EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

** The main stories out of the region**

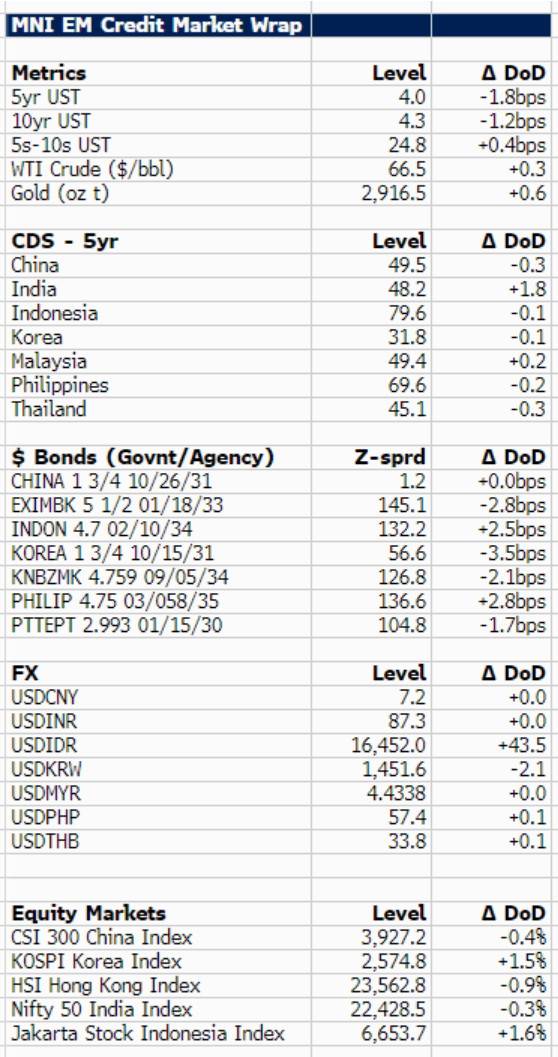

U.S. 10y treasury yields are 1bp lower at 4.3% in Asia hours, as U.S. steel and aluminium tariffs came in to effect, predictably leading to countermeasures, notably from the EU. EU tariffs are expected to match the economic scope of the U.S tariffs. Australia took a different approach, with the government for now, not proposing countermeasures.

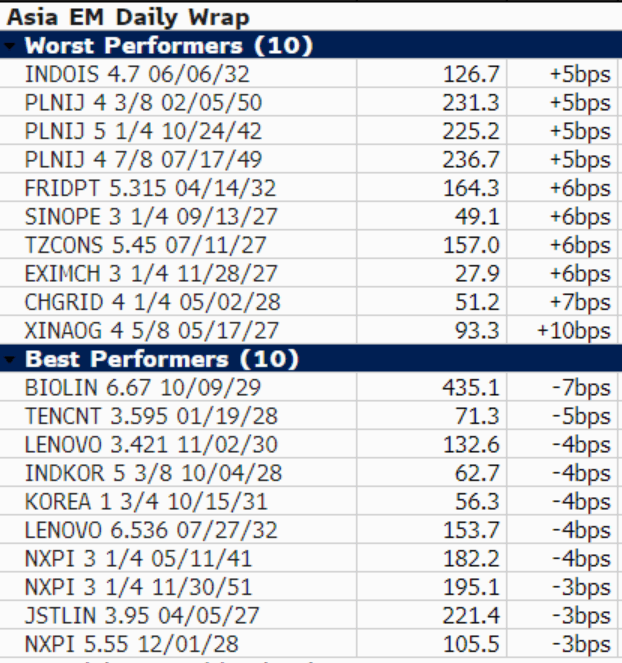

Asia emerging markets are a bit of a mixed bag today. In terms of govie/agency bonds, Korea $ 31's are -4bp tighter after reporting better than expected job numbers. Indeed unemployment fell to 2.7% from 2.9% in the prior period. In contrast, the Philippines $ 10yr is +4bp wider.

In terms of newsflow, SpaceX is collaborating with Indian telco Bharti Airtel and Jio Platforms, a Reliance Industries company, to provide access to Starlink. A positive strategic development. We also have a number of new $ Issues today, including from Bank of China, Ganzhou Development Investment, Yangzhou Economic and Technology, Shengzhou Communications Investment and a mandate from Zhuzhou City Construction.

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUNDS: /SWAPS: Long End ASWs Remain Under Pressure

The long end of the ASW spread curve continues to trade heavily, both in relative terms against Schatz and outright.

- Buxl ASW vs. 3-month Euribor registered a fresh cycle closing low on Friday, with increased free float and German issuance/fiscal risks continuing to weigh.

- These fundamental sources of pressure mean that relief episodes in long swap spreads remains contained, even when bonds manage to rally in outright trade.

- Meanwhile, repo/collateral dynamics have seemingly been binding in the front end of the ASW curve, preventing Schatz spread tightening towards ’24 lows.

- Still, J.P.Morgan go against the trend and recommend a tactical Bund swap spread paid position against the Schatz equivalent, given what they deem to be “attractive valuations.” They also suggest that their “2s/10s German cash bond curve flattening bias is also supportive of a steeper swap spread curve.”

SILVER TECHS: Bullish Trend Condition

- RES 4: $34.903 - High Oct 23 and the bull trigger

- RES 3: $33.450 - 76.4% of the Oct 23 - Dec 19 ‘24 bear leg

- RES 2: $33.000 - Round number resistance

- RES 1: $32.652 - High Feb 7

- PRICE: $32.160 @ 08:11 GMT Feb 10

- SUP 1: $30.814 - 50-day EMA

- SUP 2: $29.704 - Low Jan 27

- SUP 3: $28.748 - Low Dec 19 and bear trigger

- SUP 4: $28.446 - 76.4% retracement of the Aug 8 - Oct 23 bull cycle

Silver traded higher last week. Key resistance at $32.338, the Dec 12 high, has been pierced. Clearance of this hurdle would highlight a stronger reversal and cancel a recent bearish theme. This would open the $33.00 handle and expose $33.450, a Fibonacci retracement. Initial firm support lies at $30.814, the 50-day EMA and a pivot level. A clear break of the EMA would reinstate the recent bearish theme.

CROSS ASSET: Yen sees broader lows, Gold edges towards $2,900.00

- There's broader selling going through against the Yen, testing session low with the EUR, AUD, GBP and just short of the intraday low with the Dollar.

- Yields aren't moving, Risk on Tone could at play, although not seeing similar moves with the likes of the Swissy.

- The resistance in USDJPY is seen much further out, up to 152.89 High Jan 6.

- Gold continues to firm higher, now just $5 short of the $2,900.00 level, although most Desks will be eyeing the big Psychological $3000.00 level.

- In between these two levels, resistance is seen at $2917.5 - 1.764 proj of the Nov 14 - Dec 12 - 19 price swing, followed by $2962.2 - 2.00 proj of the Nov 14 - Dec 12 - 19 price swing.