EM LATAM CREDIT: MNI EM Credit Market Wrap - LATAM (11 Mar)

Source: BBG

Measure Level Δ DoD

5yr UST 4.03% +6bp

10yr UST 4.28% +6bp

5s-10s UST 24.7 +0bp

WTI Crude 66.5 +0.4

Gold 2920 +31.5

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 875bp -4bp

BRAZIL 6 1/8 03/15/34 270bp -2bp

BRAZIL 7 1/8 05/13/54 356bp -1bp

COLOM 8 11/14/35 381bp -5bp

COLOM 8 3/8 11/07/54 467bp -2bp

ELSALV 7.65 06/15/35 480bp -1bp

MEX 6 7/8 05/13/37 271bp -1bp

MEX 7 3/8 05/13/55 329bp -0bp

CHILE 5.65 01/13/37 155bp -2bp

PANAMA 6.4 02/14/35 317bp -4bp

CSNABZ 5 7/8 04/08/32 602bp +2bp

MRFGBZ 3.95 01/29/31 303bp -8bp

PEMEX 7.69 01/23/50 677bp -2bp

CDEL 6.33 01/13/35 200bp -4bp

SUZANO 3 1/8 01/15/32 202bp -7bp

FX Level Δ DoD

USDBRL 5.81 -0.05

USDCLP 934.60 -9.57

USDMXN 20.2 -0.11

USDCOP 4133.97 -46.87

USDPEN 3.66 -0.01

CDS Level Δ DoD

Mexico 125 1

Brazil 178 1

Colombia 202 0

Chile 56 (0)

CDX EM 97.38 0.00

CDX EM IG 100.93 (0.01)

CDX EM HY 93.42 (0.02)

Main stories recap:

· Focus on tariffs today with Canada and the US conducting a verbal trade war which weighed on global equities, but primary markets were active and secondary spreads generally tightened anyway.

· EM Asia and CEEMEA primary markets were active with some Asia mandates proposed for TATA Capital (TATSON), PT Bank Tabungan Negara (BBTNIJ) and Chengdu Airport Xingcheng Investment (SLSCCI) while in CEEMEA we saw deals from Bank Gospodarstwa Krajowego, Islamic development bank, Seplat and Aragvi.

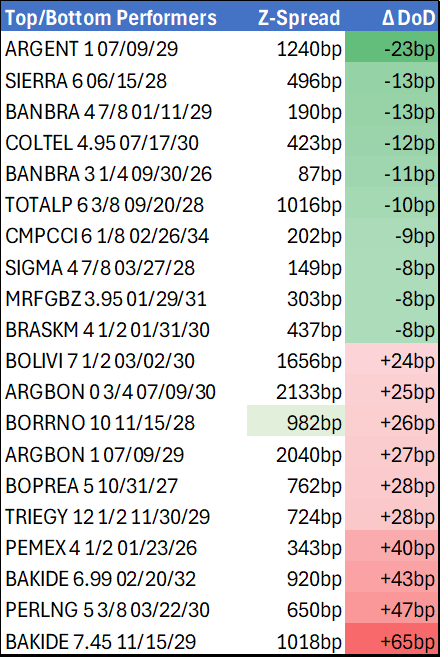

· One new issue was placed in Latam for AES Andes while in the secondary market bond spreads tightened about 2-8bps.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE 10-YEAR TECHS: (H5) Resistance Remains Intact

- RES 3: 96.501 - 76.4% of the Mar 14 - Nov 1 ‘23 bear leg

- RES 2: 96.207 - 61.8% of the Mar 14 - Nov 1 ‘23 bear leg

- RES 1: 95.665/851 - High Feb 5 / High Dec 11

- PRICE: 95.575 @ 16:37 GMT Feb 7

- SUP 1: 95.275 - Low Nov 14 (cont) and a key support

- SUP 2: 94.477 - 1.000 proj of the Dec 11 - 23 - 31 price swing

- SUP 3: 94.495 - 1.0% 10-dma envelope

The Aussie 10-yr futures contract continues to trade below the Dec 11 high of 95.851. A stronger bearish theme would expose 95.275, the Nov 14 low and a key support. Clearance of this level would strengthen a bearish theme. For bulls, a confirmed reversal and a breach of 95.851, the Dec 11 high, would instead reinstate a bull cycle and refocus attention on resistance at 96.207, a Fibonacci retracement point.

FED: Gov Kugler: "Prudent" To Hold Rates "For Some Time"

Gov Kugler (permanent voter, leans dovish) said Friday that rates were likely to be held for "some time" - making her the latest FOMC participant to express little impetus for a cut in the near-term.

- "The cautious and the prudent step is to hold the federal funds rate where it is for some time, given that combination of factors, given that the economy is solid, given the fact that we haven't achieved our 2% target, and given the fact that we may have uncertainties and other factors that may be pushing up inflation or maybe reducing output and growth into the future."

- "We reduced our policy rate 100 basis points through December, but the recent progress on inflation has been slow and uneven, and inflation remains elevated. There is also considerable uncertainty about the economic effects of proposals of new policies." She noted in a Q&A that inflation has recently "firmed a little bit."

- She noted that the January jobs report is "consistent with a healthy labor market that is neither weakening nor showing signs of overheating,"

FED: Federal Reserve "Earnings" Briefly Go Positive, But Hole Is Still Large

The Federal Reserve posted positive net earnings in the week to Feb 5, the first time it has done so since September 2022. The $0.4B uptick compares with an average of negative $1.3B over the preceding 6 months.

- Technically, this was a less negative "deferred asset". When the Fed "earns" money on its asset holdings after netting out expenses, it remits this money to the Treasury. With the Fed posting negative earnings for the past 2+ years, it is falling in to deeper and deeper cumulative negative earnings, a "deferred asset" which means that until the figure goes back into a positive balance, no remittances are made to Treasury.

- The "deferred asset" is currently $220.8B.

- The variability of earnings is due to the relationship between rates paid on Fed liabilities versus those paid on its assets.

- The post-GFC rise in the balance sheet saw ZIRP policy and a large set of Treasury and MBS holdings, meaning Fed remittances to the Treasury rose from 0.2% of GDP and 1.3% of government receipts in 2007 to 0.6% and 3.4%, respectively, in 2015, per St Louis Fed calculations. The 2015-18 tightening cycle saw a pullback in remittances, with about $900B remitted to the Treasury over the course of the 2011-20 period.

- The pandemic balance sheet expansion and return to ZIRP saw remittances pick up strongly again, but they have since pulled back. The 52-week average of weekly remittances has shifted, from showing about $10B in monthly "losses" in late 2023/early 2024, to around $6B on a monthly basis now.

- This reflects first the inversion of the yield curve amid the Fed's tightening cycle, and the slow normalizing of the curve since then.

- Unless the Fed easing goes much further, the Fed is unlikely to transmit cash to Treasury for some time.