MNI Europe Pi: German Short-End Going Long

Apr-07 14:44By: Tim Cooper

Bunds+ 1

Download Full Document Here

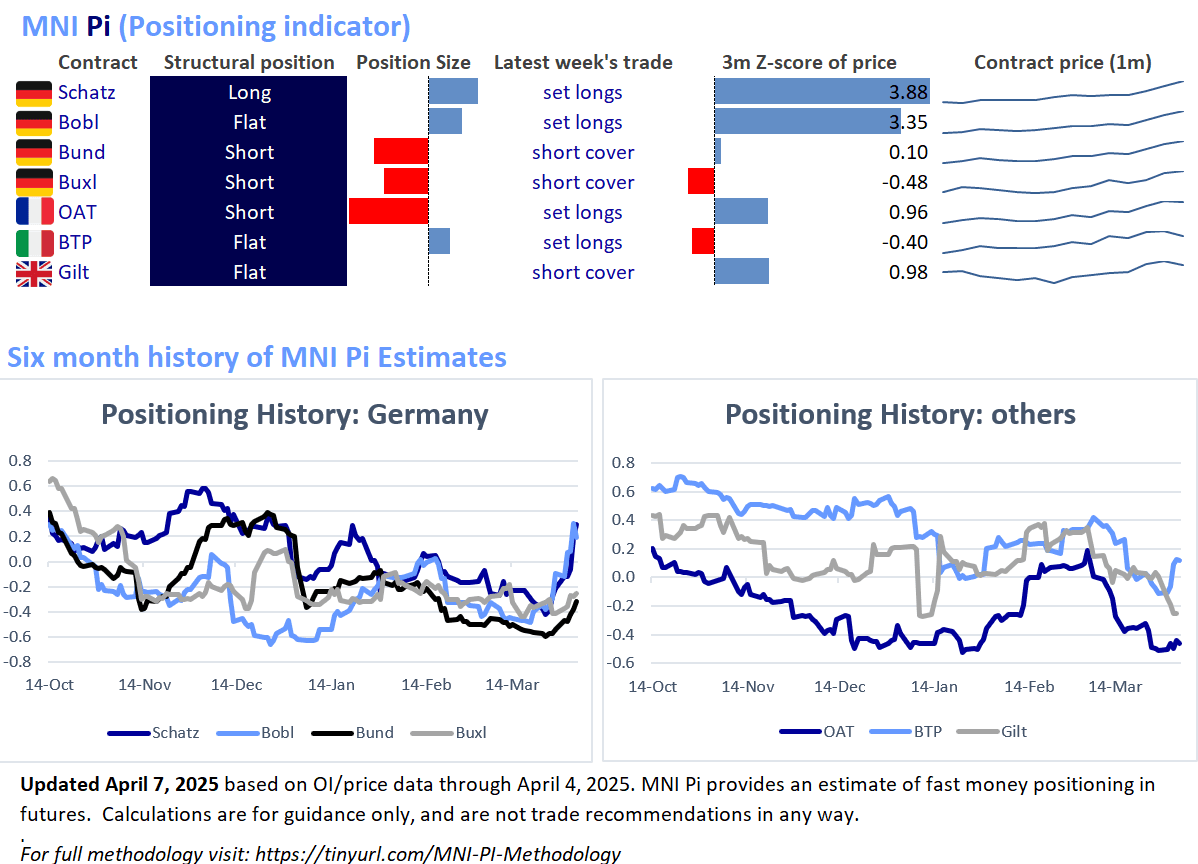

- There has been a sharp shift toward long structural positioning territory for nearer-dated German bond futures contracts in the last two weeks, per MNI Pi.

- That contrasts with the longer-end contracts, as well as some non-German contracts (especially Gilts).

- Last week saw trade consistent with long-setting and short covering across the European FI space.

- GERMANY: German contracts, which were all all "short"" or "very short" in our last biweekly update, have seen a notable shift in Schatz and Bobl, to long and flat respectively, following long-setting trade last week. Bund and Buxl remain in short territory but off recent extremes (Bund had been "very short" two weeks ago), having seen short covering last week.

- OAT: OAT remains in short structural positioning, having entered that territory after being "flat" for most of February. Last week's trade was indicative of long setting.

- GILT: Gilt structural positioning remains flat, where it has been the last 7 months, but is now as close to "short" as it's been since early January. Last week some some shorts set.

- BTP: BTP has now been flat since late January, though has ticked a little bit closer to "long" territory in the last week or so following some long-setting.