EM CEEMEA CREDIT: MNI EM Credit Market Wrap - CEEMEA (14 Mar)

| MNI EM Credit Market Wrap - CEEMEA (14 Mar) |

A more constructive tone today to end the week, as cease fire hopes continue. US 10Y +3bp 4.30% and 5s/10 -1bp at 22.7. DNONO priced their USD 500m 5NC3 at 8.5%, IPT was 8.5-8.75|%. We had FV at 8.375%, please see our note from yesterday: https://www.mnimarkets.com/articles/dnono-new-issue-mandate-usd-500mn-5nc3-1741872686022

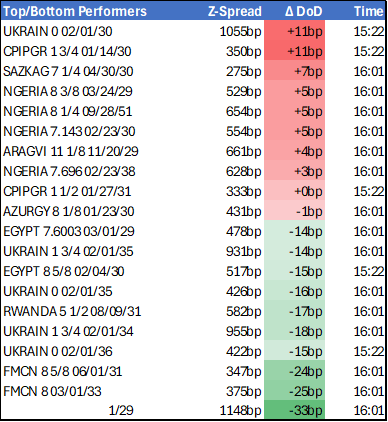

- Most sovereigns were a few basis points tighter as well as the UKRAIN curve. Egypt and Ghana marginal outliers with both 10Y’s -10bp and -8bp respectively. Limited corporate earnings, but Panama government will enter into talks with FMCN regarding Cobre mine and MTN will report FY 24 results next week which we don’t think will impact spreads, see note: https://www.mnimarkets.com/articles/mtn-fy24-results-unlikely-to-impact-spreads-1741950038157

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US: House Unveils Budget Resolution, Includes Debt Ceiling Hike

The House of Representatives has unveiled a budget resolution, kicking off the reconciliation process to legislate President Donald Trump's agenda.

- The resolution includes $4.5 trillion for the House Way and Means Committee to write up Trump's tax agenda, including the extension of 2017 tax cuts and potentially new reforms to cover campaign pledges like exempting tipped earnings from tax.

- The resolution aims to "reduce mandatory spending by $2 trillion over the budget window" setting floors for various departments to decrease the federal deficit including $880B for the Department of Energy and Commerce, $330B for the Department of Education, and $230B for the Department of Agriculture. The extent of proposed cuts suggests Medicaid reform will be required, potentially clashing with Trump's pledge to protect entitlement programmes.

- The spending levels allotted for tax reform are lower than called for by Ways and Means Chair Jason Smith (R-MO), suggesting that House Republicans will seek further offsets over the coming weeks, this may include codifying tariff revenue or spending cuts identified by Elon Musk's Department of Government Efficiency (DOGE).

- Notably, the resolution also includes a $4 trillion hike to the federal debt limit, a risky gambit that ties Trump's agenda to one of the most intractable political issues in Congress, which requires near-unanimous GOP support to pass the House.

- The House Budget Committee is expected to markup the resolution tomorrow with Johnson eyeing a full House vote by the end of the month. Passing the Budget committee will be the first major test of Trump's influence over Congress. Several hardline deficit hawks, including Rep Chip Roy (R-TX) and Ralph Norman (R-SC), sit on the panel.

- Once an identical resolution is passed by both the House and Senate, work can begin on the legislative text of a reconciliation package for Trump's agenda.

US SWAPS: Spds Wider As Powell Flags Potential SLR Tweak & Tsy Liquidity Worry

Fed Chair Powell says that he believes the central bank will take another look at the SLR rule, alongside concerns surrounding Treasury liquidity.

- Delayed, contained widening in long dated swap spreads following the comments.

- A reminder that Governor Bowman (a favourite to succeed Vice Chair for Supervision Barr) triggered widening in long end swap spreads last week, as she pointed to a preference regulatory tweaks.

- 10-YEar swap spread through last week's high.

- 30-Year swap spread less than 0.5bp off last week's high.

STIR: SOFR Options Update

Midmorning SOFR options leaning toward downside puts as underlying futures drift at/near session lows. Projected rate cuts through mid-2025 continue to recede vs. this morning's pre-CPI levels (*) as follows: Mar'25 at -0.5bp (-0.7bp), May'25 at -3.9bp (-6.3bp), Jun'25 at -8.9bp (-13.9bp), Jul'25 at -12.6bp (-18.9bp).

- +18,000 SFRU5 95.37/95.62 put spds, 3.5

- +6,000 2QM5 95.25 puts w/ 3QM5 95.25 put strip covered 13.0

- +10,000 SFRZ5 96.12/96.37 call spds, 6.0 ref 95.905/0.10%