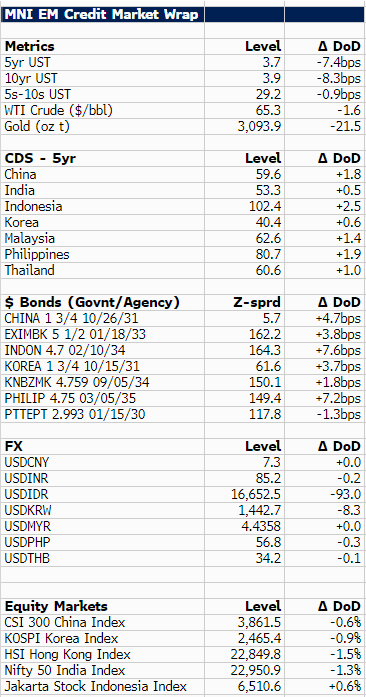

EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

** The main stories out of the region**

10yr U.S. treasury yields are 8bp tighter in the Asia-Pacific session and below 4% with risk off sentiment continuing with markets also now looking to today's U.S. payroll data. Asia EM govie/agency bond spreads are 3-8bp wider, with Indonesia (INDON $ 2/34s +8bp) and the Philippines (PHILIP $ 3/35s +7bp) underperforming. China is out today, and company specific newsflow was light. Potential issuers remain on the sideline given market volatility.

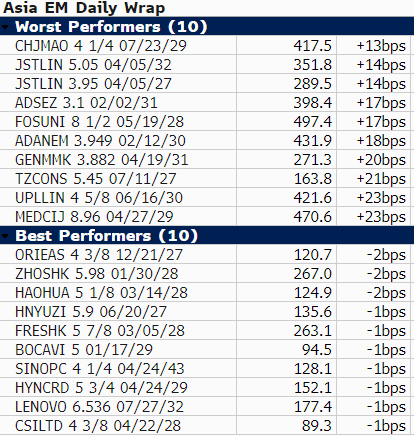

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD TECHS: Support At The 50-Day Is Intact For Now

- RES 4: $3000.0 - Psychological round number

- RES 3: $2972.0 - 2.0% 10-dma envelope

- RES 2: $2962.2 - 2.00 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 1: $2930.1/2956.2 - High Feb 26 / 24 and the bull trigger

- PRICE: $2918.5 @ 08:09 GMT Mar 5

- SUP 1: $2884.5/2832.7 - 20-day EMA / Low Feb 28

- SUP 2: $2812.4 - 50-day EMA

- SUP 3: $2758.3 - Low Jan 30

- SUP 4: $2730.6 - Low Jan 27

The recent pullback in Gold appears to be a correction. The move through the 20-day EMA does signal scope for an extension towards the next important support around the 50-day EMA, at $2812.4. However, this week’s gains are a positive development and potentially an early reversal signal. A stronger rally would refocus attention on the next objective at $2962.2, a Fibonacci projection. This would also open the $3000.0 handle.

USDCAD TECHS: Bull Cycle Remains In Play

- RES 4: 1.4793 High Feb 3 and key resistance

- RES 3: 1.4700 Round number resistance

- RES 2: 1.4641 76.4% retracement of the Feb 3 - 14 bear leg

- RES 1: 1.4548 61.8% retracement of the Feb 3 - 14 bear leg

- PRICE: 1.4410 @ 08:05 GMT Mar 5

- SUP 1: 1.4370/4300 Low Mar 3 / 50-day EMA

- SUP 2: 1.4151/4107 Low Feb 14 / 50.0% of Sep 25 - Feb 3 bull run

- SUP 3: 1.4011 Low Dec 5 ‘24

- SUP 4: 1.3944 61.8% retracement of the Sep 25 ‘24 - Feb 3 bull cycle

The USDCAD correction / bull cycle that started Feb 14 remains in play for now and the pair is holding on to the bulk of its recent gains. Monday’s gains reinforce current conditions and sights are on a climb towards 1.4548, a Fibonacci retracement point. The short-term bear trigger has been defined at 1.4151, the Feb 14 low. Initial firm support to watch lies at 1.4300, the 50-day EMA. A break of this average would highlight an early reversal signal.

SWEDEN: Services Sentiment At Broadly Neutral Levels

The Swedish services PMI has been in expansionary territory for the last five months, after ticking up to 50.8 in February (vs 50.2 prior). The PMI has been somewhat more stable than the Economic Tendency Indicator services series in recent months, though both now sit around neutral levels.

- New orders returned to expansionary territory at 50.5 (vs 49.6 prior), with production also increasing to 51.0 (vs 50.3 prior).

- The input price series remains elevated at 60.6 (vs 64.5 prior), which likely feeds into recent increases in expected output prices in the Economic Tendency survey.

- Meanwhile, the employment index registered a seventh consecutive month in contraction at 47.6 (vs 46.0 prior).

- Tomorrow’s Swedish data calendar includes flash February inflation data.