MNI EUROPEAN MARKETS ANALYSIS: Gold Slips On Higher USD

- Tariff concerns continue to dominate FX sentiment. The dollar gaining ground against all the majors and Asian currencies in the first part of Thursday trade. Nvidia earnings were out this morning, the results were somewhat underwhelming, however the stock managed to close up 3.67% in after hours trading.

- US Tsy futures have softened, while JGB futures have also weakened, with the 2yr JGB auction a headwind. In Australia, private capital expenditure volumes unexpectedly fell 0.2% q/q in Q4.

- Gold prices have been pressured.

- Later the Fed’s Barkin, Schmid, Barr, Bowman, Hammack and Harker all speak. Revised Q4 US GDP, preliminary January orders, jobless claims, February Kansas Fed manufacturing, euro area February EC survey, preliminary February Spanish CPI and ECB January meeting accounts are published.

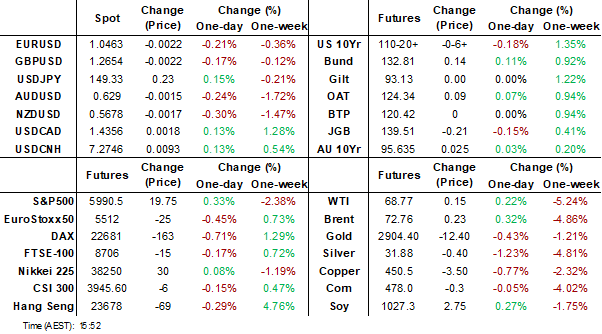

MARKETS

US TSYS: Tsys Futures Slip Ahead Of GDP & Fed Speak

- Tsys futures are trading lower today, as investors look to position ahead of tonight GDP data. TY recent traded through key resistance at 110-20, the 76.4% retracement of the Dec 3 - Jan 13 bear leg, the contract last trades -05+ at 110-21+, while TU is -00⅝ at 103-02⅜.

- Nvidia earnings were out this morning, the results were somewhat underwhelming, however the stock managed to close up 3.67% in after hours trading.

- Cash tsys yields are trading a touch cheaper today with curves slightly steeper. The 2yr is 1.2bps at 4.084%, while the 10yr is +1.9bps at 4.275%.

- Projected rate cuts through mid-2025 have firmed up from morning levels (*) as follows: Mar'25 at -0.7bp (-0.5bp), May'25 at -6.9bp (-6.4bp), Jun'25 at -21.5bp (-19.6bp), Jul'25 at -29.6bp (-27.6bp).

- Later today we have GDP, PCE, Durable Goods & Jobless Claims. While speeches from Fed officials such as Jeffrey Schmid, Michael Barr and Michelle Bowman are also expected

JGBS: Futures Down But Up From Lows, Tokyo CPI In Focus Tomorrow

JGB futures sit at 139.43, -.29 versus settlement levels in latest dealings. We are slightly up from session lows (139.27), but have had a mostly downside bias for much of the session.

- There has been negative spillover from lower US Tsy futures, (TYH5 off -06), but JGBs have generally underperformed.

- In the cash JGB space, yields are up over 3bps for some parts of the curve, led by the 7 and 10yr tenors. In comparison US Tsy yields are up a little under 2bps at this stage. The 10yr JGB outright is back to 1.40%, session highs rest at 1.416%.

- The 2yr debt auction printed a while ago, with softer demand metrics. The bid to cover ratio slipped to 3.16 from 4.06 prior. This is the worst bid to cover ratio since end 2023. The tail yield was 0.8330%, which compares to the current benchmark of 0.82%.

- Carry over from comments made yesterday from Japan's top currency official, Atsushi Mimura, that there is no push back on the market view for further BoJ rate hikes, may have also aided yields today.

- US-JP 10yr yield differentials sit back at +287bps, off nearly 45bps since the start of the month.

- Tomorrow the data calendar is busy headlined by Tokyo CPI.

BONDS: ACGBs Trade Richer, Curve Flattens

ACGBs (YM +1 & XM +2) are stronger and trade in the middle of the session's ranges.

- Today, the local calendar has been light, we had Private capital expenditure, that came in at -0.2% for 4Q, with 3Q numbers being revised up to 1.6% from 1.1%, however this did little to move markets.

- Australia sold A$150m of inflation-linked bonds due Aug 2035. Investors offered to buy 3.41 times the amount of securities sold.

- RBA Deputy Governor Andrew Hauser signaled that under the new monetary policy committee regime, the central bank is unlikely to disclose individual board votes to avoid adding "noise" around rate decisions. Public speeches by members will likely reflect the board's consensus rather than personal views. Hauser also reaffirmed that the RBA remains cautious on rate cuts, diverging from market expectations of a steady easing cycle.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s gains, curves are steeper, with the 2s10s +0.5bps at 18.726, just off recent lows of 16bps.

- Cash ACGBs are outperforming US Tsys & NZGBS today, trading flat to 2.5bps richer with the AU-US 10-year yield differential at +6.5bps.

- Swap rates are 1bps higher.

- The bills strip is little changed today

- Tomorrow, the local calendar will see January's Private Sector Credit MoM. The market expects it to decrease to 0.5% from 0.6%

- The AOFM plans to sell A$700mn of the 1.75% 21 November 2032 bond tomorrow

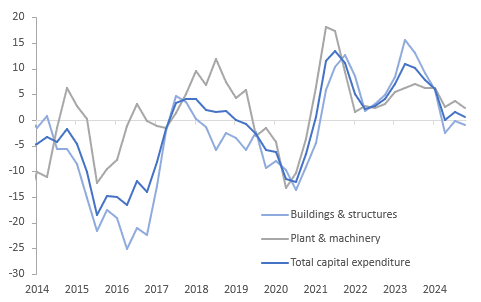

AUSTRALIA DATA: Private Investment Weakened In Q4, GDP Out March 5

Private capital expenditure volumes unexpectedly fell 0.2% q/q in Q4 after an upwardly-revised +1.6% q/q in Q3. It looks like private investment will be soft in the Q4 national accounts published on March 5, especially plant and equipment. The RBA noted at its February meeting that “there has been continued subdued growth in private demand”. Q4 GDP may see stronger growth in private consumption.

- Investment volumes in building & structures rose 0.2% q/q after 1.9%, while plant & equipment fell 0.8% q/q following a 1.3% increase. This left the components down 1.0% y/y (Q3 -0.2%) and up 2.4% y/y (Q3 +3.8%) respectively. Total private capex rose 0.6% y/y following 1.6%.

- The weakness in plant& equipment was driven by non-mining (-1.0% q/q), and specifically the construction sector (-8.1%), with mining up 0.6% q/q.

- Buildings & structures were supported by a 1.1% q/q rise in non-mining, driven by electricity infrastructure, but mining fell 1.1% q/q.

- Investment intentions for FY25 were revised up 3.2% on the last estimate, while the first estimate for FY26 is 1.8% higher than FY25’s first estimate.

Australia private capex volumes y/y%

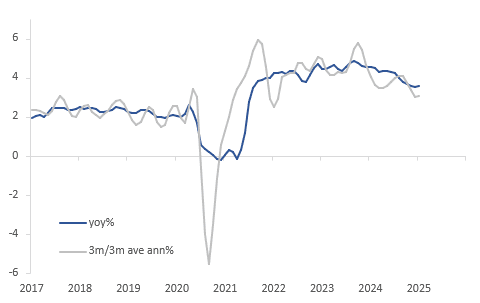

AUSTRALIA DATA: Advertised Salary Growth Stabilising As Jobs Market Tight

January SEEK advertised salary data is showing a gradual pick up in wages offered in line with the labour market tightening “a little further in late 2024”, as the RBA stated in its February meeting statement. Advertised wages rose 0.3% m/m last month to be up 3.6% y/y, the third straight month at this annual rate signalling stabilisation after moderating since the September 2023 peak. The monthly increase has been gradually rising since it troughed at 0.23% m/m in October.

- Today RBA Deputy Governor Hauser said that the central bank is unsure how much spare capacity is in the labour market and haven’t seen evidence that wage moderation is due to an excess.

- 3-month momentum in advertised salaries appears to have stabilised around 3% annualised. SEEK doesn’t expect wage growth to slow as much this year as last given the tightness in the labour market.

- SEEK also observes that “with less people intending to quit their jobs in 2025, the flow through from advertised salary growth to overall income and wage growth may be a little subdued this year.”

- Legal jobs saw the fastest growth up 7.8% y/y as labour demand remains strong, while advertising ,arts & media were weakest rising 1.0% y/y.

Australia SEEK advertised salaries index %

RBA: Uncertainty Driven By US Trade Policy Contributed To Rate Cut Decision

Deputy Governor Hauser reiterated the reasons for the February rate cut but added that the economic impact of heightened uncertainty contributed to the decision.

- Unclear US trade policy is increasing economic uncertainty with decisions being delayed and the negative impact of this uncertainty, rather than tariff details, added to the RBA’s reasons to ease this month. Hauser cited a Fed study that found that uncertainty reduced US growth by 1pp during Trump’s first term.

- Hauser reiterated that the OCR was cut this month as activity was “subdued” and softer wage growth and lower-than-expected inflation made the Board “more confident” that inflation was sustainably moving towards target but that it will need “to see” inflation fall further before cutting again given that the tightness of the labour market remains a challenge to inflation.

- The market path for rates and the strength in the labour market hold core inflation above 2.5% but unchanged policy saw it undershoot this rate.

- The RBA is unsure how much spare capacity there is in the labour market and is watching data closely to determine this. Some believe the fall in wages growth signals that there is room but the RBA is waiting for evidence of this. The risk remains that wage growth rises as it is close to full employment.

- Market sector employment growth remains positive but in line with activity. Non-market employment has accounted for around 80% of total employment growth and its outlook will depend on government spending. Market jobs growth is expected to improve in line with the forecast recovery in the economy.

RBA: Decision On Vote Communication To Be Made At Next Meeting

RBA Deputy Governor Hauser, Assistant Governors Jones and McPhee appeared before the Senate Economics Committee today and how the new Board system will work was discussed.

- The new dual Board structure will begin at the start of March with its first monetary policy meeting over March 31-April 1.

- How the policy vote is communicated has not yet been decided and options will be discussed at this meeting. Deputy Governor Hauser said that a decision has not yet been made. He doesn’t expect the RBA to follow the BoE’s model where each member’s vote is listed and that they often publicly explain their alternative views later or the RBNZ’s consensus approach and is likely to be somewhere in the middle.

- Hauser believes that the discussion should be centred on promoting clarity around why a decision was made, thus maximising the signal but not adding noise. He didn’t think it would be helpful to focus on the arguments made by individuals at the meeting.

- Board members will also be obliged to make public appearances but again the format of this and how much freedom they’ll have on content has not yet been decided.

- The policy decision is made the Tuesday morning (the second day), after each Board member is asked their view.

BONDS: NZGB Curve Steepens, Business Confidence Rises

NZGBs closed mostly cheaper, the short-end outperforming as the curve bear-steepens. NZ Treasury sold NZ$225m 2029, NZ$225m 2033, NZ$30m 35 (linkers) & NZ$50m 2041 bonds today, while NZ business confidence increases in Feb.

- Today’s weakness appears tied to cash US tsys, which are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s gains.

- NZGBs closed -1.4bps to +1.8bps. Short end outperformed today, with the 2yr -1.4bps at 3.644%, while the 10yr closed +1.4bps at 4.490%. The 5s10s closed +1.1bps at 38.50

- Nevertheless, NZGBs have underperformed US tsys recently, although the NZ-US 10-year yield differential is little changed from yesterday.

- Swap rates are mixed closing +/- 1bps

- RBNZ-dated OIS pricing was steady today. Currently, 26bps of easing is priced for April, with a total of 65bps expected by November 2025.

- New Zealand business confidence increased in February 2025 to 58.4 from 54.4 in January, supported by lower interest rates. While past activity weakened to -2.9 from 0.2, it remained better than six months prior, and export and investment intentions rose to 17.9 and 18.1, respectively, led by agriculture. Profit expectations dipped slightly to 22.3, with agriculture most optimistic, and inflation expectations softened to 2.5% from 2.7%.

- RBNZ reported January new residential mortgage lending at NZ$5.1b, up 50% YoY but down 11% MoM seasonally adjusted. First-home buyers accounted for NZ$1.04b (20.2%), rising 26% YoY, while investors borrowed NZ$1.15b (22.5%), surging 90% YoY. The number of new mortgage commitments rose 37% YoY to 14,122.

- Tomorrow we have ANZ Consumer Confidence, and Filled jobs

NEW ZEALAND: ANZ Survey Signals Soft Q1 But Likely Recovery Over 2025

ANZ February business confidence improved 4 points to 58.4, while the activity outlook was slightly lower at 45.1 after 45.8. The Q1 average of both measures though is below Q4 signalling a more cautious view on the economy going forward. In line with this, past own activity fell 3 points to -3, which ANZ notes is the best indicator of GDP. The RBNZ signalled this month that consecutive 25bp rate cuts are likely in April and May.

- Price and cost measures had ticked up in January. In February, cost & wage expectations eased and inflation expectations a year ahead moderated 0.2pp to 2.5%, but pricing intentions rose for the third straight month to their highest since April. The RBNZ noted that the weaker NZD was adding to inflation volatility.

NZ ANZ business price/cost components

- ANZ notes that manufacturers are saying that higher electricity prices are adding to cost pressures and that the weaker currency is also likely contributing to this.

- Past employment was little changed at -7.4, suggesting that Q1 jobs data is likely to stay soft. With employment intentions improving to 17.0, its highest since August 2021, the labour market should recover over 2025. The RBNZ expects the unemployment rate to decline to 4.9% by year end.

- Profit expectations were little changed, while investment intentions rose 3.5 points to 18.1. Export intentions were 2 points higher at 17.9. These indicators are consistent with a gradual recovery in the economy.

NZ growth outlook

FOREX: USD Index Firms Amid Fresh Tariff Threats, Yen Marginally Outperforms

The USD BBDXY index has ticked up to 1288.5, a modest 0.15% gain. Still, the technical picture for this index looks a little less adverse than it did at the start of the week. The USD is up against all of the G10 currencies, and also firmer against all of the Asian currencies as well.

- The US Wednesday session was buffeted by various tariff headlines from Trump and administration officials. In the wash up tariff announcements on Mexico and Canada could still take place next week, after earlier Trump remarks pointed to a delay. Trump also had strong rhetoric against the EU, proposing a 25% tariff.

- EUR/USD is off around 0.20%, last near 1.0465. EU equity futures are off close to 0.60% for Euro Stoxx.

- Higher beta plays are off 0.25-0.30%, with AUD and NZD slightly underperforming the rest of the G10. AUD/USD was last just under 0.6290, off 0.25%, which is fresh lows back to mid Feb. NZD/USD is near 0.5680, also around multi week lows.

- The A$ looked through RBA Deputy Governor Hauser’s comments before the Senate Economics Committee, which were in line with the February meeting statement and Governor Bullock’s press conference. Q4 Capex in Australia was weaker than forecast, pointing to a drag on GDP growth.

- USD/JPY has been supported below 149.00, with lows of 148.75. We have seen US yields tick higher, but JGB yields are also higher, biasing US-JP yield differentials lower. Yen is marginally outperforming the G10.

- US equity futures are lower for the Nasdaq, as the market digested the Nvidia result earlier. Headline earnings were better than forecast but this hasn't boosted aggregate sentiment.

- Later the Fed’s Barkin, Schmid, Barr, Bowman, Hammack and Harker all speak. Revised Q4 US GDP, preliminary January orders, jobless claims, February Kansas Fed manufacturing, euro area February EC survey, preliminary February Spanish CPI and ECB January meeting accounts are published.

ASIA STOCKS: Asia Equities Fall Following Tariff Talk & Nvidia Earnings

Asian equities are mostly lower today as investors reacted to Trump’s latest tariff announcements and disappointing earnings from Nvidia. Trump’s proposed 25% tariffs on the EU and delayed levies on Mexico and Canada, set for April 2, has seen volatility increase, while Nvidia’s lackluster results and warnings of tighter margins amid its Blackwell chip rollout failed to reassure markets. Equity indexes in China, Hong Kong, South Korea, Taiwan & fell, European futures slid 0.9%, and the USD strengthened, buoyed by tariff news while Bitcoin dropped to $84,000.

- HK & Chinese stockers are struggling today with the HSI down 1.05% and the HSTech Index down 2.50% after a tech-driven rally pushed benchmarks to multi-year highs yesterday. Major tech firms like Alibaba, Tencent, and Meituan saw declines. On the mainland, the CSI 300 and Shanghai Composite indices slipped 0.2% and 0.4%, respectively, as investors shifted focus to Chinese stocks amid U.S. tariff fears under President Trump, which raised concerns about inflation and growth.

- Japanese equities are mixed, with the tech heavy Nikkei slipping 0.10%, while the broader TOPIX trades 0.35% higher. Consumer Staples & Healthcare stocks are the worst performing sectors

- South Korea's KOSPI is trading -1.10% with Samsung & SK Hynix both slightly lower, with the 2.5% climb in the SOX overnight doing little to help the stocks today. Taiwan's TAIEX is -0.75% lower.

- Australia's ASX200 is trading 0.20% higher, with consumer Staples & Material stocks leading the way today, while New Zealand NZX 50 is the top performer in Asia today, up 0.75%.

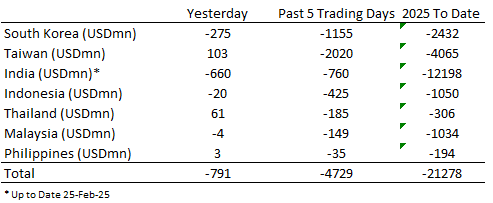

ASIA STOCKS: Foreign Investors Continue Selling Asian Equities

India continues to see heavy outflows with over $12b of outflows this year. Taiwan saw small inflows following a large outflows on Tuesday.

- South Korea: Recorded -$275m in outflows yesterday, bringing the 5-day total to -$1.16b. YTD flows remain negative at -$2.43b. The 5-day average is -$231m, worse than the 20-day average of -$99m and the 100-day average of -$112m.

- Taiwan: Posted $103m in inflows yesterday, bringing the 5-day total to -$2.02b. YTD flows remain negative at -$4.07b. The 5-day average is -$404m, significantly worse than the 20-day average of -$115m and the 100-day average of -$90m.

- India: Recorded -$660m in outflows Monday, bringing the 5-day total to -$760m. YTD outflows remain heavy at -$12.2b. The 5-day average is -$152m, better than the 20-day average of -$253m and the 100-day average of -$248m.

- Indonesia: Posted -$20m in outflows yesterday, bringing the 5-day total to -$425m. YTD flows remain negative at -$1.05b. The 5-day average is -$85m, worse than the 20-day average of -$41m and the 100-day average of -$33m.

- Thailand: Saw $61m in inflows yesterday, bringing the 5-day total to -$185m. YTD flows remain negative at -$306m. The 5-day average is -$37m, worse than the 20-day average of -$4m and the 100-day average of -$19m.

- Malaysia: Registered -$4m in outflows yesterday, bringing the 5-day total to -$149m. YTD flows are negative at -$1.03b. The 5-day average is -$30m, worse than the 20-day average of -$22m and the 100-day average of -$28m.

- Philippines: Recorded $3m in inflows yesterday, bringing the 5-day total to -$35m. YTD flows remain negative at -$194m. The 5-day average is -$7m, worse than the 20-day average of -$4m and the 100-day average of -$6m.

Table 1: EM Asia Equity Flows

OIL: Crude Range Trading As Outlook Clouded, Fed Speakers Later

Oil prices have traded in a very narrow range during today’s APAC session holding onto the week’s losses as markets remain worried about the impact of protectionism on global demand. WTI is up 0.1% to $68.71/bbl after falling to $68.68 and then rising to $68.90. Brent is 0.3% higher at $72.75/bbl after a low of $72.65 and a high of $72.84. The USD index is up 0.2% and pressuring dollar-denominated crude.

- US President Trump said that tariffs on imports from Canada and Mexico will still go ahead. He also attacked European trade practices and has threatened 25% tariffs on imports from the EU. Deadlines have changed and it remains unclear when they will be imposed with the details also uncertain.

- Uncertainty around trade policy is believed to have weighed on a number of recent US confidence surveys.

- While markets are currently focussed on the demand outlook, supply trends are also significantly clouded by sanctions and production goals. It appears very premature to expect increased Russian energy exports from a relaxing in sanctions following a Ukraine peace deal. Ukrainian President Zelensky is scheduled to meet Trump on Friday.

- Later the Fed’s Barkin, Schmid, Barr, Bowman, Hammack and Harker all speak. Revised Q4 US GDP, preliminary January orders, jobless claims, February Kansas Fed manufacturing, euro area February EC survey, preliminary February Spanish CPI and ECB January meeting accounts are published.

GOLD: Softer Backdrop As USD Firms

As confusion abounds on what happens next for tariffs, Gold took a breather today with some investors taking profit. We were last sub $2900 (near $2896), off around 0.70% from end Wednesday levels in the US ($2916.39). The 20-day EMA is back close to $2882.5.

- The USD is better bid, along with firmer US tsy yields, additional headwinds for bullion. Trump headlines from Wednesday suggested a possible delay to tariff announcements for Canada and Mexico next week, although the White House later stated no such decision has been made. US Commerce Secretary Lutnick also reiterated the April 2 date for reciprocal tariffs.

- Indonesia’s President Prabowo has indicated that the country is expecting to boost gold reserves in a growing theme amongst Central Banks globally.

- As South East Asia’s largest gold producer announced that state owned bank PT Bank Syariah Indonesia will open gold banking services in a bid to bring into the financial sector the estimated 1,800 tonnes of gold held privately in the country.

- Gold has gained in every trading week in 2025 but if this week’s current trend continues has the potential to deliver its first weekly decline of the year.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 27/02/2025 | 0745/0845 | ** | PPI | |

| 27/02/2025 | 0800/0900 | ** | Economic Tendency Indicator | |

| 27/02/2025 | 0800/0900 | *** | HICP (p) | |

| 27/02/2025 | 0800/0900 | *** | GDP | |

| 27/02/2025 | 0900/1000 | ** | M3 | |

| 27/02/2025 | 0900/1000 | ** | ISTAT Consumer Confidence | |

| 27/02/2025 | 0900/1000 | ** | ISTAT Business Confidence | |

| 27/02/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 27/02/2025 | 1000/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 27/02/2025 | 1230/1330 | Publication of MonPol Meeting Account | ||

| 27/02/2025 | 1330/0830 | * | Current account | |

| 27/02/2025 | 1330/0830 | * | Payroll employment | |

| 27/02/2025 | 1330/0830 | *** | Jobless Claims | |

| 27/02/2025 | 1330/0830 | ** | WASDE Weekly Import/Export | |

| 27/02/2025 | 1330/0830 | ** | Durable Goods New Orders | |

| 27/02/2025 | 1330/0830 | *** | GDP | |

| 27/02/2025 | 1415/0915 | Kansas City Fed's Jeff Schmid | ||

| 27/02/2025 | 1500/1000 | ** | NAR Pending Home Sales | |

| 27/02/2025 | 1500/1000 | Fed Governor Michael Barr | ||

| 27/02/2025 | 1530/1030 | ** | Natural Gas Stocks | |

| 27/02/2025 | 1600/1100 | ** | Kansas City Fed Manufacturing Index | |

| 27/02/2025 | 1630/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 27/02/2025 | 1630/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 27/02/2025 | 1645/1145 | Fed Governor Michelle Bowman | ||

| 27/02/2025 | 1815/1315 | Cleveland Fed's Beth Hammack | ||

| 27/02/2025 | 2015/1515 | Philly Fed's Pat Harker | ||

| 28/02/2025 | 2330/0830 | ** | Tokyo CPI | |

| 28/02/2025 | 2350/0850 | ** | Industrial Production | |

| 28/02/2025 | 2350/0850 | * | Retail Sales (p) | |

| 28/02/2025 | 0700/0800 | *** | GDP | |

| 28/02/2025 | 0700/0800 | ** | Retail Sales | |

| 28/02/2025 | 0700/0800 | ** | Import/Export Prices | |

| 28/02/2025 | 0700/0800 | ** | Retail Sales | |

| 28/02/2025 | 0700/0700 | BOE's Ramsden speech on MonPol in geopolitical fragmentation | ||

| 28/02/2025 | 0700/0700 | * | Nationwide House Price Index | |

| 28/02/2025 | 0730/0830 | ** | Retail Sales | |

| 28/02/2025 | 0745/0845 | *** | HICP (p) | |

| 28/02/2025 | 0745/0845 | ** | Consumer Spending | |

| 28/02/2025 | 0745/0845 | *** | GDP (f) | |

| 28/02/2025 | 0800/0900 | ** | KOF Economic Barometer | |

| 28/02/2025 | 0855/0955 | ** | Unemployment | |

| 28/02/2025 | 0900/1000 | *** | North Rhine Westphalia CPI | |

| 28/02/2025 | 0900/1000 | *** | Bavaria CPI | |

| 28/02/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 28/02/2025 | 0900/1000 | *** | Baden Wuerttemberg CPI | |

| 28/02/2025 | 1000/1100 | *** | HICP (p) | |

| 28/02/2025 | 1300/1400 | *** | HICP (p) | |

| 28/02/2025 | 1330/0830 | *** | GDP - Canadian Economic Accounts | |

| 28/02/2025 | 1330/0830 | *** | Gross Domestic Product by Industry | |

| 28/02/2025 | 1330/0830 | *** | CA GDP by Industry and GDP Canadian Economic Accounts Combined | |

| 28/02/2025 | 1330/0830 | *** | Personal Income and Consumption | |

| 28/02/2025 | 1330/0830 | ** | Advance Trade, Advance Business Inventories |