LATIN AMERICA: MNI EM Credit Market Wrap - LATAM (24 Mar)

Source: BBG

Measure Level Δ DoD

5yr UST 4.09% +9bp

10yr UST 4.33% +8bp

5s-10s UST 23.6 -1bp

WTI Crude 69.2 +0.9

Gold 3006 -16.1

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 932bp -3bp

BRAZIL 6 1/8 03/15/34 265bp -2bp

BRAZIL 7 1/8 05/13/54 350bp -0bp

COLOM 8 11/14/35 387bp -4bp

COLOM 8 3/8 11/07/54 469bp -2bp

ELSALV 7.65 06/15/35 443bp -6bp

MEX 6 7/8 05/13/37 266bp -4bp

MEX 7 3/8 05/13/55 326bp -3bp

CHILE 5.65 01/13/37 156bp -3bp

PANAMA 6.4 02/14/35 328bp -0bp

CSNABZ 5 7/8 04/08/32 543bp -11bp

MRFGBZ 3.95 01/29/31 293bp -8bp

PEMEX 7.69 01/23/50 645bp -12bp

CDEL 6.33 01/13/35 197bp -5bp

SUZANO 3 1/8 01/15/32 192bp -6bp

FX Level Δ DoD

USDBRL 5.75 +0.02

USDCLP 927.84 +0.95

USDMXN 20.1 -0.18

USDCOP 4155.21 +10.66

USDPEN 3.65 +0.01

CDS Level Δ DoD

Mexico 132 (5)

Brazil 184 (7)

Colombia 219 (7)

Chile 60 (4)

CDX EM 97.47 0.24

CDX EM IG 100.99 0.10

CDX EM HY 93.44 0.32

Main stories recap:

· For today at least the Trump administration seemed to move towards more targeted tariffs creating a buoyant mood as US equities rose while US Treasury prices fell and EM benchmark bond spreads in Asia and CEEMEA moved a couple bps tighter.

· Stronger than expected US service sector data also helped lessen concerns about the US economy.

· The Asia primary market was active with nine new deal announcements while CEEMEA offered a couple of new issues as well. Latam primary was noticeably absent with no new issues, which may mean tomorrow we get a lot more if the optimistic market mood continues.

· Latam benchmark spreads were almost all tighter with low beta liquid sovereign bonds like Chile and Mex about 3-4bps better while high yield Brazil corporate bond spreads were more like 10-15bps tighter.

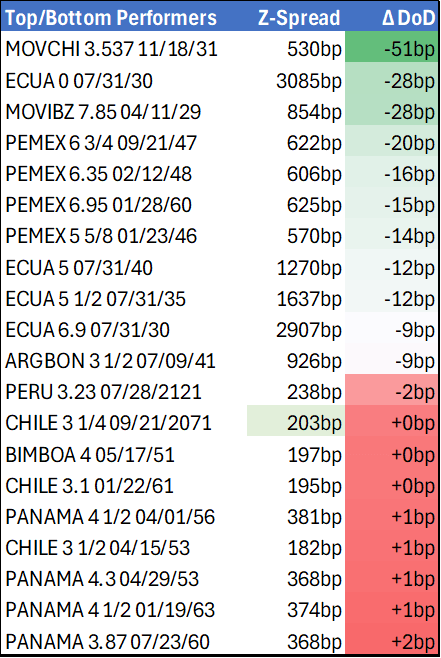

· Pemex outperformed with the company providing more details of investment plans designed to boost oil and gas production.

· Bonds of Telefonica Moviles Chile (MOVCHI) moved up over 2%, possibly related to Telefonica’s failed attempt to sell its Argentina subsidiary to Telecom Argentina due to government objections.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: July Fed Cut Priced Back In

The next Fed rate cut is again fully priced for the July meeting, following a 6bp futures-implied move today on the back of soft Services PMI data exacerbated in the afternoon by a risk-off move in equities.

- This comes following a run of mixed-at-best data (retail sales, housing starts, various consumer and business surveys) in the last week and is the first time a July cut has been priced since Feb 7 (just prior to January payrolls data) - previously it was priced for September.

- There's now almost two rate cuts priced through the end of the year (47bp through the December FOMC, an increase of 9bp on the day), the most seen since Feb 5.

- For the week, implied 2025 rate cuts have ranged between 35 and 48bp (the latter seen in the last hour of trade)

- See our US Macro Weekly for more on what to watch next week, with PCE and GDP the data highlights.

| Meeting | Current FF Implieds (%), LH | Cumulative Change From Current Rate (bp) | Incremental Chg (bp) | Prior Session (Feb 20) | Chg Since Then (bp) | End of Last Week (Feb 14) |

| Mar 19 2025 | 4.32 | -1.5 | -1.5 | 4.32 | -0.9 | 4.32 |

| May 07 2025 | 4.25 | -8.4 | -6.9 | 4.28 | -3.1 | 4.28 |

| Jun 18 2025 | 4.14 | -19.4 | -11.0 | 4.18 | -4.2 | 4.18 |

| Jul 30 2025 | 4.07 | -26.2 | -6.8 | 4.13 | -6.0 | 4.13 |

| Sep 17 2025 | 3.97 | -35.7 | -9.5 | 4.04 | -6.5 | 4.04 |

| Oct 29 2025 | 3.92 | -41.2 | -5.5 | 4.00 | -8.0 | 3.99 |

| Dec 10 2025 | 3.86 | -47.3 | -6.1 | 3.95 | -8.8 | 3.93 |

US TSYS: Late Risk-Off Support Lends to Weak Data Support

- Treasuries look to finish near session highs Friday, second half support spurred by risk-off sentiment as wires recirculated report of a new Covid strain out of China with "pandemic potential" (SCMP).

- Tsy Mar'25 10Y futures climbed to 109-24 high (+18.5), still shy of initial technical resistance at 110-00 (High Feb 7 and the bull trigger); 10Y yield fell to 4.4042% low; curves mixed: 2s10s -1.123 at 22.205, 5s30s +.956 at 40.929. Heavy volumes (TYH over 3.3M tied to quarterly roll action, June takes lead next Friday).

- Early Treasury support triggered by weaker than expected data: flash S&P PMIs w/ composite at 50.4 (cons 53.2) after 52.7 in Jan, services (49.7 vs cons 53.0, after 52.9); and existing home sales were softer than expected in January at 4.08m (cons 4.13m) after an upward revised 4.29m (initial 4.24m). UofM data showed a worrying rise in long-term inflation expectations alongside a deterioration in consumer sentiment.

- US stocks fell hard, DJIA back to January 21 levels while SPX Eminis and Nasdaq withdrew to last Thursday lows. Trading desks also cited today's call weighted option expiration that has historically leaned toward bearish price action in the week after.

- Late weekend focus on German elections take focus over the weekend, before New Zealand retail sales and German IFO data cross. There is a public holiday in Japan Monday.

LOOK AHEAD: The Week Ahead: 2nd Q4 GDP and January PCE Reports

- The upcoming US economic calendar is backloaded, with the second release for Q4 national accounts on Thursday before the January PCE report on Friday. Real GDP growth is seen confirming what was at the time a softer than expected 2.3% annualized in Q4, whilst there will also be a first estimate for real GDI growth after 2.1% in Q3.

- Much of the relative GDP weakness in Q4 after two quarters averaging 3.0% came from a large drag from inventories. It should continue to show signs of robust domestic demand after personal consumption increased 4.2% annualized in the advance release.

- However, January’s monthly report is likely to show consumption got off to a much weaker start of 2025. Recall that retail sales were far weaker than expected in January as they slid -0.9% M/M (cons -0.2) along with an even larger miss for the control group at -0.8% M/M (cons 0.3) to more than unwind the previously strong 0.8% M/M increase in December. Early days for the Bloomberg consensus currently see real personal spending growth of -0.1% M/M in Jan after 0.4% in Dec.

- As for inflation, Governor Waller cited estimates for core PCE inflation of around 0.25% M/M and it likely rounding to 2.6% Y/Y with some help from modest upward revisions.

- Base effects will have helped it drop from the 2.8% Y/Y averaged in Q4 whilst recent run rates should look a little more favorable (2.1% and 2.4% annualized over three and six months assuming no revisions). Note that revisions will go back to Q4, reflecting the new seasonal adjustment factors for both CPI and PPI, but longer dated revisions will have to wait for the comprehensive national account revisions due in September.