EM CEEMEA CREDIT: MNI EM Credit Market Wrap - CEEMEA (18 Feb)

| MNI EM Credit Market Wrap - CEEMEA (18 Feb) |

A four-hour meeting between US and Russian officials didn’t result in any significant outcome, but instead they agreed to further talks, resulting in the 10Y Treasury 5bp wider at 4.51% and the 5s/10s flat at 15.02. Emirates NBD priced their PNC6 at 6.25% with IPT’s at 6.75%, we had fair value at 6.5%. Uzbekistan also came to the market and issued EUR 4.5Y and USD 7.25Y bonds. IPT’s were at 5.5A and 7.375A, we had FV at 5.25% and 7.15%, with the bonds pricing at 5.1% and 6.95% respectively. Arab energy fund also announced they were mandating banks for USD 5Y bond.

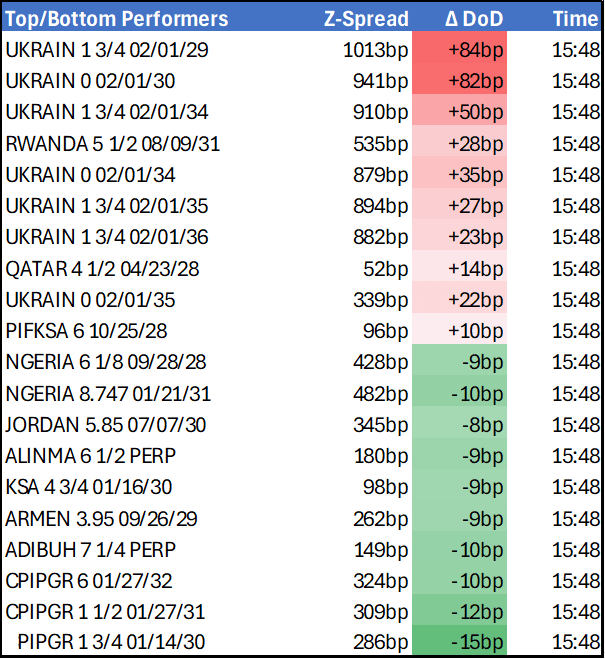

- UKRAIN bonds were in focus again in the secondary market, with a general widening across the curve following US and Russian talks. UKRAIN’s benchmark 10Y bond was 27bps wider, while other sovereigns across CEEMEA were marginally tighter. Tabreed commented they are looking at different funding options for their debt, which is in line with their strategy of buying back their shorter dated bonds in the secondary market.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI: US TSY TICS NET FLOWS IN NOV +$159.9B

- MNI: US TSY TICS NET FLOWS IN NOV +$159.9B

- US TSY TICS NET L-T FLOWS IN NOV +$79.0B

US TSYS: Tsy Curves Twist Flatter, Heavy Short End Sales Ahead Inauguration

- Treasuries look to finish mixed Friday, well off early session highs with heavy short end selling weighing across the strip while curves twisted flatter (2s10s -4.357 at 33.679, 5s30s -2.657 at 43.037).

- Massive -46k Mar'25 2Y futures sale triggered a broad based reversal by midmorning, while morning headlines that incoming President Trump held a call with China President Xi elevated volatility. Descriptions of a positive tone for China/US relations provided a boost for the Chinese Yuan.

- A surprise $10B 5-tranche debt issuance from Bank of America contributed to selling in rates.

- Generally positive data: Industrial production surprisingly jumped 0.9% M/M (cons 0.3) in Dec after an upward revised 0.2% M/M (initial -0.1%). Utilities may have helped with their 2.1% M/M increase (strongest since May) but manufacturing production was also stronger than expected with 0.6% M/M (cons 0.2%) after an upward revised 0.4% M/M (initial 0.2%).

- Building permits were a little higher than expected in December at 1483k (cons 1460k) for little change from 1493k in Nov. Housing starts meanwhile, which are more prone to weather disruption, surprisingly jumped to 1499k (cons 1327k) after 1294k in Nov.

- Reminder, the Federal Reserve enters their policy Blackout at midnight tonight through January 30.

- Corporate earnings pick up in earnest next week, headliners expected to announce next Tuesday include KeyCorp, DR Horton Inc, Charles Schwab, Prologis Inc and 3M Co before the market opens, Fifth Third Bancorp, Netflix Inc, Interactive Brokers, United Airlines, Seagate Technology and Capital One Financial after the market closes.

US TSYS: Late SOFR/Treasury Option Roundup

Large SOFR & Treasury put flow reported Friday after leaning toward upside calls overnight (note late Thursday evening buy of 20k Feb 10Y 108.75 calls - expire next Friday). Over 60,000 TYG5 108.5 puts bought on the day, Mar'25 30Y put spread buying. Underlying futures reversed early highs, partially data driven. Projected rate cuts through mid-2025 cooling again, current lvls vs. Friday morning* as follows: Jan'25 at -0.1bp, Mar'25 at -7.5bp (-8bp), May'25 -12.9bp (-14.6bp), Jun'25 -22.3bp (-24.6bp), Jul'25 at -26.1bp (-29.1bp).

- SOFR Options:

- +10,000 SFRZ5 96.00/96.50/97.00 call trees 3.5 ref 96.05

- +3,000 SFRM5 95.68/95.81 put spds vs 0QM5 95.81/95.93 put spds, 0.0

- +8,000 SFRH5 95.62/95.68 3x2 put spds 0.5 ref 95.785

- +4,000 SFRG5 95.62/95.68/95.75 put trees 1.5 ref 95.785

- +4,000 SFRK5 95.62/95.75 2x1 put spds, 1.0 ref 95.925

- +10,000 SFRZ5 96.00/96.50/97.00 call trees, 3.5 ref 96.05

- 2,000 3QH5 95.37/95.50/95.62/95.75 put condors ref 95.92

- 2,000 SFRZ5 95.12/95.75 put spds ref 96.05

- 2,000 SFRZ5 95.43/95.68 put spds ref 96.05

- 5,500 SFRH5/SFRU5 95.75/96.00 call spd spds

- 4,500 SFRJ5 95.75 puts ref 95.92

- Block, 6,000 2QH5 96.00/96.12 call spds 5.5 ref 95.995

- 3,000 SFRM55 96.00/96.12 call spds

- 2,600 SFRH5 95.75/95.87 call spds vs. SFRM5 95.87/96.00 call spds

- Treasury Options:

- 3,000 TYG5 110.25/111.5 1x2 call spds, ref 108-18

- 2,475 USH5 120 calls, 9 ref 113-00

- +12,000 TYH5 105/113 2x1 strangles, 15

- 11,900 TYG5 106/107 put spds

- 30,000 TYG5 108.5 puts, 21 vs. 108-18.5/0.47% (total volume over 60,000)

- 1,300 TYG5 107.5/108/108.5 put flys, ref 108-18

- 4,000 USH5 119/121/123/127 broken call condors ref 113-10

- 11,500 TYG5 108.5 puts, 14

- 15,000 USH5 106/108 put spds (open interest 30,19 and 19,346 respectively)

- 4,000 FVH5 106 puts, ref 106-08.25

- 7,000 TYH5 109.5/110.5 call spds

- Block, 4,500 FVG5 105.5/107.5 strangles 3.5 vs. FVH5 106.25 straddles 104.5

- 1,800 TYH5 106.5/108 put spds

- 2,600 TYG5 110 calls ref 108-20

- 2,500 wk3 TY 108.5/109 call spds ref 108-20.5 (expire today)

- 2,000 TYG5 108 puts, 9 ref 108-18.5

- 20,000 TYG 108.75 calls 18 (late Thursday evening) total volume near 23k