EM ASIA CREDIT: MNI EM Credit Market Wrap - Asi

** The main stories out of the region**

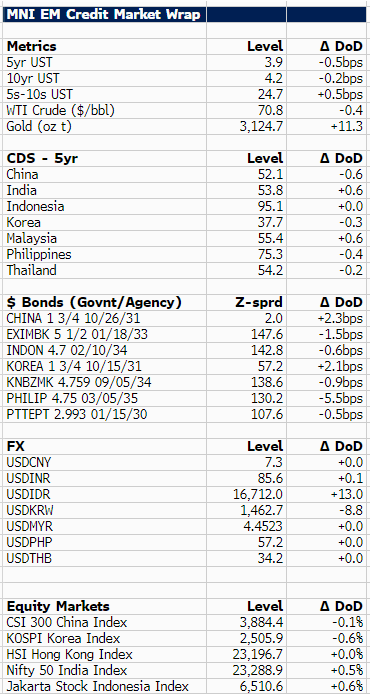

10yr U.S. treasury yields were more or less unchanged in the Asia-Pacific session with the market holding its breath ahead of U.S. tariff announcements. Asia EM govie/agency bond spreads are mostly better on the day, with the Philippines outperforming ($10y -6bp) on the back of a surprise contraction in the March PMI figure (+49.4 versus +51 in the prior period). Asia equities are also mostly modestly higher. There were no material single name stories in the session, though there continues to be some attention on the Xiaomi SU7 accident. The risk to brand image and profitability heightened given the SU7 is the only model produced at present. No new issuance today.

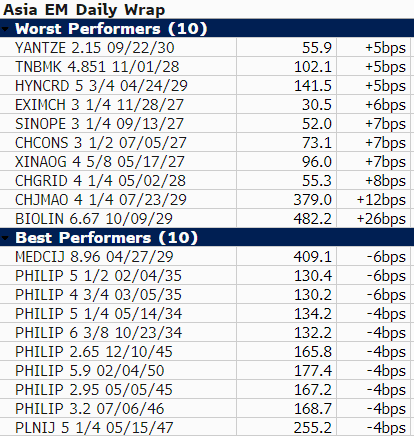

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SWEDEN: Manufacturing PMI Another Solid Data Release

The Swedish manufacturing PMI rose to 53.5 in February, from a 0.2p point upwardly revised 53.1 prior. Although there was no consensus for the print, it’s another solid piece of economic data which underscores expectations for a Riksbank pause in March. As noted above, SEK continues to outperform the G10 this morning.

- The manufacturing PMI has been in expansionary territory since July 2024, and has better reflected the recent rise in industrial production momentum than the Economic Tendency Indicator’s manufacturing sentiment series.

- In February, new orders were 54.8 (vs 54.4 prior), driven largely by the domestic orders component. Production (53.8 vs 52.3 prior) and employment (54.7 vs 54.5 prior) also rose on the month.

- Input prices remained expansionary, but softened to 52.4 (vs 54.3 prior), consistent with the Economic Tendency Indicator series.

- The Riksbank’s Business Survey (due 0830GMT today) may not alter expectations for the next decision, but will nonetheless be an important input for the March MPR rate path.

GILTS: Opening calls

Gilt calls: 93.04/93.27 range.

AUDUSD TECHS: Bear Cycle Remains Intact

- RES 4: 0.6429 High Dec 12 ‘24

- RES 3: 0.6414 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg

- RES 2: 0.6409 High Feb 21 and a bull trigger

- RES 1: 0.6309 50-day EMA

- PRICE: 0.6218 @ 07:56 GMT Mar 3

- SUP 1: 0.6193 Low Feb 28

- SUP 2: 0.6171/6088 Low Feb 4 / 3 and a key support

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 4: 0.6000 Round number support

AUDUSD traded lower last week. The impulsive sell-off undermines a recent bullish theme. Price is once again trading below both the 20- and 50-day EMAs and the move down has exposed support at 0.6171, the Feb 4 low. A break of this level would strengthen a bearish theme and suggest scope for a test of the bear trigger at 0.6088, the Feb 3 low. Initial resistance to watch is 0.6309, the 50-day EMA.