MNI ASIA OPEN: Tariffs Draw Focus Off US Data, Curves Steepen

EXECUTIVE SUMMARY

- MNI US: UKRAINE: Washington Pushes Broader Mineral Deal With Kyiv - Bloomberg

- MNI US/CANADA: Ontario Expect Significant Easing Of Tariff Impact After Lutnick-Ford Call

- MNI UK: PM-'All Options On The Table' When It Comes To US Tariffs

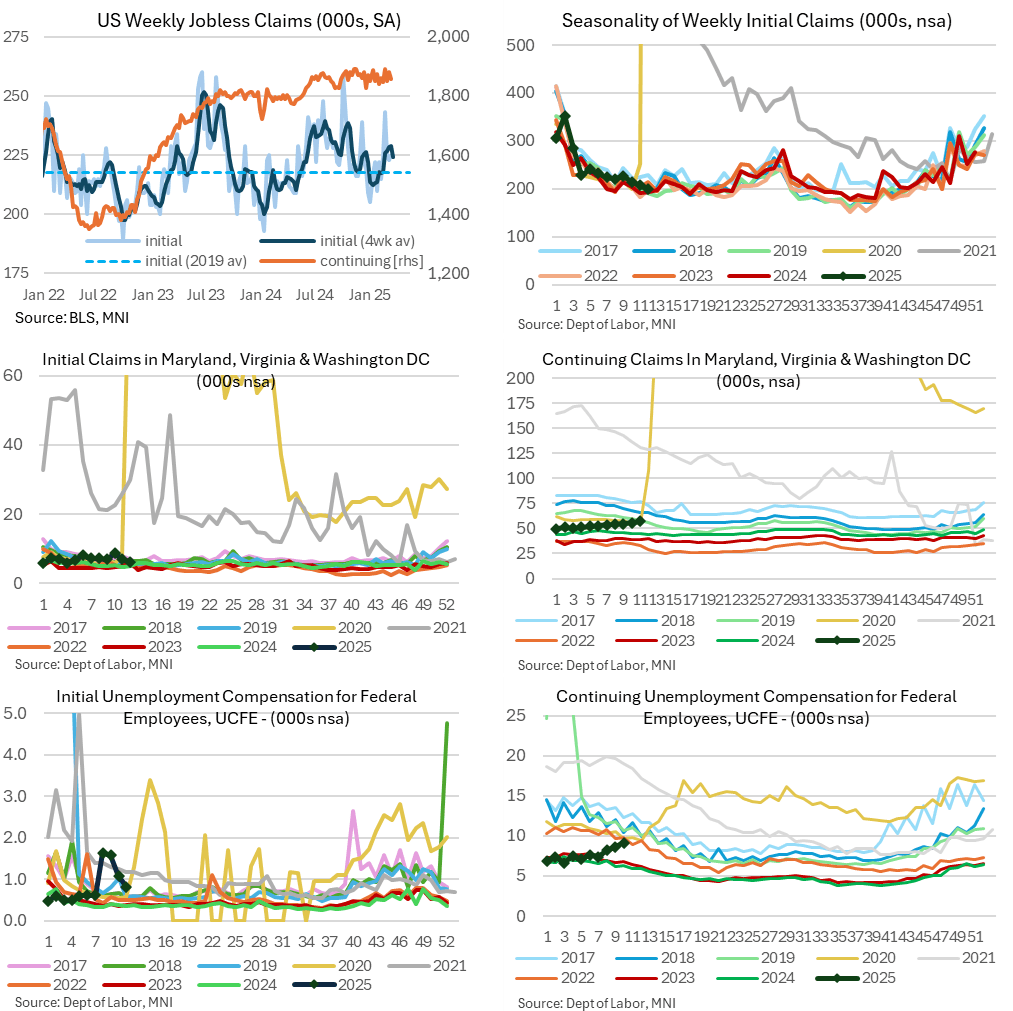

- MNI US DATA: No Sign Of Alarm In Claims But Govt-Sensitive Areas Drift Higher

- MNI US DATA: Corporate Profits, Employee Income Drive GDI Acceleration In Q4

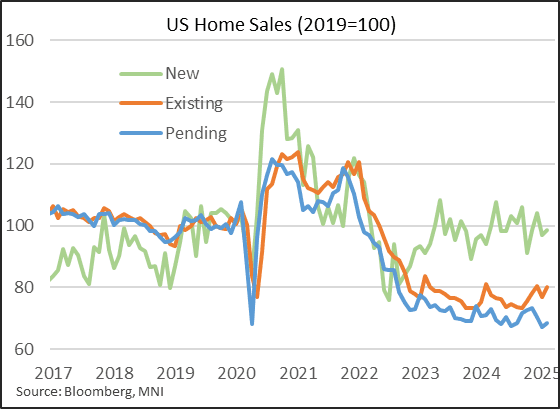

- MNI US DATA: Pending Home Sales Regain Ground, But Remain Very Weak

US

MNI US/CANADA: Ontario Expect Significant Easing Of Tariff Impact After Lutnick-Ford Call

Canada's Globe and Mail reports "Ontario expects the U.S. administration to significantly ease the impact of auto tariffs on Canada, following a phone call from Commerce Secretary Howard Lutnick to Premier Doug Ford on Wednesday, according to a source." The source claims that Lutnick "understands how integrated auto supply chains are", and that the Ontario gov't "expects further refinement and development" to the tariffs. Globe and Mail: "[source says] the changes likely won’t eliminate the impact of tariffs but will give Canadian and Ontario automakers a very significant relative advantage against the rest of the world."

NEWS

MNI US: UKRAINE: Washington Pushes Broader Mineral Deal With Kyiv - Bloomberg

Bloomberg News reports that the US is, “pushing to control all major future infrastructure and mineral investments in Ukraine, potentially gaining a veto over any role for Kyiv’s other allies and undermining its bid for European Union membership.” The report notes: “If accepted, the partnership agreement would bestow enormous power on the US to control investments into Ukraine in projects including roads and railways, ports, mines, oil and gas and extraction of critical minerals.”

MNI UK: PM-'All Options On The Table' When It Comes To US Tariffs

Prime Minister Sir Keir Starmer has said that "We will keep all options on the table" when it comes to US tariffs, calling the measures "very concerning". Starmer says he wants the UK to be "pragmatic and clear-eyed" on the issue. In line with Mexico and diverging from the EU and Canada, the UK has steered away from retaliatory tariffs to date and has not indicated that it will do so either in regard to the auto tariffs announced on 26 March, or on the broader reciprocal tariffs pencilled in for 2 April.

MNI TARIFFS: EU Spox-Preparing Response, Will Be 'Timely, Robust & Well-Calibrated'

A European Commission spokesperson says that the EU is 'preparing its response' to the new autos tariffs announced by US President Donald Trump on 26 March, but there is 'no timing yet' on when this response will come. Spox: 'The EU's answer will be timely, robust, and well-calibrated'. The comments chime with those of Commission Exec-VP Teresa Ribera, who said earlier the EU needs "to see how they are framing in exact terms what they want to do and be sure we respond accordingly.”

MNI UKRAINE: 'Coalition Of The Willing' Meets In Paris

Leaders and senior officials from 30+ countries, deemed 'the coalition of the willing', who have indicated that they could contribute troops to a Ukraine peacekeeping force or at least maintain financial and military support for Kyiv, are currently meeting in Paris. French President Emmanuel Macron pledged an additional E2bln in military aid for Ukraine, including missiles, planes and air defences, ahead of the start of the meeting.

MNI UKRAINE: Macron-Not The Time To Lift Russia Sanctions

Speaking at a press conference following a meeting of leaders and politicians from 31 countries allied to Ukraine, French President Emmanuel Macron says that "all countries agreed that it was not the time to lift sanctions against Russia", and that they will "continue to put pressure on Russia's shadow fleet [via sanctions]". Macron says the group has mandated its foreign ministers with the task of coming up with proposals on how a ceasefire could be monitored, giving a deadline of three weeks. These conclusions will then be shared with the US.

MNI IRAN: Khamenei Adviser-Iran 'Ready' For Indirect Talks w/US

An adviser to Supreme Leader Ayatollah Ali Khamenei has said that Iran is "ready" for indirect talks with the US. Tasnim News, linked to the powerful Islamic Revolutionary Guards Corps (IRGC) quotes Kamal Kharrazi as saying Tehran “is ready for indirect negotiations in order to assess the other side, present its own conditions, and make a suitable decision,”. Observers continue to await Iran's official response to a letter sent to Khamenei by US President Donald Trump.

MNI US TSYS: Tsy Yields Inch Higher, Focus on Tariffs Continue

- Treasuries look to finish moderately lower for the most part, underlying focus remains on tariffs after President Trump announced a 25% tariffs on auto imports last night - starting next week.

- Tsy futures see-sawed off late overnight lows after weekly claims come out near in-line with expectations, continuing claims lower than expected while the prior was also down-revised. GDP near expectations, Personal Consumption a little lower than expected as are Wholesale/Retail Inventories.

- Pending home sales ticked up to 72.0 in February from 70.6 in January, per the NAR's index. This represents a slightly better-than-expected rebound from January's all-time low, but at still moribund levels (the index's construction implies sales were 28% below the levels of 2001 when the series begins).

- TYM5 currently 110-13 last (-5) - well within the session range after the $44B 7Y note auction (91282CMT5) tailed 0.6bp with 4.233% high yield vs. WI of 4.227%. Initial technical support below at 110-06.5/06 (50-day EMA/Intraday low).

- Curves twisting steeper with the short end outperforming throughout the session (2s10s +4.203 at 37.307, 5s30s +2.302 at 62.685 vs. 63.866 -- the steepest level since early January 2022.).

- Today marked value-date month- and quarter end in FX markets, and despite the signals pointing to US corporate demand for dollars, the USD index sits weaker on the session, declining 0.25% on the session as we approach the APAC crossover.

OVERNIGHT DATA

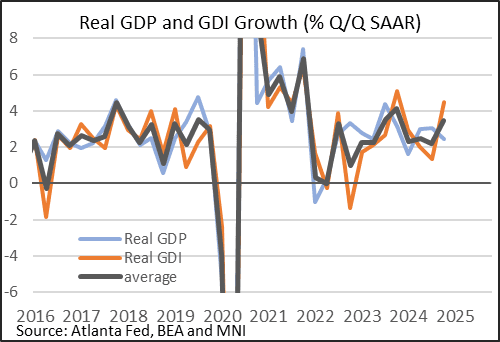

MNI US DATA: Corporate Profits, Employee Income Drive GDI Acceleration In Q4

The third reading of Q4 2025 GDP showed real gross domestic income (GDI) soared to 4.5% Q/Q annualized (there was no consensus), up from 1.4% in Q3 for the highest since Q4 2023. For 2024 as a whole, GDI rose 3.0% (vs GDP 2.8%) vs 1.7% in 2023 (GDP was 2.9%).

- While more volatile than GDP lately, the upturn in GDI provides a sign that overall economic activity was very robust at the end of last year. The strong quarterly GDI outturn brought the average of GDP and GDI to 3.5%, likewise the fastest since Q4 2023. (The "statistical discrepancy", or the difference between the two, was 0.6pp, lowest since Q1, so the data were telling a fairly consistently solid story across both measures at year-end.)

- Current dollar GDI rose 6.9% (which with current GDP 4.8% made for a 5.9% average for the quarter).

MNI US DATA: Pending Home Sales Regain Ground, But Remain Very Weak

Pending home sales ticked up to 72.0 in February from 70.6 in January, per the NAR's index. This represents a slightly better-than-expected rebound from January's all-time low, but at still moribund levels (the index's construction implies sales were 28% below the levels of 2001 when the series begins). While this was a 2.0% M/M gain, pending transactions were down 3.6% Y/Y. Activity across regions was mixed, falling in the Northeast and West, but picking up in the Midwest and, especially, the South (+6.2% M/M). All regions were down Y/Y.

MNI US DATA: No Sign Of Alarm In Claims But Govt-Sensitive Areas Drift Higher

Initial jobless claims were essentially as expected whilst continuing claims were better than expected in a payrolls reference period. There is no sign of unusually large government layoffs although continuing claims for most sensitive areas are drifting higher in a hint of re-hiring frictions.

- Initial jobless claims: 224k (sa, cons 225k) in the week to Mar 22 after an upward revised 225k (initial 223k).

- Government layoffs have continued to ramp up anecdotally (although the deferred resignation scheme, the single most impactful approach so far, won’t show in claims until Oct) but there doesn’t look to be any major sign of higher claims that show up on a macro level.

- Continuing claims: 1856k (sa, cons 1886k) in the week to Mar 15, covering a payrolls reference period, after a downward revised 1881k (initial 1892k). The decline sees continuing claims pullback from what had been close to three-year highs, and offers a relatively more favorable comparison of prior payrolls reference periods (following 1847k in the relative week for Feb and 1849k for Jan).

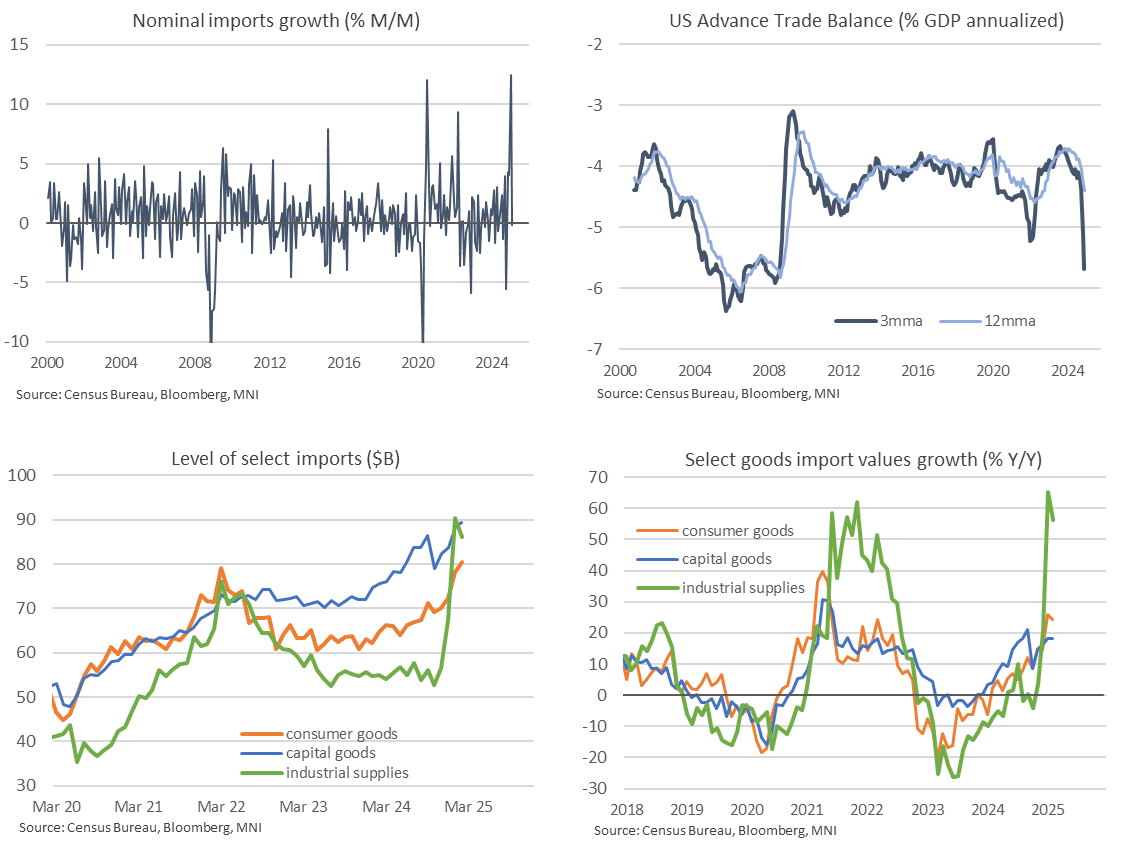

MNI US DATA: Another Huge Trade Deficit, ‘Tentative’ Signs Of More Gold Disruption

The goods trade deficit was again notably larger than expected in February, at $148bn (cons $139bn) in the advance release after what was a huge overshoot of $156bn back in January. Regular GDP tracking could be marked even more negative after this release but next week's final release is needed to know the extent of the latest gold disruption here.

- Demonstrating the particular uncertainty at the moment, the 35 analyst estimates had ranged from a deficit of $120bn to $162bn for February. On a three-month rolling basis, this put a goods deficit at circa 5.7% GDP for its largest since late 2008 although there is a significant monetary gold angle at play.

- Imports saw barely any pullback after jumping in January (-0.2% M/M after an almost unprecedented 12.5% M/M in Jan). Exports meanwhile drove the sequential improvement (4.1% M/M after 1.6% M/M), driven by auto exports rising 12.7% M/M after two monthly declines but it’s a noisy series.

- Most focus will be on the import ledger, and here there was only limited pullback in “industrial supplies”, with -5% after +34% in Jan and 19% in Dec. To put this in perspective, whilst the actual value dipped from $90.5bn to $86.0bn in February, it’s still significantly above the ~$55bn averaged each month through most of 2024.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 80.87 points (-0.19%) at 42371.03

S&P E-Mini Future down 3 points (-0.05%) at 5754.75

Nasdaq down 32 points (-0.2%) at 17863.96

US 10-Yr yield is up 1.2 bps at 4.3634%

US Jun 10-Yr futures are down 3/32 at 110-15

EURUSD up 0.0045 (0.42%) at 1.0798

USDJPY up 0.49 (0.33%) at 151.06

WTI Crude Oil (front-month) up $0.21 (0.3%) at $69.86

Gold is up $37.82 (1.25%) at $3057.08

European bourses closing levels:

EuroStoxx 50 down 30.61 points (-0.57%) at 5381.08

FTSE 100 down 23.47 points (-0.27%) at 8666.12

German DAX down 160.29 points (-0.7%) at 22678.74

French CAC 40 down 40.57 points (-0.51%) at 7990.11

US TREASURY FUTURES CLOSE

3M10Y +0.754, 6.249 (L: 1.942 / H: 9.873)

2Y10Y +3.633, 36.737 (L: 33.007 / H: 37.753)

2Y30Y +4.355, 72.478 (L: 68.486 / H: 73.817)

5Y30Y +2.283, 62.666 (L: 60.262 / H: 63.866)

Current futures levels:

Jun 2-Yr futures up 0.75/32 at 103-13.25 (L: 103-10.625 / H: 103-14.5)

Jun 5-Yr futures steady at at 107-22 (L: 107-15.5 / H: 107-24.5)

Jun 10-Yr futures down 3.5/32 at 110-14.5 (L: 110-06 / H: 110-21)

Jun 30-Yr futures down 14/32 at 115-23 (L: 115-08 / H: 116-08)

Jun Ultra futures down 23/32 at 120-3 (L: 119-15 / H: 120-25)

MNI US 10YR FUTURE TECHS: (M5) Testing Support

- RES 4: 112-13 1.500 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 3: 112-01 High Mar 4 and a bull trigger

- RES 2: 111-17+/25 High Mar 20 / 11

- RES 1: 110-26 High Mar 25

- PRICE: 110-13 @ 1224 ET Mar 27

- SUP 1: 110-06+/06 50-day EMA / Intraday low

- SUP 2: 110-00 High Feb 7 and a key support

- SUP 3: 109-19 50.0% retracement of the Jan - Mar bull cycle

- SUP 4: 109-16 Trendline support drawn from the Jan 13 low.

Treasury futures are trading lower as the current corrective cycle extends. The contract is testing support at 110-06+, the 50-day EMA. The average represents a key short-term pivot level - a clear break of it would signal scope for a deeper retracement. This would expose an equally important support at 110-00, the Feb 7 high. The medium-term trend condition is bullish, the first key resistance is located at 111-17+, the Mar 20 high.

SOFR FUTURES CLOSE

Jun 25 -0.010 at 95.870

Sep 25 -0.005 at 96.095

Dec 25 +0.005 at 96.265

Mar 26 +0.015 at 96.385

Red Pack (Jun 26-Mar 27) +0.005 to +0.020

Green Pack (Jun 27-Mar 28) -0.02 to steadysteady0

Blue Pack (Jun 28-Mar 29) -0.035 to -0.025

Gold Pack (Jun 29-Mar 30) -0.05 to -0.04

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00227 to 4.32492 (+0.00481/wk)

- 3M -0.00350 to 4.29917 (+0.00134/wk)

- 6M -0.00698 to 4.21660 (+0.01194/wk)

- 12M -0.00614 to 4.05880 (+0.03542/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.35% (+0.02), volume: $2.472T

- Broad General Collateral Rate (BGCR): 4.34% (+0.03), volume: $950B

- Tri-Party General Collateral Rate (TCR): 4.34% (+0.03), volume: $921B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $104B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $273B

FED Reverse Repo Operation

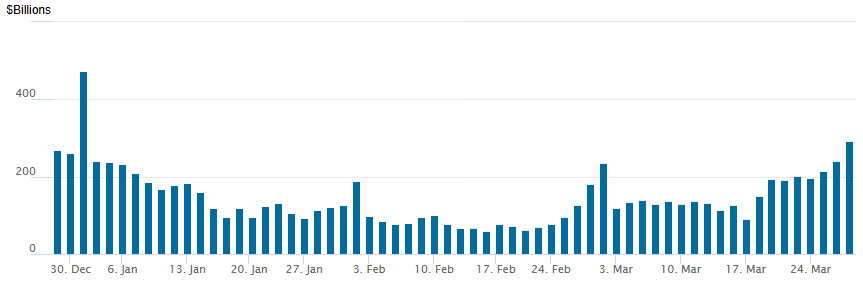

RRP usage climbs to $291.785B this afternoon from $241.371B Wednesday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 43.

MNI PIPELINE: Corporate Bond Roundup: Over $60B Issued Since Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 03/27 $600M Owens & Minor 5NC2

- 03/27 $Benchmark DBK 5Y 5.875%a

- $20.1B Priced Wednesday, $60.15B/wk

- 03/26 $5B *Petronas $1.6B +5Y +90, $1.8B 10Y +100, $1.6B 30Y +115

- 03/26 $4B *Dell Int $1B each: 3Y +75, 5Y +95, 7Y +110, 10Y +120

- 03/26 $2.85B *Mercedes-Benz $550M 2Y +65, $650M 2Y SOFR+78, $450M 3Y +75, $450M 3Y SOFR+93, 450M 5Y +95, $300M 10Y +115

- 03/26 $2B *United Overseas Bank (UOB) 3Y +40, 3Y SOFR+58, 5Y FOR+65

- 03/26 $1.3B *VICI Properties $400M 3Y +85, $900M 10Y +140

- 03/26 $1B *Kingdom of Belgium 10Y SOFR+67

- 03/26 $750M *Fortitude Group 5Y +220

- 03/26 $700M *BGC Group 5Y +210

- 03/26 $500M *Glencore Funding WNG 30Y +145

- 03/26 $500M *Union Electric WNG 10Y +92

- 03/26 $500M *GA Global Funding 7Y +130

- 03/26 $500M *Mutual of Omaha 5Y +95

- 03/26 $500M *MSD Corp +5Y +240

MNI BONDS: EGBs-GILTS CASH CLOSE: Bunds Rally Amid Auto Tariff Concerns

European curves steepened Thursday, with Bunds easily outperforming Gilts.

- The overnight announcement of the US's imposition of 25% tariffs on auto imports saw Bunds rally on the open, and while they would fluctuate through the session they held onto those gains.

- Conversely, Gilts weakened through most of the morning session, as equities regained ground, and the UK seen as relatively less economically vulnerable to the auto tariffs.

- Norges Bank held rates (a slight chance of a cut had been priced), while in data, Eurozone lending and M3 money supply growth picked up.

- Both Bunds and Gilts gained on weaker-leaning US data out in early afternoon. Both the UK and German curves twist steepened, with short-end yields lower. Periphery EGB / semi-core spreads were mixed but little changed overall.

- Friday's data includes UK retail sales and GDP, with the first country-level data of March's flash Eurozone inflation round (France and Spain) - MNI's preview is here - and ECB CPI expectations, plus appearances by Nagel and Muller.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5bps at 2.069%, 5-Yr is down 4.1bps at 2.373%, 10-Yr is down 2.2bps at 2.773%, and 30-Yr is down 0.3bps at 3.134%.

- UK: The 2-Yr yield is down 1.7bps at 4.273%, 5-Yr is up 2.2bps at 4.392%, 10-Yr is up 5.5bps at 4.783%, and 30-Yr is up 5.9bps at 5.368%.

- Italian BTP spread up 0.4bps at 110.6bps / Spanish down 0.2bps at 62.3bps

MNI FOREX: USDJPY Pierces Above Key Resistance, GBP Outperforms

- Today marked value-date month- and quarter end in FX markets, and despite the signals pointing to US corporate demand for dollars, the USD index sits weaker on the session, declining 0.25% on the session as we approach the APAC crossover.

- GBP has outperformed on Thursday relative to the rest of G10, with the stability off lows for GBPUSD overnight largely responsible. Markets continue to digest the relatively smooth reception of yesterday's Spring Statement.

- Despite the moderate declines for US stock indices, the JPY is weaker, and USDJPY has pierced above a key cluster of resistance around 150.95, trading to a three-week high of 151.15.

- This has allowed GBPJPY to extend its intra-day rally to ~0.85%, comfortably extending above the 195.00 across the session. We noted yesterday Tuesday that on a shorter-term basis, 20-and 50-day moving averages have proven supportive for the cross, culminating in a test of medium-term pivot resistance at the 195.00 mark. On the topside, 198.95 would be a notable target for the move.

- In similar vein, AUDJPY is also breaking above its 50-day EMA, which intersected ~95.20. Importantly, we have not closed above this average since January. Above here, the February highs at 97.33 would be a notable target for a more protracted recovery.

- The single currency also trades well, shrugging off the latest auto-tariff developments, with EURUSD hovering just below 1.08 after recording a fresh pullback low of 1.0735 overnight. Faring less well has been the Mexican peso, depreciating over 1% against the greenback, as President Sheinbaum said her administration is working on a thorough response to auto tariffs. USDMXN trades at 20.33 ahead of what should be a well telegraphed 50bp cut from Banxico late Thursday.

- Eurozone inflation data kicks off Friday, with readings from France and Spain. UK retail sales and activity data is also scheduled before the focus turns to the US PCE report.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 28/03/2025 | 0700/0800 | * | GFK Consumer Climate | |

| 28/03/2025 | 0700/0800 | ** | Retail Sales | |

| 28/03/2025 | 0700/0700 | *** | Retail Sales | |

| 28/03/2025 | 0700/0700 | * | Quarterly current account balance | |

| 28/03/2025 | 0700/0700 | *** | GDP Second Estimate | |

| 28/03/2025 | 0700/0700 | ** | Trade Balance | |

| 28/03/2025 | 0745/0845 | ** | PPI | |

| 28/03/2025 | 0745/0845 | ** | Consumer Spending | |

| 28/03/2025 | 0745/0845 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | ** | KOF Economic Barometer | |

| 28/03/2025 | 0830/0930 | ECB de Guindos At Fed. of Female Professionals Conf | ||

| 28/03/2025 | 0855/0955 | ** | Unemployment | |

| 28/03/2025 | 0900/1000 | Business and Consumer confidence | ||

| 28/03/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 28/03/2025 | 1000/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 28/03/2025 | 1100/1200 | ** | PPI | |

| 28/03/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 28/03/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 28/03/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 28/03/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 28/03/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 28/03/2025 | 1615/1215 | Fed Governor Michael Barr | ||

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1930/1530 | Atlanta Fed's Raphael Bostic |