MNI EUROPEAN MARKETS ANALYSIS: April RBNZ Pricing At 27bp

- The PBOC fixing was above the closely watched 7.2000 for the time since 2023. The market is taking this as a sign of them being open to let the peg go, and continues to see a higher USD/CNH as the cleanest way to play the tariffs. Asia though could once again not get above the key 7.36/37 area.

- Indonesia came back from extended break and had to play catch up today, falling heavily. Despite that China’s markets had a positive day with major bourses up. News that China’s state backed funds are planning to step in to buy markets and stabilize things gave bourses a boost today as the likelihood of policy intervention grows.

- Cash US tsys are showing a bull-steepener, with benchmark yields 2-5bps lower, in today's Asia-Pac session after yesterday's extremely heavy session.

- RBNZ OIS pricing has 27bps of easing is priced for tomorrow, with a cumulative 98bps by November 2025.

MARKETS

US TSYS: Cash Bonds Partially Reverse Yesterday’s Heavy Session

TYM5 is 112-04+, +0-03 from closing levels in today's Asia-Pac session.

- Cash US tsys are showing a bull-steepener, with benchmark yields 2-5bps lower, in today's Asia-Pac session after yesterday's extremely heavy session.

- “Even 'safe haven' trades like Treasurys are falling on Trump's tariffs. What does that tell investors?” (DJ see BBG link)

- “The recent US bond market selloff may appear linked to an increase in risk appetite, however simultaneous high yield US credit spread widening suggests otherwise, according to Citigroup. Investors may instead opt for alternative G-10 sovereign debt, such as that from Europe and Australia.” (per BBG)

- Economic data remains light ahead of key releases later this week. Markets are looking ahead to Wednesday's release of the March FOMC minutes, followed by CPI data on Thursday and PPI on Friday.

CROSS ASSET: Risk Parity - Is The Party Over ?

Over the last 15 years there has been a mass migration to passive funds in the trillions of USD’s. The growth in these funds have been extraordinary at the expense of the active funds and in 2024 total assets in passive mutual funds and ETF’s surpassed those in active ones.

- With the allure of low fees, broad diversification and liquidity, Risk Parity became the new buzz word.

- The Cons though are beginning to mount. Capital floods into the same names, amplifying market weightings.

- No fundamental discrimination, it will buy whatever the index holds regardless of macro risks or price discovery. As long as money comes in the fund continues to pay the highs.

- This all works very well in a 15 year bull market that has consistently been protected by the FED put.

- What happens in a bear market ? Redemptions spike and just like when they buy on the way up at the highs, there is no fundamental discrimination on execution so as redemptions hit the fund will sell at the lows.

- This can amplify downside risks to the market especially in the names that are most heavily held.

- As you can see from the graph below Risk Parity has put in a lower high around the 850 area and is now looking to break below its pivotal 750/750 support. A move back through here would see redemptions begin to increase and the negative feedback loop in stocks would add a serious headwind to risk.

Risk Parity Index

Source: MNI - Market News/Bloomberg

JGBS: Bear-Steepener Extends After Poor 30Y Auction

JGB futures remain sharply weaker, -104 compared to settlement levels, although off session lows.

- “Japan selected its economic revitalization minister Ryosei Akazawa to lead tariff negotiations with the US as it scrambles to seek a reprieve from the Trump administration, according to Chief Cabinet Secretary Yoshimasa Hayashi.” (per BBG)

- Cash US tsys are showing a bull-steepener, with benchmark yields 1-5bps lower. US economic data remains light today. Markets are looking ahead to Wednesday's release of March FOMC minutes, followed by CPI data on Thursday and PPI on Friday.

- Cash JGBs are 5-19bps cheaper, with a steeper curve, after today’s lacklustre 30-year auction.

- The 30-year bond auction delivered disappointing results. The low price came in at 99.00, falling short of dealer expectations at 100.00 (Bloomberg poll). The cover ratio declined to 2.9582x from 3.4997x, while the auction tail widened significantly to 0.75 — the largest since 2023 — up from just 0.12 previously, all pointing to noticeably weaker demand.

- Swap rates are flat to 4bps higher, with swap spreads tighter.

- Tomorrow, the local calendar will see Consumer Confidence and Machine Tool Orders data alongside BoJ Rinban Operations covering 1-3-year and 5-25-year JGBs.

- BoJ Governor Ueda will also give a speech at the Trust Companies Conference.

AUSSIE BONDS: Cheaper But At Bests, RBA Gov Speech Tomorrow

ACGBs (YM -4.0 & XM -11.5) are cheaper but at session highs after a paring of yesterday’s losses by US tsys in today’s Asia-Pac session. Cash US tsys are showing a bull-steepener, with benchmark yields 2-5bps lower.

- US economic data remains light today. Markets are looking ahead to Wednesday's release of the March FOMC minutes, followed by CPI data on Thursday and PPI on Friday.

- Domestically, Westpac's measure of consumer confidence sank 6% m/m in April to 90.1 down from 95.9 in March, which had been boosted by February's rate cut.

- Meanwhile, NAB's March business survey was little changed from February with confidence down 1 point to -3 and conditions up 1 point to +4.

- Cash ACGBs are 4-11bps cheaper with the AU-US 10-year yield differential at +8bps.

- Swap rates are 3-8bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -3 to -6.

- RBA-dated OIS pricing is 4-8bps firmer across meetings today. A 50bp rate cut in May is given a 46% probability, with a cumulative 114bps of easing priced by year-end.

- Tomorrow, the local calendar will see Consumer Inflation Expectation data and a speech by RBA Governor Bullock.

- The AOFM plans to sell A$1000mn of the 2.75% 21 November 2028 bond tomorrow.

AUSTRALIA DATA: NAB Business Survey Little Changed Ahead Of US Tariffs

NAB’s March business survey was little changed from February with confidence down 1 point to -3 and conditions up 1 point to +4. The result is in line with moderate growth but doesn’t signal any pickup in the pace of the recovery, likely given heightened uncertainty. The survey results don’t suggest any worry about a global trade war before US reciprocal tariffs were announced, which were higher than expected.

- On the inflation side, labour costs remained elevated at 1.5% 3m/3m after 1.6% and purchase costs were steady at 1.4%. However, the rise in final product prices held at a subdued 0.4%

- The pickup in conditions was driven by a 2 point increase in profitability to +1, while employment was steady at +4 and trading fell 1 point to +6. Capex rose 1 point to +7.

- Forward looking orders rose 1 point to -2, while stocks increased 2 points to +5, which may be indicating preparation for stronger demand as capacity utilisation rose almost 1pp to 82.9%.

- On the external front, exports were flat at 0 and sales rose 1 point to +1.

AUSTRALIA DATA: Consumers Worried About Outlook Following US Tariffs

Westpac’s measure of consumer confidence sank 6% m/m in April to 90.1 down from 95.9 in March, which had been boosted by February’s rate cut. Both current conditions and expectations were lower. Households were spooked by US President Trump’s reciprocal tariff announcement which dealt 10% on imports from Australia but a total 54% on China, Australia’s largest export destination. The equity sell off that followed likely also made consumers feel pessimistic given the extent of pension savings.

- Westpac noted that confidence after the April 3 (AEDT) tariff announcement was down 10%. The volatility which has followed will also likely weigh on sentiment.

- The RBA leaving rates on hold on April 1 plus the ongoing election campaign may have also dampened consumer confidence. Westpac observes that the March 25 federal budget was a slight positive.

- There was a drop in all the components of the survey. The economic outlook for the year ahead fell 5.7% and the key “time to buy a major” item -7.3%. Unemployment expectations also deteriorated by 5.1%. Time to buy a dwelling fell 6.5% m/m.

- In terms of backward looking elements, family finances compared to a year ago were down 8.5% to its lowest since 2024’s July 1 tax cuts.

BONDS: NZGBS: Closed Cheaper But Mid-Range Ahead Of RBNZ Decision Tomorrow

NZGBs closed showing a dramatic bear-steepener, with benchmark yields 6-17bps higher. Nevertheless, yields closed well off session highs, particularly at the short end, This move aligned with richening in today's Asia-Pac session. NZGBs 16-20bps cheapening earlier in the session.

- On a relative basis, NZGBs underperformed their $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 3bps and 7bps wider.

- Swap rates closed finished 4-11bps higher, with the 2s01 s curve steeper.

- Tomorrow, the local calendar will see the RBNZ Policy Decision, with consensus unanimous in expecting a 25bp cut to 3.50%.

- RBNZ dated OIS pricing closed 1-5bps firmer across meetings, with Feb-26 leading. 27bps of easing is priced for tomorrow, with a cumulative 98bps by November 2025.

- Christian Hawkesby will be the head of RBNZ for an initial six-month period while a permanent governor is sought. The Reserve Bank board has started the recruitment process to find a permanent governor who will serve for five years, with Hawkesby and Assistant Governor Karen Silk considered likely candidates. (per BBG)

- On Thursday, the NZ Treasury plans to sell NZ$275mn of the 0.25% May-28 bond and NZ$225mn of the 4.25% May-34 bond.

STIR: RBNZ Dated OIS Pricing Firmer Today, Softer Vs Feb Pre-RBNZ Levels

RBNZ dated OIS pricing closed 1-5bps firmer across meetings, with Feb-26 leading.

- 27bps of easing is priced for tomorrow, with a cumulative 98bps by November 2025.

- Relative to February’s pre-RBNZ levels, pricing is flat to 33bps softer led by late 2025 meetings.

Figure 1: RBNZ Dated OIS Today vs. February’s Pre-RBNZ (%)

Source: MNI – Market News / Bloomberg

FOREX: Consolidation Sees The USD Give Back Some Gains

China is signaling it is not backing down and prepared for a prolonged standoff. The communist Party’s official newspaper has declared Beijing is no longer “clinging to illusions” of striking a deal. Asian equities have found some support though in sympathy with the bounce in the US and a statement that the “PBOC to provide Re-Lending support for Huijin when needed”. In other words, the Chinese will smooth the stock market and not allow it to collapse.

- EUR/USD - 1.0905 - 1.0980, approaching the London session near the Asian highs around 1.0980 as risk continues to bounce.

- GBP/USD - 1.2721 - 1.2792, trading at the day's highs going into the London session.

- AUD/USD - 0.5978 - 0.6062, a good bounce off its lows as price rejects the first foray below 0.6000. Look for the 0.6150/0.6250 area to find good resistance.

- AUD/JPY - 88.25 - 89.44, pressing this highs going into the London session, an ugly rejection on the Daily chart means there might be some more reversion back to the mean, but when risk takes another leg lower expect sellers to return. The 91.50/93.00 area is good resistance.

- USD/CNH - 7.3366 - 7.3651, trading near the day's lows going into the London session. The PBOC fixing was above the closely watched 7.2000 for the time since 2023. The market is taking this as a sign of them being open to let the peg go, and continues to see a higher USD/CNH as the cleanest way to play the tariffs. Asia though could once again not get above the key 7.36/37 area. A break above 7.38/40 would be significant for USD/CNH and broader the USD backstory.

- USD/JPY - 147.25 - 148.12. USD/JPY has seen a significant bounce and is now approaching a key sell zone between 148 - 150.

- Cross asset : SP +1.1%, Gold 3000.00, US 10yr 4.1450%, BBDXY 1266, Brent 65.11

- Key US data this week will be the US CPI April 10th.

USDCNH

Source: MNI - Market News/Bloomberg

ASIA STOCKS: A Better Day as China Bounces.

Indonesia came back from extended break and had to play catch up today, falling heavily. Despite that China’s markets had a positive day with major bourses up.

News that China’s state backed funds are planning to step in to buy markets and stabilize things gave bourses a boost today as the likelihood of policy intervention grows. Key state owned fund China Reform Holdings said it will invest $10bn in shares to support the market.

- China’s major bourses all rallied today with the Hang Seng better by +0.35%, CSI 300 +0.60%, Shanghai +0.50% and Shenzhen the outlier down -0.25%.

- The KOSPI got a boost from the China sentiment rising +0.33%

- In its first day back since an extended break, Indonesia’s Jakarta Composite is down -7.7% today as it plays catch up. %

- This dragged other SE Asian bourses with it with Singapore down -1.80%, Malaysia down -0.08%, whilst Philippines had a strong day today up +2.00%.

- India’s NIFTY 50 is up +0.95% at the open, having fallen -3.20% yesterday.

ASIA STOCKS: Taiwan Bounces Back as Korea’s Outflows Intensify.

A large inflow into Taiwan after their break as global Investors continue to withdraw from Korea with another day of significant outflow from Malaysia.

- South Korea: Recorded outflows of -$1,552m as of yesterday, bringing the 5-day total to -$4,773m. 2025 to date flows are -$10,082, m. The 5-day average is -$955m, the 20-day average is -$287m and the 100-day average of -$147m.

- Taiwan: Had inflows of +$1,291m as of yesterday, with total outflows of -$552m over the past 5 days. YTD flows are negative at -$16,956. The 5-day average is -$110m, the 20-day average of -$402m and the 100-day average of -$236m.

- India: Had outflows of -$367m as of 4th, with total outflows of -$630m over the past 5 days. YTD flows are negative -$14,373m. The 5-day average is -$126m, the 20-day average of +$17m and the 100-day average of -$145m.

- Indonesia: Had inflows of $38m as of the 27/3, with total inflows of +$54m over the prior five days. YTD flows are negative -$1,830m. The 5-day average is +$11m, the 20-day average -$33m and the 100-day average -$34m

- Thailand: Recorded outflows of -$185m the 4th, totaling -$202m over the past 5 days. YTD flows are negative at -$1,331m. The 5-day average is -$40m, the 20-day average of -$34m the 100-day average of -$19m.

- Malaysia: Recorded outflows of -$237m as of yesterday, totaling -$419m over the past 5 days. YTD flows are negative at -$2,575m. The 5-day average is -$84m, the 20-day average of -$64m the 100-day average of -$39m.

- Philippines: Saw outflows of -$56m as of yesterday, with net outflows of -$71m over the past 5 days. YTD flows are negative at -$285m. The 5-day average is -$14m, the 20-day average of -$2m the 100-day average of -$6m.

OIL: Crude Higher But Trade Deals Needed To Prevent Further Sell Off

Oil prices are higher today as risk-sensitive assets rally following sharp falls since the US announced higher-than-expected tariffs. WTI trended up through today’s APAC session and is +1.4% to $61.55/bbl after a high of $61.75. Brent is 1.4% stronger at $65.09, close to the intraday high and off the low of $64.45. The softer USD is also likely providing some support to dollar-denominated oil (USD index -0.4%).

- Today has seen a relief rally but concerns over the impact of a trade war on global oil demand are never far away. Markets appear to have paused due to a mix of selling fatigue and watching & waiting to see the results of imminent negotiations between the US and numerous regions, including EU, ASEAN and Japan. A lack of compromise though would likely send oil prices lower again.

- The US has threatened China with a further 50% tariff if it retaliates. China said today that it prefers to negotiate but will “fight to the end”. China is the world’s largest importer of crude and is likely to switch any flows from the US to other suppliers.

- While lower fuel prices may help US consumers, they are unlikely to encourage further drilling with the Dallas Fed estimating that average WTI needs to be $65 to make new wells profitable (Bloomberg).

- The EIA’s short-term energy monthly outlook will now be published on April 10, a delay from April 8. It said that it is “re-running” models to include the latest developments, according to Bloomberg.

- Today US industry-based inventory data is released. Also the Fed’s Daly, BoE’s Lombardelli and ECB’s Cipollone & de Guindos speak. US March NFIB small business optimism and Canada’s March Ivey PMI print.

GOLD: Gold Up in Asian Trading as Equities Stabilise

- In US trading overnight, gold fell for the third day straight yet as equity markets in the region showed some positive signs, gold improved also.

- Opening at US$2,983.28, gold added small gains today to reach $3,004.22.

- *Despite reassurances from Trump officials to investors that the tariff plan won't derail the economy, there remains little appetite for risk in most asset classes.

- Despite the reassurances, Trump then threated with upping the tariffs on China.

- *With the arbitrage in pricing between the US and UK over, the flow of physical gold into London resumed in March with an increase for the first time in five months.

- Yesterday, in China's FX Reserves release, the Central Bank provided details on the growth of gold held by the PBOC, as it rose for a fifth consecutive month.

MNI RBI Preview April 2025: RBI to Cut as CPI Softens.

- The February's CPI decline provides an opportunity for the RBI to cut.

- US tariffs announced last week represent downside risk to the growth outlook.

- The RBI Governor has spoken openly about the growth / inflation dynamics being suitable for further policy action.

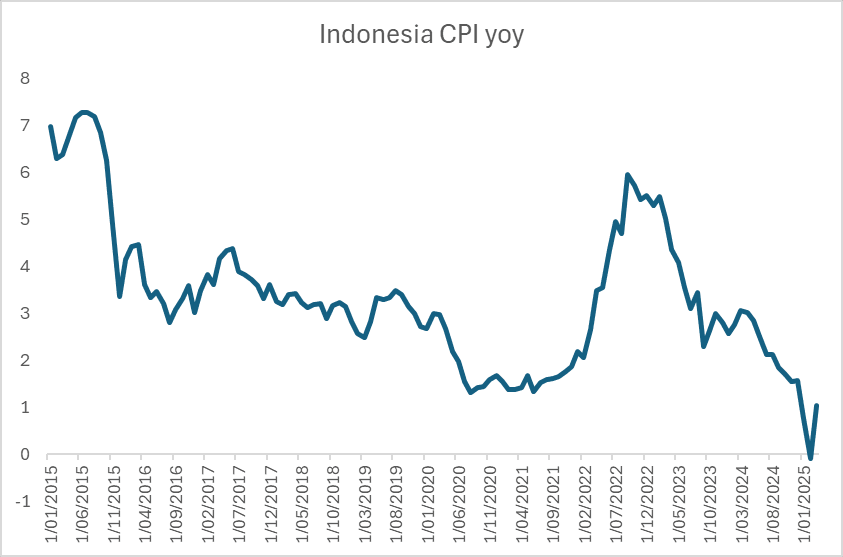

INDONESIA: CPI Creeping Up Again.

- Indonesia's CPY for March printed at +1.03%, up from -0.09% prior.

- The government's temporary discount on electricity was the main driver for the collapse in CPI in February.

- The discount expired and today's numbers shows CPI heading back towards the BI's target of +1.5%-3.5%.

- The CPI Core has remained consistent of late printing at +2.48% YoY for the second consecutive month.

- The non-seasonally adjusted MoM release saw a bounce back from -0.48% in February to record +1.65% in March.

The BI meets next on April 23.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 08/04/2025 | 0645/0845 | * | Foreign Trade | |

| 08/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 08/04/2025 | 0900/1100 | ECB's De Guindos At Spanish Banking Association Meeting | ||

| 08/04/2025 | 1000/0600 | ** | NFIB Small Business Optimism Index | |

| 08/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 08/04/2025 | 1400/1000 | * | Ivey PMI | |

| 08/04/2025 | 1400/1600 | ECB's Cipollone at ECON Hearing On Digital Euro | ||

| 08/04/2025 | 1400/1000 | United States Trade Representative Jamieson Greer | ||

| 08/04/2025 | 1600/1700 | BoE's Lombardelli on 'What can the UK learn from the US' | ||

| 08/04/2025 | 1700/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 08/04/2025 | 1800/1400 | San Francisco Fed's Mary Daly | ||

| 09/04/2025 | - | Reserve Bank of New Zealand Meeting | ||

| 09/04/2025 | 0200/1400 | *** | RBNZ official cash rate decision | |

| 09/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 09/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 09/04/2025 | - | Higher Reciprocal Tariffs On Imports | ||

| 09/04/2025 | 1230/1430 | ECB's Cipollone On Macro-Financial Stability Panel | ||

| 09/04/2025 | 1400/1000 | ** | Wholesale Trade | |

| 09/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks |