EM ASIA CREDIT: MNI EM Credit Market Update - Asia

Mar-12 04:52

MNI EM Credit Market Update - Asia

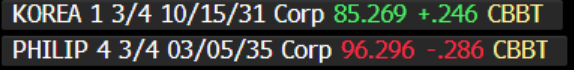

Asia emerging markets are a bit of a mixed bag this morning. In terms of govie/agency bonds, Korea $ 31's are -4bp tighter after reporting better than expected job numbers. In contrast, the Philippines $ 10yr is +4bp wider. Equities are reflecting credit with the Kospi +1.5% on the day. We also have a number of new $ Issues today, including from Bank of China, Ganzhou Development Investment, Yangzhou Economic and Technology, Shengzhou Communications Investment and a mandate from Zhuzhou City Construction.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD: Gold Heads Higher Again on Tariff News.

Feb-10 04:47

- If Friday’s moves for gold was all about US data giving mixed messages about the US economy and the potential for rate rises; today it was more about news that Trump is to levy tariffs on steel and aluminum imports.

- The mixed data result from Friday was quickly forgotten as gold’s safe haven bid re-asserted itself as the tariff news broke.

- Opening $$2,861.07 in Asian trade gold has trended higher throughout reaching highs of $2,878.87.

- To add to the tariff headlines coming from Trump on aluminum and steel are claims that Elon Musk has found ‘irregularities’ at treasury.

- Gold’s ascent through all key technical levels continued last week as bullion moved further away from the 20-day EMA of $2,785.85 pulling all major technicals higher in signs that the bullish momentum is likely to continue.

- The coming fortnight sees major gold producers report earnings, and likely to provide insight into gold’s outlook.

- Safe haven demand remains a key determinant of gold’s fortunes and yet as US data provides mixed results for the outlook for rates, the strength of the USD in the face of tariff threats remains a key factor that determines gold’s fortunes in the near term.

US TSYS: Tsys Yields Richer Following Trumps 25% Tariffs On Steel

Feb-10 04:46

- There was little reaction to headlines out earlier this morning surrounding a 25% tariff on steel and aluminum imports to the US. TU is -00 3/8 at 102-22 3/4, while TY is 00+ at 109-08.

- A bull phase in Treasury futures remains in play and the contract is holding on to its latest gains. TY Price has traded through the 50-day EMA of 109-11. This highlights potential for a stronger reversal and sights are on 109.30, a Fibonacci retracement. On the downside, initial support to watch is unchanged at 108-20+, Tuesday’s low. Clearance of it would signal a reversal and the end of a corrective cycle.

- In cash tsys today, the belly of the curve is outperforming, with the 2s5s20s -1.5bps at -36.170. The 2yr is -0..8bps at 4.281%, while the 10yr is -1.4bps at 4.481%

- Hedge funds increased their net short position in 5yr note futures to over 3m contracts, the most bearish stance since November, per CFTC data for the week ending Feb. 4. Leveraged funds added $12.8m/DV01 in shorts on 5yr notes and extended net shorts in 10-year and ultra 10yr notes by $7.7m/DV01 combined. Meanwhile, asset managers aggressively unwound net long positions in 10yr note futures by $9.1m/DV01 but increased net longs across most other tenors, including ultra 10yr to ultra-long bonds, by a combined $9.1m/DV01.

- Fed-dated OIS was pricing in approximately 35bp of rate cuts for the year vs. 42bp priced at Thursday close with the first full 25bp of easing moving out to the September policy meeting from July prior

- Projected rate cuts through mid-2025 consolidate vs. Friday (*) as follows: Mar'25 at -2.5bp (-3.9bp), May'25 at -7.3bp (-10.7bp), Jun'25 at -15.8bp (-19.6bp), Jul'25 at -20.6bp (-25.1bp).

- There is little on the calendar today, focus this week is on Powell's testimony to Congress, on Tuesday CPI and Wednesday PPI inflation measures.

CHINA: Bond Futures Move Lower Despite Weaker onshore Equity.

Feb-10 04:40

- China’s bond futures have followed from Friday’s selloff to move lower again in trading today.

- China’s 10YR future opened at 109.405 and has moved gradually lower throughout the trading day, to be down by -0.115 to 109.29.

- Over the weekend, China reported the January CPI surprised to the upside with food and service price inflation the main driver and likely feeding into the price action from investors in today’s trading session.

- China’s 10YR future continues to sit above the 20-day EMA of 109.1652, with a bullish bias remaining.

- China’s 2YR future opened at also followed Friday’s selloff falling by -0.09 today to be at 102.69.

- The 2YR future’s technicals are a very different story as the 50-day EMA has been breached, and the price action moves the contract towards the 100-day EMA of 102.62, dragging the 20-day and 50-day EMA’s lower with it.

- Having done very little in the shortened week last week, the 10YR CGB has moved higher in yield today by +1.5bp to 1.62% but remains in a very tight range.

- Data releases this week are dominated by the New Yuan Loans and Aggregate Financing, which will give a further snapshot of whether the various stimulus measures are having impact on consumer behaviours.