EM LATAM CREDIT: MNI EM Credit Market Wrap - LATAM (17 Apr)

Source: BBG

Measure Level Δ DoD

5yr UST 3.93% +3bp

10yr UST 4.32% +5bp

5s-10s UST 39.4 +2bp

WTI Crude 64.7 +2.2

Gold 3312 -31.4

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 911bp -16bp

BRAZIL 6 1/8 03/15/34 295bp -1bp

BRAZIL 7 1/8 05/13/54 389bp -2bp

COLOM 8 11/14/35 469bp -9bp

COLOM 8 3/8 11/07/54 545bp -7bp

ELSALV 7.65 06/15/35 496bp -6bp

MEX 6 7/8 05/13/37 302bp -6bp

MEX 7 3/8 05/13/55 362bp -5bp

CHILE 5.65 01/13/37 175bp -6bp

PANAMA 6.4 02/14/35 359bp -2bp

CSNABZ 5 7/8 04/08/32 712bp +11bp

MRFGBZ 3.95 01/29/31 362bp -5bp

PEMEX 7.69 01/23/50 724bp -20bp

CDEL 6.33 01/13/35 240bp -2bp

SUZANO 3 1/8 01/15/32 249bp -6bp

FX Level Δ DoD

USDBRL 5.81 -0.06

USDCLP 966.89 -2.24

USDMXN 19.8 -0.14

USDCOP 4305.77 -48.74

USDPEN 3.72 -0.01

CDS Level Δ DoD

Mexico 147 (2)

Brazil 197 (1)

Colombia 283 4

Chile 78 0

CDX EM 96.37 0.00

CDX EM IG 99.92

CDX EM HY 90.63

Main stories recap:

· US equities stabilizing, other than the UNH outlier from an earnings warning, and oil prices recovering nearly 4% today led to a reassuring rally across emerging market USD debt.

· LATAM benchmark bond spreads tightened 2-5bps across higher quality names like Chile, Uruguay and Peru sovereigns as well as some high grade Mexico corporate bonds.

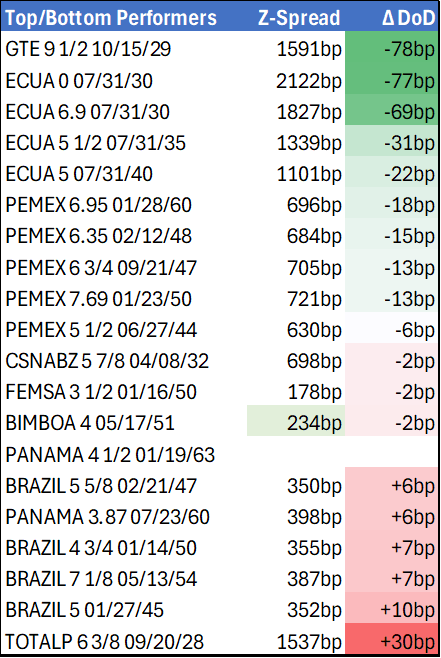

· Higher beta, oil related credits like Pemex and Ecuador outperformed with Pemex up nearly a point while Ecuador moved up 1 ½ to 2 points in price.

· Brazil corporate bond spreads were generally 5-10bps tighter.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS/SUPPLY: Review 20Y Bond Auction Re-Open

- Treasury futures gaining (TYM5 110-25.5 +6) after the $13B 20Y Bond auction reopen (912810UJ5) trades through: drawing 4.632% high yield vs. 4.646% WI; 2.78x bid-to-cover vs. 2.43x prior.

- Peripheral stats: indirect take-up rises to 68.84% vs. 63.0% prior; direct bidder take-up 22.35% from 19.5% prior; primary dealer take-up retreats to 8.81% vs. 17.5% prior.

- The next 10Y auction (re-open) is tentatively scheduled for April 16.

FED: US TSY 19Y-11M BOND AUCTION: HIGH YLD 4.632%; ALLOT 97.34%

- US TSY 19Y-11M BOND AUCTION: HIGH YLD 4.632%; ALLOT 97.34%

- US TSY 19Y-11M BOND AUCTION: DEALERS TAKE 8.81% OF COMPETITIVES

- US TSY 19Y-11M BOND AUCTION: DIRECTS TAKE 22.35% OF COMPETITIVES

- US TSY 19Y-11M BOND AUCTION: INDIRECTS TAKE 68.84% OF COMPETITIVES

- US TSY 19Y-11M BOND AUCTION: BID/COV 2.78

US 10YR FUTURE TECHS: (M5) Bounces Off Support

- RES 4: 113-02 2.0% 10-dma envelope

- RES 3: 112-13 1.500 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 2: 112-01/02 High Mar 4 / 1.382 proj of Jan 13-Feb 7-12 swing

- RES 1: 111-25 High Mar 11

- PRICE: 110-23 @ 16:56 GMT Mar 18

- SUP 1: 110-14+/14 20-day EMA / Low Mar 18

- SUP 2: 110-12+/00 Low Mar 6 & 13 / High Feb 7 and 50-day EMA

- SUP 3: 109-13+ Low Feb 24

- SUP 4: 108-21 Low Feb 19

The trend condition in Treasury futures is unchanged, a bull cycle remains in play and the current consolidation marks a pause in the uptrend. A bull theme is reinforced by MA studies that are in a bull-mode condition, highlighting a dominant uptrend. Recent gains have resulted in a print above 111-22+, the Dec 3 ‘24 high. A clear breach of this level would open 112-02 and 112-13, Fibonacci projections. Firm support is 110-00, the Feb 7 high. The 20-day EMA was tested Tuesday, but prices firmly bounced off support.