EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

** The main stories out of the region**

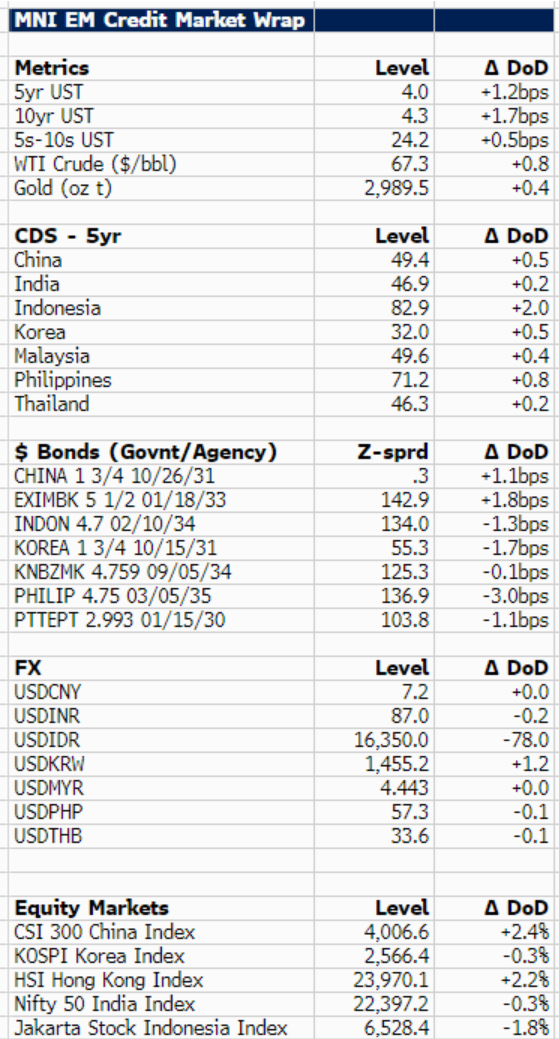

U.S. 10y treasury yields are around 2bp higher in Asia hours at 4.3%, with the possibility that a U.S. government shutdown may be subsiding. In Asia, EM was mostly better on the day, with govie/agency bonds 2-3bp tighter, an exception being India where the $ 1/33s EXIMBK bond is around 2bp wider. In the Indian corporate space, news that Adani legal woes may be returning has put pressure on Adani group company bond spreads (10-20bp wider) - the main underperformer today.

In China, the China CSI 300 equity index was up 2.4% on the day, with the market buoyed by the announcement of a State press conference, the topic being "Boosting Consumption", on Monday. China online retail company bonds higher on the day, with the Tencent 1/28s an outperformer (7bp tighter). In other news, we saw more evidence that the China real estate sector may be turning, with China Resources Land sales up 47% YoY in February.

Finally, in terms of new issuance, we have a mandate for a $benchmark 3y deal from Bank Mandiri, the Indonesian State majority owned bank.

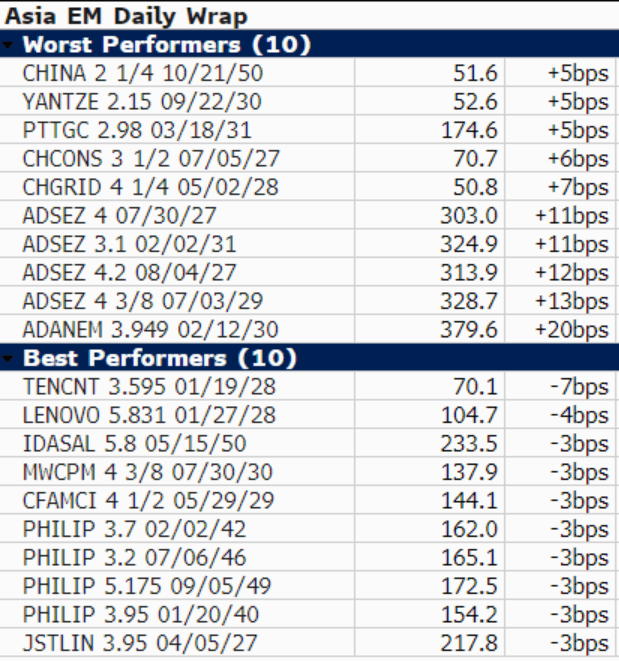

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGBS: /SWAPS: Commerzbank Reiterate Long End Swap Spread Shorts

Commerzbank believe that “converging duration free-float of Bunds with that of U.S. Treasuries and gilts suggests that global ASW-curves will have to align further. We hence reiterate our structural shorts in (ultra-)long Bund-spreads, also vs. Schatz, and in 30y OATs vs. swaps.”

GILTS: Softer Start As Global Supply & Equity Bid Weighs

Supply-related pressure and a bid in European equities weighs on core global FI markets, biasing gilts lower at the open.

- Futures pierce yesterday’s base, printing as low as 92.83.

- First support at the 20-day EMA (91.63), with the short-term bullish cycle still intact but losing some momentum.

- Yields 1-2bp higher across the curve.

- 10-Year spread to Bunds 1bp tighter at ~207bp, sticking within the multi-week 203.8-213.3bp closing range.

- Local media outlets dominated by the latest fiscal warnings, with the NIESR noting that the UK’s fiscal headroom will have been fully eroded when the new OBR forecasts are released next month. This increases the risk of further tax hikes and spending cuts, although isn’t a new line of thought.

- Hawkish drift in GBP STIRs as gilts soften. BoE-dated OIS showing 58bp of cuts through December vs. ~60bp early today. SONIA futures flat to -2.5.

- Looking forwards, comments from BoE MPC member Greene are due later today (15:00 GMT).

- On the supply front the DMO will come to market with GBP1bln of 0.625% Mar-45 I/L supply.

STIR: Euribor Futures Extend Session Lows Alongside Bunds

Euribor futures are once again being dragged lower by core EGBs, amid another day of solid sovereign supply and buoyant European equities.

- Futures are are -1.5 to -3.0 ticks through the blues at typing, extending session lows. ERZ5 has closed last Monday’s tariff-induced gap higher, currently at 98.015.

- ECB-dated OIS price 80.5bps of easing through year-end, down from 83bps at yesterday’s close.

- A 25bp cut remains essentially fully priced through March (24bps of cuts priced), while OIS price a ~70% implied probability of 25bp cuts at each of the April and June decisions.

- Today’s regional data calendar is light, with only Italian IP due. ECB Executive Board member Elderson speaks at an MNI Webcast at 1000GMT on “Climate Change: Impact on Monetary Policy & Bank Supervision”.

| Meeting Date | ESTR ECB-Dated OIS (%) | Difference Vs. Current Effective ESTR Rate (bp) |

| Mar-25 | 2.428 | -23.7 |

| Apr-25 | 2.252 | -41.2 |

| Jun-25 | 2.083 | -58.1 |

| Jul-25 | 2.012 | -65.2 |

| Sep-25 | 1.923 | -74.1 |

| Oct-25 | 1.902 | -76.2 |

| Dec-25 | 1.861 | -80.4 |

| Feb-26 | 1.859 | -80.5 |

| Source: MNI/Bloomberg. | ||