MNI BoE Review - March 2025: New "cases" for the May MPR

Mar-24 06:36By: Tim Davis

UK

Download Full Report Here

- There was a slight hawkish bias to Thursday’s MPC meeting from the 8-1 vote in favour of maintaining Bank Rate at 4.50%.

- The guidance was largely unchanged although there were some tweaks to the first guidance paragraph, however, with the main addition being a more explicit reference to potential second-round effects from near-term inflation increases.

- Perhaps the most significant thing to come out of the March MPC meeting was not an explicit view for now, but the lack of any discussion over the three cases that have previously been the bedrock of MPC communication for the past few months. Instead, the MPC outlined the intention for how its guidance would evolve under new scenarios.

- We note that Governor Bailey is due to deliver a speech on “growth in the UK economy” on Monday 24 March and it would be very possible that he could set out these new cases more granularly. If this was the case, we would expect other MPC members to stick to this new script and to move away from the old case 1/2/3 rhetoric.

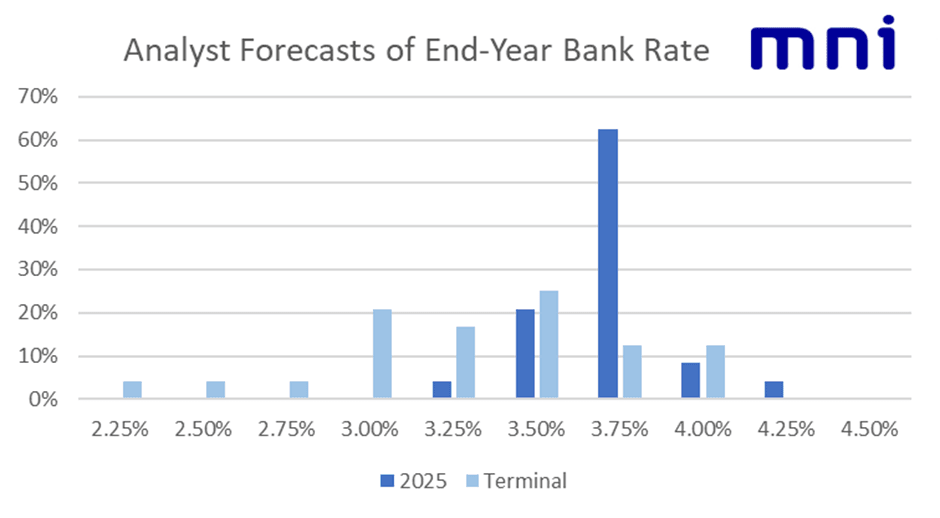

- We have only seen one sellside forecast change following the March MPC meeting: All 24 analyst reviews that we read look for the next 25bp cut in May, 63% of analysts (15/24) expect a further 75bp of cuts across the year to 3.75% while over 3/5 of analysts (15/24, 63%) have their terminal rate base case in a 3.00-3.50% range.