EM CEEMEA CREDIT: MNI EM Credit Market Wrap - CEEMEA (12 Mar)

Mar-12 15:52

| MNI EM Credit Market Wrap - CEEMEA (12 Mar) |

- A potential cease fire agreement and easing US inflation offered a positive backdrop to the latest tariff saga and brought some stability to markets. US 10Y +3bp 4.31% and 5s/10 flat at 24.06. No new deals in the primary market today. Bank Gospodarstwa Krajowego priced their EUR BM 5Y and 12Y bonds at MS+ 85 and MS+165bp broadly in-line with our FV – see link https://mni.marketnews.com/4ikbJFt .

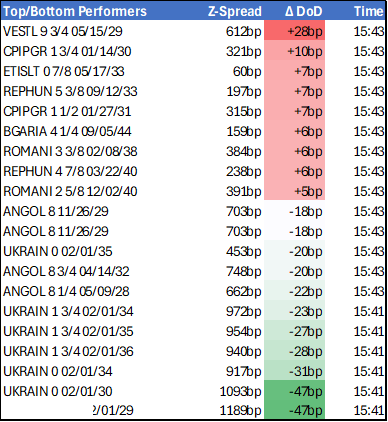

- UKRAIN curve was tighter on a possible cease fire with the 10Y -28bp. Angola was tighter on limited news flow while Ghana bounced back today following the widening yesterday with the 10Y at -13bps. South African parliament is currently voting on the budget. Key points for our coverage include Eskom borrowing requirements being reduced by ZAR20bn and for Transnet the government will consider adding guarantees to finance the co. maturity debt profile. The finance minister also commented that additional debt wouldn’t support South Africa’s current credit rating, and the cost of borrowing would be unaffordable. In corporate news flow Aydem reported FY24 results which were impacted by non-cash write downs while Zorlu Enerji FY 24 results were weak.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: Rally In Euribor Extends Alongside Core FI

Feb-10 15:50

Euribor futures continued to extend higher alongside broader core FI, now +1.0 to + 5.5 ticks through the blues. Headline flow has been relatively limited throughout the day, leaving volumes comfortably below recent averages.

- The back of the whites/front of the reds lead the rally in Euribor. Upside in ERZ5 continues to be capped by the Feb 3 high at 98.125, while ERZ6 has tested the Feb 5 high at 98.010.

- The ERH5/M5 spread has flattened 3.0 ticks today to -30.0 ticks, a fresh multi-week low.

- ECB-dated OIS up to 3bps more dovish than last Friday’s close, with 90bps of easing now priced through year-end.

- ECB President Lagarde will participate in a plenary debate on the ECB’s 2023 Annual Report at the EU Parliament at 1615GMT/1715CET (text will be released). However, any near-term policy signals are unlikely to deviate from the January decision guidance.

| Meeting Date | ESTR ECB-Dated OIS (%) | Difference Vs. Current Effective ESTR Rate (bp) |

| Mar-25 | 2.413 | -25.3 |

| Apr-25 | 2.216 | -44.9 |

| Jun-25 | 2.011 | -65.4 |

| Jul-25 | 1.923 | -74.2 |

| Sep-25 | 1.829 | -83.6 |

| Oct-25 | 1.807 | -85.8 |

| Dec-25 | 1.761 | -90.4 |

| Feb-26 | 1.758 | -90.7 |

| Source: MNI/Bloomberg. | ||

STIR: SOFR Option Update

Feb-10 15:50

More put structures and vol sales:

- +15,000 SFRN5 95.25/95.37/95.62 2x3x1 broken put flys, 0.75/wings over and bid

- -5,000 SFRU5 9593 straddles 39.5 ref 95.945

- -8,000 0QJ5 9550 puts, 2.0 vs 96.08/0.10%

- +8,000 SFRK5 95.62/95.68/95.75 put flys 1.75

- +10,000 SFRK5 95.68/95.75/95.81 put flys 1.5-1.75

STIR: Midmorning SOFR Option Update

Feb-10 15:40

Volume gradually picking up this morning, leaning towards downside puts as accts fade the bid in underlying off early session lows. Projected rate cuts through mid-2025 look steady to mildly higher vs. this morning's levels (*) as follows: Mar'25 at -1.9bp (-2.5bp), May'25 steady at -7.3bp, Jun'25 at -16.4bp (-15.5bp), Jul'25 at -21.6bp (-20.1bp).

- +2,500 SFRM5/SFRU5 95.68/97.00 call spd strip 43.00

- +4,000 SFRM5 95.50/95.62 put spds, 0.5 vs. 95.85/0.06%

- 1,500 SFRK5 95.68/95.75/95.81 put flys

- -6,000 SFRM5 96.31/96.50 call spds .25 over SFRM5 95.50/95.62 put spds ref 9583.5

- +10,000 0QM5 95.12/95.50 put spds 4.0 ref 96.065

- +2,500 0QU5/0QZ5 96.12/96.62/97.12 call fly strip, 16.5

- +2,500 0QM5 95.12/95.50 put spds, 4.0