MNI BOK WATCH: Board To Cut On Q1 GDP Contraction Concerns

The Bank of Korea is widely expected to cut its Base Rate by 25 basis points to 2.5% this Thursday to prevent further economic deterioration following Q1’s GDP contraction, observers told MNI.

The central bank is also likely to downgrade its GDP growth forecasts – from 1.5% for this year and 1.8% in 2026 – to reflect persistent weakness in domestic demand and uncertainty over exports.

“Rate cuts to 2.25% in Q3 and 2% in Q4 are likely, as domestic demand won’t recover quickly and exports lack clear momentum,” said a source familiar with South Korea’s economy and policy. The economy will likely remain stagnant in the near term, supporting further easing, they added.

A 25bp rate cut this week would mark 100bp of easing by the BOK since October 2024, and follows its decision to hold rates steady in April. (See MNI BOK WATCH: Governor Flags Cut, But Timing Unclear)

GROWTH OUTLOOK

The bank could revise this year’s growth outlook closer to 1% given South Korea’s reliance on exports to the U.S. and China, and persistent weakness in household spending, the source argued, pointing to Q1 GDP which contracted 0.2% q/q, the first decline in three quarters, driven by a 0.6 percentage point drag from domestic demand.

The International Monetary Fund recently cut its 2025 South Korea growth forecast to 1.0%, and to 1.4% for 2026, from 2.0% and 2.1% respectively, citing external demand risks. The Korea Development Institute also flagged signs of a slowdown, despite previously only highlighting downside risks.

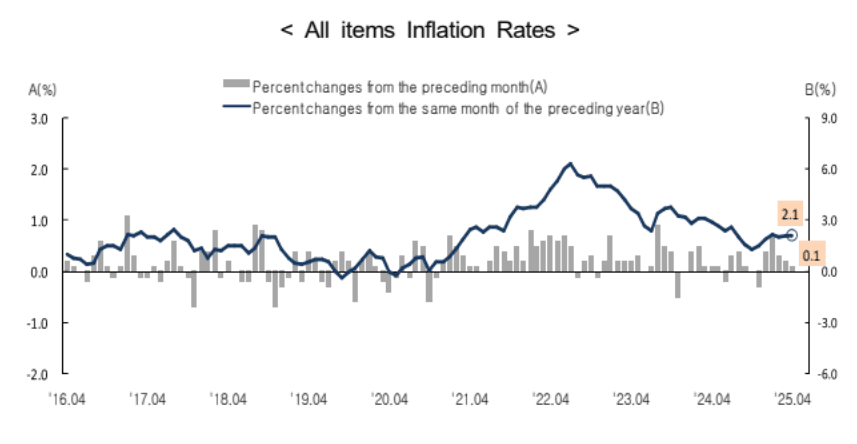

Uncertainty over potential U.S. tariffs is expected to weigh on exports and growth, according to a seperate observer, adding that contained inflation and a stable currency leave room for further easing. (See chart) Exports rose 3.7% y/y in April for a third month, led by a 17.2% surge in semiconductor shipments, though auto exports declined 3.8% and shipments to the U.S. fell 3.8%.

Markets are also closely watching the June 3 presidential election and U.S.-Korea trade talks, both seen as pivotal to the economic outlook. However, observers say political developments are unlikely to shift growth prospects dramatically. Lee Jae-myung of the Democratic Party is leading polls ahead of the vote, well ahead of conservative rival Kim Moon-soo.