EM LATAM CREDIT: MNI EM Credit Market Wrap - LATAM (24 Apr)

Source: BBG

Measure Level Δ DoD

5yr UST 3.93% -9bp

10yr UST 4.31% -7bp

5s-10s UST 37.9 +2bp

WTI Crude 62.7 +0.4

Gold 3340 +52.1

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 855bp -13bp

BRAZIL 6 1/8 03/15/34 276bp -7bp

BRAZIL 7 1/8 05/13/54 372bp -7bp

COLOM 8 11/14/35 449bp -12bp

COLOM 8 3/8 11/07/54 534bp -7bp

ELSALV 7.65 06/15/35 451bp -13bp

MEX 6 7/8 05/13/37 290bp -6bp

MEX 7 3/8 05/13/55 354bp -5bp

CHILE 5.65 01/13/37 163bp -1bp

PANAMA 6.4 02/14/35 352bp -1bp

CSNABZ 5 7/8 04/08/32 641bp -7bp

MRFGBZ 3.95 01/29/31 347bp +3bp

PEMEX 7.69 01/23/50 701bp -7bp

CDEL 6.33 01/13/35 234bp +2bp

SUZANO 3 1/8 01/15/32 229bp +2bp

FX Level Δ DoD

USDBRL 5.68 -0.03

USDCLP 935.58 -8.70

USDMXN 19.6 -0.05

USDCOP 4266.91 -39.08

USDPEN 3.67 -0.02

CDS Level Δ DoD

Mexico 141 (3)

Brazil 187 (7)

Colombia 271 (6)

Chile 71 (5)

CDX EM 95.75 0.24

CDX EM IG 100.19 0.28

CDX EM HY 91.28 0.24

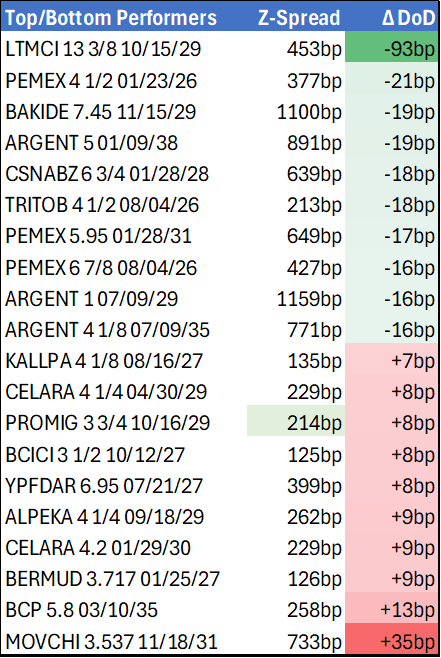

Main stories recap:

· Dovish comments from a couple of Federal Reserve officials led the US Treasury curve to bull steepen 6-10bps which also helped global equity indexes to move higher.

· That provided a supportive tailwind for EM generally, though CEEMEA benchmark bond spreads were more mixed while LATAM spreads were broadly tighter.

· Bonds of Canada’s First Quantum outperformed, tightening 12 bps as a spread to Treasuries, with optimism about the Panama copper mine reopening and after an earnings call signaled strength in Zambia operations. Please see the following links for more information: https://mni.marketnews.com/3RzBXrZ

https://mni.marketnews.com/44H8zaR

· The primary market in Asia and CEEMEA was active again with one Korean and one UAE issuer while LATAM was quiet. The new Peruvian bank BCP tier 2 notes priced yesterday underperformed today despite coming with a generous concession and with solid credit fundamentals.

· Latam low beta sovereign bond spreads tightened 2-4bps and higher beta rallied 10-15bps with Argentina, El Salvador and Ecuador outperforming while corporate bond spreads were mixed.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUDUSD TECHS: Monitoring Support

- RES 4: 0.6429 High Dec 12 ‘24

- RES 3: 0.6414 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg

- RES 2: 0.6409 High Feb 21 and a bull trigger

- RES 1: 0.6391 High Mar 17 / 18

- PRICE: 0.6307 @ 16:20 GMT Mar 25

- SUP 1: 0.6258 Low Mar 21

- SUP 2: 0.6187 Low Feb 4

- SUP 3: 0.6171/6088 Low Feb 4 / 3 and a key support

- SUP 4: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

AUDUSD recovered early losses into the London close. A short-term bull theme remains intact and the latest pullback appears corrective. Key short-term support to watch lies at 0.6187, the Mar 4 low. A break of this level is required to reinstate a bear threat. First support is at 0.6258, the Mar 21 low. A resumption of gains would refocus attention on 0.6409, the Feb 21 high. Clearance of this hurdle would strengthen a bull cycle and resume the uptrend that started Feb 3.

US DATA: House Prices Continue To Grow At Robust Pace

Data out Tuesday showed house prices were a little firmer than expected in January per the S&P CoreLogic 20-City measure (0.46% M/M SA, vs 0.40% expected and 0.54% prior), though slightly on the soft side in the FHFA (0.2% vs 0.3% survey, offset by an 0.1pp upside revision to December to 0.5%).

- House price growth remains closely clustered in the 5% annual area - that's true looking at either 3M annualized rates or Y/Y readings for FHFA or S&P CoreLogic price indices.

- That's a cooler pace of growth than the well-into-double-digit readings of a few years ago, but prices continue to set new all-time highs on the above metrics, and price gains are running ahead of inflation.

- Continued house price appreciation, even amid limited price discovery as existing home sales remain low, continue to bolster household balance sheets, giving the Fed one less reason to want to ease policy.

EURJPY TECHS: Support Remains Intact

- RES 4: 165.43 High Nov 8

- RES 3: 164.90 High Dec 30 ‘24 and a key medium-term resistance

- RES 2: 164.55 High Jan 7

- RES 1: 164.19 High Mar 18 and the bull trigger

- PRICE: 161.91 @ 16:19 GMT Mar 25

- SUP 1: 160.74 Low Mar 20

- SUP 2: 160.28 50-day EMA

- SUP 3: 158.90 Low Mar 10

- SUP 4: 158.00 Round number support

A recent sell-off in EURJPY appears corrective and has allowed an overbought trend condition to unwind. Short-term pivot support to watch is 160.37, the 50-day EMA. A break of this level would signal potential for a deeper retracement. Recent gains resulted in a print above resistance at 164.08, the Jan 24 high. A clear break of this hurdle would strengthen a bullish condition and open 164.90, the Dec 30 ‘24 high.