MNI EUROPEAN MARKETS ANALYSIS: US Tsy Curve Steeper

- USD losses continued, led by EUR and the safe havens JPY and CHF. AUD and CNH lagged. Cash US tsys are showing a twist-steepener in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year.

- US equity futures have been volatile, sharply up from session lows, but not impacting broader risk appetite much. Regional equities are mixed, with Japan markets down, while Hong Kong is higher. In the commodity space, oil has underperformed this past week but gold is stronger.

- Looking ahead we have monthly UK GDP, as well as final inflation reads for Germany and Spain. In the US the PPI is out, along with the U.of Mich. sentiment reading.

MARKETS

US TSYS: Twist-Steepener As Chinese Retaliation Remains In Focus

TYM5 is dealing at 110-09, -0-10 from closing levels in today's Asia-Pac session, after hitting a low of 110-01.

- Cash US tsys are showing a twist-steepener in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year.

- Sentiment toward longer-dated US tsys has weakened this week, as markets grow concerned about potential Chinese retaliation in response to US tariffs on Chinese goods.

- US bond auctions will be closely monitored going forward given the sales are seen as the first line of offence should foreign central banks decide to reject US tsys. Nonetheless, if overseas holders are indeed buying fewer US tsys, or actually becoming net sellers, it could be a while before it clearly shows up in the data.

- To that end, yesterday’s auction of 30-year bonds was met with strong demand. The $22B 30Y auction re-open stopped through: 4.813% high yield vs. 4.838% WI; 2.43x bid-to-cover vs. 2.37x in the prior month. Peripheral measures saw an indirect take-up 61.88% vs. 60.45% prior; direct bidder take-up 25.82% vs. 22.65% prior; primary dealer take-up 12.30% vs. 16.89% prior.

- Aside from headline risk, the focus turns to Friday's data: PPI at 0830ET and University of Michigan Sentiment at 1000ET.

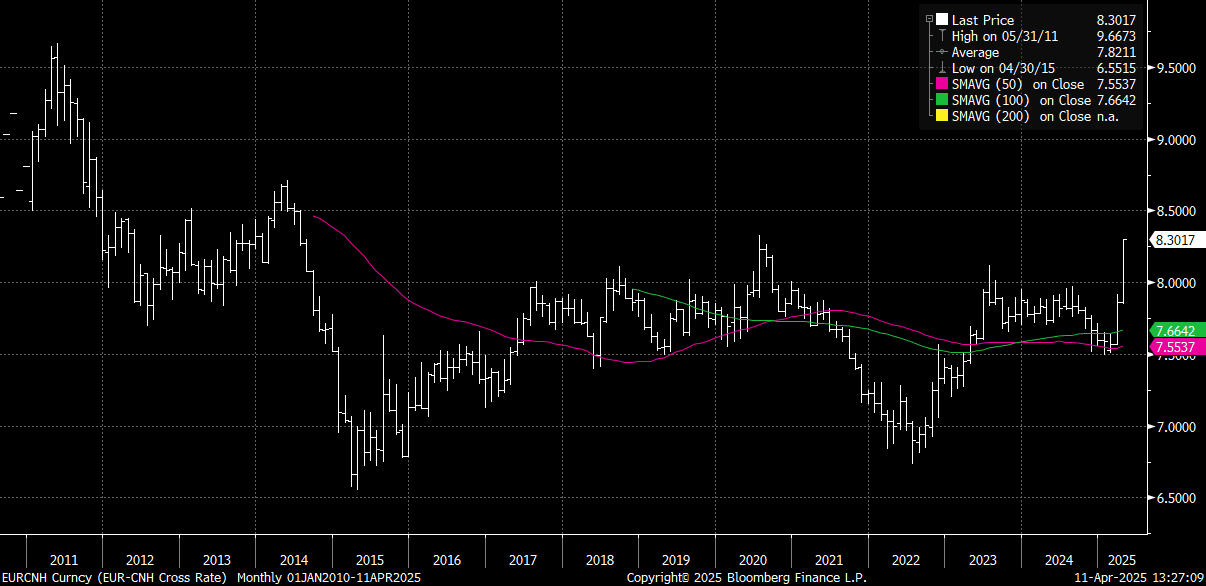

STIR: Mixed Performance In $-Bloc Over The Past Week

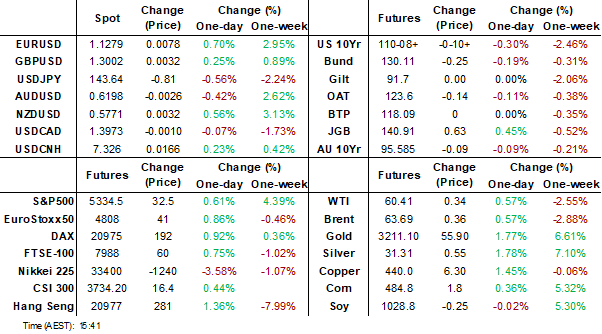

Rate expectations across the $-bloc through December 2025 posted a mixed performance over the past week, with Canada (+22bps) and the US (+7bps) firming, while Australia (-33bps) and New Zealand (-11bps) softened. Key developments included:

- Rising trade tensions: Investor concerns have intensified around a potential escalation in the US-China trade conflict. Following the latest tariff hike, China now faces an effective 145% tariff rate. This backdrop has supported the short end of global bond curves and STIR markets over the past week.

- The RBNZ cut the OCR by 25bps to 3.50% on Wednesday, as widely expected. This marked the fifth consecutive cut, with the RBNZ leaving the door open for further easing, citing global trade tensions as a key risk to both growth and inflation.

- On Thursday, US core CPI for March surprised meaningfully to the downside, coming in at 2.79% Y/Y (vs. 3.0% consensus), down from 3.12% in February. This marks the softest reading since March 2021.

- Looking ahead: The BoC policy decision is due on 16 April. Markets are currently pricing in just a 37% probability of a rate cut.

- Looking ahead to December 2025, the projected official rates and cumulative easing across the $-bloc are as follows: US (FOMC): 3.38%, -95bps; Canada (BOC): 2.34%, -41bps; Australia (RBA): 2.76%, -134bps; and New Zealand (RBNZ): 2.63%, -87bps.

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

AUSSIE BONDS: Light Calendar, Narrow Ranges, Twist-Steepener With US Tsys

ACGBs (YM +8.0 & XM -7.5) are holding a twist-steepener after dealing in narrow ranges in today’s Sydney session.

- The local calendar has been light apart from the AOFM's sale of A$600mn of the 2.75% 21 June 2035 bond, which showed solid demand despite this week’s souring in sentiment towards longer-dated US tsys. Markets have grown concerned about potential Chinese retaliation in response to US tariffs on Chinese goods.

- Cash US tsys are showing a twist-steepener in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year.

- Cash ACGBs are 8bps richer to 8bps cheaper with the AU-US 10-year yield differential at -4bps.

- Swap rates are 4bps lower to 11bps higher, with EFPs substantially wider.

- The bills strip is richer, with pricing +7 to +9.

- RBA-dated OIS pricing is 4-10bps softer across meetings today. A 50bp rate cut in May is given a 47% probability, with a cumulative 128bps of easing priced by year-end.

- The local calendar will be empty on Monday, ahead of the release of the RBA Minutes for the April Meeting on Tuesday.

- The AOFM plans to sell A$1000mn of the 3.50% 21 December 2034 bond on Wednesday.

BONDS: NZGBS: Followed Global Lead And Closed With Twist-Steepener

NZGBs closed showing a twist-steepening, with benchmarks 4bps richer to 9bps cheaper. The 2-year finished near its best while the 10-year closed near its worst. Nevertheless, the NZ-US 10-year yield differential narrowed 7bps on the day to +30bps.

- The local calendar was relatively light today even though the BusinessNZ Performance of Manufacturing Index fell to 53.2 in March from 54.1 in February.

- The NZGB short end was likely supported by Wednesday’s signalling by the RBNZ that there is room for further easing, citing global trade tensions as a threat to growth and inflation.

- The key driver of today’s market movements once again has come from abroad. Cash US tsys are showing a twist-steepening in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year. Aside from headline risk, the focus turns to Friday's data: PPI and University of Michigan Sentiment.

- Swap rates closed 4bps lower to 10bps higher, with implied swap spreads little changed.

- RBNZ dated OIS pricing closed flat to 6bps softer across meetings. 33bps of easing is priced for May, with a cumulative 84bps by November 2025.

- On Monday, the local calendar will see the Performance Services Index, Card Spending and Net Migration data.

FOREX Wrap - USD’s Move Lower Starts To Accelerate

Broad USD weakness overnight was given a tailwind from the CPI miss. The FED’s Kansas City President Jeff Schmid said he would be prioritizing reining in inflation, and is concerned about inflation expectations rising. The BBDXY has seen another leg lower in Asia as the market grapples with what many traders think is the end of US exceptionalism.

- EUR/USD - Asian range 1.1191 - 1.1383, Eur was bought from the start and was up almost 1.7% today, this is a very unusual move for Asia and points to some decent stops having been triggered as we break some big weekly resistance. These sort of moves normally have a decent correction as we head into London, but as the USD selloff intensifies the EUR looks to be one of the main beneficiaries.

- GBP/USD - Asian range 1.2968 - 1.3048, trading just off the day's highs going into the London session.

- USD/CNH - Asian range 7.2903 - 7.3347, tested below the 7.3000 area going into the fix but has since bounced very strongly from there. USD/CNH goes into the London open near the session highs. The market views a higher USD/CNH as one of the cleanest ways to express 145% tariffs being applied.

- USD/JPY - Asian range 142.89 - 144.64, was under pressure from the open making a low below 143.00 before some demand returned into the Japanese fix. It could not hold onto these gains and the appetite to buy JPY looks set to continue as the USD rout picks up pace. Huge support level around 140, a break here could see the move gather momentum though

- Cross asset : SPX flat, Gold 3213.00 + 1.17%, US 10yr 4.44%, BBDXY 1240, Crude oil 59.90.

- Data/Events : UK Ind Prod, UK Man Prod, Ger CPI, Spain CPI. In the US it will be PPI and the April read of U. Of Mich. consumer sentiment.

Fig 1: EUR/USD Spot

Source: MNI - Market News/Bloomberg

FOREX: Antipodean Wrap - AUD & NZD holding onto gains

The AUD and NZD have both held onto their respective gains, with the NZD price action in particular looking ominous as it extends to new highs in Asia. Broad USD weakness overnight was given a tailwind from the CPI miss. RBA governor Bullock urged patience while markets got a handle on tariff driven volatility, “it will take time to see how all of this plays out” (BBG).

- AUD/USD - Asian range 0.6204 - 0.6259, AUD retraced early from the overnight highs but good buying emerged back towards the 0.6200 area and it has traded with a solid bid from there moving above the highs to go into London around 0.6220.

- AUD/JPY - Asian range 88.81 - 90.12, AUD/JPY retraced early in the session breaking the overnight lows before buyers reemerged. Some consolidation after the big moves yesterday, price goes into the London open around 89.35

- NZDUSD - Asian range 0.5735 - 0.5800, NZD did not even get a dip before the overnight price action continued with a relentless bid, looking very much like a Time Weighted Algorithm being executed over the last 27/28 hours. NZD printing around 0.5800 going into London, the market is short and the price action poor, watch the 0.5850 area for the next potential level to trigger short covering risks.

- AUD/NZD - Asian range 1.0770 - 1.0862, the cross drifted lower in the Asian session breaking the overnight lows around 1.0810 and extending lower. The cross is going into London trading heavy as the NZD with a smaller liquidity pool is starting to outpace the AUD as shorts are beginning to be covered.

Fig 1: Spot NZD/USD

Source: MNI - Market News/Bloomberg

ASIA STOCKS: China Bourses Defy Tariffs Whilst Others Mixed.

China’s Hang Seng defied the ongoing tariff headlines to finish the week positively, whilst regional peers fell.

In what has been a challenging week for the region, some markets are down significantly and struggling again today.

- Leading China’s bourses, the Hang Seng is up +0.56% despite being down -9% on the week. The CSI 300 is marginally lower by -0.10%, and down just -3.3% for the week. Shanghai is up +0.12% whilst lower by -3.4% for the week and Shenzhen is up +0.33%, whilst lower by -5.9% on the week.

- Taiwan’s TAIEX is one of the strongest in the region today up +1.7%, but one of the biggest fallers for the week, down -9.2%

- The KOSPI has fallen again today by -0.90% and yet only down -1.7% for the week following Thursdays exceptionally rally.

- The FTSE Malaysia Bursa KLCI struggled again today, losing -0.5% and set to be down -3.3% for the week.

- Indonesia’s Jakarta Composite had a shortened, but challenging week and is up today by +0.22%, whilst down -3.1% on the week.

- India’s NIFTY 50 has opened very strong this morning, rallying +1.8% following a cut in rates by the RBI, yet is down -1.8% for the week.

ASIA STOCKS: Korea Has First Inflow of Month

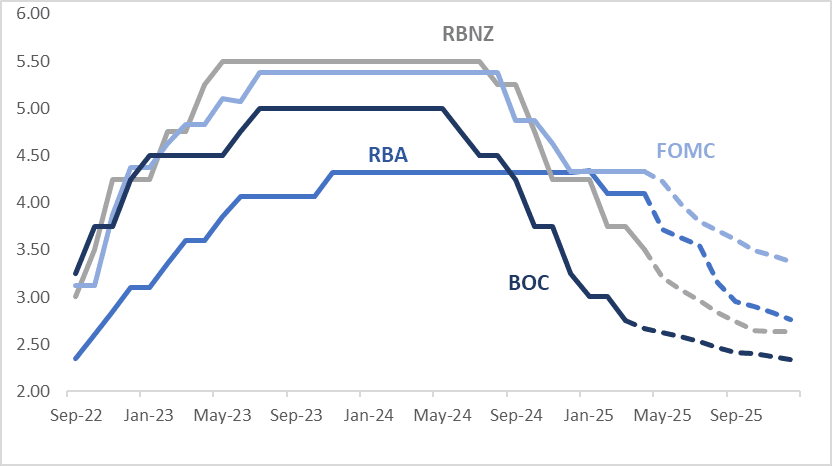

A period of significant outflows for Korea halted briefly with a meaningful inflow yesterday as other countries’ flows remain mixed.

- South Korea: Recorded inflows of +$300m as of yesterday, bringing the 5-day total to -$3,763m. 2025 to date flows are -$11,011, m. The 5-day average is -$753m, the 20-day average is -$276m and the 100-day average of -$152m.

- Taiwan: Had outflows of -$134m as of yesterday, with total outflows of -$472m over the past 5 days. YTD flows are negative at -$18,739. The 5-day average is -$94m, the 20-day average of -$335m and the 100-day average of -$253m.

- India: Had outflows of -$544m as of the 8th, with total outflows of -$2,421m over the past 5 days. YTD flows are negative -$15,958m. The 5-day average is -$484m, the 20-day average of -$36m and the 100-day average of -$149m.

- Indonesia: Had outflows of -$45m as of yesterday, with total inflows of -$145m over the prior five days. YTD flows are negative -$2,167m. The 5-day average is -$29m, the 20-day average -$43m and the 100-day average -$35m

- Thailand: Recorded inflows of +$28m yesterday, outflows totaling -$278m over the past 5 days. YTD flows are negative at -$1,361m. The 5-day average is -$56m, the 20-day average of -$24m the 100-day average of -$19m.

- Malaysia: Recorded inflows of +$26m as of yesterday, totaling -$488m over the past 5 days. YTD flows are negative at -$2,752m. The 5-day average is -$98m, the 20-day average of -$64m the 100-day average of -$40m.

- Philippines: Saw outflows of -$2m as of yesterday, with net outflows of -$81m over the past 5 days. YTD flows are negative at -$294m. The 5-day average is -$16m, the 20-day average of -$3m the 100-day average of -$6m.

Oil Hits New Lows as Sell Off Gathers Momentum.

- Oil’s sell off continued in Asia as new lows were hit.

- After a very strong rally Wednesday oil declined almost 4% yesterday, consistent with daily falls seen over the last few weeks.

- WTI finished the day at US$60.24 bbl a near term low, moving lower throughout the Asia trading day to reach $59.95; a loss of -3.3% for the week

- Brent opened at US$63.42, moving lower throughout to reach $63.20; a loss of -3.6% for the week

- The move has crashed oil through all major moving averages.

- All major moving averages are trending downwards indicating the bearish momentum is gathering pace.

- The US has dramatically cut is forecasts for the demand for oil demand globally with the EIA outlook forecasting 400k less demand than previously forecast.

- GS forecasts that the Saudi budget deficit could reach US$67bn on lower oil prices

- Kazakhstan is negotiating with its oil companies to reduce production to ensure compliance with OPEC+ limits.

- Fund managers have upped their shorts on oil to the highest level since 2018.

Gold Delivers Strong Weekly Gain.

- Gold’s rally to new heights continued today in Asia trading as tariff anxiety fueled the 'safe haven' status of bullion.

- The rally today may have many forecasters restating their year end expectations as gold blasted above US$3,200 for the first time.

- The 90-day tariff pause on higher tariffs on trading partners gave markets a short respite mid-week but concerns about the potential impact on global growth remain.

- Gold’s ascent was gradual throughout the trading day in Asia trading higher again at $3,215.10

- Gold is on course to deliver a weekly gain of over +5.5%, despite falling on Monday.

- Gold stocks too benefited from bullions ascent with the VanEck Gold Miners ETF up over +3.5% on Thursday, hitting new highs.

MALAYSIA: Country Wrap: I/P Drop Likely Distorted by Holidays

- Malaysia's industrial production I February rose by the slowest level since the end of 2023. Rising by just +1.5% it is the second successive month of moderation. The key contributor to the decline is the mining sector which is declining both on a year on year basis and monthly data. Manufacturing declined on a monthly basis too though. As the data release is February it is likely that a big contributor is the Lunar New Year holidays that greatly impacted the whole region over the early part of the month as well as a further domestic holiday. Malaysia's manufacturing sales rose +4.7% Y/Y in February from +3.5% Y/Y. The BNM next meets on May 08

- Chinese President Xi Jinping will visit Vietnam, Malaysia and Cambodia next week, Beijing's foreign ministry said Friday, on his first official foreign trip this year. Xi's tour of Southeast Asia will last from Monday until Friday, a foreign ministry spokesperson said. (source BBG)

- The FTSE Malaysia Bursa KLCI struggled again today, losing -0.5% and set to be down -3.3% for the week.

- MYR: the ringgit has had a strong finish to the week, gaining +0.75% to end flat for the week at 4.437.

- Bonds are finishing the week weaker with the MGS 10YR at 3.76%, +2bp today and for the week unchanged.

INDONESIA: Country Wrap: Minister Supportive of Economic Outlook

- The Minister for the Economy said that the import tariff policy by U.S. President Donald J. Trump opened up opportunities for growth of several local commodities not captured under tariffs, such as textiles and textile products (TPT) with Nike already requesting an online meeting with the government (source ID Biz)

- Indonesia’s economy remains resilient despite global uncertainties fueled by shifting geopolitical dynamics and U.S. trade tariff policies, which have disrupted the global trade environment. "Our Third Party Funds (DPK) is above 5 percent and credit distribution is above 10.42 percent. Our banking liquidity is maintained, with the loan to deficit ratio is good at 88.92 percent. We also see the capital adequacy ratio at 27 percent. So actually our banking is solid in the current period," according to the Minister for Economic Affairs. (source ID Biz)

- Indonesia's Jakarta Composite had a shortened, but challenging week and is up today by +0.22%, whilst down -3.1% on the week.

- IDR is stronger today by +0.17%, yet remains down by -0.8% for the week at 16,793.

- Bonds are higher in yield across the curve today with the 10YR at 7.065%, +2bp today

CHINA: Country Wrap: PBOC Meets with Regional Bank Heads

- Central bank officials from China, Japan and South Korea held meeting in Kuala Lumpur, discussing the impact of US tariff on the global and regional economy, according to a statement released by Chinese central bank. (source PBOC)

- China’s Commerce Minister on Thursday met with Saudi Minister of Commerce and G20 Presidency holder, South Africa’s Minister of Trade, Industry, and Competition strengthening ties following the imposition of tariffs by the US. (source Global Times)

- Leading China's bourses, the Hang Seng is up +0.56% despite being down -9% on the week. The CSI 300 is marginally lower by -0.10%, and down just -3.3% for the week. Shanghai is up +0.12% whilst lower by -3.4% for the week and Shenzhen is up +0.33%, whilst lower by -5.9% on the week.

- Yuan Reference Rate at 7.2087 Per USD; Estimate 7.3067

- China’s 10YR bond is finishing 6bps lower in yield at 1.65%

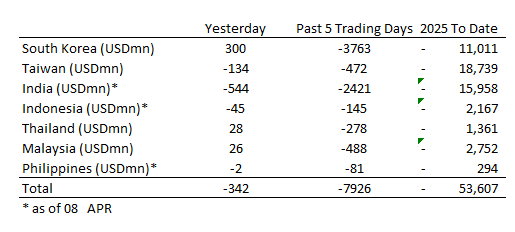

CNH: USD/CNH Supported On Dips, Underperforms Majors Amid Tariff Headwinds

USD/CNH has rebounded back above 7.3300, but sits slightly lower in latest dealings. We are still close to +400pips from earlier lows close to 7.2900. The USD/CNY fixing was little changed despite Thursday's sharp USD fall, which provided little fresh encouragement for further USD/CNH downside. Spot USD/CNY has also been supported on dips since the open as well, last above 7.3200.

- These moves come despite further USD index losses in the first part of Friday trade the BBDXY down a further 0.60%, albeit up from session lows.

- This is leaving CNH underperforming against the majors. CNH/JPY was last near 19.58, close to recent lows of 19.55. EUR/CNH has pushed towards 8.3000, with 2020 highs above 8.3300 within sight, see the chart below. Beyond that is the 8.5000 region.

- The US tariff level of 145% on China imports is aimed at pushing China towards the negotiating table, but at face value the two-sides still appear some distance from any meaningful discussions around a deal.

- China equities are providing relative outperformance, but until greater clarity is attained around the tariff outlook it may not mean much for CNH. US-CH yield differentials are also tracking higher, but shaky foundations in terms of broader ownership of US assets is certainly a factor. This suggests such spreads may not be that useful for determining USD/CNH trends in the near term.

Fig 1: EUR/CNH Looking At Multi Year Highs

Source: MNI - Market News/Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 11/04/2025 | 0600/0700 | ** | UK Monthly GDP | |

| 11/04/2025 | 0600/0800 | *** | Final Inflation Report | |

| 11/04/2025 | 0600/0700 | ** | Trade Balance | |

| 11/04/2025 | 0600/0700 | ** | Index of Services | |

| 11/04/2025 | 0600/0700 | *** | Index of Production | |

| 11/04/2025 | 0600/0800 | *** | HICP (f) | |

| 11/04/2025 | 0600/0700 | ** | Output in the Construction Industry | |

| 11/04/2025 | 0700/0900 | *** | HICP (f) | |

| 11/04/2025 | 0940/1040 | BoE's Saporta on 'How financial crisis reshape market and strategies’ | ||

| 11/04/2025 | 0945/1145 | ECB's Lagarde at Eurogroup Press Conference | ||

| 11/04/2025 | - | *** | Money Supply | |

| 11/04/2025 | - | *** | New Loans | |

| 11/04/2025 | - | *** | Social Financing | |

| 11/04/2025 | 1230/0830 | *** | PPI | |

| 11/04/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 11/04/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 11/04/2025 | 1400/1000 | St. Louis Fed's Alberto Musalem | ||

| 11/04/2025 | 1500/1100 | New York Fed's John Williams | ||

| 11/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 11/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 12/04/2025 | 0630/0730 | BoE's Greene on ‘The dynamics of monetary policy’ |