MNI ASIA OPEN: Reassessing Tariff, Negotiations Arc

EXECUTIVE SUMMARY

- MNI GLOBAL: Tsy Sec Bessent: China "In Need Of A Rebalancing"

- MNI FED: Beige Book: Economic Outlook "Worsened Considerably" In Several Districts

- MNI TARIFFS: Proposal Last Year Eyed Tiered, Phased-In Approach To China

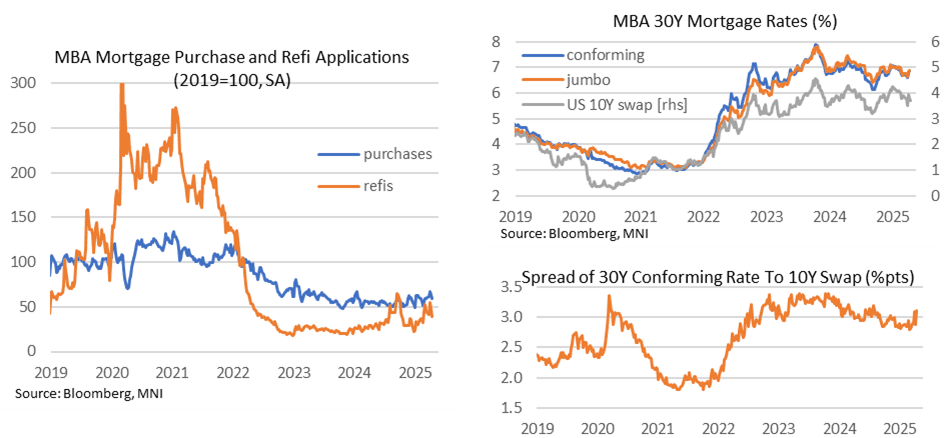

- MNI US DATA: Higher Rates Further Crimp Mortgage Applications

- MNI US DATA: April Flash PMIs Disappoint Whilst Charge Inflation Accelerates

US

MNI GLOBAL: Tsy Sec Bessent: China "In Need Of A Rebalancing"

Here is the text of Tsy Sec Bessent's speech at the IIF (link), which he is still delivering - there will be a discussion afterward.

- There is plenty on the US's role in the World Bank and IMF, and calling for those institutions to reform, while focus in the "trade" portion of the text is on China and Europe - see below for some of the key passages including on global trade imbalances and US security partnerships that reflect global economic relationships.

- Bessent: "China, in particular, is in need of a rebalancing. Recent data shows the Chinese economy tilting even further away from consumption toward manufacturing. China’s economic system, with growth driven by manufacturing exports, will continue to create even more serious imbalances with its trading partners if the status quo is allowed to continue.

NEWS

MNI TARIFFS: Proposal Last Year Eyed Tiered, Phased-In Approach To China

The WSJ article identifying a potential change in the White House's approach on China is most notable for bringing up potential for a tiered, phased-in approach to tariffs on Chinese imports. In particular, "a tiered approach similar to the one proposed by the House committee on China late last year". This is of course referring to a bill and not an executive order but it makes a certain amount of sense for the White House at this point, as it arguably reduces uncertainty for both Fed and businesses on the approach ahead (especially if it were codified as a bill), potentially avoids the worst of the near-term disruptions, and could provide a better roadmap toward the reshoring/supply chain restructuring the White House is looking for.

MNI US: White House Considering Slashing China Tariffs in Latest De-Escalation

Trump's administration is reportedly considering "slashing" its steep tariffs on Chinese imports by more than half in some circumstances, according to WSJ sources. The piece writes that Trump has not yet made a final determination, with discussions remaining fluid and several options still on the table. The piece writes that tariffs are likely to come down to between roughly 50-65% and is considering a tiered approach as proposed late last year - effectively dropping tariffs on items the US does not deem a threat to national security.

MNI UKRAINE: London Talks Downgraded; Trump Peace Plan Gives Russia Notable 'Wins'

Peace talks will take place today in London involving officials from the UK, US, Ukraine, France and Germany. The meeting had initially been intended as a summit of foreign ministers, but on 22 April the US State Dep't confirmed that Secretary of State Marco Rubio would not be able to attend due to 'logistical reasons'. White House Middle East envoy Steven Witkoff is also skipping the talks. In their stead, Keith Kellogg, President Donald Trump’s envoy for Ukraine, will represent the US. Without Rubio, the meeting has been downgraded to a closed-door discussion among security officials.

MNI CANADA: YouGov MRP Poll Has Liberals Winning Majority w/182 Seats

Patrick English at YouGov posts on X regarding the pollster's pre-election multilevel regression and post-stratification (MRP) poll, "We are currently projecting that Mark Carney's Liberal Party will win a majority at the 2025 Canadian Federal Election, with 182 seats. We expect the Conservatives to win 133 seats. A hung parliament remains a distinct possibility."

MNI US TSYS: Trade Wars Are Not an Easy Win, Negotiations Take Time

- Treasuries finishing near late session lows, curves continue to unwind Monday's sharp steepening with short end rates weaker vs. Bonds. Busy session for chasing tariff related headline risk.

- Treasuries opened higher as Pres Trump softened his stance on sacking Fed Chair Powell and reducing China tariffs, improved sentiment also lifting S&P eminis with ESM5 futures tapping 5499.75 high.

- Rates gapped higher briefly on a WSJ article that rehashed possible China tariff cuts, but support was short lived as markets assessed potential reductions, non-unilateral negotiations as well as comments from Tsy Sec Bessent's "in need of a rebalancing".

- US Treasury Secretary Bessent further stated that there is no unilateral offer from Trump to cut China tariffs, and that a full China trade deal could take two-to-three years.

- Tsy Jun'25 10Y futures currently -3.5 at 110-22 vs. session high of 111-18.5. Initial technical support at 110-15 (Apr 15 low) followed by 109-08 (bear trigger). Curves holding flatter profiles but off lows, 2s10s -5.713 at 52.252 (46.527 low), 5s30s -6.569 at 81.760 (77.371 low).

- Cross asset: Bbg US$ index near session high currently +6.84 a t 1228.46; stocks firmer but well off highs: SPX eminis +90.50 at 5405.25 (5499.75 high), Gold cratered: down over 103 at 3277.5 earlier trades 3295.5 at the moment, crude retreated as well (WTI -1.36 at 62.31).

OVERNIGHT DATA

MNI FED: Beige Book: Economic Outlook "Worsened Considerably" In Several Districts

April's Beige Book portrayed an economy in which economic activity was relatively little changed from the previous edition in February, but with increasing uncertainty over government policy causing businesses' outlooks to deteriorate. Likewise, inflation pressures were seen as little changed (still "modest" / "moderate" for the most part) vs prior, but the outlook is for increasing upside to input prices albeit with questionable ability to pass them through to buyers.

Economic Activity: "Economic activity was little changed since the previous report, but uncertainty around international trade policy was pervasive across reports. Just five Districts saw slight growth, three Districts noted activity was relatively unchanged, and the remaining four Districts reported slight to modest declines...The outlook in several Districts worsened considerably as economic uncertainty, particularly surrounding tariffs, rose."

- Prior edition (Feb): "Overall economic activity rose slightly since mid-January. Six Districts reported no change, four reported modest or moderate growth, and two noted slight contractions."

MNI US DATA: April Flash PMIs Disappoint Whilst Charge Inflation Accelerates

Manufacturing PMI: 50.7 (cons 49.0) in April flash after 50.2 in March.; Services PMI: 51.4 (cons 52.6) after 54.4 in March.; Composite PMI: 51.2 (cons 52.0) after 53.5 in March, hitting a 16-month low.

- Highlights from the S&P Global PMI press release (in full here): "US business activity growth slowed to a 16-month low in April, according to flash PMI® survey data, with business expectations about the year ahead also dropping to one of the lowest levels seen since the pandemic. Prices charged for goods and services meanwhile rose at the sharpest rate for just over a year, with an especially steep increase reported for manufactured goods, linked to tariffs."

MNI US DATA: Higher Rates Further Crimp Mortgage Applications

MBA mortgage applications saw a second week of declines to unwind a pop higher early in April as rates rebounded. Current swap rates suggest the climb in mortgage rates is likely to slow ahead but also won’t offer much of a tailwind for mortgage activity.

- MBA composite mortgage applications fell -12.7% (sa) last week to build on the -8.5% previously to have now fully reversed the 20% increase two weeks ago.

- Refis -20% after -12.4% and 35%, new purchases -6.6% after -4.9% and 9.2%.

- It came from another step higher in the 30Y conforming rate, up 9bps to 6.90% after a 20bp increase the week prior, to leave rates at their highest since mid-Feb.

- There should be some respite in the short-term ahead, with 10Y swap rates currently 6-7bp lower than last week’s average.

- For now though, it’s helped new purchases full back further from what had been their highest since Jan 2024 (most recently at 59% of 2019 levels) whilst refis are 39% of 2019 levels.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA up 419.59 points (1.07%) at 39606.57

S&P E-Mini Future up 108 points (2.03%) at 5423.5

Nasdaq up 407.6 points (2.5%) at 16708.05

US 10-Yr yield is down 1.2 bps at 4.389%

US Jun 10-Yr futures are down 5.5/32 at 110-20

EURUSD down 0.0107 (-0.94%) at 1.1314

USDJPY up 1.93 (1.36%) at 143.5

#VALUE!

Gold is down $89.34 (-2.64%) at $3291.96

European bourses closing levels:

EuroStoxx 50 up 137.29 points (2.77%) at 5098.74

FTSE 100 up 74.58 points (0.9%) at 8403.18

French CAC 40 up 155.89 points (2.13%) at 7482.36

US TREASURY FUTURES CLOSE

3M10Y -1.646, 6.166 (L: -6.589 / H: 7.789)

2Y10Y -5.742, 52.223 (L: 46.527 / H: 54.235)

2Y30Y -8.966, 96.673 (L: 90.496 / H: 100.058)

5Y30Y -7.043, 81.286 (L: 77.371 / H: 84.326)

Current futures levels:

Jun 2-Yr futures down 4.875/32 at 103-19.75 (L: 103-19.625 / H: 103-26.375)

Jun 5-Yr futures down 7/32 at 108-1.25 (L: 108-00.25 / H: 108-19.75)

Jun 10-Yr futures down 5.5/32 at 110-20 (L: 110-18.5 / H: 111-18.5)

Jun 30-Yr futures up 17/32 at 114-4 (L: 113-29 / H: 115-31)

Jun Ultra futures up 25/32 at 118-5 (L: 117-29 / H: 120-19)

MNI US 10YR FUTURE TECHS: (M5) Monitoring Resistance

- RES 4: 113-04 76.4% retracement of the Apr 7 - 11 bear leg

- RES 3: 112-12 61.8% retracement of the Apr 7 - 11 bear leg

- RES 2: 111-25 50.0% retracement of the Apr 7 - 11 bear leg

- RES 1: 111-17+ High Apr 16

- PRICE: 111-12 @ 14:35 BST Apr 23

- SUP 1: 110-15/109-08 Low Apr 15 / 11 and the bear trigger

- SUP 2: 108-26+ 76.4% retracement of the Jan 13 - Apr 7 bull cycle

- SUP 3: 108-21 Low Feb 19

- SUP 4: 108-03+ Low Dec 12 ‘24 and a key support

Treasury futures are trading higher today but for now, remain below last week’s highs. Recent gains are considered corrective and the bear cycle that started Apr 7, remains in play. The next resistance to watch is 111-25, 50.0% of the Apr 7 - 11 bear leg sell-off. Clearance of this level would undermine the bearish theme. A resumption of weakness would refocus attention on 109-08, the Apr 11 low and the bear trigger.

SOFR FUTURES CLOSE

Jun 25 -0.040 at 95.865

Sep 25 -0.070 at 96.20

Dec 25 -0.085 at 96.455

Mar 26 -0.090 at 96.625

Red Pack (Jun 26-Mar 27) -0.095 to -0.08

Green Pack (Jun 27-Mar 28) -0.07 to -0.04

Blue Pack (Jun 28-Mar 29) -0.035 to -0.01

Gold Pack (Jun 29-Mar 30) -0.01 to steady

REFERENCE RATES (PRIOR SESSION)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.30% (-0.02), volume: $2.527T

- Broad General Collateral Rate (BGCR): 4.29% (-0.03), volume: $1.034T

- Tri-Party General Collateral Rate (TCR): 4.29% (-0.03), volume: $993B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $287B

FED Reverse Repo Operation

RRP usage rises to $171.780B this afternoon from $137.951B yesterday. Usage had fallen to $54.772B last Wednesday, April 16 -- lowest level since April 2021. Conversely, usage had surged to the highest level since December 31, 2024 on Monday, March 31: $399.167B. The number of counterparties at 45.

MNI PIPELINE: Corporate Bond Roundup: $4B Walmart Leads Midweek Supply

$11.85B to Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 04/23 $4B *Walmart $750M 2Y +22, $750M 2Y SOFR+43, $1B 5Y +37, $1.5B 10Y +52

- 04/23 $2.25B #QXO Inc. 7NC3 6.75%

- 04/23 $1.5B *OCP $750M 5Y +235, $750M +10Y +260

- 04/23 $1.25B *Rentokil Terminix $750M 5Y +115, $500M 10Y +135,

- 04/23 $1B *Jane Street 8NC3 6.75%

- 04/23 $750M *Bank of Peru 10.25NC5 6.5%

- 04/23 $700M *Guardian Life 5Y +80

- 04/23 $400M *Hanwa Futureproof 3Y +95

MNI BONDS: EGBs-GILTS CASH CLOSE: Curves Flatten On Back-And-Forth US Tariff News

European curves flattened Wednesday, with Bunds underperforming Gilts.

- Bunds were steadily weakening with Gilts a little stronger on the day when an WSJ afternoon sources article pointed toward potential for the US relaxing tariffs on China sent core FI sharply lower. While this was later talked down by US Tsy Sec Bessent, Bunds and Gilts largely held their losses.

- The Eurozone-wide services PMI was on the soft sign of expectations, with weaker-than-expected French and German data appearing to be offset by stronger performances elsewhere in the Eurozone.

- Meanwhile in the UK, public sector net borrowing was higher than expected, though like the Eurozone, Services PMI disappointed. BoE Gov Bailey's speaking appearance was not market-moving.

- While the German and UK curves moved in parallel across the short-end/belly, Gilts outperformed in the segments beyond that with the UK curve twist flattening (vs German bear flattening).

- EGB periphery/semi-core spreads closed tighter amid equity gains and the Bund sell-off, with BTPs and OATs outperforming.

- German IFO leads Thursday's data docket, while we get multiple ECB speakers including Lane.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.5bps at 1.746%, 5-Yr is up 6.6bps at 2.048%, 10-Yr is up 5.4bps at 2.497%, and 30-Yr is up 5.2bps at 2.911%.

- UK: The 2-Yr yield is up 8.6bps at 3.916%, 5-Yr is up 5.9bps at 4.039%, 10-Yr is up 0.7bps at 4.552%, and 30-Yr is down 5.9bps at 5.309%.

- Italian BTP spread down 3.3bps at 113.3bps / French OAT down 3.7bps at 73.8bps

MNI FOREX: Dollar Index Extends Recovery, Advances 0.75%

- Initial overnight price action was dominated by headlines emanating from President Trump, who said it was not his intention to fire the Federal Reserve Chair, Jerome Powell. The news provided a solid boost for the greenback as the market breathed a sigh of relief surrounding the pessimistic narrative attached to the US.

- Despite subsequently trading in a volatile manner, the US dollar index is gaining for a second consecutive session on Wednesday, registering a 0.75% advance as we approach the APAC crossover. This extends the bounce from Monday’s fresh 3-year lows to ~1.7%, with the DXY narrowing the gap back to the psychological 100 mark.

- Positioning dynamics appear to be leaning in favour of the greenback across the major pairs, as the likes of USDJPY and USDCHF look set to close the session with gains above 1%. For USDJPY, spot remains just shy of the overnight highs at 143.22, with initial firm resistance not seen until the 20-day EMA, at 144.90.

- Given the sensitivity of the Swiss Franc to souring sentiment in recent weeks, the recovery in risk appetite has understandably weighed on CHF. This brings USDCHF to 0.8280, a significant 3% recovery from the Monday lows. Resistance is seen at the prior breakdown point of 0.8333, the 2023 low.

- For EURUSD, we appear to be witnessing a technical correction, as even US treasury secretary Bessent remarked on the ‘substantial appreciation’ for the single currency. The softer price action and higher equity markets have weighed on EUR crosses, as the higher beta AUD and NZD relatively outperform.

- Separately, crude front month fell to a fresh low for the week on the potential for another increase in OPEC+ production in June. This in turn weighed on the Norwegian krona, prompting USDNOK to extend session gains to over 1%.

- German IFO data headlines the European calendar on Thursday, before US durable goods, initial jobless claims and existing home sales are scheduled.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 24/04/2025 | 0645/0845 | ** | Consumer Sentiment | |

| 24/04/2025 | 0700/0900 | ** | PPI | |

| 24/04/2025 | 0800/1000 | *** | IFO Business Climate Index | |

| 24/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 24/04/2025 | 1000/1100 | ** | CBI Industrial Trends | |

| 24/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 24/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 24/04/2025 | 1230/0830 | * | Payroll employment | |

| 24/04/2025 | 1230/0830 | ** | Durable Goods New Orders | |

| 24/04/2025 | 1300/1500 | ** | BNB Business Confidence | |

| 24/04/2025 | 1300/1500 | ECB's Lane at Peterson Institute Webcast on Monetary Policy Strategy | ||

| 24/04/2025 | 1325/1425 | BOE's Lombardelli on Monetary Policy Strategy | ||

| 24/04/2025 | 1400/1000 | *** | NAR existing home sales | |

| 24/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 24/04/2025 | 1500/1100 | ** | Kansas City Fed Manufacturing Index | |

| 24/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 24/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 24/04/2025 | 1700/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 24/04/2025 | 2100/1700 | Minneapolis Fed's Neel Kashkari | ||

| 25/04/2025 | 2301/0001 | ** | Gfk Monthly Consumer Confidence | |

| 25/04/2025 | 2330/0830 | ** | Tokyo CPI |