MNI EUROPEAN MARKETS ANALYSIS: Steady Start To The Week

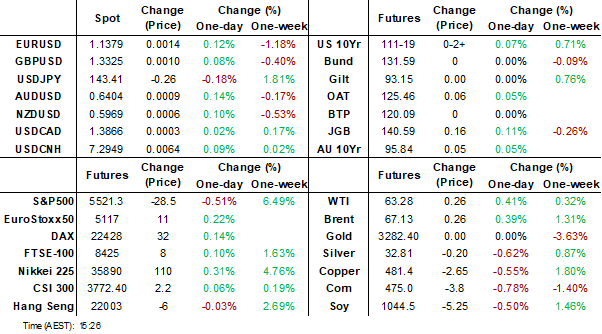

- It has been a relatively steady start to the week. US equity futures have weakened, but losses aren't large. The US 10-year yield is a little higher, dealing around 4.24%, up from its last close around 4.23%. Gold was down sharply, but is up from earlier lows. The USD index is close to unchanged.

- Markets remain focused on trade/tariff developments, but nothing major emerged today. China policy makers held a briefing on measures to support the economy and the jobs market, but no major stimulus announcements emerged.

- Later US April Dallas Fed manufacturing and UK April Nationwide house prices are released. ECB’s de Guindos presents ECB’s 2024 Annual Report. Oil markets will be monitoring Friday’s US payrolls.

MARKETS

US TSYS: Asia Wrap - Quiet Start

TYM5 has traded a little higher with a range of 111-18 to 111.22+ during the Asia-Pacific session. It last changed hands at 111-19, up 0.03 from the previous close.

- The US 10-year yield is a little higher, dealing around 4.24%, up from its close around 4.23%

- The US 2-year yield is up, dealing around 3.75%, up from its close around 3.748%.

- Risk has struggled to hold onto its gains leaking lower in Asia as the market gives back some of its gains made on Friday night.

- Bloomberg - “ Big tech earnings earnings estimates may be way too high, with analysts projecting an average of 15% profit growth for the magnificent Seven in 2025, despite recent market turmoil. Any hint of a shortfall in Microsoft, Apple, Meta and Amazon’s results this week will probably “cause a further selloff”.”

- US TSY: Block - Sell TYM5, SELL 3020 of TYM5 traded at 111-19+, post-time 01:36:55 BST (DV01 $193,162).

- The 10-year Yield, has put in a lower high around 4.40% and is attempting to break through the recent support around 4.25%. Should this give way the next support is towards the 4.10 area which should find supply once more as the market will continue to look for higher term premium while uncertainty remains elevated.

- Data/Events : US GDP, ISM Manufacturing, NFM payrolls the main events this week. Trump’s first 100 days in office speech tomorrow.

JGBS: Twist-Steepener, Market Closed Tomorrow, BoJ Decision Thursday

JGB futures are stronger, +16 compared to the settlement levels, hovering just below Tokyo session highs.

- (MNI) The BoJ board is expected to keep its 0.5% policy interest rate unchanged at the two-day meeting ending May 1, as policymakers monitor the economic and inflationary impact of recent U.S. trade policies and volatile markets.

- Greater clarity on the economic outlook – particularly regarding the U.S. economy and Fed policy – is expected by July, when the BoJ releases its updated medium- to long-term growth and inflation forecasts. Should the U.S. fall into recession, it would likely remove any chance of a BoJ rate hike this year.

- Cash US tsys are 1-2bps cheaper, with a flattening bias, in today's Asia-Pac session after Friday's solid gains. GDP, ISM Manufacturing and NFM payrolls are the main events in this week's US calendar. Trump's first 100 days in office speech is tomorrow.

- Cash JGBs are 1-2bps richer out to the 20-year benchmark and 1-3bps cheaper beyond. The benchmark 10-year yield is 2.1bps lower at 1.321% versus the cycle high of 1.596%.

- Swap rates are 1-3bps lower. Swap spreads are mixed.

- Tomorrow, the local market is closed for the Showa Day holiday.

AUSSIE BONDS: Richer A Data-Light Session, Q1 CPI On Wednesday

ACGBs (YM +3.0 & XM +5.0) are richer and near Sydney session highs on a data-light day.

- Cash US tsys are slightly mixed, with a flattening bias, in today's Asia-Pac session after Friday's solid gains.

- The focus of the week locally will be on Wednesday’s Q1 CPI, which is forecast to show the RBA’s preferred trimmed mean falling below the top of the 2-3% target band for the first time since Q4 2021. This should signal another 25bp cut on May 20. Retail sales are on Friday, and the Federal Election Saturday.

- Cash ACGBs are 4-7bps richer with the AU-US 10-year yield differential at -8bps.

- Swap rates are 6-8bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing -2 to +4.

- RBA-dated OIS pricing is flat to 5bps softer across meetings today. A 50bp rate cut in May is given a 12% probability, with a cumulative 118bps of easing priced by year-end.

- Tomorrow, the local calendar will see a speech from RBA Kent, Assistant Governor (Financial Markets) on Australia’s External Position and the Evolution of the FX Markets.

- The AOFM plans to sell A$1200mn of the 2.75% 21 June 2035 bond on Friday.

AUSTRALIA: Polls In Line With 2022 Election Signalling A Return Of Labor

The polls in the second half of April have been fairly steady with the average 2-party preferred estimated at 52.5% to 47.5% where it has been through the election campaign and close to the May 2022 result. If the surveys have accurately gauged voting intentions, then the incumbent centre-left Labor government (ALP) may retain a small majority but given that there is unlikely to be a uniform swing given the strength of local issues this time, it could easily find itself with a minority.

- Opinion poll results in the second half of April range from 50:50 (Freshwater) to 56:50 in favour of the ALP (Roy Morgan). A poll hasn’t shown the centre-right opposition LNP in front since late March (Freshwater).

- In terms of the primary vote, the average is showing the LNP on around 35% (+1pp from first half of April), ALP 34% (+2pp), Greens steady on 13%, One Nation 8% (+1pp) and others (includes green Teals) 12% (-1pp). Given standard errors around polling, these results are in line with the 2022 results.

- The Australian’s Newspoll shows that PM Albanese remains the preferred PM with 51% support with the opposition leader Dutton on 35%. Voters are net unsatisfied with both leaders with Albanese steady on -9% but Dutton down 2pp to -24%. Despite these results, only 39% of respondents believe that the government deserves to be returned but this is up 5pp on February. However, 62% think that the opposition LNP is not “ready to govern” up 7pp.

- Given that the ALP looks likely to retain government, it is worth noting that S&P warned that Australia’s AAA credit rating is threatened by the government’s large increase in off balance sheet spending. The Australian observes that it plans to increase this type of expenditure by close to $85bn over the coming 4 years.

BONDS: NZGBS: Bull-Flattener As Local Market Plays Catch-Up

NZGBs closed showing a bull-flattener, with benchmark yields 4-9bps lower.

With the local calendar empty, today’s moves reflected US tsys’ strong close to last week. The local market was closed on Friday for the ANZAC Day holiday.

- Cash US tsys are little changed in today's Asia-Pac session. GDP, ISM Manufacturing and NFM payrolls are the main events in this week’s US calendar. Trump’s first 100 days in office speech is tomorrow.

- “RBNZ increased its foreign currency intervention capacity to a record NZ$26.7b at the end of March as it sold New Zealand dollars.” (per BBG)

- The NZ economy will expand 0.5% q/q in 1Q, according to the latest results of a Bloomberg News survey. The RBNZ’s OCR is forecast to drop from 3.50% to 3.25% by end-2025.

- Swap rates closed 4-6bps lower, with 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings. 27bps of easing is priced for May, with a cumulative 82bps by November 2025.

- Tomorrow, the local calendar will see Filled Jobs data and a Pre-Budget speech from Finance Minister Willis.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 4.50% May-30 bond, NZ$150mn of the 4.25% May-34 bond and NZ$50mn of the 5.00% May-54 bond.

FOREX: G10 Wrap - USD Has A Quiet session

The BBDXY has had an Asian range of 1225.84 - 1227.93, Asia is currently trading around 1226. The headlines from the PBOC press conference aimed at stabilizing the economy and supporting the jobs market didn’t shift market sentiment greatly. It still appears more monetary stimulus is on the way, but the authorities will enact such moves in a timely manner. Bloomberg - “ECB: Klaas Knot told FD the June meeting will be “really complicated” due to uncertainty over US tariff policy and European fiscal plans."

- EUR/USD - Asian range 1.1340 - 1.1367, Asia is currently trading 1.1363. Intra-day support is around 1.1300, should this area not hold demand should remerge on dips back to 1.1100.

- GBP/USD - Asian range 1.3280 - 1.3312,the market seems happy to accumulate GBP on dips but the risk of a short-term retracement remains. Buyers should reemerge back towards the 1.3000/3100 area.

- USD/JPY - Asian range 143.35 - 143.88, has traded sideways for most of the Asia session. On the day the 143 handle should still see some supply, then more importantly the 145/146 area should once more offer good levels for sellers to reengage.

- USD/CNH - Asian range 7.2878 - 7.2986, the USD/CNY fix printed at 7.2043. USD/CNH continues to trade sideways and find support towards 7.2800, as it weakens in the crosses.

- Cross asset : SPX -0.52%, Gold $3293, US 10yr 4.23%, BBDXY 1226, Crude oil $63.31.

Data/Events : Spain Unemployment, Retail sales, ECB’s Guindos and Rehn Speak, US April Dallas Fed Manufacturing Activity.

Fig 1: EUR/USD Spot Daily Chart

Source: MNI - Market News/Bloomberg

FOREX: Antipodean Wrap - AUD & NZD Drift Sideways

Risk has struggled to hold onto its gains leaking lower in Asia as the market gives back some of its gains made on Friday night. (Bloomberg) -- RBNZ increased its foreign currency intervention capacity to a record NZ$26.7b at the end of March as it sold New Zealand dollars, according to data released by the central bank Monday. (Bloomberg) -- S&P Global Ratings warned Australia’s prized AAA sovereign credit rating may be at risk if election campaign pledges result in larger structural deficits, debt and interest costs, highlighting fiscal pressures facing the next government.

- AUD/USD - Asian range 0.6373 - 0.6407, AUD has traded sideways most of the Asian session. Dips back to the 0.6250/0.6300 area should continue to find demand while the market continues to focus on a lower USD.

- AUD/JPY - Asian range 91.54 - 92.04. Price goes into the London trading around 91.80, testing the highs within the last 10 days range of 0.8950/0.9200. Goldman’s like AUDJPY as the best vehicle to tactically express JPY strength.

- NZDUSD - Asian range 0.5943 - 0.5968, going into London trading around 0.5960. Demand should return first around 0.5900, then around the 0.5850 area.

- AUD/NZD - Asian range 1.0717 - 1.0737, the cross has drifted sideways in the Asian session. Watch for supply to return on any bounce back towards the 1.0800 area.

ASIA STOCKS: A Positive Regional Day ahead of Earnings

The focus this week will be on major China bank earnings as investors see if tariffs are impacting companies yet as markets show signs that the tariff threats may not be the driving forces in the week ahead. With over 400 companies reporting this week, investors will be looking for firsthand evidence that the trade war is impacting profitability.

As the press conference in China reiterated its commitment to jobs and support to the economy the government indicated that contingency plans are in place and that they remain 100% confident of achieving 5% economic growth.

- China’s major bourses were mixed today with the Hang Seng barely gaining up +0.07% whilst the CSI 300 was flat. Shanghai was down -0.03% and Shenzhen -0.72%.

- The KOSPI had a quiet start to the week in a week with significant data releases, rising just +0.16%.

- The FTSE Malay KLCI rose +0.65% to add to last week’s modest gains.

- The Jakarta Composite was up +0.72% today following on from last week's strong week where it gained +3.74%.

- In Singapore, the FTSE Straits Times was down -0.43% whilst the PSei in the Philippines rose +0.39%.

- India’s NIFTY 50 is up +0.90% in Monday’s trading, following on from last week’s poor end to the week with losses on Thursday and Friday

ASIA STOCKS: Strong Inflows to End Last Week

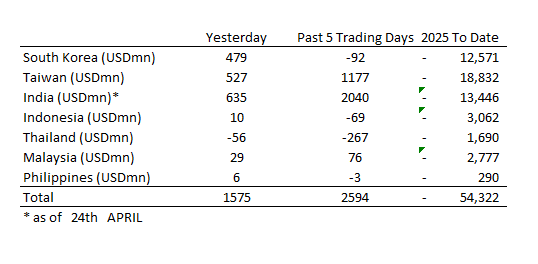

The ongoing theme of outflows took a breather at the end of last week as strong inflows were recorded across major markets.

- South Korea: Recorded inflows of +$479m as of Friday, bringing the 5-day total to -$92m. 2025 to date flows are -$12,571m. The 5-day average is -$18m, the 20-day average is -$424m and the 100-day average of -$151m.

- Taiwan: Had inflows of +$527m as of Friday, with total inflows of +$1,177m over the past 5 days. YTD flows are negative at -$18,832. The 5-day average is +$235m, the 20-day average of -$185m and the 100-day average of -$207m.

- India: Had inflows of +$635m as of the 24th, with total inflows of +$2,040m over the past 5 days. YTD flows are negative -$13,446m. The 5-day average is +$408m, the 20-day average of +$129m and the 100-day average of -$118m.

- Indonesia: Had inflows of +$10m as of Friday, with total outflows of -$69m over the prior five days. YTD flows are negative -$3,062m. The 5-day average is -$14m, the 20-day average -$63m and the 100-day average -$39m

- Thailand: Recorded outflows of -$56m as of Friday, outflows totaling -$267m over the past 5 days. YTD flows are negative at -$1,690m. The 5-day average is -$53m, the 20-day average of -$30m the 100-day average of -$21m.

- Malaysia: Recorded inflows of +$29m as of Friday, totaling +$76m over the past 5 days. YTD flows are negative at -$2,777m. The 5-day average is +$15m, the 20-day average of -$32m the 100-day average of -$38m.

- Philippines: Saw inflows of +$6m as of Friday, with net outflows of -$3m over the past 5 days. YTD flows are negative at -$290m. The 5-day average is -$1m, the 20-day average of -$5m the 100-day average of -$5m.

Gold Softer Again as Profit Takers Move In.

- Gold has kicked off the week with a fall in Asian trading, down -0.80% today.

- Up over 25% year to date on trade war concerns, gold is one of the best performing assets in what is proving to be a volatile start to the year.

- Reaching a new all-time high of US$3,423.98 this month, gold has surged through most predictions at the beginning of the year.

- Gold started the trading week this week in Asia at $3,325.21 and fell to $3,292.74

- Key central banks globally have reported increases to their gold reserves, boosting demand for the precious commodity whilst China’s Gold Association reported a 6% decline in gold consumption in Q1.

- Data out from the CFTC last Friday showed that Hedge Funds have reduced the number of their gold longs to the lowest level in one year indicating that the rally for now may be stalled.

- For now, all major moving averages are pointing upwards: a sign that the bullish momentum remains in place but with the CFTC positioning data, it is possible we could see a modest week for gold should trade war headlines not dominate.

OIL: Geopolitical Uncertainty Clouding Oil Outlook

Oil prices are moderately higher during today’s APAC session as markets watch and wait for progress on US trade negotiations. WTI is up 0.5% to $63.34/bbl off the intraday low of $62.88/bbl and Brent is +0.3% to $67.10/bbl after falling to $66.70 earlier. The USD index is off its high to be little changed on the day.

- The oil markets looked through today’s China economic press conference which included a statement that rates and the RRR would be reduced and that the 5% 2025 growth target is expected to be met.

- Geopolitical uncertainty is at the fore with significant uncertainty around US tariffs, threats to increase sanctions on Russia if it doesn’t reach a deal on Ukraine and ongoing US-Iran talks on Iran’s nuclear programme. In addition, with a meeting on May 5 the outlook for OPEC production is also unclear after the larger-than-expected increase in April.

- Later US April Dallas Fed manufacturing and UK April Nationwide house prices are released. ECB’s de Guindos presents ECB’s 2024 Annual Report. Oil markets will be monitoring Friday’s US payrolls.

CHINA: Industrial Profits Up in the Face of Trade Tensions

- Over the weekend China released their industrial profits for March.

- Rising +2.6% YoY this took the gain for the first quarter to +0.80%

- For China’s economy to gain momentum industrial profits need to strengthen, a move that would breathe confidence across businesses in the face of the trade war.

- Manufacturing companies focused on the technology space saw their profits rise +3.5% on the back of a decline of over -5% in the first two months of the year.

- More than 50% of sectors reported profit growth in March.

- On Friday China’s authorities stated that they are readying ‘emergency plans’ to protect the economy from external shocks on account of the US trade war as it aims to achieve 5% economic growth this year.

- The week ahead sees Manufacturing and Non-Manufacturing PMI’s released for April with market forecasts suggesting that manufacturing PMIs may slip into contraction.

ASIA FX: USD/CNH Drifts Higher, KRW Unwinding Some Of April's Outperformance

USD/CNH has drifted a little higher, but remains sub 7.3000 at this stage, so still well within recent ranges. Support is still seen in the low 7.2800 region, but earlier comments from the PBoC around continuing to maintain yuan stability, suggests any fresh upside in the pair will likely be gradual. Other comments from the authorities in China spoke about support for the economy, which after Friday's Politburo meeting. As expected, no major stimulus measures were announced today, as the authorities are likely waiting to see how the local data evolves and where tariff rates end up with the US. Local equities are little changed onshore and continue to show limited volatility.

- Spot USD/KRW has been supported on dips under 1436, while we have also found selling interest above 1440. Friday highs just above 1450 remain intact. The won has given back some of its outperformance in April over the past week, which is at odds with the generally softer USD tone and improved global equity backdrop. Still, CNH is lagging the broader USD sell off, while USD/JPY has rebounded around 1%, likely won headwinds. The softer economic backdrop may also be causing concern, given GDP growth is already negative ahead of higher tariff levels. The won is still up 2.3% this month, the best EM Asia FX performer.

- Spot USD/TWD continues to largely track sideways, the pair last just under 32.50.

INDIA: Country Wrap: RBI Confirms Growth Targets

- The RBI Central Bank has reiterated its economy is to expand at 6.5% this year, making it one of the leading sources of growth for the world economy (source BBG).

- Despite rising protectionism around the world, India remains committed to market reforms, according to Sanjay Malhotra, governor of the Reserve Bank of India. Speaking at an event organized by the Confederation of Indian Industry and the US India Strategic Partnership Forum on Friday, Malhotra pointed to the new liberalization measures in defence, insurance, petroleum, telecom, and space. (source Times of India).

- India's NIFTY 50 is up +0.90% in Monday's trading, following on from last week's poor end to the week with losses on Thursday and Friday

- The Rupee is one of the strongest in the region today gaining +0.15% at 85.31.

- Bonds are marginally weaker Monday with the IGB 10Yr 6.38% (+2bps)

CHINA: Country Wrap: Authorities to Support Exporters.

- China authorities will continue to support for exporters impacted by tariffs and will show greater urgency to shore up the economy said policymakers in a press conference in Beijing today (source BBG)

- China will lower RRR and interest rates based on domestic and international economic situation, to ensure ample liquidity, PBOC Deputy Governor Zou Lan says at a briefing today stating that China will step up efforts to implement more proactive macroeconomic policies and make full use of moderately loose monetary policy. (source BBG).

- China's major bourses were mixed today with the Hang Seng barely gaining up +0.07% whilst the CSI 300 was flat. Shanghai was down -0.03% and Shenzhen -0.72%.

- Yuan Reference Rate at 7.2043 Per USD; Estimate 7.2843

- China’s bonds eked out gains today with the CGB 10YR at 1.65% (-1bp today)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 28/04/2025 | 0600/0800 | ** | PPI | |

| 28/04/2025 | 1000/1100 | ** | CBI Distributive Trades | |

| 28/04/2025 | 1300/1500 | ECB's de Guindos Presenting 2024 Annual Report | ||

| 28/04/2025 | 1400/1000 | ** | housing vacancies | |

| 28/04/2025 | 1430/1030 | ** | Dallas Fed manufacturing survey | |

| 28/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 28/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 29/04/2025 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 29/04/2025 | 0600/0800 | * | GFK Consumer Climate | |

| 29/04/2025 | 0600/0800 | ** | Private Sector Production m/m | |

| 29/04/2025 | 0600/0800 | Flash Quarterly GDP Indicator | ||

| 29/04/2025 | 0600/0800 | ** | Retail Sales | |

| 29/04/2025 | 0700/0900 | ** | Economic Tendency Indicator | |

| 29/04/2025 | 0700/0900 | *** | HICP (p) | |

| 29/04/2025 | 0700/0900 | *** | GDP (p) | |

| 29/04/2025 | 0700/0900 | ECB's Cipollone On Financial and Trade Fragmentation | ||

| 29/04/2025 | 0800/1000 | ** | M3 | |

| 29/04/2025 | 0800/1000 | ** | ISTAT Consumer Confidence | |

| 29/04/2025 | 0800/1000 | ** | ISTAT Business Confidence | |

| 29/04/2025 | 0800/1000 | ** | ECB Consumer Expectations Survey | |

| 29/04/2025 | 0900/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 29/04/2025 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 29/04/2025 | 0940/1040 | BOE Ramsden At Innovate Finance Global Summit | ||

| 29/04/2025 | 1230/0830 | ** | Advance Trade, Advance Business Inventories | |

| 29/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 29/04/2025 | 1300/0900 | ** | S&P Case-Shiller Home Price Index | |

| 29/04/2025 | 1300/0900 | ** | FHFA Home Price Index | |

| 29/04/2025 | 1300/0900 | ** | FHFA Home Price Index |