EM LATAM CREDIT: MNI EM Credit Market Wrap - LATAM (14 Mar)

Source: BBG

Measure Level Δ DoD

5yr UST 4.09% +6bp

10yr UST 4.32% +5bp

5s-10s UST 22.5 -1bp

WTI Crude 67.2 +0.6

Gold 2983 -6.4

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 892bp -8bp

BRAZIL 6 1/8 03/15/34 270bp -5bp

BRAZIL 7 1/8 05/13/54 357bp -5bp

COLOM 8 11/14/35 375bp -7bp

COLOM 8 3/8 11/07/54 464bp -5bp

ELSALV 7.65 06/15/35 451bp -13bp

MEX 6 7/8 05/13/37 269bp -7bp

MEX 7 3/8 05/13/55 327bp -5bp

CHILE 5.65 01/13/37 156bp -6bp

PANAMA 6.4 02/14/35 310bp -8bp

CSNABZ 5 7/8 04/08/32 587bp -8bp

MRFGBZ 3.95 01/29/31 303bp -6bp

PEMEX 7.69 01/23/50 666bp -8bp

CDEL 6.33 01/13/35 196bp -3bp

SUZANO 3 1/8 01/15/32 202bp -4bp

FX Level Δ DoD

USDBRL 5.75 -0.05

USDCLP 928.76 -7.52

USDMXN 19.9 -0.15

USDCOP 4101.05 -23.14

USDPEN 3.66 -0.01

CDS Level Δ DoD

Mexico 127 (1)

Brazil 178 (1)

Colombia 201 (2)

Chile 57 (0)

CDX EM 97.35 0.08

CDX EM IG 100.92 0.04

CDX EM HY 93.3 0.07

Main stories recap:

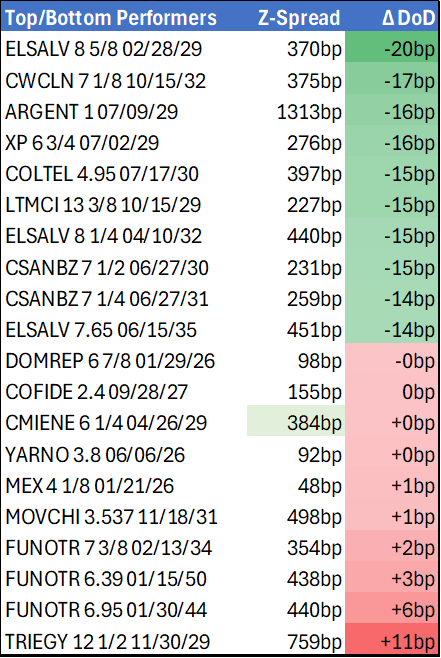

EM opened firm with rallying global equities. There was a pause after some negative data from the University of Michigan survey as consumer sentiment and expectations fell significantly while inflation expectations increased meaningfully. The market shrugged off the news as US equities closed 2% higher and US Treasury yields moved up 4-6bps while Latam benchmark bond prices were unchanged generally, so spreads moved tighter. Argentina, El Salvador, Pemex and other high beta benchmarks were more like 9-13bps tighter.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Rise in Core/Supercore CPI, But Wait Until Thursday's PPI: Powell

- Treasuries gapped lower after unexpected rise in January Core/Supercore CPI inflation data Wednesday, 10Y yield climbing to 4.6576% high on heavy volumes.

- Fed chair Powell cautions against getting "excited" about today's CPI report ahead of PPI (Thursday 0830ET), reminding that the latter report carries potentially different implications for the Fed's preferred PCE gauge: "The CPI reading was above almost every forecast.

- Treasury Mar'25 10Y futures trade 108-09 (-21.5) after the bell, above initial technical support at 108-00 (Low Jan 16); curves mixed: 2s10s +2.413 at 26.981, 5s30s -1.858 at 35.507. Tsy 10Y auction didn't help matters as the new supply tailed: drawing 4.632% high yield vs. 4.622% WI; 2.48x bid-to-cover vs. 2.53x prior.

- Nevertheless, projected rate cuts through mid-2025 continue to recede vs. this morning's pre-CPI levels (*) as follows: Mar'25 at -0.5bp (-0.7bp), May'25 at -3.2bp (-6.3bp), Jun'25 at -9.1bp (-13.9bp), Jul'25 at -12.6bp (-18.9bp).

- Weaker yen, with EURJPY’s 1.85% rally particularly standing out. Price dynamics kickstarted across the APAC session but were then bolstered by a hotter-than-expected US CPI report.

AUDUSD TECHS: Testing Resistance At The 50-Day EMA

- RES 4: 0.6429 High Dec 12

- RES 3: 0.6384 High Dec 13

- RES 2: 0.6331 High Jan 24 and a key resistance

- RES 1: 0.6301/09 50-day EMA / Intraday high

- PRICE: 0.6266 @ 16:14 GMT Feb 12

- SUP 1: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 3: 0.6000 Round number support

- SUP 4: 0.5931 1.764 proj of the Sep 30 - Nov 6 - 7 price swing

AUDUSD continues to trade at its recent highs, having recovered off the intraday low. Despite the latest bounce, the trend structure remains bearish. The Feb 3 fresh cycle low confirmed a continuation of the downtrend and maintains the price sequence of lower lows and lower highs. A resumption of the bear leg would open 0.6045, a Fibonacci projection. Key resistance is at 0.6301 (pierced), the 50-day EMA, and 0.6331, the Jan 24 high. A clear break of both levels would be bullish.

US TSYS: Late SOFR/Treasury Options Roundup

Heavier SOFR & Treasury option trade remained mixed Wednesday, underlying futures near post-CPI lows while projected rate cuts through mid-2025 continue to recede vs. this morning's pre-CPI levels (*) as follows: Mar'25 at -0.5bp (-0.7bp), May'25 at -3.2bp (-6.3bp), Jun'25 at -9.1bp (-13.9bp), Jul'25 at -12.6bp (-18.9bp).

- SOFR Options:

- 18,000 SFRU5 95.37/95.62 put spds, 3.5

- +6,000 2QM5 95.25 puts w/ 3QM5 95.25 put strip covered 13.0

- +10,000 SFRZ5 96.12/96.37 call spds, 6.0 ref 95.905/0.10%

- -5,000 SFRZ5 95.00 puts, 5.0 ref 95.89

- +5,000 0QZ5 96.25/96.75/97.25/97.75 call condors, 10.0 vs 95.92

- +5,000 SFRN5 95.75/95.87/96.00 put flys, 1.0 ref 95.83

- +3,000 SFRK5 95.81/95.93/96.00/96.12 call condors 1.5 ref 95.755

- +10,000 0QU5 97.12 calls 5.5 vs. 95.965/0.10

- +5,000 SFRJ5 95.62/95.68/95.75 put trees, 2.75 ref 9576

- -2,000 0QU5/3QU5 95.25 put spds, 2.0 net

- +5,000 0QU5 97.12 calls 5.0 ref 95.935

- +4,000 0QH5 95.81/95.93/97.06 put flys 2.5 ref 95.925

- +4,000 0QH5 96.37/96.43 1x2 call spds, 1.25, 2 legs over ref 96.025

- 4,000 0QJ5 95.43/95.50 2x1 put spds ref 96.03

- 10,000 SFRZ5 95.37/95.50 put spds ref 95.975 to -.97

- 2,000 0QG5 95.81/95.93/96.06 put flys ref 96.01

- Block, 2,500 SFRJ5 95.62/95.75 put spds ref 95.805

- 11,500 SFRZ5 96.00 calls

- 4,100 SFRM5 95.00/95.56/95.62 broken put trees ref 95.81

- 4,000 SFRM5 95.75/96.00 call spds ref 95.81

- 5,000 SFRZ5 96.18/97.18 call spds ref 95.975

- 3,500 SFRH5 96.00 calls, 0.5

- 2,900 SFRG5 95.68 puts, 0.5

- Treasury Options:

- Block: +10,000 TYJ5 109/110/110.5 broken call flys, 12 vs. 108-09/0.10%

- Update +20,000 TYH5 107/107.5 2x1 put spds, 2

- -10,000 TYH5 108 puts, 19

- -7,500 FNH5 105.5 puts, 5.5

- -3,000 TYK5 108 straddles, 214 (appr vol 5.81%)

- +14,400 TYJ5 106.5 puts, 15

- 2,000 TYJ5 108 straddles

- 3,800 FVK5 109 calls vs. 105.75/106.5 put spds

- -30,000 TYH5 109 puts, 43-45 unwind

- 2,400 FVJ5 105/106 put spds vs. 107.25 calls ref 106-12

- 8,000 TYH5 106/107 put spds ref 108-28 to -28.5

- 2,000 USJ5 108 puts, 8 ref 114-18

- 5,800 TYH5 107.5 puts, 3 ref 108-29.5

- 30,000 TYH5 110.5 calls, 3 total volume over 33k

- over 18,600 TYH5108.5 puts, 14 last

- over 6,000 TYH5 110 calls, 5 ref 108-29