher beta currencies in G10, before a sharp souring of sentiment prompted a significant turnaround for the likes of AUD & NZD. Overall, the dollar index remains close to unchanged, with a lot of the focus remaining on the JPY and CHF crosses, given they remain a strong barometer for global risk sentiment.

- Specifically for AUDUSD, the most recent turn lower for equities has certainly sapped the overnight enthusiasm, prompting the pair to almost entirely erode the prior 1.5% advance. The turnaround for risk was exacerbated by the USTR's Greer stating that tariff exemptions will not come through in the near-term, and late confirmation that 104% tariffs on China would be implemented from April 09.

- Earlier 0.6085 highs fell short of initial resistance, which stands at 0.6127, and technical conditions remain firmly in bearish territory. Yesterday’s low print of 0.5933 matched closely with an initial technical support, the 1.764 projection of the Sep 30 - Nov 6/7 price swing. This will remain the key short-term mark on the downside.

- USDJPY is also substantially off the overnight highs, located at 148.12. The pair maintains a bearish tone following last week’s sharp sell-off and the Monday recovery is - for now - considered corrective. A resumption of the downtrend and a break of Friday’s 144.56 low would signal scope for an extension towards 144.13, a Fibonacci retracement point.

- Amid the deterioration of the US/China trade relationship, USDCNH has been pushing fresh record highs today, at 7.3930 at typing. Market moves follow the push higher for the USD/CNY midpoint fix overnight - at 7.2038, the CFETS fix was the highest since Sept'23 and not far off the highest fix on record from late 2022 at 7.2555.

- Calendar focus turns to the RBNZ decision on Wednesday, before the market’s attention shifts to US inflation data, scheduled on Thursday.

WENESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 09/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 09/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 09/04/2025 | - | Higher Reciprocal Tariffs On Imports | ||

| 09/04/2025 | 1230/1430 | ECB's Cipollone On Macro-Financial Stability Panel | ||

| 09/04/2025 | 1400/1000 | ** | Wholesale Trade | |

| 09/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 09/04/2025 | 1500/1100 | Richmond Fed's Tom Barkin | ||

| 09/04/2025 | 1700/1300 | ** | US Note 10 Year Treasury Auction Result | |

| 09/04/2025 | 1800/1400 | *** | FOMC Minutes | |

| 10/04/2025 | 2301/0001 | * | RICS House Prices | |

| 10/04/2025 | 0130/0930 | *** | CPI | |

| 10/04/2025 | 0130/0930 | *** | Producer Price Index |