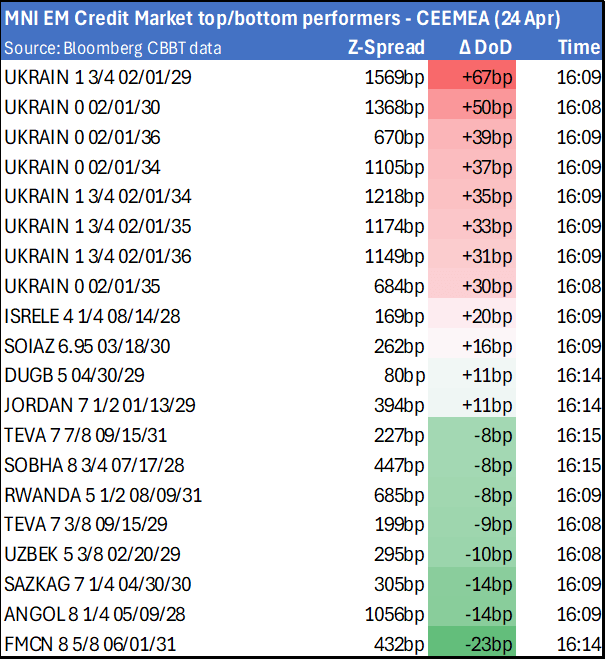

EM CEEMEA CREDIT: MNI EM Credit Market top/bottom performers - CEEMEA (24 Apr)

Apr-24 15:21

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GBP: Retracement Mode in EURGBP Remains in Play

Mar-25 15:20

- A retracement mode in EURGBP remains in play as attention for the cross remains on the 50-day EMA, at 0.8351. The average marks a key short-term pivot level and has been pierced. A clear break of it would undermine the recent bull theme and signal scope for a deeper pullback, towards 0.8321, a Fibonacci retracement.

- Overall, levels between 0.8300-0.8200 continue to represent the base of a longer-term range, as indicated below. Key resistance and the bull trigger are located at 0.8450, the Mar 11 high.

STIR: April ECB Pricing Unfazed By Cautious Speakers

Mar-25 15:16

April ECB implied rates have been unfazed by today’s cautious/hawkish leaning Governing Council speakers, with ESTR OIS continuing to price just over a ~65% implied probability of a 25bp cut.

- Both Kazimir and Muller suggested the ECB’s deposit rate was no longer in restrictive territory, evidently not subscribing to ECB staff’s (heavily caveated) 1.75-2.25% nominal neutral range.

- Both speakers (alongside GC colleague Vujcic) noted that the April decision remains an open question.

- February lending data is due on Thursday, before the March flash inflation round kicks off with Spain and France on Friday. Expect the majority of speakers to display a non-committal tone until next Tuesday at the earliest, following the Eurozone-wide inflation print and US President Trump’s next wave of tariff announcements.

- With the exception of the April meeting, OIS-implied rates are higher on the day, tracking similar movements in Euribor implied yields and core EGBs.

OPTIONS: Expiries for Mar26 NY cut 1000ET (Source DTCC)

Mar-25 15:16

- EUR/USD: $1.0690(E912mln), $1.0775-90(E766mln), $1.0900-25(E2.3bln)

- USD/JPY: Y148.00-10($932mln), Y151.74($519mln), Y152.00($955mln)

- AUD/USD: $0.6370-80(A$699mln)

- USD/CAD: C$1.4200($556mln), C$1.4240($634mln), C$1.4500($781mln)

- USD/CNY: Cny7.2430($600mln), Cny7.3000($500mln)