MNI DAILY TECHNICAL ANALYSIS - Bear Shock Undermining Markets

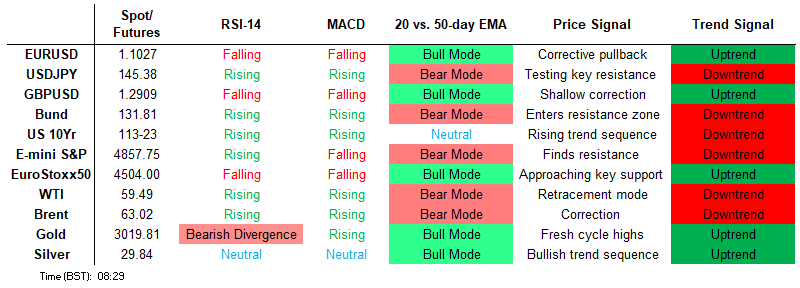

Price Signal Summary – Bear Shock Still Undermining Markets

- S&P E-Minis continue to trade in a volatile manner and are once again lower, today. A bearish theme remains intact and the latest fresh cycle lows, strengthens current conditions. Eurostoxx 50 futures remain in a bear cycle following the latest impulsive sell-off. Last week’s move down resulted in a break of 5229.00, the Mar 11 low. Today’s sell-off has resulted in a breach of a key support at 4699.00.

- EURUSD has pulled back from last week’s high. The trend condition remains bullish and a move lower is considered corrective. Recent gains resulted in the break of key resistance at 1.0955, the Mar 18 high, confirming a resumption of the uptrend. EURGBP maintains a bullish tone. The latest rally has resulted in a break of key resistance at 0.8474, the Jan 20 high. Clearance of this hurdle highlights an important technical breach and strengthens a bullish condition. Friday’s steep sell-off in AUDUSD cancels a recent bullish theme and instead, confirms a resumption of the downtrend that started late September last year. Today’s fresh cycle low reinforces a bear theme. A key support at 0.6088, the Feb 3 low, has been broken.

- The trend condition in Gold remains bullish and the latest pull back - for now - appears corrective. Moving average studies are in a bull-mode position highlighting a dominant uptrend and positive market sentiment. The impulsive sell-off in WTI futures continues to accelerate and last week’s move down resulted in the breach of a number of important support levels. The break reinforces a bearish threat and, despite being in oversold territory, signals scope for a continuation of the bear leg.

- A bull cycle in Bund futures remains in play and the contract is holding on to the bulk of its recent gains. Fresh short-term cycle highs last week signal scope for a continuation of the uptrend. The contract has cleared 131.14, the 76.4% retracement of the Feb 28 - Mar 11 bear leg. Gilt futures maintain a firmer tone and the contract is trading at its recent highs. A key resistance at 93.79, the Mar 4 high, has been cleared and this has been followed by a move through the 94.00 handle.

FOREIGN EXCHANGE

EURUSD TECHS: Trend Condition Remains Bullish

- RES 4: 1.1276 High Jul 18 ‘23

- RES 3: 1.1214 High Sep 25 2024 and a key resistance

- RES 2: 1.1188 0.764 proj of the Feb 28 - Mar 18 - 27 price swing

- RES 1: 1.1144 High Oct 1 2024 / High Apr 3

- PRICE: 1.0982 @ 05:47 BST Apr 7

- SUP 1: 1.0882 Intraday low

- SUP 2: 1.0824 20-day EMA

- SUP 3: 1.0733 Low Mar 27 and a key short-term support

- SUP 4: 1.0684 50-day EMA and a short-term pivot level

EURUSD has pulled back from last week’s high. The trend condition remains bullish and a move lower is considered corrective. Recent gains resulted in the break of key resistance at 1.0955, the Mar 18 high, confirming a resumption of the uptrend. It paves the way for a climb towards 1.1188 next, a Fibonacci projection. MA studies are in a bull-mode position highlighting a dominant uptrend. Initial firm support lies at 1.0824, the 20-day EMA.

GBPUSD TECHS: Monitoring Support At The 50-Day EMA

- RES 4: 1.3434 High Sep 26 ‘24 and a key resistance

- RES 3: 1.3305 High Oct 2 ‘24

- RES 2: 1.3207/3274 High Oct 3 ‘24 / High Apr 3 and the bull trigger

- RES 1: 1.3016 50.0% retracement of the Apr 3 - 7 pullback

- PRICE: 1.2910 @ 06:47 BST Apr 7

- SUP 1: 1.2824 Intraday low

- SUP 2: 1.2792 50-day EMA

- SUP 3: 1.2679 Low Mar 4

- SUP 4: 1.2559 Low Feb 28

Last week’s climb in GBPUSD resulted in a break of 1.3015, the Mar 20 high. This confirms a resumption of the uptrend that started Jan 13 and maintains the bullish price sequence of higher highs and higher lows. Note too that moving average studies are in a bull-mode position, highlighting a dominant uptrend. The latest pullback is considered corrective, key support to watch lies at 1.2792, the 50-day EMA. The bull trigger is 1.3207, the Apr 3 high.

EURGBP TECHS: Has Cleared Key Resistance

- RES 4: 0.8628 1.500 proj of the Mar 3 - 11 - 28 price swing

- RES 3: 0.8604 1.382 proj of the Mar 3 - 11 - 28 price swing

- RES 2: 0.8593 High Aug 14 ‘24

- RES 1: 0.8533 Intraday high

- PRICE: 0.8525 @ 07:01 BST Apr 7

- SUP 1: 0.8432/0.8380 Low Apr 4 / 20-day EMA

- SUP 2: 0.8316 Low Mar 28 and a key near-term support

- SUP 3: 0.8299 Low Mar 5

- SUP 4: 0.8251 Low Mar 4

EURGBP maintains a bullish tone. The latest rally has resulted in a break of key resistance at 0.8474, the Jan 20 high. Clearance of this hurdle highlights an important technical breach and strengthens a bullish condition. Sights are 0.8593 next, the Aug 14 ‘24 high. On the downside, firm support lies at 0.8380, the 20-day EMA. The contract is overbought, a pullback would allow this condition to unwind.

USDJPY TECHS: Trend Needle Points South

- RES 4: 151.30 High Mar 3

- RES 3: 150.43/151.21 50-day EMA / High Mar 28 and reversal trigger

- RES 2: 149.12 20-day EMA

- RES 1: 148.18 Low Mar 20

- PRICE: 145.92 @ 07:07 BST Apr 7

- SUP 1: 144.56 Low Apr 4

- SUP 2: 144.13 76.4% retracement of the Sep 16 ‘24 - Jan 10 bull leg

- SUP 3: 143.43 Low Oct 2 ‘24

- SUP 4: 142.95 1.00 proj of the Feb 12 - Mar 11 - 28 price swing

USDJPY maintains a softer tone following last week’s sharp sell-off and is trading just ahead of its recent lows. A resumption of the downtrend and a break of Friday’s 144.56 low would signal scope for an extension towards 144.13, a Fibonacci retracement point. Initial firm resistance to watch is 149.12, the 20-day EMA. Short-term gains would - for now - be considered corrective.

EURJPY TECHS: Retracement Mode

- RES 4: 165.43 High Nov 8

- RES 3: 164.90 High Dec 30 ‘24 and a key medium-term resistance

- RES 2: 164.55 High Jan 7

- RES 1: 161.39/164.19 20-day EMA / High Mar 18 and the bull trigger

- PRICE: 159.87 @ 07:51 GMT Apr 7

- SUP 1: 158.30 Intraday low

- SUP 2: 157.02 76.4% retracement of the Feb 28 - Mar 18 bull cycle

- SUP 3: 155.60 Low Low Mar 4

- SUP 4: 154.80 Low Low Feb 28

EURJPY is trading in a volatile manner. The latest pullback still appears corrective, however, following recent weakness, a deeper retracement is likely. The 61.8% retracement point of the Feb 28 - Mar 18 bull cycle, at 158.39, has been pierced. A clear break of this level would open 157.02, the 76.4% retracement level. Initial resistance to watch is 161.39, the 20-day EMA. Key resistance is 164.19, the Mar 18 high.

AUDUSD TECHS: Clears Key Support

- RES 4: 0.6409 High Dec 9 and a key resistance

- RES 3: 0.6389 High Apr 3

- RES 2: 0.6295 50-day EMA

- RES 1: 0.6077/0.6219 Intraday high / Low Mar 31

- PRICE: 0.6015 @ 07:57 BST Apr 7

- SUP 1: 0.59311.764 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 2: 0.5900 Round number support

- SUP 3: 0.5830 2.000 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 4: 0.5729 2.236 proj of the Sep 30 - Nov 6 - 7 price swing

Friday’s steep sell-off in AUDUSD cancels a recent bullish theme and instead, confirms a resumption of the downtrend that started late September last year. Today’s fresh cycle low reinforces a bear theme. A key support at 0.6088, the Feb 3 low, has been broken. This paves the way for an extension towards 0.5931 next, a Fibonacci projection. On the upside, resistance to watch is at 0.6219, the Mar 31 low.

USDCAD TECHS: Corrective Bounce

- RES 4: 1.4452/4543 High Mar 13 / 4 and a bull trigger

- RES 3: 1.4415 High Apr 1

- RES 2: 1.4304 50-day EMA

- RES 1: 1.4271 Intraday high

- PRICE: 1.4255 @ 08:01 BST Apr 7

- SUP 1: 1.4028 Low Apr 3

- SUP 2: 1.3986 Low Dec 2 ‘24

- SUP 3: 1.3944 61.8% retracement of Sep 25 ‘24 - Feb 3 bull run

- SUP 4: 1.3894 Low Nov 11 ‘24

USDCAD has recovered from last week’s low. For now, the move higher appears corrective. The sell-off last week confirmed a clear reversal of the bull cycle between Sep 25 ‘24 and Feb 3. Price has traded through a key support at 1.4151, the Feb 14 low, and this signals scope for an extension towards 1.3944, a Fibonacci retracement. On the upside, key short-term resistance is seen at 1.4304, the 50-day EMA.

FIXED INCOME

BUND TECHS: (M5) Bull Cycle Still In Play

- RES 4: 132.80 High Feb 5

- RES 3: 132.56 High Feb 28 and a key resistance

- RES 2: 132.04 High Mar 3

- RES 1: 131.48 High Apr 4

- PRICE: 130.80 @ 05:17 BST Apr 7

- SUP 1: 129.78 Low Apr 4

- SUP 2: 129.02/128.47 20-day EMA / Low Mar 28

- SUP 3: 127.74 Low Mar 25 and a key short-term support

- SUP 4: 127.20 Low Mar 17

A bull cycle in Bund futures remains in play and the contract is holding on to the bulk of its recent gains. Fresh short-term cycle highs last week signal scope for a continuation of the uptrend. The contract has cleared 131.14, the 76.4% retracement of the Feb 28 - Mar 11 bear leg. Clearance of this level strengthens the bullish condition and opens 132.56, the Feb 28 high. Initial firm support to watch lies at 129.02, the 20-day EMA.

BOBL TECHS: (M5) Trading At Its Recent Highs

- RES 4: 119.852 3.382 proj of the Mar 6 - 11 - 12 price swing

- RES 3: 119.706 3.236 proj of the Mar 6 - 11 - 12 price swing

- RES 2: 119.500 Round number resistance

- RES 1: 119.410 High Apr 4

- PRICE: 119.360 @ 06:14 BST Apr 7

- SUP 1: 118.430/117.641 Low Apr 4 / 20-day EMA

- SUP 2: 117.410 Low Mar 27

- SUP 3: 117.600 Low Mar 28

- SUP 4: 117.080 Low Mar 25 and a ey short-term support

Bobl futures are trading at their recent highs. Last week’s gains resulted in a break of key resistance at 119.040, the Feb 28 high. This strengthens bullish conditions and signals scope for a continuation. The focus is on the 119.500 handle next and 119.706, a Fibonacci projection. The contract is overbought, a pullback would allow this condition to unwind. Initial firm support lies at 117.766, the 20-day EMA.

SCHATZ TECHS: (M5) Northbound

- RES 4: 107.835 2.000 retracement proj of the Mar 4 - 6 bear leg

- RES 3: 107.666 1.764 retracement proj of the Mar 4 - 6 bear leg

- RES 2: 107.600 Round number resistance

- RES 1: 107.575 Intraday high

- PRICE: 107.550 @ 06:37 BST Apr 7

- SUP 1: 107.470 Intraday low

- SUP 2: 107.150 Low Apr 4

- SUP 3: 106.913 20-day EMA

- SUP 4: 106.830 Low Mar 27

Schatz futures maintain a firmer tone and today’s fresh cycle high once again, reinforces a bullish theme. The contract has recently traded through a key resistance at 107.120, the Mar 4 high. This confirmed a full reversal of the Apr 3 - 6 impulsive sell-off. The break also highlights a stronger bull cycle and signals scope for a climb towards 107.600 next. Initial firm support is seen at 106.913, the 20-day EMA.

GILT TECHS: (M5) Trading At Its Highs

- RES 4: 95.57 High Dec 11 ‘24 (cont)

- RES 3: 95.00 Round number resistance

- RES 2: 94.75 76.4% retracement of the Dec 3 - Jan 13 bear leg (cont)

- RES 1: 94.50 Intraday high

- PRICE: 94.30 @ 08:10 BST Apr 7

- SUP 1: 93.01 High Mar 20

- SUP 2: 92.13 20-day EMA

- SUP 3: 91.59 Low Mar 31

- SUP 4: 91.03 Low Mar 28

Gilt futures maintain a firmer tone and the contract is trading at its recent highs. A key resistance at 93.79, the Mar 4 high, has been cleared and this has been followed by a move through the 94.00 handle. The breach signals scope for a climb towards 94.75, 76.4% of the Dec 3 - Jan 13 bear leg (cont). On the downside, initial support lies at 93.01, the Mar 20 high. A firmer support is seen at 92.13, the 20-day EMA.

BTP TECHS: (M5) Bull Cycle Remains Intact

- RES 4: 120.39 High Feb 28 and a key resistance

- RES 3: 120.12 High High Mar 4

- RES 2: 119.31 Low Mar 4 and a gap high on the daily chart

- RES 1: 119.07 High Apr 4

- PRICE: 118.21 @ 07:12 BST Apr 7

- SUP 1: 117.73 20-day EMA

- SUP 2: 116.89 Low Mar 25 and a key short-term support

- SUP 3: 116.15 Low Mar 17

- SUP 4: 115.75 Low Mar 14

BTP futures maintain a firmer short-term tone. A continuation of the bull phase signals scope for an extension towards 119.31, the Mar 4 low and gap high on the daily chart. A breach of this level would open 120.39, the Feb 28 high and a key resistance. On the downside, initial firm support to watch is 117.73 the 20-day EMA. A break of this average would highlight a potential reversal.

EQUITIES

EUROSTOXX50 TECHS: (M5) Impulsive Sell-Off Extends

- RES 4: 5254.79 20-day EMA

- RES 3: 5047.00 High Apr 4

- RES 2: 4931.00 Low Jan 13 (cont)

- RES 1: 4809.00 Low Dec 20 ‘24 (cont)

- PRICE: 4625.00 @ 05:45 BST Apr 7

- SUP 1: 4600.00 Round number support

- SUP 2: 4542.27 3.000 proj of the Mar 3 - 11 - 19 price swing

- SUP 3: 4494.00 Low Aug 5 ‘24 (cont)

- SUP 4: 4372.46 46.4% retracement of the Oct ‘23 - Mar ‘25 bull cycle

Eurostoxx 50 futures remain in a bear cycle following the latest impulsive sell-off. Last week’s move down resulted in a break of 5229.00, the Mar 11 low. Today’s sell-off has resulted in a breach of a key support at 4699.00, the Nov 19 ‘24 low (cont). This exposes the 4600.00 handle ahead of 4494.00, the Aug 5 ‘24 low (cont). The contract is oversold, a recovery would allow this condition to unwind. Initial resistance is 4809.00, the Dec 20 ‘24 low (cont).

E-MINI S&P: (M5) Bear Leg Extends

- RES 4: 5664.68 20-day EMA

- RES 3: 5435.00 High Apr 4

- RES 2: 5120.00 Low Aug 5 ‘24 (cont)

- RES 1: 5007.00 Intraday high

- PRICE: 4929.75 @ 06:02 BST Apr 7

- SUP 1: 4832.00 Intraday low

- SUP 2: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 3: 4663.75 1.764 proj of the Feb 19 - Mar 13 - 25 price swing

- 7SUP 4: 4519.84 61.8% retracement of the Oc ‘22 - Feb ‘25 bull cycle

S&P E-Minis continue to trade in a volatile manner and are once again lower, today. A bearish theme remains intact and the latest fresh cycle lows, strengthens current conditions. Scope is seen for an extension towards the 4800.00 handle next. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

COMMODITIES

BRENT TECHS: (M5) Impulsive Reversal Extends

- RES 4: $77.75 - High Jan 20

- RES 3: $76.26 - High Feb 20

- RES 2: $72.31/75.47 - 50-day EMA / High Apr 2 and a bull trigger

- RES 1: $67.95 - Low Mar 5 and a recent breakout level

- PRICE: $63.80 @ 07:02 BST Apr 7

- SUP 1: $63.01 - Intraday low

- SUP 2: $61.97 - 2.236 proj of the Jan 15 - Feb 4 - 20 price swing

- SUP 3: $60.00 - Psychological round number

- SUP 4: $58.26 - 3.000 proj of the Jan 15 - Feb 4 - 20 price swing

Brent futures traded in a volatile manner last week and also traded sharply lower. The move down cancels a recent bullish theme. Price has traded cleared both the 20- and 50-day EMAs. Furthermore, the contract has breached $67.87, the Oct 10 ‘24 low. This signals scope for a continuation towards $91.97, a Fibonacci projection. On the upside, initial firm resistance is seen at $67.95, the Mar 5 low.

WTI TECHS: (K5) Fresh Cycle Low

- RES 4: $74.66 - High Jan 22

- RES 3: $72.91 - High Feb 11

- RES 2: $69.05/$72.28 - 50-day EMA / High Apr 2 and key resistance

- RES 1: $64.85 Low Mar 5 low and a recent breakout level.

- PRICE: $60.38 @ 07:07 BST Apr 7

- SUP 1: $59.39 - 2.000 proj of the Jan 15 - Feb 4 - 11 price swing

- SUP 2: $57.79 - 2.236 proj of the Jan 15 - Feb 4 - 11 price swing

- SUP 3: $56.81 - 2.382 proj of the Jan 15 - Feb 4 - 11 price swing

- SUP 4: $55.00 - Round number support

The impulsive sell-off in WTI futures continues to accelerate and last week’s move down resulted in the breach of a number of important support levels. The break reinforces a bearish threat and, despite being in oversold territory, signals scope for a continuation of the bear leg. Sights are on $59.39 next, a Fibonacci projection (pierced). Initial resistance is seen at $64.85, the Mar 5 low and a recent breakout level.

GOLD TECHS: Corrective Pullback

- RES 4: $3223.8 - 3.382 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 3: $3200.00 - Round number resistance

- RES 2: $3196.2 - 3.236 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 1: $3055.6/3167.8 - Intraday high / High Apr 3 and bull trigger

- PRICE: $3036.5 @ 06:19 BST Apr 7

- SUP 1: $3971.3 - Intraday low

- SUP 2: $2943.8 - 50-day EMA

- SUP 3: $2880.3 - Low Mar 10

- SUP 4: $2832.7 - Low Feb 28

The trend condition in Gold remains bullish and the latest pull back - for now - appears corrective. Moving average studies are in a bull-mode position highlighting a dominant uptrend and positive market sentiment. Price has traded through the 20-day EMA. The next key support to watch lies at 2943.78, the 50-day EMA. A resumption of gains would refocus attention on $3196.2, a Fibonacci projection. The bull trigger is 3167.8, the Apr 3 high.

SILVER TECHS: Impulsive Reversal Wave

- RES 4: $34.903 - High Oct 23 ‘24 and the bull trigger

- RES 3: $32.947/34.590 - 20-day EMA / High Mar 28

- RES 2: $32.491 - 50-day EMA

- RES 1: $30.815 - Low Feb 28

- PRICE: $29.826 @ 08:15 BST Apr 7

- SUP 1: $28.351 - Intraday low

- SUP 2: $27.686 - Low Sep 6 ‘24

- SUP 3: $27.180 - Low Aug 14 ‘24

- SUP 4: $26.451 - Low Aug 8 ‘24 and a key support

Silver continues to trade in a volatile manner. Last week’s sell-off confirmed a clear reversal of its recent uptrend. The metal has today traded through support at $28.748, the Dec 19 low. A clear break of this level would signal scope for a continued sell-off, towards $27.686, the Sep 6 ‘24 low. Initial resistance to watch is $30.815, the Feb 28 low. The contract is oversold, gains would allow this set-up to unwind.