MNI EUROPEAN MARKETS ANALYSIS: FX Risk Appetite Firms Modestly

- Markets have been relatively steady as we await the US tariff announcement later. Risk appetite is a little better in the FX space, with AUD and NZD outperforming yen. US Tsy yields have firmed a little.

- Equity markets are mixed throughout the region, while US equity futures couldn't hold earlier gains.

- Looking ahead, apart from the US tariff announcement, the Fed’s Kugler speaks on inflation expectations and March US ADP employment and February orders are released. The ECB’s Lagarde, Schnabel and Lane talk.

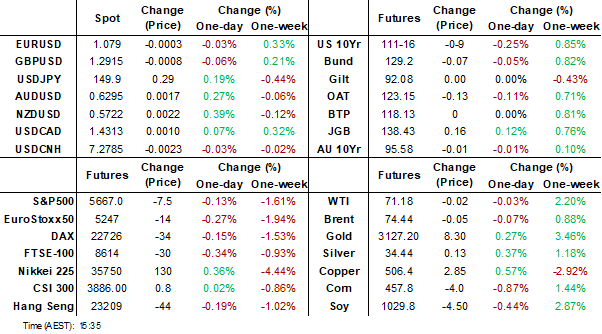

MARKETS

US TSYS: Cash Bonds Cheaper Ahead Of ADP Employment Data & Trump Tariffs

TYM5 is 111-16+, -0-08 from closing levels in today's Asia-Pac session.

- “Treasury 10-year futures are slightly lower in early Wednesday action but traders can see momentum building for a break above the 112 area and toward higher ground. The trigger is likely to be the fallout from the tariff announcements and responses from other nations.” (per BBG)

- Cash US tsys are ~2bps cheaper after yesterday's modest gains ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Trump's tariffs will take immediate effect after they are announced.

- The latest information includes: a CNBC reporter posting on X, citing Republican Rep. Kevin Hern, that the tariff rates announced Wednesday will be the highest they will go and countries can then take steps to bring the tariffs down.

- Today’s US calendar will see ADP Employment Change and Factory Orders data, and Fedspeak from Kugler on Inflation Expectations.

GERMANY: Bankers Pessimistic About Growth Outlook

The Association of German Banks is painting a subdued picture for Germany’s economy. Quarterly growth has alternated between positive and negative outcomes since Q4 2022 leaving Q4 2024 down 0.2% y/y and the group is forecasting it to recover to only 0.2% in 2025 revised down from 0.7%, according to projections seen by Reuters. It expects it to improve to 1.4% in 2026 helped by fiscal stimulus.

- Heiner Herkenhoff, CEO of the Association of German Banks, said that “with strong reforms and the prospect of a competitive tax policy, the new government could stimulate investment earlier” than 2026, the earliest the new fiscal package will be felt, which includes increased defence and infrastructure spending.

- He expects real business investment to contract this year. "Even the expected increase of 3.5% for 2026 is rather weak compared to previous recoveries," Herkenhoff said.

- US 25% tariffs on imported autos is expected to weigh on Germany’s carmakers significantly and details on any further pain from reciprocal tariffs will be discovered later on Wednesday (4pm ET/9pm BST).

JGBS: Cash Bond Bull-Flattener Going Into US Liberation Day News

JGB futures are stronger and near session highs, +14 compared to settlement levels.

- Outside of the previously outlined monetary base date, BoJ Governor Ueda has stated that US tariffs could significantly impact trade activity in affected nations, depending on their size and area. Ueda expressed uncertainty about the overall picture of the policies, awaiting an official announcement, and will closely watch developments to grasp their economic impacts.

- “The Japanese government will continue to strongly urge the US to exempt Japan from tariff measures, while assessing the details and potential impact on the country, Finance Minister Katsunobu Kato says” (per BBG)

- Cash US tsys are ~2bps cheaper ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Trump's tariffs will take immediate effect after they are announced. Today's US calendar will see ADP Employment Change and Factory Orders data, and Fedspeak from Kugler on Inflation Expectations.

- Cash JGBs have bull-flattened, with yields flat to 3bps lower. The benchmark 10-year yield is -0.4bp at 1.495% versus the cycle high of 1.596%.

- Swap rates are little changed. Swap spreads are mixed.

- Tomorrow, the local calendar will see Weekly International Investment Flow and Jibun Bank Composite & Services PMIs data.

AUSSIE BONDS: Little Changed Ahead Of Trump Tariff Announcement

ACGBs (YM -1.0 & XM +1.0) are little changed after dealing in narrow ranges in today's local session.

- There was a small payback in February non-house building approvals. Nevertheless, looking through the volatility the total number is trending robustly higher.

- Cash US tsys are ~2bps cheaper ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Today's US calendar will see ADP Employment Change and Factory Orders data, and Fedspeak from Kugler on Inflation Expectations.

- Cash ACGBs have bear-flattened, with yields flat to 2bps higher, with the AU-US 10-year yield differential unchanged. At +22bps, the differential is approaching the top of the range that it has traded in since late 2022.

- The latest round of ACGB May-34 supply sees the weighted average yield print 0.35bps through prevailing mids, with the cover ratio of 3.9125x was significantly higher than at the previous auction.

- Swap rates are flat to 1bp lower, with EFPs tighter.

- The bills strip is little changed.

- RBA-dated OIS pricing is slightly softer today. A 25bp rate cut in May is given a 77% probability, with a cumulative 71bps of easing priced by year-end.

- Tomorrow, the local calendar will see S&P Global Composite and Services PMIs.

RBA: MNI RBA Review-April 2025: Keeping Options Open

Download Full Report Here

- The RBA left rates unchanged at 4.10% on April 1, as was widely expected given the cautious tone following February’s 25bp cut. In the press conference, Governor Bullock said that it was a consensus decision and that easing wasn’t part of the discussion.

- It appears that the RBA is keeping its options open given that risks are to both sides and there is significant uncertainty around the outlook, especially from overseas. Upcoming Q1 CPI and March/April jobs data will be important in determining if the Board has become "more confident" that underlying inflation is returning "sustainably" to the mid-point of the target band, which enable it to consider the timing of the next rate cut.

- The central bank believes that Australia is unlikely to experience major direct effects from US tariffs given its small exposure to the US, but key concerns centre around how its main trading partners (China) & supply chains are affected and what retaliatory measures are taken. It noted that policy is "well placed to respond".

- A 25bp rate cut in May is given a 77% probability, with a cumulative 71bps of easing priced by year-end.

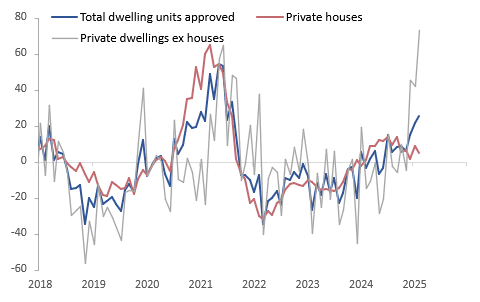

AUSTRALIA DATA: Positive Momentum In New Dwelling Approvals

There was a small payback in February for the sharp rise in non-house building approvals over December/January but looking through the volatility the total number is trending robustly higher. While it fell 0.3% m/m in February, less than expected, it was up 25.7% y/y after 21.6% and 3-month annualised momentum continues to run just under 30%. There has been a significant demand/supply imbalance in Australian housing and the positive trend in building approvals is welcome news.

- Private house approvals rose 1.0% m/m in February, the second consecutive rise after a weak Q4, which was driven by NSW (+5.1% m/m). They are 5.2% higher than a year ago but still down 3% on September 2024.

- Recent strength has been in multi-dwelling approvals which posted double-digit monthly increases over December/January. There was only a small decline of 1.5% m/m in February and they are running 73% above a year ago, the fastest rate since June 2012.

- The value of total residential building rose 5% m/m to a new record high level, due to a 5.8% increase in new building while alterations fell 0.3% m/m.

Australia number of dwelling building approvals y/y%

BONDS: NZGBS: Bull-Flattener Ahead Of Tariff News, May-32 Syn Tap

NZGBs closed mid-range, flat to 3bps richer, with the 2/10 curve flatter.

- Cash US tsys are ~2bps cheaper after yesterday's modest gains ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Trump's tariffs will take immediate effect after they are announced.

- The NZ-US 10-year yield differential closed 3bps tighter +35bps after reaching the highest level since October last year yesterday.

- Today the NZ Treasury announced that an additional NZ$4.0bn of the nominal 15 May 2032 bond had been issued via syndicated tap. The bonds, which carry a coupon of 2.00%, were issued at a spread of 14bps over the 15 May 2031 nominal bond, at a yield to maturity of 4.3100%. Total book size, at final price guidance, exceeded NZ$18.3bn. There will be no further issuance of the bond prior to July 2025.

- Swap rates closed flat to 2bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed little changed. 24bps of easing is priced for April, with a cumulative 72bps by November 2025.

- Tomorrow, the local calendar will see CoreLogic Home Value and ANZ Commodity Price data.

FOREX: A$ & NZD Outperform Yen Ahead Of US Tariff Announcement

AUD and NZD gains, against both the USD and JPY, have been the main focus points in the first part of Wednesday trade G10 FX trade. The USD BBDXY index was last just under 1273, a touch below end Tuesday levels in NY. Focus remains firmly on the US reciprocal tariff announcement, later on Wednesday US time (4pm EST).

- We had a number of news wire stories related to tariffs towards the tail end of the US Tuesday session/early Asia Pac trade. To recap:

A CNBC reporter posted on X, citing Republican Rep. Kevin Hern, that the tariff rates announced Wednesday will be the highest they will go and countries can then take steps to bring the tariffs down. This reportedly followed a meeting with US Tsy Secretary Bessent. - The WSJ also noted earlier the USTR is preparing another tariff option for Trump: ""The U.S. Trade Representative's office is preparing a third option of across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option, according to people with knowledge of the plans."

- There was also a Washington Post article around the use of tariff revenue to support the economy, including options for a tax dividend or refund, but these plans are reportedly only in the very early stages.

- US equity futures re-opened higher, but positive momentum waned and we were last -0.10% for Eminis. US Tsy yields are higher across the benchmarks, up 2bps for the 10yr to 4.19%. This has likely helped nudge USD/JPY a little higher, but at 149.80/85 we are only marginally above end Tuesday levels. EUR/USD is holding under 1.0800.

- AUD and NZD have ticked up. AUD/USD last near 0.6300, while NZD/USD is back to 0.5720, slightly outperforming the AUD. Both currencies are firmer against the yen and challenging 20-day EMA resistance points. AUD/JPY was last near 94.35/40, while NZD/JPY was at 85.70/75.

- Looking ahead, apart from the US tariff announcement, the Fed’s Kugler speaks on inflation expectations and March US ADP employment and February orders are released. The ECB’s Lagarde, Schnabel and Lane talk.

ASIA STOCKS: China’s Bourses Hold on to Marginal Gains

Xiaomi’s stock has been under selling pressure today down over 3% as one of its vehicles equipped with smart driving software crashed, with people killed. This followed losses of over 5% yesterday.

Despite the pressure on Xiaomi, Chinese electric vehicle manufacturers shares rise as delivery data shows year on year growth.

Malaysia’s Petronas shares slumped 2% as a main pipeline leak caused a fire that damaged multiple homes in a KL suburb.

- China’s main bourses delivered gains today with the Hang Seng up just +0.06, CSI 300 up +0.15%, Shanghai up +0.25% and Shenzhen up +0.38%.

- Taiwan’s TAIEX was weaker today by -0.10%, following yesterday’s huge gains of +2.8%.

- The KOSPI made yesterday’s gains look like an anomaly and fell again by -0.70%.

- With Indonesia still out, after being closed for two days for holidays, Malaysia’s FTSE Bursa KLCI is up +0.57% in trading today, after Friday’s fall of -1.44%

- In Singapore, the Straits Times is down -0.28% whilst the Philippines is up +0.42%.

- India’s NIFTY 50 is opening stronger this morning following yesterday’s significant falls of -1.50%, to be stronger by +0.50% in morning trading.

As the world awaits news on tariffs from the White House, flow data is disrupted at present due to South East Asian holidays, whilst outflows from Korea continue.

- South Korea: Recorded outflows of -$269m yesterday, bringing the 5-day total to -$1,669m. 2025 to date flows are -$5,578m. The 5-day average is -$334m, the 20-day average is -$82m and the 100-day average of -$103m.

- Taiwan: Had inflows of +$23m yesterday, with total outflows of -$3,161m over the past 5 days. YTD flows are negative at -$18,266. The 5-day average is -$632m, the 20-day average of -$534m and the 100-day average of -$257m.

- India: Saw inflows of +$947m as of the 27th, with a total inflow of +$3,231m over the previous 5 days. YTD outflows stand at -$12,796m. The 5-day average is +$646m, the 20-day average of -$14m and the 100-day average of -$144m.

- Indonesia: Saw inflows of $38m as of the 27th, with a total inflow of +$54m over the previous 5 days. YTD outflows stand at -$1,830m. The 5-day average is +$11m, the 20-day average of -$33m and the 100-day average of -$34m.

- Thailand: Recorded inflows of +$42m yesterday, totaling -$39m over the past 5 days. YTD flows are negative at -$1,130m. The 5-day average is -$8m, the 20-day average of -$27m the 100-day average of -$18m.

- Malaysia: Recorded outflows of -$87m as of 28th, totaling -$2,60m over the past 5 days. YTD flows are negative at -$2,242m. The 5-day average is -$52m, the 20-day average of -$59m the 100-day average of -$36m.

- Philippines: Saw inflows of +$4m as of 31st, with net outflows of -$26m over the past 5 days. YTD flows are negative at -$209m. The 5-day average is -$5m, the 20-day average of +$2m the 100-day average of -$7m.

OIL: Crude Range Trading Ahead Of US Tariff Announcement

Oil prices are little changed during APAC trading today as markets wait for details on US reciprocal tariffs due to be announced at 1600 ET or 0700 AEDT Thursday. Worries regarding the impact of increased trade protectionism on global oil demand have often driven prices lower this year and so the announcement will be important for energy markets. The reaction is likely to depend on markets’ assessment of the severity of the policy. The USD is 0.1% lower.

- WTI is flat today at $71.19/bbl off the intraday high of $71.34. It has remained below initial resistance at $71.83. Brent has also traded in a narrow range and is moderately higher at $74.50 close to today’s peak of $74.62. Initial resistance is at $75.04.

- US President Trump has said that the tariffs will take effect immediately, while Treasury Secretary Bessent stated that there will be a “cap” and that countries can negotiate to reduce the tariff they face below this. There could be a tiered tariff structure along with specific reciprocal taxes depending on what the US faces in other countries, according to Bloomberg.

- Other significant uncertainties include the outlook for Russia-Ukraine. A bipartisan group of 50 US senators tabled a sanctions plan on Russia and those who buys its fossil fuels, if Russia’s President Putin doesn’t honestly negotiate a truce and then stick to it.

- Bloomberg reported that there was a US crude stock build of 6mn barrels last week, according to people familiar with the API data. Product inventories continued to decline though with gasoline down 1.6mn and distillate 11k. Official EIA data is out later today.

- Apart from the US tariff announcement, the Fed’s Kugler speaks on inflation expectations and March US ADP employment and February orders are released. The ECB’s Lagarde, Schnabel and Lane talk.

GOLD: Buyers Re-Emerge as Gold Surges in Afternoon Trading.

- Having hit $3,149.00 yesterday, gold retreated as profit taking set in and traders squared their positions ahead of the tariff announcements.

- Opening in the Asian trading session at $3,113.38, gold did very little in the morning session before a surge in afternoon trading to a high of $3,135.71, before backing off to $3,125.09

- As the gold price hits levels that were (for many forecasters) a year end target, BofA is the first to flinch, suggesting that gold could reach US$3,500.

- Up 19% year to date, Gold has surged over 3% in three trading sessions, prior to the decline into the US market close.

- Demand for Gold ETFs remains strong with assets under management growing by over 5% this year.

- Gold’s rally is impacting markets globally with South African mining stocks putting in their best monthly performance on record in March.

- Wednesday in the US sees the President announcing wide ranging tariffs on ‘all’ of America’s trading partners, a move that inevitably will see counter measures and bring with it volatility.

SOUTH KOREA: An Unexciting CPI Places No Pressure on the BOK

- Today’s CPI print likely provides no pressure point for the BOK in their April 17 meeting.

- Whilst the y/y release saw a modest rise to +2.1%, with core at +1.9% this release does not present any new pressures for the voting members to be concerned about.

- The Bank of Korea (BOK) aims to maintain a flexible inflation targeting system, with the goal of keeping headline inflation at 2.0% over the medium term to ensure price stability.

- The broader data provides somewhat of a mixed bag with exports showing some signs of improvement, whilst yesterday’s PMI release was weaker than expected.

- Leading up to the rates decision next week will see Unemployment and early trade data.

- The market has gradually re-priced rate cut expectations with only 8bps of cuts priced in over the next three months and 30 over the next year

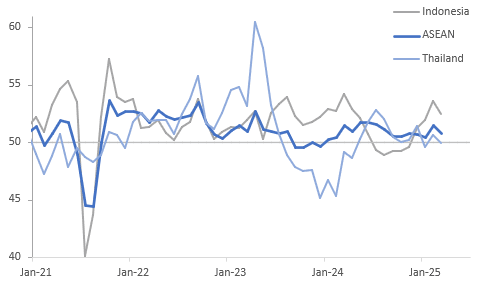

ASIA: ASEAN Manufacturing PMI Stays Above 50 Due To Indonesia

Manufacturing activity posted more moderate growth in March with the S&P Global PMI falling to 50.8, still above January and Q4 average, from 51.5. Growth was driven by Indonesia and Vietnam as they were the only two to record PMIs above the breakeven-50 level. Output and new orders continue to grow but March saw a slower pace and there was some moderate job shedding. However, businesses remain positive regarding the outlook and expect output to rise over the year.

- The Q1 average of the ASEAN manufacturing PMI was slightly higher than Q4, signalling that growth was in line or possibly moderately higher in the sector at the start of 2025. The index has been positive since December 2023.

- Capacity pressures persisted in the region and while cost inflation remains high it eased last month to its slowest since July 2023. Soft demand means that firms continue to struggle to pass on higher costs with selling price inflation moderating further.

- After seeing a contraction in industrial growth in H2 2024, Indonesia has seen positive growth since December although it moderated in March with the PMI down to 52.4 from 53.6. Apart from February, this was the highest since April 2024. Confidence in the outlook remains close to a 3-year high and at this stage seems little affected by US trade threats. Expected growth over the year was steady.

- Manufacturing output and orders growth remain positive with new foreign orders rising in March. Solid demand growth has resulted in an increase in purchasing and order backlogs but also moderate hiring.

- Both cost and output inflation are below the series average. Costs continue to be driven by the weaker rupiah and higher commodity prices.

ASEAN S&P Global manufacturing PMIs sa

MALAYSIA: March PMI Contracts Again

- A tenth straight month of contraction for the Manufacturing PMI is unlikely to shift the thinking at the Central Bank at their next meeting early in May.

- The March result sees a further contraction in the PMI to +48.8, from +49.7 in February.

- Output contracted for a tenth month in a row at +48.4.

- New orders fell to the last reading in a year.

- However, with GDP growth forecast of +4.7% in 2025 and CPI at +2.4%, the BNM do not seem pressured at present to act.

- The bond market seemingly thinks the same with just -5bps of cuts priced in on a 3 month time horizon.

- With just just 28bps over the next year, Malaysia has the least rate cuts priced in of any of its regional peers.

INDIA: March PMI Manufacturing Beat Expectations

- India’s HSBC PMI Manufacturing for March surprised to the upside for the highest reading in eight months.

- Following February’s +56.3 release, March’s was an upside surprise at +58.1, the highest reading since July last year.

- Output was up substantially at +61.7, from +58.1 in February.

- New orders were stronger than the prior month to be the strongest since mid year last year.

INDIA: Country Wrap: Moody’s Sees India Topping EM Growth.

- Moody's Ratings on Tuesday said India's growth at 6.5 per cent this fiscal will remain the highest amongst the advanced and emerging G-20 countries, supported by tax measures and continued monetary easing, and the country will continue to attract capital and withstand any cross-border outflow. In its report on emerging markets, Moody's said such economies are "exposed to choppy waters" from the churn of US policies and its potential to reshape global capital flows, supply chains, trade and geopolitics. (source: India Business Standard)

- China is willing to buy more Indian products to balance trade and are are willing to work with the Indian side to strengthen practical cooperation in trade and other areas, and to import more Indian products that are well-suited to the Chinese market,” the ambassador to India was quoted as saying by China’s state-run Global Times (source: BBG).

- India’s NIFTY 50 is opening stronger this morning following yesterday’s significant falls of -1.50%, to be stronger by +0.50% in morning trading.

- INR remains the best performing currency from its regional peers over the last month yet today is one of the weakest, down -0.21% at 85.65.

- Bonds: the RBI conducted an open market operation purchase of government bond late yesterday, buying INR200bn as part of its ongoing focus on the provision of liquidity. Consequently, the IGB 10YR is lower today at the market open by -6bps to 6.51%

CHINA: Country Wrap: China to Focus on Domestic Consumption.

- China on Tuesday unveiled a plan to strengthen financial services for technology-based enterprises, as part of the country's efforts to promote integrated advancements in technological and industrial innovation. The plan, jointly issued by the National Financial Regulatory Administration, the Ministry of Science and Technology and the National Development and Reform Commission, outlines measures to boost financial services including service mechanism establishment, product supply, specialized services and risk control capabilities. (source: Xinhua)

- China will further strengthen the role of domestic consumption in driving economic growth this year to offset the impact of weaker external demand caused by higher tariffs imposed by the Trump administration, according to Chinese think tank experts. One key policy initiative for the year is allowing local governments to collect a portion of the consumption tax to ease their financial difficulties and incentivize them to promote spending (source: Yicai)

- Equity markets were all positive with marginal gains across the major bourses. The Hang Seng barely held onto gains, rising +0.06%, CSI 300 +0.15%, Shanghai +0.25% and Shenzhen +0.40%.

- CNY: Yuan Reference Rate at 7.1793 Per USD; Estimate 7.2678

- Bonds: A subdued day in the bond market with the CGB 10YR marginally lower in yield at 1.80% (-1bps)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 02/04/2025 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 02/04/2025 | 1030/1230 | ECB's Schnabel At SciencesPo Conference | ||

| 02/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 02/04/2025 | 1215/0815 | *** | ADP Employment Report | |

| 02/04/2025 | 1400/1000 | ** | Factory New Orders | |

| 02/04/2025 | 1405/1605 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 02/04/2025 | 2030/1630 | Fed Governor Adriana Kugler | ||

| 03/04/2025 | 2200/0900 | * | S&P Global Final Australia Services PMI | |

| 03/04/2025 | 2200/0900 | ** | S&P Global Final Australia Composite PMI | |

| 03/04/2025 | 0030/1130 | Job Vacancies | ||

| 03/04/2025 | 0030/1130 | ** | Trade Balance | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Services PMI | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Composite PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Services PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Composite PMI | |

| 03/04/2025 | 0630/0830 | *** | CPI | |

| 03/04/2025 | 0700/0300 | * | Turkey CPI | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0720/0920 | ECB's De Guindos On "Financial Stability In Uncertain Times" | ||

| 03/04/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0830/0930 | Decision Maker Panel data | ||

| 03/04/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 03/04/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 03/04/2025 | 0900/1100 | ** | PPI | |

| 03/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI |