MNI EUROPEAN MARKETS ANALYSIS: Asia Pac Equities Firmer

- As expected, the RBA left rates on hold. The press conference may have pushed back a little on May easing expectations, but not dramatically. The A$ is modestly outperforming in the G10 space. ACGBs (YM +1.0 & XM +1.5) sit slightly stronger after the RBA decision. Cash US tsys are slightly richer in today’s Asia-Pac session after small losses early.

- Japan's Tankan survey painted a resilient picture, but may not have fully captured the recent tariff announcements.

- China’s CAIXIN PMI, which emphasizes smaller, private, and export-oriented companies expanded in March in spite of US tariffs. China and Hong Kong equities are firmer in the first part of Tuesday trade. Most other equity markets in the region have started April better.

- Later, the ECB’s Lagarde, Lane and Cipollone speak and European March manufacturing PMIs and euro area CPI are released. In the US, the Fed’s Barkin speaks on policy and the economic outlook. US final March manufacturing PMI, March manufacturing ISM, February JOLTS job openings and March Dallas Fed services print.

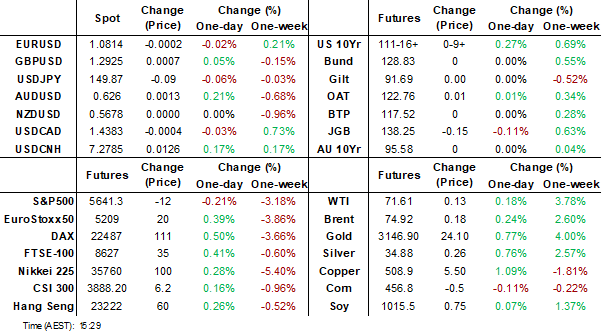

MARKETS

US TSYS: Cash Bonds Slightly Richer Ahead Of JOLTS & ISM MFG Data

TYM5 is 111-17, +0-10 from closing levels in today's Asia-Pac session.

- According to MNI's technicals team, TYM5 remains well off the initial technical resistance of 111-22.5 (today's intraday high) - next resistance above at 112-01 (High Mar 4 and a bull trigger).

- Cash US tsys are slightly richer in today’s Asia-Pac session after small losses early.

- Month/quarter-end rebalancing flow tempered Monday morning's risk-off support ahead of Wednesday's US tariff deadline.

- From our latest US Treasury Deep Dive (Here) - the Treasury isn’t expected to raise the size of its coupon offerings until Q4 2025 at the earliest, with consensus on such a shift moving following the February refunding announcement to Nov 2025/early 2026, from Aug/Nov 2025 prior.

- Today’s US calendar will be highlighted by JOLTS and ISM Mfg data.

JGBS: Futures Holding Weaker Ahead OF US Jolts & ISM Data

JGB futures are holding weaker, -18 compared to the settlement levels.

- Outside of the previously outlined labour market and Tankan survey data, there hasn't been much by way of domestic drivers to flag.

- " The impact of the tariffs on Japan could range from minimal to severe, depending on whether the US focuses solely on agricultural tariffs or also includes value-added taxes and non-tariff barriers. Japan's response is unclear, but Prime Minister Shigeru Ishiba may seek to win concessions by relaxing non-tariff barriers to US imports rather than planning retaliation." (per BBG)

- Cash US tsys are ~1bp richer in today's Asia-Pac session after yesterday's modest gains. Today's US calendar will be highlighted by JOLTS and ISM Mfg data.

- Cash JGBs are flat to 3bps cheaper, with a steepening bias, across benchmarks. The benchmark 10-year yield is 1.6bps higher at 1.506% versus the cycle high of 1.596%.

- Swap rates are little changed. Swap spreads are tighter.

- Tomorrow, the local calendar will see Monetary Base data alongside BoJ Rinban Operations covering 1-3-year and 25-years+ JGBs.

JAPAN DATA: Q1 Tankan Close To Expectations, Manufacturing & Services Diverging

Japan's Q1 Tankan survey presented mixed results. The headline for large manufacturing was +12, in line with forecasts, but down from the Q4 read of +14. The outlook was above expectations though at +12 (+9 was forecast and prior was +13). Non-manufacturing for large firms were better for Q1 but the outlook was slight below. The large industry capex estimate was 3.1%, close to the 3.2% forecast, but well off Q4's pace of 11.3%. For smaller firms, outcomes were mostly above expectations. The table below outlines the results relative to the BBG consensus and prior.

- The data is showing some divergence between manufacturers and non-manufacturers (or services), with the latter holding up better. The manufacturing base may be seeing more external uncertainties though. The resilient for small firms will be pleasing for the authorities, given some concerns how such firms would cope with higher wage costs. More details to follow

Table 1: Q1 Tankan Results & Expectations

| Actual | Estimate | Prior | ||

| Tankan Large Mfg Index | 1Q | 12 | 12 | 14 |

| Tankan Large Mfg Outlook | 1Q | 9 | 12 | 13 |

| Tankan Large Non-Mfg Index | 1Q | 33 | 35 | 33 |

| Tankan Large Non-Mfg Outlook | 1Q | 29 | 28 | 28 |

| Tankan Large All Industry Capex Estimate FY | 1Q | 3.20% | 3.10% | 11.30% |

| Tankan Small Mfg Index | 1Q | -1 | 2 | 1 |

| Tankan Small Mfg Outlook | 1Q | -3 | -1 | 0 |

| Tankan Small Non-Mfg Index | 1Q | 15 | 16 | 16 |

| Tankan Small Non-Mfg Outlook | 1Q | 10 | 9 | 8 |

JAPAN DATA: Tankan Suggests Resilience, But Tariff/Trade Impact Likely

The chart below plots the Tankan results for manufacturing (the white line), along with non-manufacturing (or services, the green line) and y/y Japan real GDP growth. Manufacturing ticked lower but is just off recent highs. For the non-manufacturing index, we hit fresh highs back to the early 1990s. This is likely to give the authorities/BoJ some comfort around broader macro conditions, particularly with so much off uncertainty.

- The manufacturing outlook was also better than forecast at +12 and only slightly sub Q4's +13 read. Still a BoJ official noted that most firms likely responded before the recent US auto tariff announcement (per RTRS). This tempers the resilient results to a degree.

- Smaller firm results were generally firmer than forecast, but non-manufacturing firms have much higher outright levels relative to manufacturing.

- On the capex side, the large all industry capex estimate at 3.1% was very close to forecasts but down from the prior +11.3% pace. This arguably won't be a huge surprise, with other indicators of capex coming off in recent months.

- The second chart below takes this capex estimate and plots it against the total capex (ex software) series in y/y terms, which is the orange line on the chart.

Fig 1: Tankan Sentiment & Japan GDP Growth

Source: MNI - Market News/Bloomberg

Fig 2: Japan Tankan Capex Intentions & Actual Capital Spending (ex Software) Y/Y

Source: MNI - Market News/Bloomberg

JAPAN DATA: Jobless Rate Ticks Lower, But So Does Job-to-Applicant Ratio

Japan's jobless rate for Feb ticked down to 2.4%, versus a 2.5% forecast and 2.5% (which was also the prior outcome). This puts the jobless rate back at 2024 lows, which was fresh cycle lows back to late 2019. This indicates a still tight labor market for Japan.

- The job-to-applicant ratio painted a less positive picture though. It eased to 1.24, versus a 1.26 forecast and prior 1.26 outcome. The chart below plots this index, which is inverted on the chart, against the jobless rate. the two series are diverging somewhat from norms, as we usually see a higher job-to-applicant ratio associated with lower unemployment rates.

- The new job-to-applicant ratio also ticked down, but remains close to recent highs.

Fig 1: Japan Jobless Rate & Job-To-Applicant Ratio (Inverted) Diverging Somewhat

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Slightly Richer, RBA Leaves Cash Rate Unchanged

ACGBs (YM +1.0 & XM +1.5) sit slightly stronger after the RBA decision to leave the cash unchanged at 4.10%. According to the accompanying statement:

- Inflation has significantly declined since 2022, aligning with forecasts, but the Board remains cautious.

- Domestic demand is recovering, though some sectors struggle to pass on costs. Labour market conditions remain tight despite easing wage pressures. Economic uncertainty persists, with risks to growth, inflation, and global trade.

- The Board prioritises sustainably returning inflation to target and will adjust policy as needed. Future decisions will be guided by economic data, global developments, and financial market trends to ensure long-term price stability and full employment.

- Cash US tsys are slightly richer in today's Asia-Pac session.

- Cash ACGBs are 1bp richer to 2bps cheaper with the AU-US 10-year yield differential at +20bps.

- Swap rates are 1bp lower.

- The bills strip is flat across contracts.

- Tomorrow, the local calendar will see Building Approvals and a speech from RBA Assistant Governor Chris Kent, who oversees financial markets, at the KangaNews Debt Capital Market Summit.

- The AOFM plans to sell A$800mn of the 3.75% 21 May 2034 bond tomorrow and A$600mn of the 1.00% 21 November 2031 bond on Friday.

AUSTRALIA DATA: Retail Spending Maintaining Steady Growth

February retail sales were slightly weaker than expected rising 0.2% m/m after 0.3% with annual growth moderating 0.2pp to 3.6%. Looking through volatility from seasonal discounting, retail spending is in line with rates seen since October but 3-month momentum has slowed. The pickup in consumer confidence from lower inflation & rates should support the upward trend in retail spending going forward.

Australia retail sales vs consumer confidence

- February’s growth was driven by department stores (+1.5% m/m & 5.6% y/y), the fifth consecutive month of non-negative outcomes, and food retailing (+0.6% m/m & 3.0% y/y). Restaurants rose 0.2% m/m & 3.7% y/y. Spending on household goods and other sectors both contracted following heavy discounting in Q4.

- Most states & territories saw growth in sales in February except Tasmania and Queensland.

- In July, retail sales will be replaced by the household spending series. The February data for this print on Friday and the headline is forecast to rise 0.3% m/m & 3.2% y/y after 0.4% & 2.9%.

Australia retail sales $mn

BONDS: NZGBS: Twist Steepener After NZ Treasury May-32 Tap Launch

NZGBs closed modestly richer, slightly off session bests, out to the 5-year. However, the 10-year yield closed sharply higher following the NZ Treasury’s launch of the syndicated tap of the 2.00% 15 May 2032 bond.

- The Treasury expects to issue at least NZ$3.0bn and will be capped at NZ$4.0bn. Initial price guidance is 14 to 17bps over the 15 May 2031 nominal bond. The issue will be priced tomorrow, and further issuance of the bond will not occur before July 2025.

- ANZ Bank New Zealand Limited; Bank of New Zealand; Citigroup Global Markets Limited; and Westpac Banking Corporation, New Zealand are Joint-Lead Managers for the issue.

- Cash US tsys are slightly richer in today's Asia-Pac session, with the NZ-US 10-year yield differential 9bps wider at +38bps, the widest since October last year.

- Swap rates closed little changed.

- RBNZ dated OIS pricing is little changed. 24bps of easing is priced for April, with a cumulative 72bps by November 2025.

- Tomorrow, the local calendar will see Building Permits ahead of CoreLogic Home Value and ANZ Commodity Price data on Thursday.

FOREX: A$ Ticks Up Post RBA Hold, USD Softer Elsewhere

The USD has retraced some of Monday's gain in the first part of Tuesday dealings. The USD BBDXY index was last near 1273, off around 0.10% versus end Monday levels in NY. A better regional equity tone to start April has helped, while US yields have edged down a touch.

- As expected, the RBA held rates unchanged at 4.10%. The statement was cautious given uncertainties around the outlook, particularly on the international trade/tariff front. Governor Bullock stated at the press conference that a rate cut wasn't explicitly considered today.

- This backdrop along with broader USD softness has seen the A$ rise. We were last near 0.6265/70, up close to 0.35%. Earlier lows were at 0.6232, amid the earlier risk off.

- US equity futures re-opened lower, but are away from worst levels. Eminis were last off around 0.40%. Regional equities are more positive, with South Korea and Taiwan rebounding, along with Hong Kong, the latter helped by the stronger Caixin PMI out of China.

- This has helped higher beta FX at the margins. NZD/USD saw earlier lows of 0.5633, but sits higher now at 0.5685/90, up around 0.15%.

- USD/JPY is lower, last at 149.55/60. Up around 0.25% in yen terms. Earlier we had resilient Tankan survey data, although this is unlikely to have fully reflected recent auto tariff announcements from the US.

- US yields have ticked down, with 10yr yields down around 1bps in the Tsy space.

- Tomorrow (Wednesday) we have the reciprocal tariff announcements from the US at 3pm EST. Trump spoke earlier about the announcement but details remain light in terms of what will be announced.

- Later, the ECB’s Lagarde, Lane and Cipollone speak and European March manufacturing PMIs and euro area CPI are released. In the US, the Fed’s Barkin speaks on policy and the economic outlook. US final March manufacturing PMI, March manufacturing ISM, February JOLTS job openings and March Dallas Fed services print.

ASIA STOCKS: A Better Day for Stocks as China Leads the Rally.

China Vanke, often viewed as a bellwether for the property sector saw shares up +2.5% in Hong Kong despite missing earnings.

Following the lifting of a ban on short selling, global funds accounted for 90% of the short sales in stocks on the KOSPI on Monday according to exchange data.

Foreign outflows in Taiwan continue unabated and has seen over $3bn leave the market in the last five trading days.

A better day in general for Asian bourses as China’s markets performed well across the board, giving impetus to others.

- China’s Hang Seng lead the way rising +1.06%, gradually pushing it into positive territory over the last five days. The CSI 300 is up +0.29%, Shanghai Comp +0.59% and Shenzhen up +0.90%.

- Taiwan's TAIEX is up strongly despite the outflows, rising by +2.53% for its strongest day since early January.

- Following yesterday’s declines the KOSPI has roared today, rising by +1.94% spurred on by positive economic data releases.

- Having been closed yesterday, Singapore’s Straits Times is playing catch up on yesterday’s regional falls, down -0.20% whilst the Philippines is up for a second day by +0.54%.

- India’s NIFTY 50 has enjoyed a strong period of gains, but is giving back at this morning’s open, down -0.25%.

ASIA STOCKS: India Inflows Top Three Billion in Five Days (AMENDED)

As the world awaits news on tariffs from the White House, news out of India suggests that current tariffs on US agricultural products could be lowered or removed. This comes at a time when India has had five successive days of very strong inflows into their equity markets.

- South Korea: Recorded outflows of -$1,214m yesterday, bringing the 5-day total to -$1,426m. 2025 to date flows are -$5,309m. The 5-day average is -$285m, the 20-day average is -$73m and the 100-day average of -$100m.

- Taiwan: Had outflows of -$857m yesterday, with total outflows of -$3,119m over the past 5 days. YTD flows are negative at -$18,290. The 5-day average is -$624m, the 20-day average of -$602m and the 100-day average of -$266m.

- India: Saw inflows of +$947m as of the 27th, with a total inflow of +$3,231m over the previous 5 days. YTD outflows stand at -$12,796m. The 5-day average is +$646m, the 20-day average of -$14m and the 100-day average of -$144m.

- Indonesia: Saw inflows of $38m as of the 27th, with a total inflow of +$54m over the previous 5 days. YTD outflows stand at -$1,830m. The 5-day average is +$11m, the 20-day average of -$33m and the 100-day average of -$34m.

- Thailand: Recorded outflows of -$44m yesterday, totaling -$163m over the past 5 days. YTD flows are negative at -$1,172m. The 5-day average is -$33m, the 20-day average of -$30m the 100-day average of -$18m.

- Malaysia: Recorded outflows of -$13m as of 27th, totaling -$247m over the past 5 days. YTD flows are negative at -$2,155m. The 5-day average is -$49m, the 20-day average of -$56m the 100-day average of -$36m.

- Philippines: Saw inflows of +$4m yesterday, with net outflows of -$26m over the past 5 days. YTD flows are negative at -$209m. The 5-day average is -$5m, the 20-day average of +$2m the 100-day average of -$7m.

OIL: Crude Holds Onto Monday’s Gain As Risks To Russian Supply Drive Direction

Oil prices have held onto Monday’s close to 3% gain as market worries regarding US tariffs on Russia and buyers of Russian oil outweigh concerns over the impact on global demand from increased trade protectionism. WTI is up 0.2% to $71.65/bbl after a high of $71.73, still trading below key resistance at $72.91. Brent is 0.2% higher at $74.95 after breaking $75 briefly. The bull trigger is at $76.26. The USD index is slightly lower but off its intraday trough.

- US President Trump has said this week that he believes Putin won’t “go back on his word” and he wants him to make a deal but will introduce “secondary tariffs on Russian oil” if needed. Russia is the world’s third largest producer and India and China have been large buyers of its discounted crude since the full invasion of Ukraine. The actioning of Trump’s threats would impact these countries and global prices significantly.

- The Russia issue along with threats directed at Iran has so far outweighed worries over US reciprocal tariffs to be announced at 3pm ET (8pm BST) on Wednesday. Press secretary Leavitt said that there would be “no exemptions at this time”.

- Oil found some support from the better-than-expected Caixin China manufacturing PMI in March. It rose 0.4 points to 51.2 signalling moderate growth in the sector.

- Later the Fed’s Barkin speaks on policy and the economic outlook. US final March manufacturing PMI, March manufacturing ISM, February JOLTS job openings and March Dallas Fed services print. The ECB’s Lagarde, Lane and Cipollone speak and European March manufacturing PMIs and euro area CPI are released.

CHINA: CAIXIN PMI Shows Stability Despite Tariffs.

- China’s CAIXIN PMI , which emphasizes smaller, private, and export-oriented companies expanded in March in spite of US tariffs.

- The private sector survey result of +51.2 was a marked improvement from +50.8 the month prior

- This was the sixth consecutive month of expansion (i.e. above 50) and the best result since November last year.

- The results indicate a positive outlook from private companies which for many observers recognizes a clearer outlook for the broader economy.

- This week sees a press conference from the White House where further updates on tariffs will be announced at a time as the US is reviewing of Beijing’s compliance with phase 1 on the trade deal agreed during Trump’s first Presidency.

- The Senior Economist at Caixin noted that “Supply and Demand kept expanding and export growth has continued, despite the job market remaining sluggish.”

- Opening the Asian trading day at a new high of US$3,123.57, gold’s relentless climb continues at it hits $3,143.35.

- Some forecasters believed their forecasts of $3,200 may have been aggressive at the beginning of the year, only now to have questions as to whether they need to restate.

- As the world anxiously awaits news of further tariffs, investors flock to gold as a safe haven, driving up the prices.

- The rally in recent days has seen gold’s year to date performance through a 20% gain.

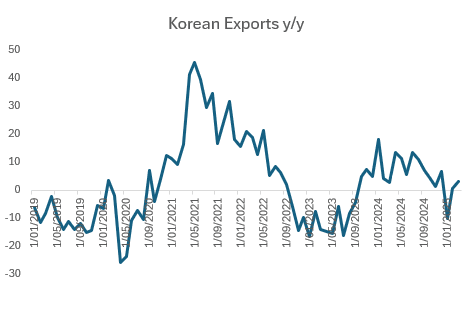

SOUTH KOREA: Trade Data Shows Ongoing Improvement in Exports

- Korea’s March exports missed expectations, with February’s release revised downwards.

- Against an expectation of +5.0%, March’s Export result of +3.1% was disappointing as the world awaits to announcement of tariffs from the US.

- When adjusted for working day differences, the rise was +5.5% on account of the Lunar New Year impact.

- March’s result for imports was slightly better than expected at +2.3%, from +0.2% in February showing that the domestic market remains robust.

- The trade surplus of USD$4.9bn is down from the prior month but in the current environment any surplus runs the risk of focus from the White House.

- The Korean government is looking to support those corporates exposed to the risk of tariffs with up to US$7bn of additional spending.

- The BOK next meets on April 17 and recent market moves have lowered expectations for a rate cut with the bond market pricing in only -9bps of cuts over the next three months.

CNH: USD/CNH Rebounding Ahead Of US Tariff Announcement

USD/CNH sits back in 7.2750/60 region, up around 0.15% so far today, but within recent ranges. Monday's low in the pair came in at 7.2531, which also marked both month and quarter end. Onshore USD/CNY spot is a little higher as well, last near 7.2650, leaving CNH-CNY basis as positive.

- USD/CNH remains within recent ranges and we are back above all key EMAs. We tested sub the 20, 50 and 100 day yesterday. The 200-day is further south near 7.2400. Note as well the simple 200-day MA, which is still near 7.2200, helped mark lows in March. Recent highs, towards the end of March were just above 7.2820.

- We are seeing a better onshore equity tone, albeit modestly, while Hong Kong shares are up over 1%. The better Caixin PMI print from earlier has been cited as a positive. This is yet to aid CNH though. The currency is also lagging a slightly softer USD tone against the majors, but aggregate moves are very modest.

- Focus remains on Wednesday's US reciprocal tariff announcement. Given China's large trade surplus with the US and tariffs already placed by the Trump Administration on China, further tariff hikes could work against the yuan.

- Still, Trump reiterated earlier today that some type of deal around TikTok was still possible. A weaker yuan may also weigh on relations with the US.

- In terms of the 1 month risk reversal level, it is still in positive territory, but above recent highs. 1 month implied vol was last at +4.4%, towards the bottom end of recent ranges (see the chart below). This fits with any upside in USD/CNH still being gradual rather than dramatic. It's a similar story for the 1 week equivalent, albeit with the risk reversal back in negative territory.

Fig 1: USD/CNH - 1 month Risk Reversal & Implied Vol

Source: MNI - Market News/Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 01/04/2025 | 0630/0830 | ** | Retail Sales | |

| 01/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0745/0945 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0750/0950 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0755/0955 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0815/0915 | BoE's Greene on ‘UK MP/macro conjuncture’ | ||

| 01/04/2025 | 0820/1020 | ECB's Cipollone At Croatian National Bank Meeting | ||

| 01/04/2025 | 0830/0930 | ** | S&P Global Manufacturing PMI (Final) | |

| 01/04/2025 | 0900/1100 | *** | HICP (p) | |

| 01/04/2025 | 0900/1100 | ** | Unemployment | |

| 01/04/2025 | - | *** | Domestic-Made Vehicle Sales | |

| 01/04/2025 | 1230/1430 | ECB's Lagarde At AI Conference | ||

| 01/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 01/04/2025 | 1300/0900 | Richmond Fed's Tom Barkin | ||

| 01/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/04/2025 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/04/2025 | 1400/1000 | * | Construction Spending | |

| 01/04/2025 | 1400/1000 | *** | JOLTS jobs opening level | |

| 01/04/2025 | 1400/1000 | *** | JOLTS quits Rate | |

| 01/04/2025 | 1430/1030 | ** | Dallas Fed Services Survey | |

| 01/04/2025 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 01/04/2025 | 1630/1830 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 0030/1130 | * | Building Approvals | |

| 02/04/2025 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 02/04/2025 | 1030/1230 | ECB's Schnabel At SciencesPo Conference | ||

| 02/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 02/04/2025 | 1215/0815 | *** | ADP Employment Report |