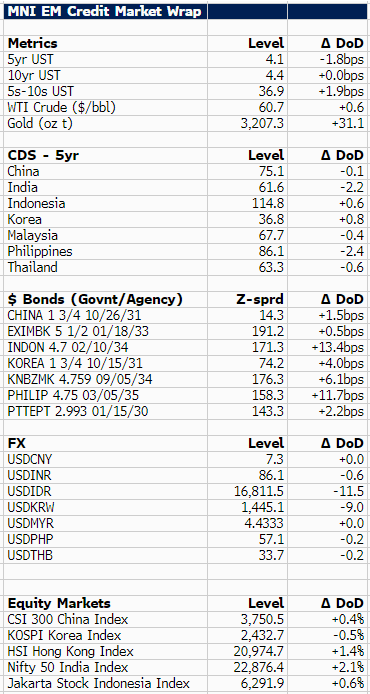

EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

10y U.S. Treasuries yields are more or less unchanged in Asia, with yields currently at 4.4%. Market concerns regarding global growth also re-asserted themselves with gold currently trading at $3,212/ oz t.

We note that President Trump has raised the possibility that Mexico may see higher tariffs if a dispute related to water rights isn't resolved, further evidence that tariffs are a tool with many possible applications. Countries may well continue plans to disengage from the U.S. economy even if reciprocal tariffs are ultimately renegotiated.

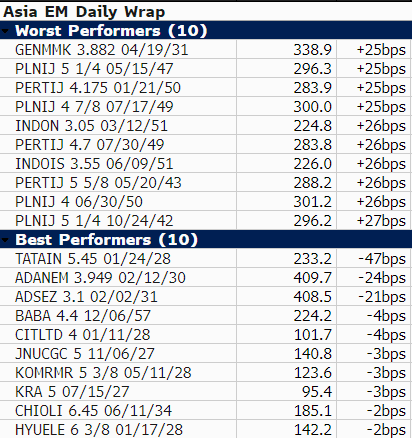

Asia EM govie/agency bond spreads are up to 14bp wider with Indonesia (+14bp) and the Philippines (+12bp) the underperformers, in what has been a volatile week for the two nations. Indonesian corporate longer dated $ bonds featured heavily today in the worst performers (see table). Asian equities in contrast are mostly higher, with the Hang Seng +1.5%.

In terms of newsflow, State backed Shandong Hi-Speed priced its 3y $500m deal overnight, we estimated fair value at 4.8% and it priced at 4.6%, equivalent to around 60bp of tightening versus the IPT. We also have a new $ mandate from Fujian Zhanglong Group, which we expect to be a 3y $ benchmark.

Best & Worst Performers (zsprd, bp)

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD TECHS: Support Remains Intact

- RES 4: $3000.0 - Psychological round number

- RES 3: $2965.1 - 2.0% 10-dma envelope

- RES 2: $2962.2 - 2.00 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 1: $2930.3/2956.2 - High Mar 7 / High Feb 24 and the bull trigger

- PRICE: $2911.7 @ 07:24 GMT Mar 12

- SUP 1: $2880.3/2832.7 - Low Mar 10 / Low Feb 28

- SUP 2: $2829.8 - 50-day EMA

- SUP 3: $2758.3 - Low Jan 30

- SUP 4: $2730.6 - Low Jan 27

Gold is in consolidation mode. The trend condition is unchanged, it remains bullish and the recent pullback appears corrective. A resumption of gains would refocus attention on $2962.2, a Fibonacci projection. This would also open the $3000.0 handle. On the downside, a move lower would instead suggest scope for a deeper correction and expose support around the 50-day EMA, at $2829.8. The 50-day average marks a key support.

EURJPY TECHS: Reversal Higher Extends

- RES 4: 164.55 High Jan 7

- RES 3: 164.08 High Jan 24 and a key resistance

- RES 2: 162.70 High Jan 28

- RES 1: 161.79 High Mar 11

- PRICE: 161.53 @ 07:17 GMT Mar 12

- SUP 1: 158.91 20-day EMA

- SUP 2: 155.60 Low Mar 4

- SUP 3: 154.80 Low Feb 28 and a bear trigger

- SUP 4: 154.42 Low Aug 5 ‘24 and key medium-term support

EURJPY traded higher Tuesday and the cross is holding on to its latest gains. A short-term bull theme remains intact following the strong reversal that started Feb 28. The cross has pierced resistance at 161.19, the Feb 13 high. A clear break of the hurdle would strengthen a bullish condition and open 162.70, the Jan 28 high. Initial support to watch is 158.91, the 20-day EMA. Key support has been defined at 154.80, the Feb 28 low.

BUNDS: EU Launches Tariffs countermeasure, US CPI in focus

- A more steady overnight session for Bund compared to the overall price action seen just in early March, as the contract plummeted 551 ticks since the 3rd March.

- Bund did trade below last Week's low of 126.64 Yesterday, printed a 126.53 low, although as noted, the next area of interest is at 2.95% in Yield.

- The German Bund is underpinned going into the Cash open, and testing session high as {eu} Europe launches countermeasure on US Imports worth up to €26bn.

- Resistance in Bund is at 127.45, but 128.33 is initial notable hurdle.

- Today sees, Portugal final CPI, ECB Wage Tracker, but it is all about the US CPI today, the main event for the Week on the Data front.

- SUPPLY: UK £4bn 10yr (Equates to 34.4k Gilt) should weigh, German €4.5bn 10yr (Equates to 37.2k Bund) could weigh, Portugal 2035, 2038 should have a limited impact. US sells $39bn of 10yr reopening.

- SPEAKERS: Packed with ECB speakers, today includes, Lagarde, Simkus, Villeroy, Nagel, Lane, Escriva, Centeno, Panetta.