EM CEEMEA CREDIT: MNI EM Credit Market Wrap - CEEMEA (05 Feb)

MNI EM Credit Market Wrap - CEEMEA (05 Feb)

Source: BBG

Measure Level Δ DoD

5yr UST 4.24% -8bp

10yr UST 4.43% -8bp

5s-10s UST 18.71 -1bp

WTI Crude 71.6 -1.1

Gold 2877 +33.9

Bonds* Z-Sprd Δ DoD

REPHUN 5 1/2 03/26/36 212bp +6bp

POLAND 5 1/8 09/18/34 141bp +3bp

ROMANI 5 3/4 03/24/35 321bp +6bp

TURKEY 6 1/2 01/03/35 323bp +2bp

KAZAKS 4.714 04/09/35 124bp +3bp

UZBEK 6.9 02/28/32 315bp +1bp

KSA 5 5/8 01/13/35 141bp -2bp

ADGB 5 04/30/34 91bp +0bp

QATAR 4 3/4 05/29/34 76bp -0bp

BHRAIN 7 1/2 02/12/36 294bp +5bp

SOAF 7.1 11/19/36 336bp +1bp

NGERIA 10 3/8 12/09/34 575bp +4bp

GHANA 5 07/03/35 697bp -9bp

BENIN 8 3/8 01/23/41 475bp +5bp

EGYPT 7.3 09/30/33 572bp +13bp

- Source: CBBT, BGN for GH and BN

FX Level Δ DoD

USDZAR 18.55 -0.12

USDTRY 35.91 -0.04

EURHUF 405.9 -1.07

EURPLN 4.20 -0.01

EURCZK 25.13 -0.03

** The main stories out of the regions **

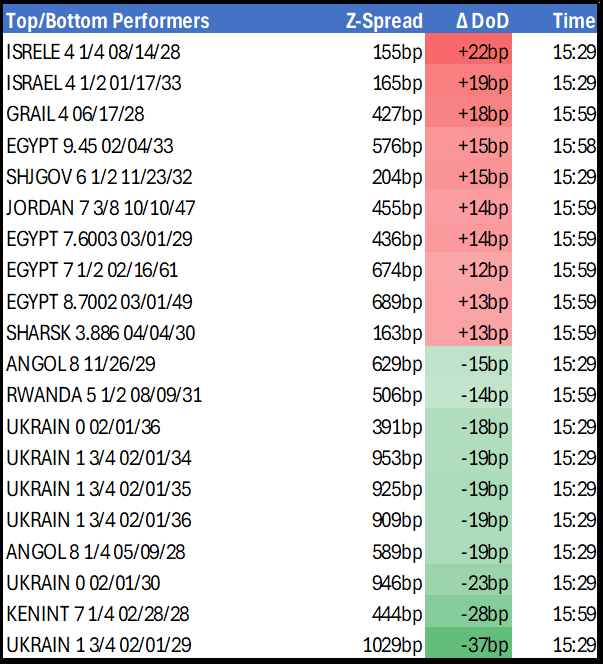

Change of pace today in CEEMEA. U.S. Treasuries are showing 10Y @ 4.43%, -8bp, with 5s/10s unch @ 18.71. Benchmark CEE seasoned sovereign bonds chart marginally wider in z-spread reflecting meaningful primary issuance, ie Poland’s USD 5Y & 10Y dual tranche with final guidance through FV estimates and Turkiye’s USD 7Y in line with FV. Among African sovereign curves, EGYPT charts some 12-15bp wider, with benchmark Nigeria and Benin paper a few bp wider. Then again, Angola and Kenya show among names in the EM primary pipeline.

In corporates, we saw Turkish Limak Renewables (LIMYEN) tap the market with a USD 5.5NC2 with final guidance in line with FV estimates as indicated in our early note. This is a niche issuer that brings name diversification to those who have been active in the busy Turkish corporate issuance space over the last several months. We refer to our earlier note when looking at South Africa’s Sasol, who issued an unsurprising profit warning; the stock did not react, ending the session unchanged and bond spreads followed a similar pattern. Among bond movers, RWANDA 5.5 31s is charting 15bp tighter on the day reversing part of the recent widening.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CANADA: Trudeau Resignation Presser To Start Shortly

Prime Minister Justin Trudeau is set to begin a press conference in the coming minutes announcing his intention to stand down as leader of the centre-left Liberal Party of Canada (LPC). Livestream of CTV expected to show the presser in full can be found here.

- Once Trudeau's resignation presser is over, attention will swiftly turn to the emergency caucus meeting of LPC MPs taking place on Wednesday 8 January. The meeting is expected to last around six hours, with MPs seeking to nail down the process of how a new leader will be elected.

- The LPC constitution lays out the procedure for electing a new party leader. Following a 'Leadership Trigger Event' (which Trudeau's resignation will count as) the LPC National President must convene the National Board of Directors to take place within 27 days. This board meeting can appoint an 'interim leader', set the date of the election, and establishing the Leadership Vote Committee.

- Highlighting the potentially lengthy period of the contest, those seeking the LPC leadership are obliged to "deliver to the National President, at least 90 days before the day of the Leadership Vote, a written nomination...."

- The constitution does lay out the potential for bypassing this lengthy process, saying if by a three-quarters margin the National Board "determines that political circumstances require that the date be reset to another date," the process can be accelerated.

US TSY FUTURES: BLOCK: Mar'25 2Y Buy

- +5,000 TUH5 102-24 (+.12), buy through 102-23.88 post time offer at 1040:36ET, DV01 $192,000. The 2Y contract trades 102-24.25 last

US DATA: Capital Investment Steadying Despite Downward Revisions

Factory orders came in stronger than expected in November when accounting for upward revisions in the final Manufacturers’ Shipments, Inventories, & Orders report, though core capital goods orders were slightly weaker than they first appeared.

- The 0.4% M/M fall in factory orders (vs -0.3% expected) was offset by an upward revision to October (+0.5% vs +0.2%), while ex-transportation growth came in at +0.2% for a second month (reflecting a 0.1pp upward revision to prior).

- Broader durable goods orders were revised down slightly (-1.2% vs -1.1% prelim), due to slower growth in machinery orders than previously estimated (-0.6pp to +0.4%). Core capital goods orders growth was revised down to 0.4% M/M from 0.1% (0.7% prelim), with core shipments down to 0.3% (0.5% prelim).

- The latter figures meant that while November was a fairly solid month in the context of a poor 2024 for core capital goods, the preliminary estimates painted an overly flattering picture.

- Despite the downward core revisions, we note the final data were still much better than expectations vs the preliminary release (core cap goods orders had been expected +0.1%), and we continue to regard the data as indicative of stabilizing domestic durable goods orders. That should translate into more solidity in broader business investment. Core capital orders have been positive for the past couple of months on a Y/Y basis (0.8% in Nov, after 0.7% in Oct), with shipments flat on a Y/Y basis (after 6 negative months).

- Though as broader surveys indicate (including ISM Manufacturing and MNI Chicago PMI), the manufacturing sector appears to have improved since a summer bottom even if activity remains weak.