MNI ASIA OPEN: Uncertainty Tempering Fed Policy

EXECUTIVE SUMMARY

- MNI BRIEF: Mark Carney Calls Snap Canada Election For April 28

- MNI FED: NY's Williams Still Sees Policy As "Modestly Restrictive" Amid Uncertainty

- MNI FED: Chicago's Goolsbee Sounds Increasingly Cautious, Auguring Later Cuts

- MNI US: Trump Hints At Tariff Flexibility Ahead Of April 2 Deadline

- MNI SECURITY: Ukraine "Proximity Talks" To Take Place In Riyadh On Monday

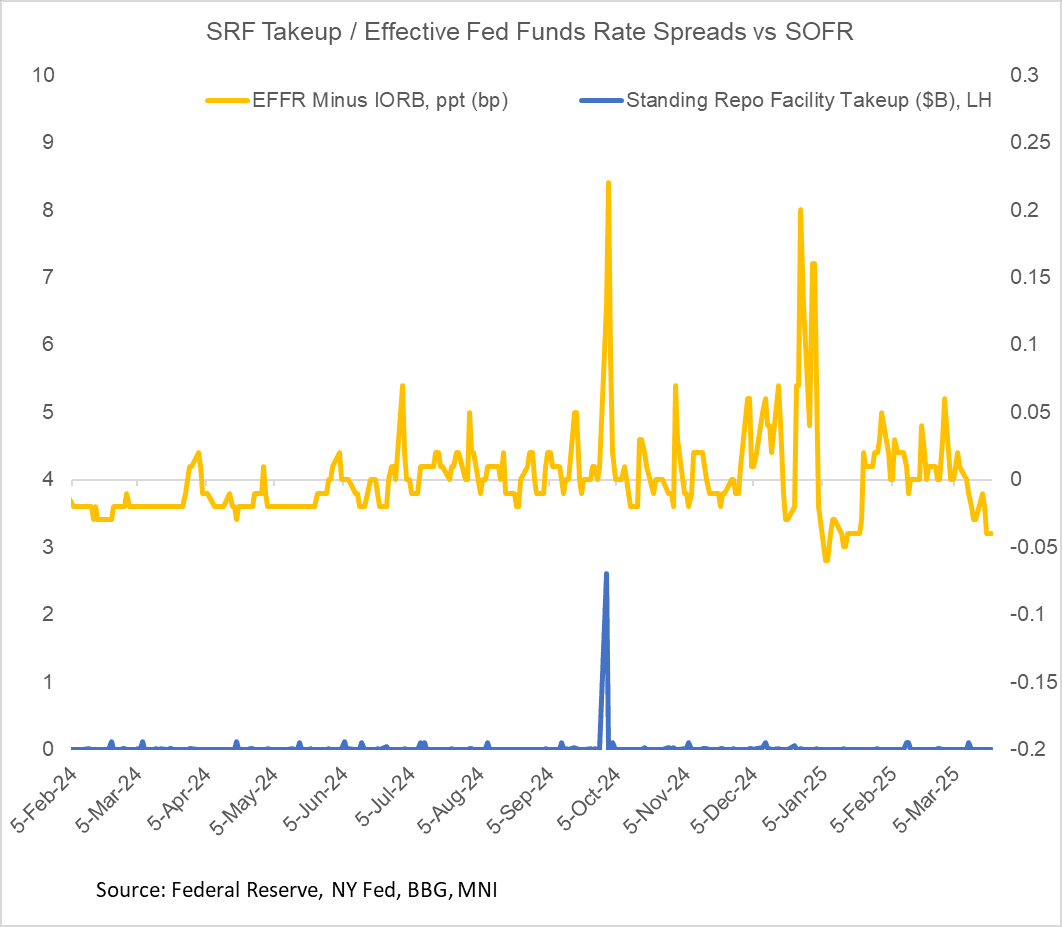

- MNI FED: Gov Waller Saw No Need To Taper, As Standing Repo Ops Underline His Point

US

MNI FED: Gov Waller Saw No Need To Taper, As Standing Repo Ops Underline His Point

Fed Governor Waller explains his dissent against the decision at the March meeting to taper the runoff of Treasuries by $20B a month to $5B, effectively cutting overall balance sheet runoff in half to $20B a month (MBS are running off at $15B/month). He writes: "Slowing further or stopping redemptions of securities holdings will be appropriate as we get closer to an ample level of reserves. But in my view we are not there yet because reserve balances stand at over $3 trillion and this level is abundant. There is no evidence from money market indicators or my outreach conversations that the banking system is getting close to an ample level of reserves." He adds that the prior pace in his view "continues to be the right one."

MNI FED: NY's Williams Still Sees Policy As "Modestly Restrictive" Amid Uncertainty

Picking up where Chair Powell left off on Wednesday (in a press conference where he used the terms "uncertain" or "uncertainty" 15 times), NY Fed Chair Williams (permanent FOMC voter, dove) says that "uncertainty is the only certainty in monetary policy" (in a speech titled "Certain Uncertainty"). His overall outlook doesn't really look like it's changed since pre-FOMC: "The current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still running somewhat above our 2 percent goal. It also positions us well to adjust to changing circumstances that affect the achievement of our dual mandate goals."

MNI FED: Chicago's Goolsbee Sounds Increasingly Cautious, Auguring Later Cuts

Chicago Fed Pres Goolsbee (2025 FOMC voter, most dovish Committee member per MNI's Hawk-Dove Spectrum) on CNBC makes the first Fed commentary after the March meeting, and he doesn't sound at all like he's pushing hard for rate cuts anytime soon: "At the end of the day, I still think that the Fed needs to be the steady hand and take the long view. I understand why the market wants to get the information as rapidly as possible and wants to know by Monday morning or by the end of today, what's going to be the path for rates, for tariffs, for fiscal policy for the entire rest of the year, but it's not realistic at this moment. The markets go up, the markets go down, they got a lot of short run, volatility, if you take the longer view I still think that there's a lot of strength in the hard numbers on the economy."

NEWS

MNI BRIEF: Mark Carney Calls Snap Canada Election For April 28

Mark Carney on Sunday called a snap election for April 28, with the former BOC and BOE Governor seeking a seat for himself in Parliament and a mandate for his Liberals to negotiate tariffs with Donald Trump. Carney called the vote about a week after taking over from Justin Trudeau as prime minister following a party leadership race. The move comes the day before Parliament was due to re-open with opposition parties saying they would have passed a non-confidence motion forcing an early election before one due in October.

MNI US: Trump Hints At Tariff Flexibility Ahead Of April 2 Deadline

US President Donald Trump has delivered a wide-ranging press availability following remarks at the Oval Office where he announced Boeing has been awarded the contract for developing sixth-generation US 'F-47' fighter planes. When asked if there is anything China can do to avoid tariffs on April 2, Trump says: "Well we can talk" but immediately follows with his regular justification for his tariff agenda: "Do believe me April 2nd is going to be 'liberation day' for America. We've been ripped off by every country in the world..."

MNI US-CHINA: USTR Greer To Call Chinese Counterpart Next Week - Bloomberg

MNI London: Bloomberg reporting that United States Trade Representative Jamieson Greer is expected to hold a first call with his Chinese counterpart next week. Bloomberg adds: "It’s not clear yet who Greer will speak with next week, but... it’s possible he will talk with one of China’s vice premiers — an elevation of the conversation from the trade file."

MNI SECURITY: Ukraine "Proximity Talks" To Take Place In Riyadh On Monday

US President Donald Trump’s Ukraine envoy, Keith Kellogg, confirmed yesterday that US officials will lead “proximity” talks between Ukraine and Russia at a hotel in Riyadh on Monday, March 24: “…one group’s going to be in this room, one group’s going to be in this room, and we’ll sit and talk, go back and forth,” Kellogg said. The first priority is to formalise a 30-day energy infrastructure ceasefire and begin talks on establishing a maritime/shipping truce. US State Dept spokesperson Tammy Bruce said: “We are just a breath away from a full ceasefire, and then we can begin to talk about [an enduring peace]…”

MNI US TSYS: Curves Twist Steeper, 5s30s At Sep'25 Highs

- Treasury futures remain mixed after the bell, curves twist steeper after bonds reversed course/extended lows after Pres Trump spoke on a host of topics including April 2 "Liberation Day" when reciprocal tariffs will bring money back to the US.

- Tsy 5s30s nears 60.0 (+5.147 at 59.336) the steepest since late September.

- Jun'25 10Y futures holding steady at 111-05.5, well within technicals: resistance above at 111-25 (High Mar 11), initial support below at 110-19 (20-day EMA).

- Bbg US$ index extended session high (1271.61) on headlines France wants the EU to consider deploying "anti-coercion .. tool: designed to strike back against nations that use trade and economic measures coercively".

- Meanwhile, stocks are paring losses, Super Micro Computer +7.11% and Boeing +3.47% leading gainers, BA surge after Trump said the plain maker won a $20B contract to produce next generation jet fighter.

- Focus on S&P flash PMIs Monday morning while more Fed speakers include Atlanta Fed Bostic on Bbg TV and Fed Gov Barr on small business lending late inb the afternoon.

OVERNIGHT DATA

MNI US DATA: Current Account Deficit Set To Widen Further In Early 2025

The Q4 current account deficit reported this week was much smaller than expected at $303.9B ($330B consensus), unexpectedly narrowing from $310.3B in Q3. This came despite a widening of the net trade deficit to $250B (widest since Q2 2022), from $236B prior as the goods deficit jumped $17B on the quarter to $326B.

- Offsetting this however were a pickup in primary income (positive $2.3B, after two consecutive negative quarters) as reinvested earnings soared $38B to $42B, the highest in 4 quarters (which appears to account for most of the consensus miss, though offset by a $20B pullback in dividends/withdrawals). There was also a $3B increase in the services surplus and a $4B decline in the secondary income deficit.

- The Q4 current account shortfall came to 4.1% of GDP, slightly smaller than Q3's 4.2% - but still above the sub-4% levels for the preceding 8 quarters.

- Obviously trade is a sensitive topic in policy circles at present, and bump in the primary income account (which looks like a one-off) doesn't obscure the very large sustained trade deficit which looks to have expanded substantially in Q1 even if that's on the back of idiosyncratic factors such as gold imports/tariff front-running.

- January's goods and services trade deficit was $131.4B, representing a material jump from December's $98.1B and by far the largest monthly print in history. Next week we get February advance goods trade data - more in a separate note ("US OUTLOOK/OPINION: Macro Week Ahead: PCE Plus A Rare Flagging Of Trade Data").

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 119.92 points (-0.29%) at 41836.48

S&P E-Mini Future down 20.5 points (-0.36%) at 5692.25

Nasdaq down 18.1 points (-0.1%) at 17673.09

US 10-Yr yield is up 0.7 bps at 4.2443%

US Jun 10-Yr futures are down 1/32 at 111-4.5

EURUSD down 0.0029 (-0.27%) at 1.0822

USDJPY up 0.44 (0.3%) at 149.22

Gold is down $23.75 (-0.78%) at $3021.15

European bourses closing levels:

EuroStoxx 50 down 27.1 points (-0.5%) at 5423.83

FTSE 100 down 55.2 points (-0.63%) at 8646.79

German DAX down 107.47 points (-0.47%) at 22891.68

French CAC 40 down 51.25 points (-0.63%) at 8042.95

US TREASURY FUTURES CLOSE

3M10Y +0.889, -4.786 (L: -9.631 / H: -3.828)

2Y10Y +3.138, 30.046 (L: 26.686 / H: 31.008)

2Y30Y +5.655, 64.421 (L: 58.881 / H: 65.59)

5Y30Y +4.49, 58.679 (L: 54.043 / H: 59.686)

Current futures levels:

Jun 2-Yr futures up 0.75/32 at 103-17.875 (L: 103-15.75 / H: 103-19.875)

Jun 5-Yr futures up 1.25/32 at 108-1.75 (L: 107-29.5 / H: 108-07.25)

Jun 10-Yr futures down 0.5/32 at 111-5 (L: 111-00 / H: 111-13.5)

Jun 30-Yr futures down 9/32 at 117-14 (L: 117-11 / H: 118-06)

Jun Ultra futures down 23/32 at 122-19 (L: 122-13 / H: 123-28)

MNI US 10YR FUTURE TECHS: (M5) Bullish Structure

- RES 4: 113-02+ 2.0% 10-dma envelope

- RES 3: 112-13 1.500 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 2: 112-01/02 High Mar 4 / 1.382 proj of Jan 13-Feb 7-12 swing

- RES 1: 111-25 High Mar 11

- PRICE: 111-13 @ 0915 ET Mar 21

- SUP 1: 110-19 20-day EMA

- SUP 2: 110-12+ Low Mar 6 & 13

- SUP 3: 110-03+/00 50-day EMA / High Feb 7 and a key support

- SUP 4: 109-13+ Low Feb 24

Treasury futures traded higher Thursday, strengthening a bullish theme. Moving average studies reinforce current trend conditions - they remain in a bull-mode position, highlighting a dominant uptrend. Recent gains have resulted in a print above 111-22+, the Dec 3 ‘24 high. A clear breach of this level would open 112-02 and 112-13, Fibonacci projections. Firm support is unchanged at 110-00, Feb 7 high.

SOFR FUTURES CLOSE

Mar 25 steady at 95.688

Jun 25 +0.020 at 95.925

Sep 25 +0.030 at 96.180

Dec 25 +0.030 at 96.355

Red Pack (Mar 26-Dec 26) +0.025 to +0.030

Green Pack (Mar 27-Dec 27) +0.015 to +0.025

Blue Pack (Mar 28-Dec 28) +0.005 to +0.015

Gold Pack (Mar 29-Dec 29) -0.005 to steady

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00092 to 4.32011 (+0.00371/wk)

- 3M -0.00501 to 4.29783 (+0.00278/wk)

- 6M -0.03057 to 4.20466 (+0.00629/wk)

- 12M -0.06551 to 4.02338 (+0.00554/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.29% (+0.02), volume: $2.438T

- Broad General Collateral Rate (BGCR): 4.28% (+0.00), volume: $954B

- Tri-Party General Collateral Rate (TCR): 4.28% (+0.00), volume: $932B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $109B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $300B

FED Reverse Repo Operation

RRP usage rises to $200.850B this afternoon from $192.640B Thursday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 42.

MNI BONDS: EGBs-GILTS CASH CLOSE: Steeper With Gilts Underperforming

The UK and German curves steepened Friday, with Gilts underperforming Bunds.

- Core FI was a little stronger in early trade, with US equities leading a global stock retreat. Stocks would bounce in mid-afternoon Europe trade, pulling Bunds and Gilts back from the session's best levels.

- In a session with little headline/macro data flow, attention was paid to further trans-Atlantic trade tension (Bloomberg reported France's push for strong EU retaliatory tariffs on the US), which saw a fleeting bounce in Bunds/Gilts that faded into the cash close.

- Bunds saw little reaction to the Bundesrat passing incoming Chancellor Merz's fiscal package, as this was was widely expected.

- The German curve twist steepened on the day, with the UK's bear steepening, with some anticipation ahead of next week's Spring budget statement/Gilt remit.

- Nonetheless, for the week, the German curve bull flattened (2s10s -5.8bp) with the UK's bear flattening (2s10s -3.7bp).

- Periphery/semi-core EGB spreads closed mostly tighter to Bunds on the day.

- Next week's calendar highlights include preliminary PMIs, UK and Eurozone inflation data, and the UK government's Spring budget statement/Gilt remit.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 2.132%, 5-Yr is down 3.2bps at 2.404%, 10-Yr is down 1.5bps at 2.765%, and 30-Yr is up 0.9bps at 3.103%.

- UK: The 2-Yr yield is up 2.6bps at 4.265%, 5-Yr is up 3.3bps at 4.346%, 10-Yr is up 6.6bps at 4.712%, and 30-Yr is up 9.4bps at 5.31%.

- Italian BTP spread down 1.2bps at 111.5bps / Spanish down 0.3bps at 64.2bps

MNI FOREX: USD Index Gains for Third Straight Session

- Early weakness for both European and US stock indices on Friday was enough to boost the greenback, culminating in a 0.22% rise for the USD Index, its third consecutive session of gains. The shaky risk appetite has weighed on the likes of AUD and NZD, while GBP has also suffered, however, it is worth noting that daily adjustments/ranges have remained relatively contained owing to a lack of major news developments.

- For AUDUSD (-0.46%), we have noted that 0.6400 continues to provide important pivot resistance, and the resumption of weakness since Tuesday (four consecutive losing sessions) highlights the medium-term bearish technical outlook. Price action was supported by the weaker-than-expected Australian jobs data earlier in the week, and AUDUSD has today tested the initial support level for the pair at 0.6259, the Mar 11 low. Below here, key short-term support remains at 0.6187.

- Cable’s inability to post a weekly close above the psychological 1.3000 mark may leave the pair vulnerable to a deeper technical correction, a dynamic that may be exacerbated as we approach the Spring statement on March 26. Firm support remains much lower at 1.2705.

- EURUSD continues to trade below its recent highs, consolidating a short-term correction seen during the latter part of this week, currently trading ~1.0820. . Initial key support to watch remains much further down at 1.0609, the 50-day EMA. The uptrend is overbought, and the pullback is allowing this set-up to unwind.

- The Eurozone week ahead is headlined by the March flash PMIs, which will be a key barometer of activity levels ahead of the ECB's April 17 decision. In the UK, CPI data and the Spring Statement are highlights. The Norges Bank decision crosses Thursday.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 24/03/2025 | 0815/0915 | ** | S&P Global Services PMI (p) | |

| 24/03/2025 | 0815/0915 | ** | S&P Global Manufacturing PMI (p) | |

| 24/03/2025 | 0830/0930 | ** | S&P Global Services PMI (p) | |

| 24/03/2025 | 0830/0930 | ** | S&P Global Manufacturing PMI (p) | |

| 24/03/2025 | 0900/1000 | ** | S&P Global Services PMI (p) | |

| 24/03/2025 | 0900/1000 | ** | S&P Global Manufacturing PMI (p) | |

| 24/03/2025 | 0900/1000 | ** | S&P Global Composite PMI (p) | |

| 24/03/2025 | 0930/0930 | *** | S&P Global Manufacturing PMI flash | |

| 24/03/2025 | 0930/0930 | *** | S&P Global Services PMI flash | |

| 24/03/2025 | 0930/0930 | *** | S&P Global Composite PMI flash | |

| 24/03/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 24/03/2025 | 1345/0945 | *** | S&P Global Services Index (flash) | |

| 24/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 24/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 24/03/2025 | 1800/1800 | BOE's Bailey lecture on UK growth | ||

| 24/03/2025 | 1910/1510 | Fed Governor Michael Barr |