MNI DAILY TECHNICAL ANALYSIS - Higher Stocks Correction Holds

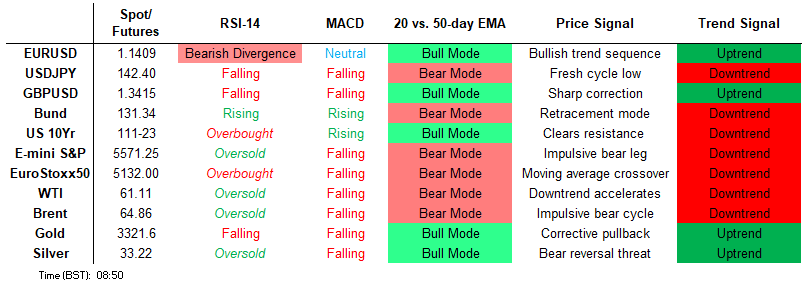

Price Signal Summary – Corrective Bull Cycle in Stocks Continues

- The corrective bull cycle in S&P E-Minis that started on Apr 7, remains in play. The contract has breached a number of important short-term resistance points. Price has cleared the 20-day EMA and pierced 5528.75. Eurostoxx 50 futures maintain a positive tone and are holding on to their recent gains. The contract has cleared the 20-day EMA and pierced the 50-day EMA, at 5101.76. A clear break of this average would strengthen the current bull cycle and signal scope for a continuation.

- Bullish trend conditions in GBPUSD remain intact and Monday’s positive start to the week reinforces current conditions. A fresh cycle high yesterday highlights a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. The recovery that started Apr 22 in USDJPY is considered corrective. Resistance to watch is 144.24, the 20-day EMA. A clear break of this level would signal scope for a stronger recovery. The trend condition in AUDUSD is unchanged, it remains bullish and the pair is trading at its recent highs. Price has recently breached a key resistance at 0.6409, the Dec 9 ‘24 high.

- Gold continues to trade below its recent highs. The trend needle points north and the latest move down appears corrective. The retracement has allowed an overbought condition to unwind. Moving average studies are unchanged. A medium-term bearish theme in WTI futures remains intact and the recovery that started on Apr 9 appears corrective. The move higher has allowed an oversold trend condition to unwind.

- Bund futures have pulled back from their recent highs. Despite the latest move down, a bull cycle remains in play and the sell-off between Apr 7 - 9 is considered corrective. Gilt futures are holding on to their latest gains. The recent rally marks an extension of the recovery that started Apr 9. 92.63, the Apr 8 high, has been breached, exposing 93.44, the 76.4% retracement of the Apr 7-9 sell-off.

FOREIGN EXCHANGE

EURUSD TECHS: Recent Pullback Considered Corrective

- RES 4: 1.1696 1.618 proj of the Feb 28 - Mar 18 - 27 price swing

- RES 3: 1.1625 1.500 proj of the Feb 28 - Mar 18 - 27 price swing

- RES 2: 1.1608 High Nov 9 2021

- RES 1: 1.1573 High Apr 21 and the bull trigger

- PRICE: 1.1379 @ 05:56 BST Apr 29

- SUP 1: 1.1308 Low Apr 23

- SUP 2: 1.1236 20-day EMA and a key support

- SUP 3: 1.1144/0986 High Apr 3 / 50-day EMA and a pivot level

- SUP 4: 1.0805 Low Apr 3

Short-term weakness in EURUSD is considered corrective and the trend structure remains bullish. Moving average studies are in a bull-mode position signalling a dominant uptrend, and the latest move down is allowing an overbought condition to unwind. A resumption of gains would open 1.1608 next, the Nov 9 2021 high. Key support is unchanged at the 20-day EMA, at 1.1236. A break of this average would signal scope for a deeper retracement.

GBPUSD TECHS: Fresh Cycle High

- RES 4: 1.3605 1.236 proj of the Feb 28 - Apr 3 - 7 price swing

- RES 3: 1.3550 High Feb 24 ‘22

- RES 2: 1.3510 1.236 proj of the Feb 28 - Apr 3 - 7 price swing

- RES 1: 1.3444 High Apr 28

- PRICE: 1.3399 @ 06:13 BST Apr 29

- SUP 1: 1.3234 Low Apr 23

- SUP 2: 1.3180 20-day EMA

- SUP 3: 1.3041/2985 Low Apr 14 / 50-day EMA

- SUP 4: 1.2807 Low Apr 10

Bullish trend conditions in GBPUSD remain intact and Monday’s positive start to the week reinforces current conditions. A fresh cycle high yesterday highlights a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. Moving average studies are in a bull-mode position too, signalling a dominant uptrend. Sights are on 1.3510, a Fibonacci projection. Support to watch lies at 1.3180, the 20-day EMA.

EURGBP TECHS: Bear Cycle Extension

- RES 4: 0.8781 2.236 proj of the Mar 3 - 11 - 28 price swing

- RES 3: 0.8768 High Nov 20 ‘23

- RES 2: 0.8624/0.8738 High Apr 21/ High Apr 11 and the bull trigger

- RES 1: 0.8557 High Apr 28

- PRICE: 0.8495 @ 06:46 BST Apr 29

- SUP 1: 0.8487 Intraday low

- SUP 2: 0.8477 61.8% retracement of the Mar 28 - Apr 11 rally

- SUP 3: 0.8459 50-day EMA

- SUP 4: 0.8415 76.4% retracement of the Mar 28 - Apr 11 rally

EURGBP traded lower Monday, marking a continuation of the current bear cycle. Note too that the move down cancels the doji reversal signal on Apr 25. Sights are on 0.8477, a Fibonacci retracement point where a break would strengthen the bearish theme. It is still possible that short-term weakness is corrective. A reversal and a resumption of gains would open 0.8738, the Apr 11 high and bull trigger.

USDJPY TECHS: Resistance Remains Intact

- RES 4: 147.05 50-day EMA

- RES 3: 146.54 Low Mar 11

- RES 2: 144.24 20-day EMA

- RES 1: 144.03 High Apr 25

- PRICE: 142.46 @ 07:00 BST Apr 29

- SUP 1: 141.49 Low Apr 23

- SUP 2: 139.79 1.382 proj of the Feb 12 - Mar 11 - 28 price swing

- SUP 3: 138.82 1.500 proj of the Feb 12 - Mar 11 - 28 price swing

- SUP 4: 138.07 Low Jul 28 ‘23

The recovery that started Apr 22 in USDJPY is considered corrective. Resistance to watch is 144.24, the 20-day EMA. A clear break of this level would signal scope for a stronger recovery. Resistance at the 50-day EMA, is at 147.05. Moving average studies are in a bear-mode position highlighting a dominant downtrend. A resumption of the trend would open 139.79 next, a Fibonacci projection.

EURJPY TECHS: Monitoring Support

- RES 4: 165.43 High Nov 8

- RES 3: 164.90 High Dec 30 ‘24 and a key medium-term resistance

- RES 2: 164.55 High Jan 7

- RES 1: 163.76/164.19 High Apr 25 / High Mar 18 and the bull trigger

- PRICE: 162.19 @ 07:10 GMT Apr 29

- SUP 1: 161.41/159.48 50-day EMA / Low Apr 9

- SUP 2: 158.30 Low Apr 7 and key support

- SUP 3: 157.02 76.4% retracement of the Feb 28 - Mar 18 bull cycle

- SUP 4: 155.60 Low Low Mar 4

Short-term weakness in EURJPY appears corrective and the trend condition remains bullish. Last week’s gains reinforce a bullish theme. Key S/T support lies at 158.30, the Apr 7 low. A break of it is required to signal scope for a deeper retracement. This would open 157.02, a Fibonacci retracement. First support to watch is 161.41, the 50-day EMA. Attention is on 164.19, the Mar 18 high and a bull trigger. Clearance of this hurdle would resume the uptrend.

AUDUSD TECHS: Short-Term Structure Remains Bullish

- RES 4: 0.6550 61.8% retracement of the Sep 30 ‘24 - Apr 9 bear leg

- RES 3: 0.6528 High Nov 29 ‘24

- RES 2: 0.6471 High Dec 9 ‘24

- RES 1: 0.6450 Intraday high

- PRICE: 0.6421 @ 07:59 BST Apr 29

- SUP 1: 0.6344/6307 Low Apr 24 / 50-day EMA

- SUP 2: 0.6181 Low Apr 11

- SUP 3: 0.6116 Low Apr 10

- SUP 4: 0.5915 Low Apr 9 and key support

The trend condition in AUDUSD is unchanged, it remains bullish and the pair is trading at its recent highs. Price has recently breached a key resistance at 0.6409, the Dec 9 ‘24 high. This breach reinforces bullish conditions and signals scope for a continuation higher near-term. Sights are on 0.6471 next, the Dec 9 2024 high. Initial key support to monitor is 0.6307, the 50-day EMA. A clear break of this EMA would be a concern for bulls.

USDCAD TECHS: Bears Remain In The Driver’s Seat

- RES 4: 1.4415 High Apr 1

- RES 3: 1.4296 High Apr 7

- RES 2: 1.4120 50-day EMA

- RES 1: 1.3906/3972 High Apr 17 / 20-day EMA

- PRICE: 1.3839 @ 08:04 BST Apr 29

- SUP 1: 1.3781 Low Apr 21 and the bear trigger

- SUP 2: 1.3744 76.4% retracement of Sep 25 ‘24 - Feb 3 bull run

- SUP 3: 1.3696 Low Oct 10 2024

- SUP 4: 1.3643 Low Oct 9 ‘24

The trend condition in USDCAD is unchanged, the outlook remains bearish. A fresh cycle low on Apr 21 highlights a resumption of the bear cycle and signals scope for a continuation near-term. Potential is seen for a move towards 1.3744, a Fibonacci retracement. Moving average studies are in a bear mode position, highlighting a dominant downtrend. First resistance to watch is 1.3972, the 20-day EMA.

FIXED INCOME

BUND TECHS: (M5) Key Resistance Remains Exposed

- RES 4: 133.90 1.236 proj of the Mar 25 - Apr 7- 9 price swing

- RES 3: 133.00 round number resistance

- RES 2: 132.56 High Feb 28 and a key resistance

- RES 1: 132.03 High Apr 7 and the bull trigger

- PRICE: 131.24 @ 05:31 BST Apr 29

- SUP 1: 130.70/129.92 20-day EMA / Low Apr 11

- SUP 2: 129.02 Low Apr 10

- SUP 3: 128.60 Low Apr 9 and a key support

- SUP 4: 128.47 Low Mar 28

Bund futures have pulled back from their recent highs. Despite the latest move down, a bull cycle remains in play and the sell-off between Apr 7 - 9 is considered corrective. Attention is on resistance at 132.03, the Apr 7 high and a bull trigger. Clearance of this level would confirm a resumption of the uptrend and open 132.56, the Feb 28 high. Firm support lies at 128.60, the Apr 9 low. A break of this level would alter the picture.

BOBL TECHS: (M5) Holding On To The Bulk Of Recent Gains

- RES 4: 120.20 High Dec 12 ‘24 (cont)

- RES 3: 120.000 Psychological round number

- RES 2: 119.960 High Apr 7 and the bull trigger

- RES 1: 119.780 High Apr 22

- PRICE: 119.360 @ 05:37 BST Apr 29

- SUP 1: 119.180 Low Apr 23

- SUP 2: 118.952 20-day EMA

- SUP 3: 118.060 Low Apr 10

- SUP 4: 117.680 Low Apr 9 and a key support

Bobl futures are holding on to the bulk of their latest gains and a bull cycle remains in play. The steep sell-off between Apr 7 - 9 appears corrective. The early April rally resulted in a break of key resistance at 119.040, the Feb 28 high, strengthening bullish conditions. The focus is on the 120.000 handle next. Firm support lies at 117.680, the Apr 9 low. The 20-day EMA, an important short-term support, is at 118.952.

SCHATZ TECHS: (M5) Bull Cycle Still In Play

- RES 4: 107.812 0.618 proj of the Mar 6 - Apr 7 - 9 price swing

- RES 3: 107.800 Round number resistance

- RES 2: 107.775 High Apr 7 and the bull trigger

- RES 1: 107.735 High Apr 22

- PRICE: 107.505 @ 05:56 BST Apr 29

- SUP 1: 107.425 Low Apr 23

- SUP 2: 107.373 20-day EMA

- SUP 3: 107.125 Low Apr 10

- SUP 4: 106.965 Low Apr 9 and a key support

A bull cycle in Schatz futures remains in play and the latest pullback appears corrective. Sights are on 107.775, the Apr 7 high and bull trigger. Clearance of 107.775 would confirm a resumption of the uptrend and open 107.812, a Fibonacci projection. Moving average studies remain in a bull-mode position, highlighting a dominant uptrend. Firm support to watch lies at 107.373, the 20-day EMA.

GILT TECHS: (M5) Bullish Theme

- RES 4: 94.50 High Apr 7 and key resistance

- RES 3: 94.00 Round number resistance

- RES 2: 93.44 76.4% retracement of the Apr 7-9 sell-off

- RES 1: 93.34 High Apr 25

- PRICE: 93.03 @ Close Apr 28

- SUP 1: 92.30 20-day EMA

- SUP 2: 91.73/91.43 Low Apr 17 / 15

- SUP 3: 90.47/89.99 Low Apr 11 / 9

- SUP 4: 89.68 Low Jan 15 (cont)

Gilt futures are holding on to their latest gains. The recent rally marks an extension of the recovery that started Apr 9. 92.63, the Apr 8 high, has been breached, exposing 93.44, the 76.4% retracement of the Apr 7-9 sell-off. A break of this level would strengthen the current bull cycle and open 94.50, the Apr 7 high and a key resistance. On the downside, support to watch is 92.30, the 20-day EMA.

BTP TECHS: (M5) Northbound

- RES 4: 121.93 76.4% of the Dec 5 ‘24 - Mar 14 bear leg (cont)

- RES 3: 121.43 1.618 proj of the Mar 14 - Apr 4 - 9 price swing

- RES 2: 121.00 High Feb 7 (cont) and a key resistance

- RES 1: 120.65 1.382 proj of the Mar 14 - Apr 4 - 9 price swing

- PRICE: 120.02 @ Close Apr 28

- SUP 1: 119.42/118.96 High Apr 22 / 20-day EMA

- SUP 2: 117.28 Low Apr 10

- SUP 3: 116.06 Low Apr 9

- SUP 4: 115.75 Low Apr 14 and a bear trigger

BTP futures have traded higher last week and the contract is holding on to the bulk of its recent gains. Last Thursday’s strong rally reinforces current bullish conditions. The move higher resulted in the break of key resistance at 120.39, the Feb 28 high. Sights are on 120.65 next, a Fibonacci projection. Firm support to watch lies at 118.96, the 20-day EMA. The contract is overbought, a pullback would unwind this trend condition.

EQUITIES

EUROSTOXX50 TECHS: (M5) Corrective Phase Remains In Play

- RES 4: 5341.00 High Mar 27

- RES 3: 5263.01 76.4% retracement of the Mar 3 - Apr 7 bear leg

- RES 2: 5165.00 High Apr 3

- RES 1: 5150.00 High Apr 28

- PRICE: 5122.00 @ 06:10 BST Apr 29

- SUP 1: 4959.00/4812.00 Low Apr 23 / 16 and a key support

- SUP 2: 4664.00 Low Apr 10

- SUP 3: 4444.00 Low Apr 7 and the bear trigger

- SUP 4: 4336.00 Low Nov 28 ‘23 (cont)

Eurostoxx 50 futures maintain a positive tone and are holding on to their recent gains. The contract has cleared the 20-day EMA and pierced the 50-day EMA, at 5101.76. A clear break of this average would strengthen the current bull cycle and signal scope for a continuation of the corrective uptrend. This would open 5165.00 next, the Apr 3 high. Support to watch lies at 4812.00, the Apr 16 low. Clearance of this level would highlight a reversal.

E-MINI S&P: (M5) Resistance To Watch Is At The 50-Day EMA

- RES 4: 5837.25 High Mar 25 and a bull trigger

- RES 3: 5773.25 High Apr 2

- RES 2: 5619.66 50-day EMA and a key resistance

- RES 1: 5578.75 High Apr 28

- PRICE: 5556.00 @ 07:22 BST Apr 29

- SUP 1: 5355.25/5127.25 Low Apr 24 / 21 and a key support

- SUP 2: 4996.43 76.4% retracement of the Apr 7 - 10 bounce

- SUP 3: 4832.00 Low Apr 7 and the bear trigger

- SUP 4: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

The corrective bull cycle in S&P E-Minis that started on Apr 7, remains in play. The contract has breached a number of important short-term resistance points. Price has cleared the 20-day EMA and pierced 5528.75, the Apr 10 high. The next key resistance is 5619.66, the 50-day EMA. A clear breach of this EMA would strengthen a bull theme. Initial key support lies at 5127.25, the Apr 21 low. A break would be bearish.

COMMODITIES

BRENT TECHS: (N5) Resistance Remains Intact

- RES 4: $78.10 - High Jan 15

- RES 3: $75.81 - High Feb 20

- RES 2: $74.63 - High Apr 2 and a bull trigger

- RES 1: $68.67 - 50-day EMA

- PRICE: $64.10 @ 07:11 BST Apr 29

- SUP 1: $61.51/58.00 - Low Apr 10 / 9 and the bear trigger

- SUP 2: $56.29 - 2.236 proj of the Feb 20 - Mar 5 - Apr 2 price swing

- SUP 3: $55.10 - 2.382 proj of the Feb 20 - Mar 5 - Apr 2 price swing

- SUP 4: $54.00 - Round number support

Brent futures have pulled back from their recent highs. For now, the latest recovery is considered corrective and has allowed a recent oversold condition to unwind. The primary trend direction remains down and a resumption of the bear cycle would open $56.29 a Fibonacci projection. Initial support to watch lies at $61.51, the Apr 10 low. On the upside, the next important resistance to monitor is at the 50-day EMA, at $68.67.

WTI TECHS: (M5) Gains Considered Corrective

- RES 4: $75.51 - High Jan 15 and a key resistance

- RES 3: $72.56 - High Feb 20

- RES 2: $71.76 - High Apr 2 and key resistance

- RES 1: $65.59 - 50-day EMA

- PRICE: $61.45 @ 07:18 BST Apr 29

- SUP 1: $58.29/54.67 - Low Apr 10 / 9 and the bear trigger

- SUP 2: $53.72 - 2.236 proj of the Feb 20 - Mar 5 - Apr 2 price swing

- SUP 3: $52.54 - 2.382 proj of the Jan 15 - Feb 4 - 11 price swing

- SUP 4: $50.00 - Psychological round number

A medium-term bearish theme in WTI futures remains intact and the recovery that started on Apr 9 appears corrective. The move higher has allowed an oversold trend condition to unwind. Recent weakness resulted in the breach of a number of important support levels, reinforcing a bearish threat. A clear resumption of the bear cycle would open $53.72, a Fibonacci projection. Resistance to watch is $65.59, the 50-day EMA.

GOLD TECHS: Trend Needle Points North

- RES 4: $3600.0 - Round number resistance

- RES 3: $3578.0 - 2.000 proj of the Dec 19 - Feb 24 - Feb 28 swing

- RES 2: $3547.9 - 1.764 proj of the Feb 28 - Apr 3 - Apr 7 price swing

- RES 1: $3386.6/3500.1 - High Apr 23 / 22 and the bull trigger

- PRICE: $3314.2 @ 07:25 BST Apr 29

- SUP 1: $3260.4 - Low Apr 23

- SUP 2: $3231.3 - 20-day EMA

- SUP 3: $3167.8 - High Apr 3 and a recent breakout level

- SUP 4: $3088.2 - 50-day EMA

Gold continues to trade below its recent highs. The trend needle points north and the latest move down appears corrective. The retracement has allowed an overbought condition to unwind. Moving average studies are unchanged, they remain in a bull-mode position highlighting a dominant uptrend. The next objective is $3547.9, a Fibonacci projection. Initial firm support to watch lies at 3231.3, the 20-day EMA.

SILVER TECHS: Bullish Structure

- RES 4: $36.000 - Round number resistance

- RES 3: $34.903 - High Oct 23 ‘24 and the bull trigger

- RES 2: $34.590 - High Mar 28

- RES 1: $33.686 - High APr 25

- PRICE: $33.100 @ 08:08 BST Apr 29

- SUP 1: $32.087 - Low Apr 17

- SUP 2: $30.577/28.351 - Low Apr 10 / 7 and the bear trigger

- SUP 3: $27.686 - Low Sep 6 ‘24

- SUP 4: $27.180 - Low Aug 14 ‘24

A strong rally in Silver on Apr 23 reinforces the current bullish theme and the metal is holding on to the bulk of its latest gains. Price has cleared $33.117, 76.4% of the Mar 28 - Apr 7 bear leg. This paves the way for a climb towards $34.590, the Mar 28 high. On the downside, initial firm support to watch has been defined at $32.087, the Apr 17 low. A break of this level would undermine the bull cycle and highlight a potential reversal.