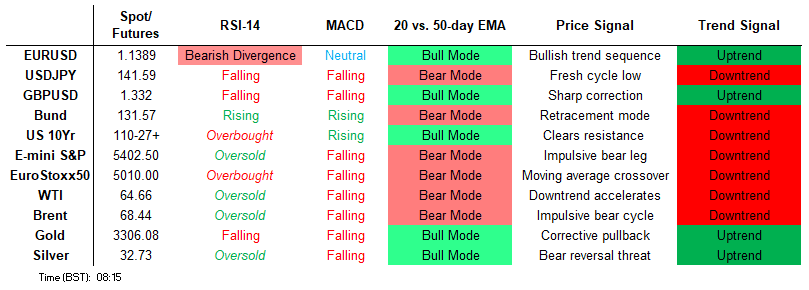

MNI DAILY TECHNICAL ANALYSIS - ES50 Unwinds Oversold Condition

Price Signal Summary – Estoxx50 Unwinds Oversold Condition

- A reversal higher in S&P E-Minis on Apr 9 highlighted the start of a correction. The trend condition has been oversold following recent weakness and gains have allowed this to unwind. Eurostoxx 50 futures have recovered from Tuesday’s low. Recent gains highlight a corrective cycle and the rally marks an unwinding of a recent oversold trend condition.

- The trend in EURUSD remains bullish and the pullback from Monday’s cycle high is considered corrective. A bullish price sequence of higher highs and higher lows remains intact and note that moving average studies are in a bull-mode position. The trend condition in USDJPY remains bearish and the bounce from Tuesday’s low is considered corrective. Recent fresh cycle lows confirm a resumption of the downtrend and maintain the price sequence of lower lows and lower highs. A bearish theme in USDCAD remains intact for now and the pair is trading at its recent lows. Fresh cycle lows continue to highlight a resumption of the downtrend and signal scope for a continuation near-term.

- The trend needle in Gold continues to point north and this week’s fresh cycle high reinforces bullish conditions. The latest move down is allowing an overbought trend condition to unwind. A bearish theme in WTI futures remains intact and the recovery since Apr 9 is - for now - considered corrective. The move higher is allowing an oversold trend condition to unwind. Recent weakness has resulted in the breach of a number of important support levels.

- Bund futures continue to trade closer to their recent highs. A bull cycle remains in play and the pullback between Apr 7 - 9 is considered corrective. A fresh short-term cycle high on Apr 7 reinforces a bullish theme. A sharp sell-off in Gilt futures between Apr 7 - 9 continues to highlight a bearish threat and recent gains - for now - appear corrective. Resistance to watch is 92.63, the Apr 8 high. A break of this level would signal scope for stronger bounce.

FOREIGN EXCHANGE

EURUSD TECHS: Corrective Pullback

- RES 4: 1.1696 1.618 proj of the Feb 28 - Mar 18 - 27 price swing

- RES 3: 1.1625 1.500 proj of the Feb 28 - Mar 18 - 27 price swing

- RES 2: 1.1608 High Nov 9 2021

- RES 1: 1.1573 High Apr 21

- PRICE: 1.1389 @ 06:05 BST Apr 23

- SUP 1: 1.1308 Intraday low

- SUP 2: 1.1167 20-day EMA and a key support

- SUP 3: 1.0919 50-day EMA and a short-term pivot level

- SUP 4: 1.0805 Low Apr 3

The trend in EURUSD remains bullish and the pullback from Monday’s cycle high is considered corrective. A bullish price sequence of higher highs and higher lows remains intact and note that moving average studies are in a bull-mode position too, signalling a continued dominant uptrend. The focus is on 1.1608 next, the Nov 9 2021 high. Key support is unchanged at the 20-day EMA, at 1.1167.

GBPUSD TECHS: Trend Needle Points North

- RES 4: 1.3550 High Feb 24 ‘22

- RES 3: 1.3500 Round number resistance

- RES 2: 1.3434 High Sep 26 ‘24 and a key resistance

- RES 1: 1.3424 High Apr 22 and the bull trigger

- PRICE: 1.3315 @ 06:21 BST Apr 23

- SUP 1: 1.3234/3207 Intraday low / High Apr 3 1

- SUP 2: 1.3099 20-day EMA

- SUP 3: 1.2923 50-day EMA

- SUP 4: 1.2807 Low Apr 10

The trend direction in GBPUSD remains up and fresh cycle highs this week reinforces current conditions. The pair has recently breached 1.3207, the Apr 3 high and a bull trigger. This highlights a resumption of the uptrend. Note that moving average studies are in a bull-mode position, signalling a dominant uptrend. Sights are on 1.3434 next, the Sep 26 ‘24 high. Support to watch is 1.3099, the 20-day EMA. The latest pullback appears corrective.

EURGBP TECHS: MA Studies Continue To Highlight An Uptrend

- RES 4: 0.8800 Round number resistance

- RES 3: 0.8781 2.236 proj of the Mar 3 - 11 - 28 price swing

- RES 2: 0.8768 High Nov 20 ‘23

- RES 1: 0.8624/0.8738 High Apr 21/ High Apr 11 and the bull trigger

- PRICE: 0.8580 @ 16:17 BST Apr 22

- SUP 1: 0.8524 20-day EMA

- SUP 2: 0.8477 61.8% retracement of the Mar 28 - Apr 11 rally

- SUP 3: 0.8442 50-day EMA

- SUP 4: 0.8415 76.4% retracement of the Mar 28 - Apr 11 rally

Recent weakness in EURGBP appears corrective and the retracement has allowed an overbought trend condition to unwind. Support to watch lies at 0.8524, the 20-day EMA. Below this level, support at the 50-day EMA is at 0.8447. The area between these two averages represents a key support zone. For bulls, a resumption of gains would refocus attention on 0.8738, the Apr 11 high and bull trigger. First resistance is 0.8624, the Apr 21 high.

USDJPY TECHS: Trend Outlook Remains Bearish

- RES 4: 149.28 High Apr 3

- RES 3: 147.77 50-day EMA

- RES 2: 144.90 20-day EMA

- RES 1: 143.22 Intraday high

- PRICE: 142.08 @ 06:55 BST Apr 23

- SUP 1: 139.79 1.382 proj of the Feb 12 - Mar 11 - 28 price swing

- SUP 2: 138.82 1.500 proj of the Feb 12 - Mar 11 - 28 price swing

- SUP 3: 138.07 LowJul 28 ‘23

- SUP 4: 137.85 1.618 proj of the Feb 12 - Mar 11 - 28 price swing

The trend condition in USDJPY remains bearish and the bounce from Tuesday’s low is considered corrective. Recent fresh cycle lows confirm a resumption of the downtrend and maintain the price sequence of lower lows and lower highs. Note too that MA studies are in a bear-mode position highlighting a dominant downtrend. Sights are on 139.79 next, a Fibonacci projection. Initial firm resistance to watch is the 20-day EMA, at 144.90.

EURJPY TECHS: Trading Above Support

- RES 4: 165.43 High Nov 8

- RES 3: 164.90 High Dec 30 ‘24 and a key medium-term resistance

- RES 2: 164.55 High Jan 7

- RES 1: 163.55/164.19 High Apr 14 / High Mar 18 and the bull trigger

- PRICE: 161.40 @ 07:31 GMT Apr 23

- SUP 1: 160.99/159.48 50-day EMA / Low Apr 9

- SUP 2: 158.30 Low Apr 7 and key support

- SUP 3: 157.02 76.4% retracement of the Feb 28 - Mar 18 bull cycle

- SUP 4: 155.60 Low Low Mar 4

EURJPY is in consolidation mode. The recent pullback appears corrective and trend conditions remain bullish. Key short-term support has been defined at 158.30, the low on Apr 7. A break of this level is required to signal scope for a deeper retracement. This would open 157.02, a Fibonacci retracement. For bulls, a resumption of gains would expose 164.19, the Mar 18 high and the bull trigger. Clearance of this hurdle would resume the uptrend.

AUDUSD TECHS: Maintains A Bullish Tone

- RES 4: 0.6550 61.8% retracement of the Sep 30 ‘24 - Apr 9 bear leg

- RES 3: 0.6528 High Nov 29 ‘24

- RES 2: 0.6471 High Dec 9 ‘24

- RES 1: 0.6439 High Apr 22

- PRICE: 0.6418 @ 07:58 BST Apr 23

- SUP 1: 0.6349/6299 Low Apr 21 / 20-day EMA

- SUP 2: 0.6181 Low Apr 11

- SUP 3: 0.6116 Low Apr 10

- SUP 4: 0.5915 Low Apr 9 and key support

AUDUSD is holding on to its recent gains and a bullish theme remains intact. The pair has breached a key resistance at 0.6409, the Dec 9 ‘24 high. This reinforces bullish conditions and signals scope for a continuation higher near-term. Sights are on 0.6471 next, the Dec 9 2024 high. Initial key support to monitor is 0.6299, the 20-day EMA. A clear break of this EMA would be a concern for bulls.

USDCAD TECHS: Southbound

- RES 4: 1.4415 High Apr 1

- RES 3: 1.4296 High Apr 7

- RES 2: 1.4165 50-day EMA

- RES 1: 1.3906/4029 High Apr 17 / 20-day EMA

- PRICE: 1.3814 @ 08:01 BST Apr 23

- SUP 1: 1.3781 Low Apr 21

- SUP 2: 1.3744 76.4% retracement of Sep 25 ‘24 - Feb 3 bull run

- SUP 3: 1.3696 Low Oct 10 2024

- SUP 4: 1.3643 Low Oct 9 ‘24

A bearish theme in USDCAD remains intact for now and the pair is trading at its recent lows. Fresh cycle lows continue to highlight a resumption of the downtrend and signal scope for a continuation near-term. Potential is seen for a move towards 1.3744, a Fibonacci retracement. Moving average studies are in a bear -mode position, highlighting a dominant downtrend. First resistance to watch is 1.4029, the 20-day EMA.

FIXED INCOME

BUND TECHS: (M5) Bullish Trend Structure Intact

- RES 4: 133.90 1.236 proj of the Mar 25 - Apr 7- 9 price swing

- RES 3: 133.00 round number resistance

- RES 2: 132.56 High Feb 28 and a key resistance

- RES 1: 132.03 High Apr 7 and the bull trigger

- PRICE: 131.82 @ 05:45 BST Apr 23

- SUP 1: 130.87/130.31 Low Apr 17 / 20-day EMA

- SUP 2: 129.02 Low Apr 10

- SUP 3: 128.60 Low Apr 9 and a key support

- SUP 4: 128.47 Low Mar 28

Bund futures continue to trade closer to their recent highs. A bull cycle remains in play and the pullback between Apr 7 - 9 is considered corrective. A fresh short-term cycle high on Apr 7 reinforces a bullish theme. The contract has recently cleared 131.14, 76.4% of the Feb 28 - Mar 11 bear leg. This opens 132.56 next, the Feb 28 high. Firm support lies at 128.60, the Apr 9 low. A break below this level would alter the picture.

BOBL TECHS: (M5) Bullish Outlook

- RES 4: 120.20 High Dec 12 ‘24 (cont)

- RES 3: 120.000 Psychological round number

- RES 2: 119.960 High Apr 7 and the bull trigger

- RES 1: 119.780 High Apr 22

- PRICE: 119.630 @ 05:55 BST Apr 23

- SUP 1: 119.030 Low Apr 17

- SUP 2: 118.703 20-day EMA

- SUP 3: 118.060 Low Apr 10

- SUP 4: 117.680 Low Apr 9 and a key support

Bobl futures are holding on to their latest highs. Recent weakness appears corrective and a bullish theme remains intact. The early April rally resulted in a break of key resistance at 119.040, the Feb 28 high. This strengthens bullish conditions. The focus is on the 120.000 handle next. Firm support lies at 117.680, the Apr 9 low. The 20-day EMA, an important short-term support, is at 118.703.

SCHATZ TECHS: (M5) Approaching The Bull Trigger

- RES 4: 107.812 0.618 proj of the Mar 6 - Apr 7 - 9 price swing

- RES 3: 107.800 Round number resistance

- RES 2: 107.775 High Apr 7 and the bull trigger

- RES 1: 107.735 High Apr 22

- PRICE: 107.595 @ 06:06 BST Apr 23

- SUP 1: 107.370 Low Apr 17

- SUP 2: 107.298 20-day EMA

- SUP 3: 107.125 Low Apr 10

- SUP 4: 106.965 Low Apr 9 and a key support

Schatz futures maintain a firmer tone and sights are on 107.775, the Apr 7 high and bull trigger. The recent pullback between Apr 7 - 9, appears corrective. Clearance of 107.775 would confirm a resumption of the uptrend and open 107.812, a Fibonacci projection. Moving average studies remain in a bull-mode position, highlighting a dominant uptrend. Firm support to watch lies at 107.298, the 20-day EMA.

GILT TECHS: (M5) Monitoring Resistance

- RES 4: 94.50 High Apr 7 and key resistance

- RES 3: 93.44 76.4% retracement of the Apr 7-9 sell-off

- RES 2: 93.00 Round number resistance

- RES 1: 92.63 High Apr 8

- PRICE: 92.44 @ Close Apr 22

- SUP 1: 91.73/91.43 Low Apr 17 / 15

- SUP 2: 90.47/89.99 Low Apr 11 / 9

- SUP 3: 89.68 Low Jan 15 (cont)

- SUP 4: 88.96 Low Jan 13 and a key support (con)

A sharp sell-off in Gilt futures between Apr 7 - 9 continues to highlight a bearish threat and recent gains - for now - appear corrective. Resistance to watch is 92.63, the Apr 8 high. A break of this level would signal scope for stronger bounce and expose 93.44, a Fibonacci retracement. For bears, a reversal would refocus attention on 89.99, the Apr 9 low where a break would resume the downtrend.

BTP TECHS: (M5) Northbound

- RES 4: 120.65 1.382 proj of the Mar 14 - Apr 4 - 9 price swing

- RES 3: 120.39 High Feb 28

- RES 2: 120.12 High High Mar 4

- RES 1: 119.99 Intraday high

- PRICE: 119.84 @ 07:27 BST Apr 23

- SUP 1: 119.07/118.41 High Apr 4 / 20-day EMA

- SUP 2: 117.28 Low Apr 10

- SUP 3: 116.06 Low Apr 9

- SUP 4: 115.75 Low Apr 14 and a bear trigger

BTP futures rallied sharply higher last week and the contract maintains a bullish tone. The rally resulted in a break of resistance at 119.07, the Apr 4 high. The breach confirms the end of the Apr 4 - 9 correction and cancels a recent bearish threat. Note too that, 119.29, 76.4% of the Feb 28 - Mar 14 bear leg, has been cleared - a bullish development. This opens 120.12 next, the Mar 4 high. Initial support to watch lies at 118.41, the 20-day EMA.

EQUITIES

EUROSTOXX50 TECHS: (M5) Corrective Cycle Remains In Play

- RES 4: 5263.01 76.4% retracement of the Mar 3 - Apr 7 bear leg

- RES 3: 5165.00 HIgh Apr 3

- RES 2: 5113.20 50-day EMA

- RES 1: 5001.00 High Apr 9

- PRICE: 4988.00 @ 06:35 BST Apr 23

- SUP 1: 4812.00/4664.00 Low Apr 16 / 10

- SUP 2: 4575.45 76.4% retracement of the Apr 7 - 9 bounce

- SUP 3: 4444.00 Low Apr 7 and the bear trigger

- SUP 4: 4336.00 Low Nov 28 ‘23 (cont)

Eurostoxx 50 futures have recovered from Tuesday’s low. Recent gains highlight a corrective cycle and the rally marks an unwinding of a recent oversold trend condition. Resistance at the 20-day EMA, at 4971.53, has been breached. The next level to watch is 5105.00, the 50-day EMA. Key support and the bear trigger has been defined at 4444.00, the Apr 7 low. A break of this level would confirm a resumption of the downtrend.

E-MINI S&P: (M5) Resistance Remains Intact

- RES 4: 5773.25 High Apr 2

- RES 3: 5639.32 50-day EMA

- RES 2: 5528.75 High Apr 10 and the bull trigger

- RES 1: 5425.57 20-day EMA

- PRICE: 5401.75 @ 07:15 BST Apr 23

- SUP 1: 5098.16 61.8% retracement of the Apr 7 - 10 bounce

- SUP 2: 4996.43 76.4% retracement of the Apr 7 - 10 bounce

- SUP 3: 4832.00 Low Apr 7 and the bear trigger

- SUP 4: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

A reversal higher in S&P E-Minis on Apr 9 highlighted the start of a correction. The trend condition has been oversold following recent weakness and gains have allowed this to unwind. The contract remains below important resistance points and the trend condition is bearish. A resumption of weakness would refocus attention on 4832.00, the Apr 7 low and bear trigger. Initial resistance to watch is 5425.57, the 20-day EMA.

COMMODITIES

BRENT TECHS: (M5) Holding On To Its Recent Gains

- RES 4: $77.75 - High Jan 20

- RES 3: $76.26 - High Feb 20

- RES 2: $75.47 - High Apr 2 and a bull trigger

- RES 1: $69.85 - 50-day EMA

- PRICE: $68.15 @ 07:02 BST Apr 23

- SUP 1: $62.00/58.40 - Low Apr 10 / 9 and the bear trigger

- SUP 2: $58.85 - 2.000 proj of the Feb 20 - Mar 5 - Apr 2 price swing

- SUP 3: $56.89 - 2.236 proj of the Feb 20 - Mar 5 - Apr 2 price swing

- SUP 4: $55.00 - Round number support

Brent futures are holding on to their recent gains and continue to trade above the Apr 9 low. For now, the latest bounce is considered corrective and this is allowing a recent oversold condition to unwind. The primary trend direction remains down and a resumption of weakness would open $56.89, a Fibonacci projection. On the upside, the next important resistance to monitor is at the 50-day EMA, at $69.85.

WTI TECHS: (M5) Corrective Cycle Still In Play For Now

- RES 4: $75.51 - High Jan 15 and a key resistance

- RES 3: $72.56 - High Feb 20

- RES 2: $66.12/71.76 - 50-day EMA / High Apr 2 and key resistance

- RES 1: $64.49 Low Mar 5 low and a recent breakout level.

- PRICE: $64.45 @ 07:11 BST Apr 23

- SUP 1: $58.29/54.67 - Low Apr 10 / 9 and the bear trigger

- SUP 2: $53.72 - 2.236 proj of the Feb 20 - Mar 5 - Apr 2 price swing

- SUP 3: $52.54 - 2.382 proj of the Jan 15 - Feb 4 - 11 price swing

- SUP 4: $50.00 - Psychological round number

A bearish theme in WTI futures remains intact and the recovery since Apr 9 is - for now - considered corrective. The move higher is allowing an oversold trend condition to unwind. Recent weakness has resulted in the breach of a number of important support levels, reinforcing a bearish threat. A resumption of the bear cycle would open $53.72, a Fibonacci projection. Resistance is seen at $64.49, the Mar 5 low. The 50- day EMA is at $66.12.

GOLD TECHS: Unwinding An Overbought Condition

- RES 4: $3600.0 - Round number resistance

- RES 3: $3578.0 - 2.000 proj of the Dec 19 - Feb 24 - Feb 28 swing

- RES 2: $3547.9 - 1.764 proj of the Feb 28 - Apr 3 - Apr 7 price swing

- RES 1: $3500.1 - High Apr 22

- PRICE: $3321.6 @ 07:18 BST Apr 23

- SUP 1: $3284.0 - Low Apr 17

- SUP 2: $3184.2 - 20-day EMA

- SUP 3: $3167.8 - High Apr 3 and a recent breakout level

- SUP 4: $3047.0 - 50-day EMA

The trend needle in Gold continues to point north and this week’s fresh cycle high reinforces bullish conditions. The latest move down is allowing an overbought trend condition to unwind. Moving average studies are unchanged, they remain in a bull-mode position highlighting a dominant uptrend. The next objective is $2547.9, a Fibonacci projection. Initial firm support to watch lies at 3184.2, the 20-day EMA.

SILVER TECHS: Short-Term Trend Set-Up Remains Bullish

- RES 4: $36.000 - Round number resistance

- RES 3: $34.903 - High Oct 23 ‘24 and the bull trigger

- RES 2: $34.590 - High Mar 28

- RES 1: $33.117/151 - 76.4% of Mar 28 - Apr 7 bear leg / High Apr 22

- PRICE: $32.787 @ 08:07 BST Apr 23

- SUP 1: $30.577/28.351 - Low Apr 10 / 7 and the bear trigger

- SUP 2: $27.686 - Low Sep 6 ‘24

- SUP 3: $27.180 - Low Aug 14 ‘24

- SUP 4: $26.451 - Low Aug 8 ‘24 and a key support

Silver is in consolidation mode and holding on to the bulk of its recent gains. The latest recovery undermines a bearish theme. Price has traded through an important resistance around the 50-day EMA - at $32.278. The break higher signals scope for a test of $33.117, a Fibonacci retracement. It has been pierced, clearance of this level would strengthen a bullish condition. On the downside, initial firm support to watch lies at $30.577, the Apr 10 low.