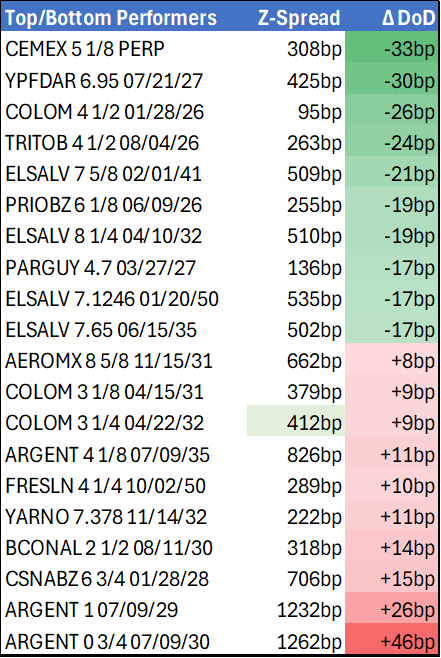

EM LATAM CREDIT: MNI EM Credit Market Wrap - LATAM (15 Apr)

Source: BBG

Measure Level Δ DoD

5yr UST 3.96% -5bp

10yr UST 4.32% -5bp

5s-10s UST 35.7 -0bp

WTI Crude 61.4 -0.1

Gold 3229 +18.1

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 921bp +5bp

BRAZIL 6 1/8 03/15/34 287bp +4bp

BRAZIL 7 1/8 05/13/54 382bp +2bp

COLOM 8 11/14/35 463bp +5bp

COLOM 8 3/8 11/07/54 532bp +8bp

ELSALV 7.65 06/15/35 503bp -17bp

MEX 6 7/8 05/13/37 302bp +1bp

MEX 7 3/8 05/13/55 360bp -0bp

CHILE 5.65 01/13/37 174bp +1bp

PANAMA 6.4 02/14/35 348bp +6bp

CSNABZ 5 7/8 04/08/32 686bp -2bp

MRFGBZ 3.95 01/29/31 365bp -10bp

PEMEX 7.69 01/23/50 727bp -6bp

CDEL 6.33 01/13/35 236bp +5bp

SUZANO 3 1/8 01/15/32 250bp -1bp

FX Level Δ DoD

USDBRL 5.89 +0.04

USDCLP 971.02 +3.44

USDMXN 20.1 +0.01

USDCOP 4354.51 +45.53

USDPEN 3.74 +0.01

CDS Level Δ DoD

Mexico 146 (2)

Brazil 196 (0)

Colombia 269 5

Chile 76 1

CDX EM 96.41 0.08

CDX EM IG 99.92 0.07

CDX EM HY 90.63 0.21

Main stories recap:

· The VIX volatility index drifted lower again today, last quoted 28.93 after reaching last week the highest level since 2020, reflecting a near term equilibrium in tariff anxiety with negotiations taking place behind the scenes and U.S. policy seeking refinement.

· European and Asian equities rallied while U.S. equity prices barely budged. US Treasury yields fell.

· EM Asia and CEEMEA benchmark bonds generally moved higher in price, tighter in spread, while Latam bond performance was more mixed.

· The primary market came alive with long awaited Republic of Colombia issuing USD3.8bn of 5- and 10-year notes to complete the country’s planned international issuance for the year.

· In the secondary market, El Salvador bonds were up close to 2 points. Ecuador bonds moved 2-3 points higher as a follow through to market friendly presidential election results this past weekend.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: March Economic Projections: Higher Inflation, Weaker Growth, Same Rates

The MNI Markets Team’s expectations for the updated Economic Projections in the March SEP are below.

- The unemployment rate is likely to rise slightly for 2025 alongside a downgrade in GDP growth, while the 2025 core and headline PCE inflation projections are set to rise again. Changes to later years will likely be limited, however.

- More detail on the shift in Fed funds rate medians is in our meeting preview - we will add more color next week.

FED: Market Pricing Nearly 3 2025 Cuts As Conditions Tighten

Amid rising government policy uncertainty, sentiment among businesses and consumers has fallen sharply since the start of the year, while equities and the dollar have reversed their post-election rise. Overall, financial conditions have tightened, even if stress is not yet mounting, e.g. no major widening of credit spreads (the accompanying chart shows the Fed’s financial conditions impulse index but only through January).

- Combined with growth fears, this has affected expectations for the Fed’s rate path, with around 18bp more cuts expected in 2025 compared with what was seen after the January FOMC. 65bp of cuts are priced for the year as a whole. 2025 cut pricing reached 71bp before the February inflation data and 76bp before the February payrolls report.

- A rate cut is seen with near zero probability for March’s meeting, but the first full cut is just about priced for June, with a second nearly priced by September.

- Chair Powell has no reason to endorse or refute these expectations – he’s likely to be happy with a press conference that ends with little discernable change in pricing.

CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX

- CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX