MNI ASIA OPEN: Tariff Tensions High, Powell on Inflation Fight

EXECUTIVE SUMMARY

- MNI: Powell Commits To Inflation Fight After Sweeping Tariffs

- MNI TARIFFS: China Announces 34% Retaliatory Tariffs, Focus Turns To US Reaction

- MNI TARIFFS: Trump Hints Vietnam Tariff Deal, Bessent "Quietly" Moderating Tariffs

- MNI US DATA: AHE Unrounded - Weak Wage Figures

- MNI US DATA: Solid Payrolls Job Creation In March

US

MNI: Powell Commits To Inflation Fight After Sweeping Tariffs

Federal Reserve Chair Jerome Powell on Friday warned President Trump's aggressive tariff hikes on major trading partners could drive inflation persistently higher and pledged the Fed's commitment to making sure inflation doesn't become a problem. However, the U.S. central bank isn't ready to make any changes to interest rates, he added. "We are well positioned to wait for greater clarity before considering any adjustments to our policy stance. It is too soon to say what will be the appropriate path for monetary policy," he said in remarks prepared for a journalists conference in Arlington, Virginia.

BBG Vietnam Offers to Remove Tariffs on US After Trump’s Action: Vietnam offered to remove all tariffs on US imports after President Donald Trump announced a 46% levy on the Southeast Asian nation, according to an April 5 letter from Vietnam’s communist party.

NEWS

MNI TARIFFS: China Announces 34% Retaliatory Tariffs, Focus Turns To US Reaction

The Chinese State Council Tariff Commission has issued a statement confirming tariffs against US goods in the first major retaliatory act against US President Donald Trump's 'reciprocal' tariffs. The statement says that "This practice of the US is not in line with international trade rules, seriously undermines China's legitimate rights and interests, and is a typical unilateral bullying practice." The Commission confirms the retaliatory tariffs will come into force from 1201 local time on 10 April. The measures in full are as follows:

A 34% tariff will be imposed on all imported goods originating from the United States on the basis of the current applicable tariff rate. The current bonded, tax reduction and exemption policies remain unchanged, and the additional tariffs will not be reduced or exempted. If the goods have been shipped from the place of departure before 12:01 on April 10, 2025, and are imported between 12:01 on April 10, 2025 and 24:00 on May 13, 2025, the additional tariffs prescribed in this announcement will not be levied.

MNI TARIFFS: Trump Hints Vietnam Tariff Deal, Bessent "Quietly" Moderating Tariffs

Charles Gasparino at Fox Business reports on X that Treasury Secretary Scott Bessent is “quietly” attempting to moderate President Donald Trump’s hardline stance on tariffs. Gasparino: “I have heard from Wall Street sources close to the Trump White House that [Bessent] is trying to moderate--albeit quietly--the president's hard line stance on trade. If he ramps it up it would be the first significant in-house battle in the new administration, pitting Bessent against [Commerce Secretary Howard Lutnick] and [Trade Counsellor Peter Navarro].”

MNI TARIFFS: Trump Says China 'Played It Wrong' With Retaliatory Tariffs

The first response from US President Donald Trump to China's announcement of 34% retaliatory tariffs on US imports does little to downplay the prospect that he could escalate the burgeoning trade war further. Posting on Truth Social, Trump writes: "CHINA PLAYED IT WRONG, THEY PANICKED - THE ONE THING THEY CANNOT AFFORD TO DO!". The Chinese State Council Tariff Commission called the US actions "a typical unilateral bullying practice" (see 'TARIFFS: China Announces 34% Retaliatory Tariffs, Focus Turns To US Reaction', 1136BST).

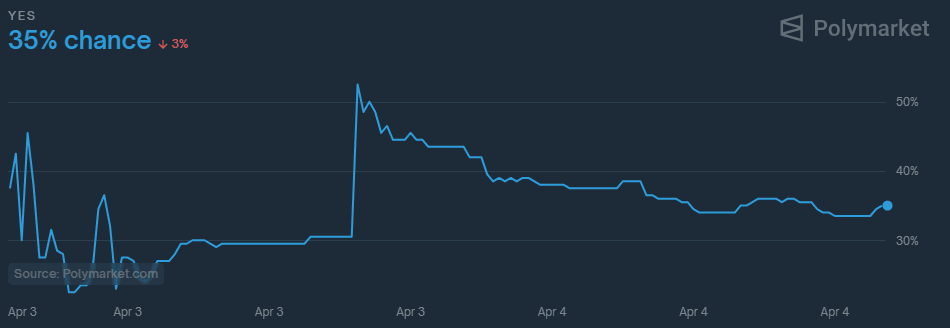

- Political betting markets show broad expectations that Trump will not lower tariffs on China in April, with Polymarket data (from a relatively illiquid market) showing bettors assigning only a 35% chance that a deal will be reached to lower tariffs. Indeed in the wake of Trump's post the balance of probability may have shifted to the upside in that tariffs could rise further, or be applied to other sectors, rather than come down.

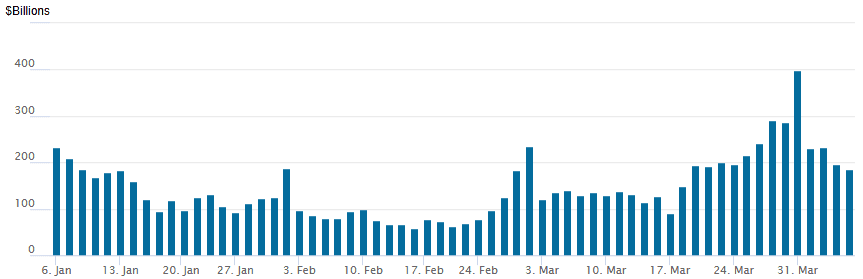

Chart 1. Political Betting Market Implied Probability, 'Will Trump Lower Tariffs On China In April?', %

Source: Polymarket

- In an earlier post, Trump claimed that "MY POLICIES WILL NEVER CHANGE", reinforcing the strand of thought noted in our US Daily Brief that the tariffs "are a pillar of long-term industrial policy," rather than, as some Congressional Republicans believe, "one lever in a negotiation towards more favourable trade terms."

MNI US: Fox-Newsom To Urge Countries Not To Hit California w/Retaliatory Tariffs

Fox News reporting that "California Gov. Gavin Newsom will announce plans Friday afternoon directing the state to pursue "strategic" relationships with countries announcing retaliatory tariffs against the U.S., urging them to exclude California-made products from those taxes," Sources in the Newsom administration told Fox that the governor is concerned about the impact that retaliatory tariffs will have on the state's vast agricultural sector, as well as the impact on consumers from higher prices of finished goods that could be subject to multiple tariff impositions as part of supply chains that cross the border in the California-Baja region.

MNI RUSSIA: Kremlin-No Plan For Putin-Trump Call In Coming Days

State-run TASS reporting comments from Kremlin spox Dmitry Peskov. Says that there are no plans for a call between President Vladimir Putin and his US counterpart Donald Trump in the coming days. This comes after NBC News reported on 3 April that members of Trump's inner circle are advising the US president not to call the Russian leader until Putin agrees to a full ceasefire in Ukraine.

MNI SOUTH KOREA: DPK Early Favourites For Presidency After Yoon's Impeachment

A spox for the South Korean National Election Commission (NEC) says that acting President Han Duck-soo and the head of the NEC have "agreed that 3 June is a good date for a presidential election" but that that date "is not yet final". A snap presidential election is required within 60 days following the Constitutional Court's unanimous decision earlier today to uphold the impeachment of Yoon Suk-yeol after his short-lived imposition of martial law in Dec 2024.

MNI SOUTH AFRICA: Foreign Min-SA Strengthening Asia & MENA Relations Amid US Tariffs

Reuters reports comments from Minister of International Relations and Cooperation Ronald Lamola saying that "US reciprocal tariffs effectively nullify preferences that sub-Saharan African countries enjoy under the African Growth and Opportunity Act (AGOA)," claiming that the levies will hit agriculture, autos, and other sectors. Says that as a result, the South African gov't "is strengthening relations with countries in Asia and the Middle East to open new market access opportunities." Lamola is speaking alongside Trade, Industry and Competition Minister Parks Tau regarding the gov'ts approach to tariffs. Livestream here.

MNI US TSYS: Markets Remain Pessimistic on Tariffs, China Responds, Powell Patient

- Treasuries remain well supported late Friday, but off early session highs after headlines filtered through markets that Tsy Sec Bessent was "quietly" attempting to moderate Pres Trumps hardline stance.

- Brief risk-off unwind late morning after Pres Trump tweeted "this would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates," but Tsys bounced after Chairman Powell's discussion on economy at SABEW conference. Chair Powell expressed patience, now is a "good time to take a step back and let things clarify" while "uncertainty of new policies" decline over time.

- Treasuries dipped then bounced after higher than expected March jobs gain was tempered slightly by down-revision in prior". The latest profile sees 228k after two weak months (111k Jan, 117k Feb) which in turn followed two booming months (261k Nov, 323k Dec).

- Tsy Jun'25 10Y contract is currently +10.5 at 112-31, earlier focus on technical resistance at 114-16 (2.000 proj of the Jan 13 - Feb 7 - Feb 12 price swing) after breaching round number resistance earlier (114-03.5 high). 10Y yield 3.8823% (-.1481) vs. 3.8564 low. Technical support well beow at 112-01 (High Mar 4 and a recent breakout level).

- Curves remain flatter: 2s10s -2.736 at 31.543, 5s30s -5.980 at 68.231. 10Y yield still below 4% at 3.9962 (-.0324) vs. 3.8564% session low.

- Cross asset update: Stocks still weaker, but off recent lows SPX eminis currently trading 5168.25 (-261.75) vs. 5107.5 low, BBG US$ index near recent highs +1264.81 (+12.57). Gold sharply lower at 3029.0.

OVERNIGHT DATA

MNI US DATA: Solid Payrolls Job Creation In March

The jobs side of the establishment survey was generally solid. Whilst there is only so much that can be taken from it with labor data being a lagging indicator and forward-looking growth implications from tariffs and other government policies such as tax cuts still so uncertain, it’s a sign that the hard labor data were still robust less than one month before the announcement of Liberation Day tariffs.

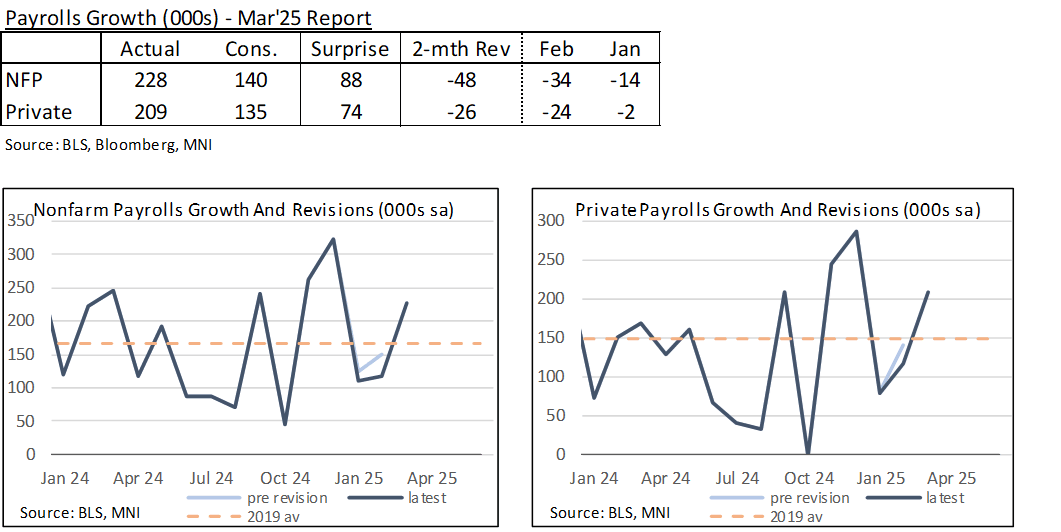

- Nonfarm payrolls increased 228k (cons 140k), although a little over half of the 88k upside surprise was offset by downward revisions, mostly in February. The latest profile sees 228k after two weak months (111k Jan, 117k Feb) which in turn followed two booming months (261k Nov, 323k Dec).

- Payrolls increased an average monthly 152k in Q1, a slowdown from the 209k in Q4 but still above 133k in both Q3 and Q2. That’s impressive considering the slowdown in immigration, although the sharpest recent declines are unlikely to have taken full effect in today’s report.

- Private payrolls were also strong, at 209k after a similar pattern to total nonfarm. It sees a Q1 av of 135k after 177k in Q4, 94k in Q3 and 118k in Q2.

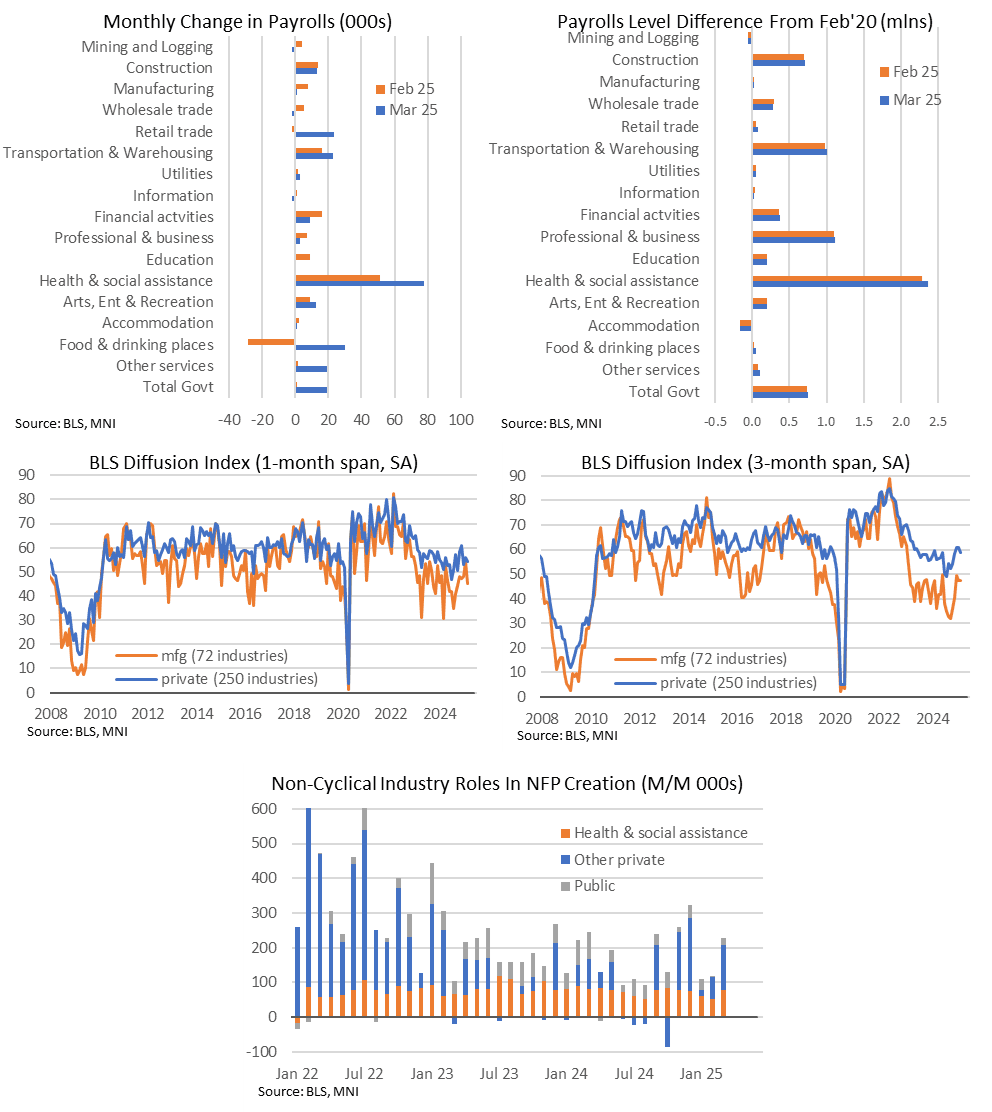

- The public sector remains in focus considering DOGE cuts, but they look small as was broadly expected. Overall government net job creation increased to 19k in March after a downward revised 1k (initial 11k). Federal government saw a decline of just -4k after -11k, but much larger declines are known to be in the pipeline with CNN tracking at 120k and yesterday’s Challenger report noting job cut announcements totaling 280k over Feb-Mar.

MNI US DATA: Reasonable Breadth To Private Job Gains, Signs Of Weather Boost

- The main driver of the acceleration in private sector payrolls growth was “food & drinking places” as it swung to adding 30k after two monthly declines of -27k/-28k.

- It’s loose evidence of what was perceived to have been a weather drag in Jan and Feb before better weather in March (and indeed, the 87k reporting not at work due to bad weather in the separate household survey nudged below the 2022 value for its lowest March since 2000).

- Elsewhere, the health & social assistance sector remains a major contributor, adding a net 78k jobs in March, its most since Nov, after 51k in Feb.

- In terms of the most tariff-sensitive industries, manufacturing payrolls only increased by 1k in March after 8k in Feb, although that increase was somewhat of a rarity having averaged -9k per month in the prior twelve months to Jan.

- The private sector one-month diffusion index dipped to 54.2% (i.e. more than half of the 250 industries reported net job gains) from a downward revised 56% although this is still reasonable having averaged 54% in 2024 and 58% in 2023.

- The manufacturing diffusion index saw a more abrupt decline as it pulled back to 45% after a solid bounce to 54% in Feb after 48% in Jan. Again though, this isn’t wildly different to recent years, with 44% in 2024 and 47% in 2023.

MNI US DATA: Payrolls Beat Expectations, Downward Revision Concentrated In Feb

- A sizeable 88k beat for payrolls (228k vs cons 140k) in March, most of which came from the private sector.

- The government added 19k of seasonally adjusted jobs, with federal a modest -4k after the -11k in Feb.

- The beat was somewhat offset by the -48k two-month nonfarm downward revision, mostly in Feb (-34k) rather than Jan (-14k).

- Private sector two-month revision of -26k, almost entirely in Feb.

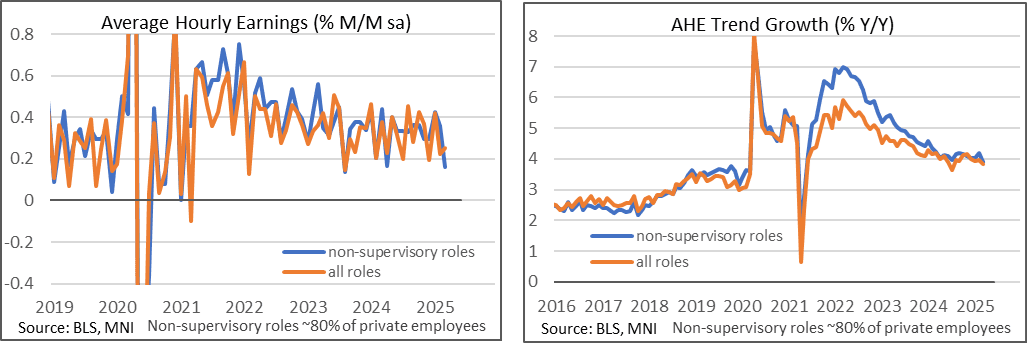

MNI US DATA: AHE Unrounded - Weak Wage Figures

- AHE very close to rounding to 0.2% M/M along with Feb downward revision. Technically softest non-supervisory since Aug 2023. Total AHE: M/M (SA): 0.251% in Mar from 0.223% in Feb (initial 0.279%); Y/Y (SA): 3.836% in Mar from 3.966% in Feb

- AHE Non-Supervisory: M/M (SA): 0.162% in Mar from 0.357% in Feb (initial 0.292%); Y/Y (SA): 3.893% in Mar from 4.179% in Feb. Source: Bloomberg, MNI:

MNI: Canada Has Biggest Full-Time Job Loss Since Apr 2021

Full-time employment in Canada recorded the biggest decline in four years in March led by wholesaling and retailing, a setback to the central bank's view its string of rate cuts since June is boosting domestic momentum even with the country headed to a U.S. trade war. Those full-time job losses totaled 62,000 versus a smaller gain of 29,500 part-time positions. That left total employment down 32,600 on the month versus an MNI consensus for a gain of 10,000, and was the biggest fall in jobs since January 2022.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 1776.6 points (-4.38%) at 38760.18

S&P E-Mini Future down 257.75 points (-4.74%) at 5175

Nasdaq down 728.8 points (-4.4%) at 15819.65

US 10-Yr yield is down 2.5 bps at 4.0037%

US Jun 10-Yr futures are up 9/32 at 112-29.5

EURUSD down 0.0102 (-0.92%) at 1.095

USDJPY up 0.88 (0.6%) at 146.94

WTI Crude Oil (front-month) down $4.24 (-6.33%) at $62.75

Gold is down $85.37 (-2.74%) at $3029.57

European bourses closing levels:

EuroStoxx 50 down 234.97 points (-4.6%) at 4878.31

FTSE 100 down 419.76 points (-4.95%) at 8054.98

German DAX down 1075.67 points (-4.95%) at 20641.72

French CAC 40 down 324.03 points (-4.26%) at 7274.95

US TSY FUTURES CLOSE

3M10Y +0.77, -26.468 (L: -41.045 / H: -25.803)

2Y10Y -2.602, 31.677 (L: 29.86 / H: 39.259)

2Y30Y -5.976, 72.48 (L: 69.472 / H: 87.46)

5Y30Y -5.893, 68.318 (L: 65.959 / H: 81.478)

Current futures levels:

Jun 2-Yr futures up 2.625/32 at 104-1 (L: 103-31.875 / H: 104-15)

Jun 5-Yr futures up 4.25/32 at 109-8.25 (L: 109-06.25 / H: 110-06.25)

Jun 10-Yr futures up 8.5/32 at 112-29 (L: 112-23 / H: 114-03.5)

Jun 30-Yr futures up 28/32 at 120-9 (L: 119-14 / H: 121-27)

Jun Ultra futures up 1-17/32 at 126-11 (L: 124-27 / H: 128-12)

MNI US 10YR FUTURE TECHS: (M5) Impulsive Rally Extends

- RES 4: 115-00+ High IOct 1 ‘24

- RES 3: 114-29+ 2.000 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 2: 114-16 2.000 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 1: 114-03+ Intraday high

- PRICE: 113-27+ @ 11:16 BST Apr 4

- SUP 1: 112-01 High Mar 4 and a recent breakout level

- SUP 2: 111-17+/111-02 High Mar 20 / 20-day EMA

- SUP 3: 110-15+ 50-day EMA

- SUP 4: 110-06 Low Mar 27

Treasury futures have traded sharply higher this week and in the process confirmed a clear break of resistance at 112-01, the Mar 4 high. The break also confirms a resumption of the uptrend that started mid-January. The move higher sets the scene for an extension towards the 114-16 next, a Fibonacci projection. Initial firm support lies at 112-01, the Mar 4 high. The contract is oversold, a pullback would allow this set-up to unwind.

SOFR FUTURES CLOSE

Jun 25 +0.090 at 96.060

Sep 25 +0.075 at 96.390

Dec 25 +0.060 at 96.625

Mar 26 +0.050 at 96.785

Red Pack (Jun 26-Mar 27) +0.040 to +0.050

Green Pack (Jun 27-Mar 28) +0.035 to +0.035

Blue Pack (Jun 28-Mar 29) +0.040 to +0.050

Gold Pack (Jun 29-Mar 30) +0.055 to +0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00130 to 4.31984 (-0.00381/wk)

- 3M -0.02571 to 4.25898 (-0.03863/wk)

- 6M -0.05237 to 4.12552 (-0.09009/wk)

- 12M -0.10772 to 3.86343 (-0.18943/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.39% (+0.02), volume: $2.577T

- Broad General Collateral Rate (BGCR): 4.37% (+0.03), volume: $1.011T

- Tri-Party General Collateral Rate (TCR): 4.36% (+0.02), volume: $976B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $263B

FED Reverse Repo Operation

RRP usage recedes to $184.499B this afternoon from $196.265B on Thursday. Usage had surged to the highest level since December 31, 2024 this last Monday: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 40.

MNI BONDS: EGBs-GILTS CASH CLOSE: Yields Close Off Lows, But Curves End Bull Steeper

Continued risk-off fallout from Wednesday's US tariff announcement saw European yields fall sharply for a second consecutive session, with periphery/semi-core spreads widerning.

- The core FI space took its cue from tumbling equities in a flight to safety in early trade, with Gilts and Bunds rallying strongly in a continuation of Thursday's price action as US officials showed no sign of backing down from aggressive tariff implementation, and China announcing retaliatory tariffs of its own.

- Yields picked up from the lows set in late morning European trade though, due in part to Fed Chair Powell expressing a patient stance on rate cuts despite recent developments, and US payroll gains that were marginally more solid than expected.

- Both the UK and German curves bull steepened, with the German short end outperforming overall.

- That capped a week in which both the German and UK curves bull steepened, with Gilts outperforming Bunds: Germany 2Y yields -19bp, 10Y -15bp; UK 2Y yields -26bp, 10Y -25bp.

- Periphery EGB spreads widened as risk appetite evaporated, led by high-beta BTPs / GGBs.

- Attention over the weekend will be on US tariff developments - next week's schedule in Europe includes UK Monthly Activity Data.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 12.1bps at 1.827%, 5-Yr is down 10.5bps at 2.128%, 10-Yr is down 7.3bps at 2.578%, and 30-Yr is down 6.3bps at 2.979%.

- UK: The 2-Yr yield is down 7.6bps at 3.934%, 5-Yr is down 7.6bps at 4.018%, 10-Yr is down 7.2bps at 4.448%, and 30-Yr is down 6.8bps at 5.116%.

- Italian BTP spread up 6.9bps at 119bps / Greek up 7.7bps at 89.1bps

MNI FOREX: Risk Sensitive Currencies Plummet Amid Tariff Turmoil, AUD Falls 4.7%

- Risk sentiment continues to be significantly dented amid the pivotal turning point for global trade policy. While pessimism was more centred around the US on Thursday, contributing to the sharp dollar declines, Friday’s broad deterioration for risk has moderately propped up the greenback. However, dynamics have weighed substantially on higher beta currencies, with the 4.7% decline for AUDUSD best displaying the severity of the moves.

- AUDUSD broken a number of important support levels between 0.6200-0.6100, exacerbating the selloff. The pair hovers just above the psychological 0.600 mark as we approach the close, the lowest level since April 2020, shortly after the onset of the covid pandemic.

- At points of the day, moves in AUDJPY and AUDCHF were even outpacing the AUDUSD decline, as investors flocked to the low yielding safe havens. Indeed, record lows for AUDCHF leave the cross sub-0.5200, and down over 5% today. AUDJPY breached the August carry unwind lows below 90.00, prompting a sharp spike down to 87.41, fresh two-year lows.

- NZDUSD sits down 3.6% on the session, while GBPUSD is also 1.5% in the red. 8% losses for crude futures have also weighed heavily on the Norwegian Krone, with USDNOK the best part of 4% higher on the session.

- The USD index is around half a percent firmer, and this magnitude of move has been echoed by the Euro. EURUSD is significantly off the 1.1144 highs from Thursday, at 1.0985, but remains only 0.6% lower on Friday as the focus fell elsewhere.

- In emerging markets, CE3 currencies and the ZAR have all been heavily impacted, dipping around 1.5% against the dollar, but it is LatAm FX that has predominantly bore the brunt of the risk selloff. USDMXN is 2.7% higher, whereas gains for USDBRL and USDCLP have eclipsed 3% amid the poorer commodity backdrop.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 07/04/2025 | 0600/0800 | ** | Trade Balance | |

| 07/04/2025 | 0600/0800 | ** | Industrial Production | |

| 07/04/2025 | 0900/1100 | ** | Retail Sales | |

| 07/04/2025 | 0945/1145 | ECB's Cipollone At CBDC Conference | ||

| 07/04/2025 | 1430/1030 | Fed Governor Adriana Kugler | ||

| 07/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 07/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 07/04/2025 | 1700/1300 | * | US Treasury Auction Result for Cash Management Bill | |

| 07/04/2025 | 1900/1500 | * | Consumer Credit |