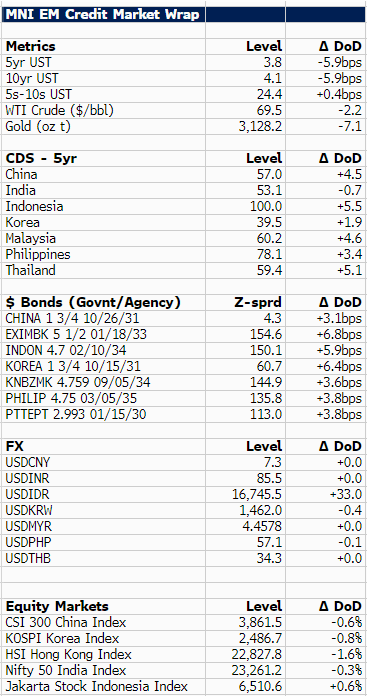

EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

** The main stories out of the region**

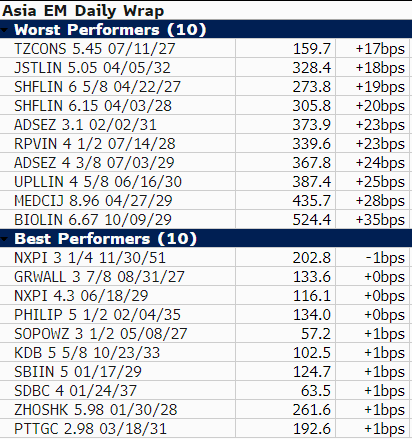

10yr U.S. treasury yields were 6bp tighter in the Asia-Pacific session this morning with markets looking for safer harbours post U.S. tariff announcements. On top there is a growing concern that the economic consequences could be quite severe, and hard to navigate, given the unpredictable nature of U.S. tariff actions. In summary, the U.S. announced it will apply a universal tariff of 10% on all US imports with reciprocal tariffs for China at 34% (on top of 20%, all in 54%), the EU's reciprocal tariff will be 20% and Japan's 24%. Asia EM govie/agency bond spreads are 4-7bp wider with India (+7bp), Indonesia (+6bp) and the Korea (+6bp) underperforming. In equities the Hang Seng is down 1.6%. In terms of individual credit moves (see table). India featured heavily, including JSW Steel, Adani Ports +20bp wider on the day. The new issue market, as you might expect, was relatively quiet ahead of the news, with only a 3y $ deal from Zhangzhou Transportation Development announced.

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSY FUTURES: A Little More On The Huge TY Block

Little else to add in terms of definitive colour when it comes to the 78K TYM5 block sale executed in early London hours.

- Our best guess is that is vs. something that isn’t traded on the CME, given the timing of day (out of U.S. hours) and huge size of the trade (~$5.09 mln DV01 equivalent).

EURIBOR OPTIONS: Call spread buyer

ERM5 98.12/98.25cs, bought for half in 6k.

AUDUSD TECHS: Support Remains Exposed

- RES 4: 0.6429 High Dec 12 ‘24

- RES 3: 0.6414 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg

- RES 2: 0.6409 High Feb 21 and a bull trigger

- RES 1: 0.6305 50-day EMA

- PRICE: 0.6202 @ 08:01 GMT Mar 4

- SUP 1: 0.6187 Intraday low

- SUP 2: 0.6171/6088 Low Feb 4 / 3 and a key support

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 4: 0.6000 Round number support

AUDUSD continues to trade at its recent lows. Last week’s strong sell-off undermines a recent bullish theme. The pair is once again trading below both the 20- and 50-day EMAs and the move down has exposed support at 0.6171, the Feb 4 low. A break of this level would strengthen a bearish theme and suggest scope for a test of the bear trigger at 0.6088, the Feb 3 low. Initial resistance to watch is 0.6305, the 50-day EMA.