EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

** The main stories out of the region**

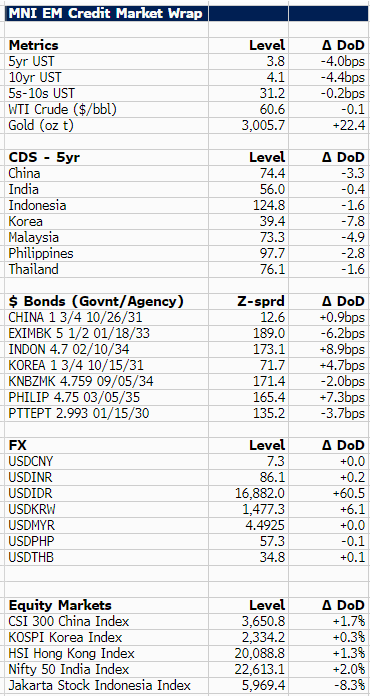

10yr U.S. treasury yields are 4bp tighter in the Asia-Pacific session with risk off sentiment easing a little, though overnight threats of additional China tariffs (+50%) from President Trump and possible Chinese countermeasures will keep investors mostly on the side-line.

Asia EM govie/agency bond spreads are up to 9bp wider with Indonesia (+9bp) and the Philippines (+7bp) underperforming again. In equities the Hang Seng is up 1.3% and South Korea's Kospi unchanged. Indonesia's JCI index opening after the Eid holiday yesterday fell 8.3%.

In terms of newsflow, Samsung reported Q1 numbers ahead of consensus, and with Americas accounting for 39% of revenues, the April 30th conference call is expected to shed more light on how they will adapt the global manufacturing footprint to mitigate tariffs

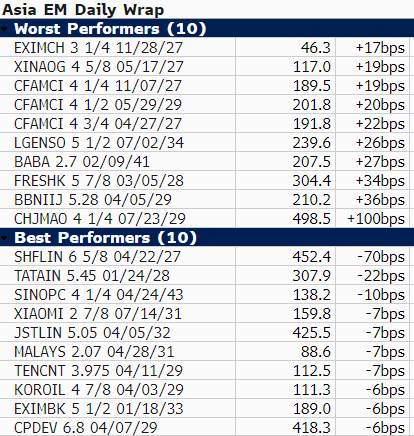

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CANADA: BoC Seen Cutting Another 25bps Next Week

- The Bank of Canada is expected to cut its overnight rate target another 25bp on Wednesday to 2.75%, with BoC-dated OIS showing it mostly priced but analysts not as clear cut with 19 of 27 forecasting a cut vs 8 looking for no change.

- It’s quite likely that a pause would have been seriously considered if going on recent trends alone, and even Friday’s labour report with disappointing jobs growth saw the unemployment rate surprisingly hold at 6.6% as it remains below November’s cycle high of 6.9%.

- Instead, a 25bp cut is seen as a prudent step to the mid-point of the BoC’s estimated neutral range of 2.25-3.25% amidst penal US trade policies under the second Trump administration. Tariffs have been threatened, deployed and then pared in a revolving cycle but the uncertainty is damaging. The latest in this ever-changing backdrop, Trump has said the US may do reciprocal tariffs on Canada as early as today (Friday) or Monday. It’s estimated that 38% of Canadian exports to the US are USMCA-compliant, a latest area of focus from Trump, although RBC estimate this could be over 90% relatively quickly.

- Governor Macklem in January talked on stepping up outreach activities with businesses and households and we watch for any guidance on how these real-time conditions might be developing.

US TSYS: Late SOFR/Treasury Option Roundup

Option desks reported heavy SOFR and Treasury option position unwinds and two-way vol trades Friday, underlying futures near late session lows after Chairman Powell stated the Fed can take its time before considering any further changes to interest rates as inflation is still above target and policy uncertainty out of Washington remains high. Projected rate cuts through mid-2025 cooled significantly vs. morning levels (*) as follows: Mar'25 at -1bp (-2.7bp), May'25 at -9.4bp (-13bp), Jun'25 at -26.3bp (-31.1bp), Jul'25 at -37bp (-42.2bp). Dec'25 had priced in three 25bp cuts this morning now show -69.1bp.

- SOFR Options:

- +10,000 SFRU5 95.50/95.62/95.75 put flys 2.0 ref 96.17

- over -100,000 SFRU5 96.25 calls, 24.0 vs. 96.26 to -.255/0.50%

- -5,000 SFRZ5 96.50/96.87/97.00/97.25 call condors, 6.0 ref 96.385

- +5,000 0QJ5 96.00/96.12/96.25/96.37 put condor, 3.0 ref 96.505

- 36,000 SFRN5 96.06/96.25 2x1 put spds ref 96.265

- 11,000 SFRM5 95.62/95.68 put spds ref 96.00 to -.005

- 9,000 SFRH5 95.68/95.75 1x2 call spds ref 95.725

- 2,000 SFRU5 96.50/97.00 call spds ref 96.25

- 5,500 SFRH5 95.75/95.81 call spds

- 3,000 SFRQ5 95.75 puts ref 96.245

- 2,000 0QK5 95.50/95.75/95.87/96.12 put condors ref 96.485

- 1,500 SFRZ5 95.50/95.75 put spds

- Treasury Options:

- +20,000 TYJ5 112 calls, 9

- Block, +9,000 Monday wkly 10Y 111 call, 4

- -9,000 TYJ5 110 puts, 10

- 5,000 TYJ5 112 calls, 19 ref 111-01 to -06 (total volume over 40.8k)

- 3,500 FVJ5 107.25/109 strangles, 16 ref 107-30.25

- +7,500 TYJ5 110 puts, 13-14

- -10,000 TYJ5 110/112.5 strangles, 23, appr 6.98% implied vol

- +10,000 TYJ5 110.5 straddles, 117-119 vs. 111-03/0.32% (implied appr 6.67-.87

- 5,000 USK5 122/126 call spds ref 117-22

- 3,000 TYJ5 110/112 strangles, 29 ref 111-05.5

- 50,000 FVJ5 108.25/108.75 call spds 10 ref 108-00.75

- over 5,000 TYJ5 109/110 put spds ref 110-30 to 111-00

- 2,000 TYK5 111/112/113.5 broken call flys ref 111-00.5

- 2,500 TYJ5 108.5/109.5 put spds ref 110-28

- 4,500 wk1 TY 110/110.5 2x1 put spds, 6 ref 110-29 (exp today)

- 1,750 FVK5 109.25/110.25/111.25 call flys ref 107-27.5

- over 7,000 wk2 TY 112/113 call spds ref 111-01 to 110-28.5

US TSY FUTURES: BLOCK: Late 2Y/10Y Ultra Flattener

Late Flattener Block, posted at 1604:32ET, appr DV01 $375,000

- -9,419 TUM5 103-15.25, sell through 103-15.5 post time bid vs.

- +4,166 UXYM5 113-18.5, post time bid