MNI EUROPEAN MARKETS ANALYSIS: USD Selling Continues

- The USD has remained under selling pressure, with USD/JPY the focus point. We are testing sub 140.00 as we approach the Asia Pac/London cross over. US equity futures have recovered modestly, while US Tsy futures remain under pressure. Trump comments from Monday raised further concerns around Fed independence.

- It has been a very quiet data day, with just NZ trade figures out. Regional equities has mostly outperformed the US sell off from Monday. Gold has stayed on the front foot and is eyeing a test above $3500.

- Later the Fed’s Jefferson, Harker, Kashkari, Barkin and Kugler appear with the focus likely to be on any comments related to central bank independence. April Philly/Richmond Fed indices and preliminary April euro area consumer confidence print. The ECB’s de Guindos speaks.

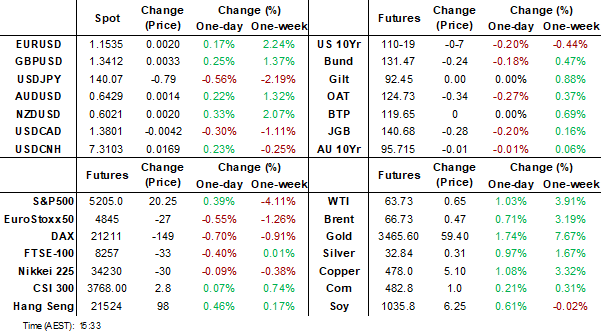

MARKETS

US TSYS: Asia Wrap - Yields Largely Unchanged

TYM5 has traded slightly lower with a range of 110-22 to 110-27+ during the Asia-Pacific session. It last changed hands at Heading 110-23, down 0.03 from the previous close.

- The US 10-year yield is unchanged, dealing around 4.41%

- The US 2-year yields is unchanged, dealing around 3.77%

- Risk has turned lower with concerns President Trump will fire Fed Chairman Jerome Powell adding to a market that is already consumed with uncertainty.

- “President Donald Trump warned the US economy may slow if the Federal Reserve doesn’t move to immediately reduce interest rates.”(per BBG)

- Dips back towards 4.25% support in US 10-years have found sellers first up as US yields continue to rise on fears of a rotation out of US assets.

- Data/Events : The IMF releases its World Economic Outlook, Fed Vice Chair Philip Jefferson as well as regional Fed chiefs Tom Barkin (Richmond), Neel Kashkari (Minneapolis) and Patrick Harker (Philadelphia) are scheduled to speak later Tuesday

JGBS: Mixed With Belly Underperforming

JGB futures are weaker but well above session lows, -28 compared to the settlement levels.

- The local calendar has been light today.

- "Bank of Japan officials see no need to change their stance on gradually raising interest rates despite US tariffs, as they wait for more data to analyse the impact. The BOJ is likely to hold its policy settings steady at its May 1 meeting and may cut its price forecast due to a stronger yen, cheaper oil, and economic weakness." (per BBG)

- "The impact of Donald Trump's tariff campaign has already filtered through to Japanese companies, with about 10% saying the measures have affected their businesses and more voicing concern on the future jolt, according to a MoF survey." (per BBG)

- Cash US tsys are ~2bps cheaper in today's Asia-Pac session after yesterday's long-end sell-off.

- Cash JGBs are mixed across benchmarks, with the belly underperforming (~3bps cheaper) and the 20-year the outperformer (~2bps richer). The benchmark 10-year yield is 3.0bps higher at 1.314% versus the cycle high of 1.596%.

- Swap rates are 1-2bps higher.

- Tomorrow, the local calendar will see Jibun Bank PMIs and the Tertiary Industry Index. PPI Services is due on Thursday.

AUSSIE BONDS: Holding A Twist-Steepener On First Trading Of The Week

ACGBs (YM +4.0 & XM -1.5) are mixed after pulling back from Sydney session highs on the first trading day following the Easter weekend. The local calendar was light today.

- Cash US tsys are ~1bp cheaper in today's Asia-Pac session after yesterday's long-end sell-off. Fed Vice Chair Philip Jefferson as well as regional Fed chiefs Tom Barkin (Richmond), Neel Kashkari (Minneapolis) and Patrick Harker (Philadelphia) are scheduled to speak later Tuesday. The IMF is also due to release its World Economic Outlook.

- Cash ACGBs are 1-6bps richer with the AU-US 10-year yield differential at -14 bps.

- Swap rates are flat to 4bps lower, with the 3s10s curve steeper.

- The bills strip has bull-flattened, with pricing +1 to +6.

- RBA-dated OIS pricing is 1-7bps softer across meetings today. A 50bp rate cut in May is given a 23% probability, with a cumulative 122bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- Tomorrow, the local calendar will see S&P Global PMIs alongside the AOFM planned sale of A$1000mn of the 3.25% 21 April 2029 bond.

BONDS: Modest Twist-Steepener To Start The Week

NZGBs closed showing a twist-steepener, with benchmark yields 2bps lower to 2bps higher.

- Cash US tsys are slightly cheaper, with a flattening bias, in today's Asia-Pac session after yesterday's long-end sell-off. Fed Vice Chair Philip Jefferson as well as regional Fed chiefs Tom Barkin (Richmond), Neel Kashkari (Minneapolis) and Patrick Harker (Philadelphia) are scheduled to speak later Tuesday.

- NZ recorded its third merchandise trade surplus in four months in March at $970mn up from $392mn. The YTD deficit narrowed to $6.13bn from $6.63bn. It has now declined around $11bn since the May 2023 peak. Both export and import growth were robust last month. Trade is a bright spot in NZ’s struggling economy but with a 10% tariff on goods to the US and an escalating US-China trade war the outlook is highly uncertain and likely to be negative.

- Swaps closed showing a bull-steepener, with rates 1-5bps lower.

- RBNZ dated OIS pricing closed flat to 3bps softer across meetings, with late 2025 / early 2026 leading. 27bps of easing is priced for May, with a cumulative 83bps by November 2025.

- Tomorrow, the local calendar will be empty.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 4.50% May-30 bond and NZ$250mn of the 4.25% May-36 bond.

NEW ZEALAND: NZ Continues To See Strong Export Growth, Outlook Clouded

NZ recorded its third merchandise trade surplus in four months in March at $970mn up from $392mn. The YTD deficit narrowed to $6.13bn from $6.63bn. It has now declined around $11bn since the May 2023 peak. Both export and import growth were robust last month. Trade is a bright spot in NZ’s struggling economy but with a 10% tariff on goods to the US and an escalating US-China trade war the outlook is highly uncertain and likely to be negative.

NZ merchandise trade balance $bn YTD

Source: MNI - Market News/LSEG

- Goods exports rose 0.6% m/m sa and 18.9% y/y with shipments strong to the two largest destinations China (+22.7% y/y) and the US (+21.8% y/y) while they were weak to Australia after a run of solid months (-0.5% y/y).

- Exports to the US have been trending higher since before Covid but they reached a new record level in March, as producers likely wanted to beat the imposition of US tariffs.

- Shipments of milk products, meat and machinery & equipment have driven the strength over the year. There was strong growth in milk products & fruit to China, while to the US it was meat.

- Imports fell 1.9% m/m sa in March but annual growth has been robust rising to 12.4%. The annual strength has been concentrated in consumer goods (+14.7% y/y) and non-transport capex (+8.3% y/y), while transport has been weak down 3% y/y, but does tend to be volatile.

- Q1 merchandise export values rose 11% q/q, while imports were up 4.1% q/q.

NZ goods exports y/y% 3-mth ma

FOREX: Asia Wrap - Back To Selling The USD

The BBDXY had an Asian range of 1218.32 - 1213.72. With hopes of any early trade deal fading and Trumps Powell comments adding further uncertainty, the market has very quickly returned to what is now becoming a consensus trade, sell the USD. An FT article quoted the Centre for European Reform - “ German support for its industry will create downstream demand for suppliers in other European countries that are reeling from Chinese competition and the threat of US tariffs. Adding that smaller countries could demand that Germany nudge its industry to build factories in other parts of Europe.”

- EUR/USD - Asian range 1.1482 - 1.1540, has traded better bid most of our session. Traders are targeting a move back to 1.2000 in the Euro as the USD’s safe haven role is reassessed. Dips back to 1.1450 should once again find demand.

- GBP/USD - Asian range 1.3362 - 1.3410, dealing near the session highs. GBP yesterday exploded higher through the previous week's highs around 1.3300. Expect buyers on dips to reemerge back towards 1.3250/1.3300.

- USD/JPY - Asian range 140.10 - 141.17,going into the London open dealing near the lows. A big break below 141.50/142.00 yesterday in low liquidity, currently testing the pivotal support around 140, a break here could see the move really accelerate, targeting 125/130.

- USD/CNH - Asian range 7.2923 - 7.3158, the USD/CNY fix printed at 7.2074. China has warned countries against striking deals with the US that could hurt Beijing’s interests, putting countries in a position where they will eventually have to pick a side. Watch EUR/CNH and CNH/JPY to really see the recent yuan underperformance.

- Cross asset : SPX +0.37%, Gold 3481, US 10yr 4.41%, BBDXY 1214, Crude oil 63.73.

- Data/Events : Spain Trade Balance, EC Govt Debt/GDP ratio, IMF releases its World Economic Outlook

Fig 1: EUR/CNH Spot Weekly Chart

Source: MNI - Market News/Bloomberg

FOREX: Antipodean Wrap - AUD & NZD Making New Highs

With hopes of any early trade deal fading, the market very quickly returned to what is now becoming a consensus trade, sell the USD. USD/CNH is stable but look at EUR/CNH and CNH/JPY to see how the Yuan is being managed lower. “ (Bloomberg) -- New Zealand exporters had a bumper start to the year, buoyed by a lower currency and higher global prices for key commodities such as milk powder and meat. Exports surged to a record NZ$20.6 billion ($12 billion) in the three months through March, Statistics New Zealand said Tuesday in Wellington. That’s a seasonally adjusted 11% jump from the fourth quarter and 19% more than the year-earlier period.”

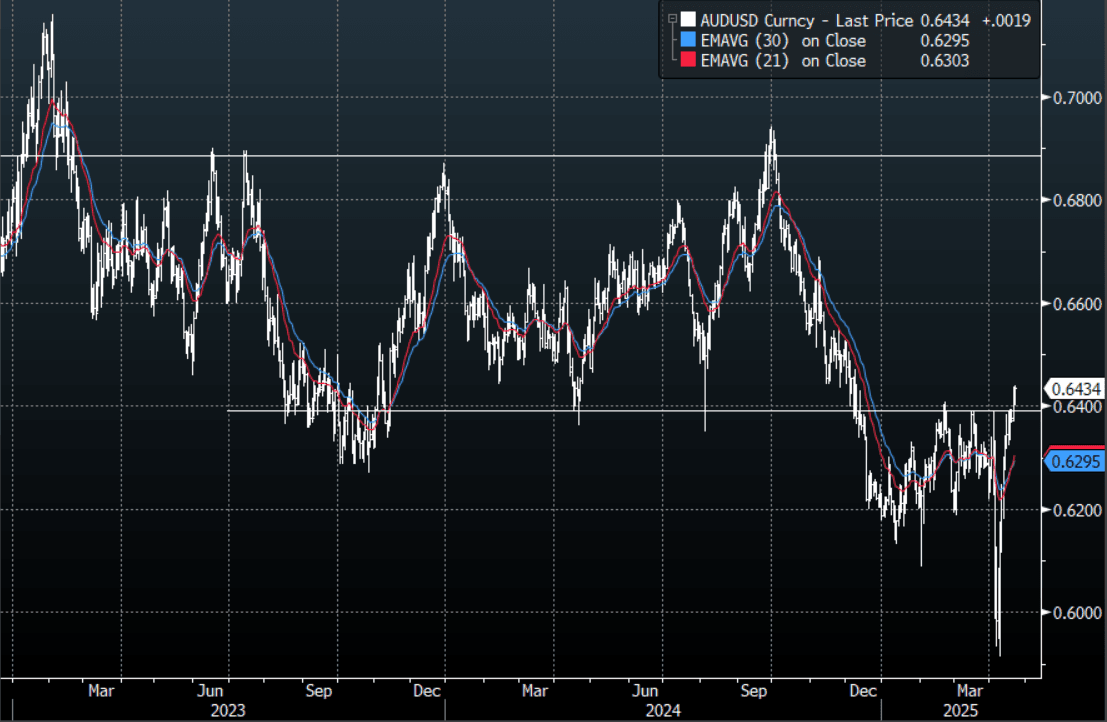

- AUD/USD - Asian range 0.6402 - 0.6436, AUD has traded better bid for most of the Asian session. After showing some signs of exhaustion at the end of last week the AUD has broken and held above the pivotal 0.6400 area. Dips back to the 0.6300 area should continue to find demand while the market obsesses about a lower USD.

- AUD/JPY - Asian range 90.12 - 90.57. Price goes into the London open towards the lows trading around 90.20, still firmly within last week’s range of 89.50-91.50. Support towards 90.00 continues to hold for now, a break through here and the downward trend could be reinstated.

- NZDUSD - Asian range 0.5981 - 0.6021, NZ exports hit a record on low currency and high commodities. The market is going into London pressing new highs. Thoughts of a reversion were fleeting as upward momentum is reignited. Expect buyers to return first around 0.5920/50, then around 0.5850/80.

- AUD/NZD - Asian range 1.0682 - 1.0706, the cross has drifted sideways in the Asian session.

Fig 1 : AUD/USD Spot Daily Chart

Source: MNI - Market News/Bloomberg

ASIA STOCKS: Mixed Trends, But Most Markets Outperforming Wall Street Falls

Asian equity markets have been mixed in the first part of Tuesday trade, although the major indices are outperforming the sharp cash losses US markets saw in Monday trade. US equity futures re-opened higher this morning in Asia Pac trade, but have only recaptured a fraction of the losses seen on Monday. Eminis were last around +0.35% higher.

- Japan markets are little changed, with a modest downside bias at this stage. The NKY 225 was off around 0.30%, but still holding above the 34000 level. Yen has continued to rally and is threatening to break through 140.00 against the USD. The Topix is little changed.

- Hong Kong markets have seen volatility, but the benchmark HSI is little changed, last just under 21400. This is within striking distance of recent April highs. The tech sub index is underperforming, down 0.50%. Bellwether China names like Meituan and JD.com have fallen amid reports of greater competition in the food delivery business (per BBG).

- Onshore China bourses are little changed, the CSI 300 holding under 3800.

- The Kospi is up modestly, but the Taiex is down 1.30%, underperforming broader region trends. Trade tensions were a factor weighing on TSMC, amid chip export control concerns

- In South East Asia, Singapore's benchmark index is up around 1.2%. Indonesian stocks are also outperforming, up close to 0.90% for the JCI.

OIL: Crude Higher But Down Sharply In April, Fed Speak Later

Oil prices are off today’s peaks but remain moderately higher although are holding onto most of yesterday’s losses. Benchmarks fell around 2% due to concerns of political interference in US monetary policy, which drove a pullback in risk. WTI is up 0.7% to $62.85/bbl down from the intraday peak of $63.25. Brent is 0.6% higher at $66.65 after reaching $67.05 earlier. They are down around 11% in April. The USD index is down another 0.2% after falling 0.7% on Monday.

- Markets continue to worry about the outlook for energy demand given increased protectionism and escalating trade tensions between the US and China at a time of expected excess supply. OPEC+ went ahead with its planned output increase in April, which was greater than expected which may have been because of pressure from President Trump to bring prices down.

- Not only are demand prospects highly uncertain, so is supply with talks between the US and Iran scheduled to resume on Wednesday. An agreement on Iran’s nuclear programme may result in an easing of sanctions. There could also be negotiations on a Ukraine-Russia truce in the coming week.

- Later the Fed’s Jefferson, Harker, Kashkari, Barkin and Kugler appear with the focus likely to be on any comments related to central bank independence. April Philly/Richmond Fed indices and preliminary April euro area consumer confidence print. The ECB’s de Guindos speaks.

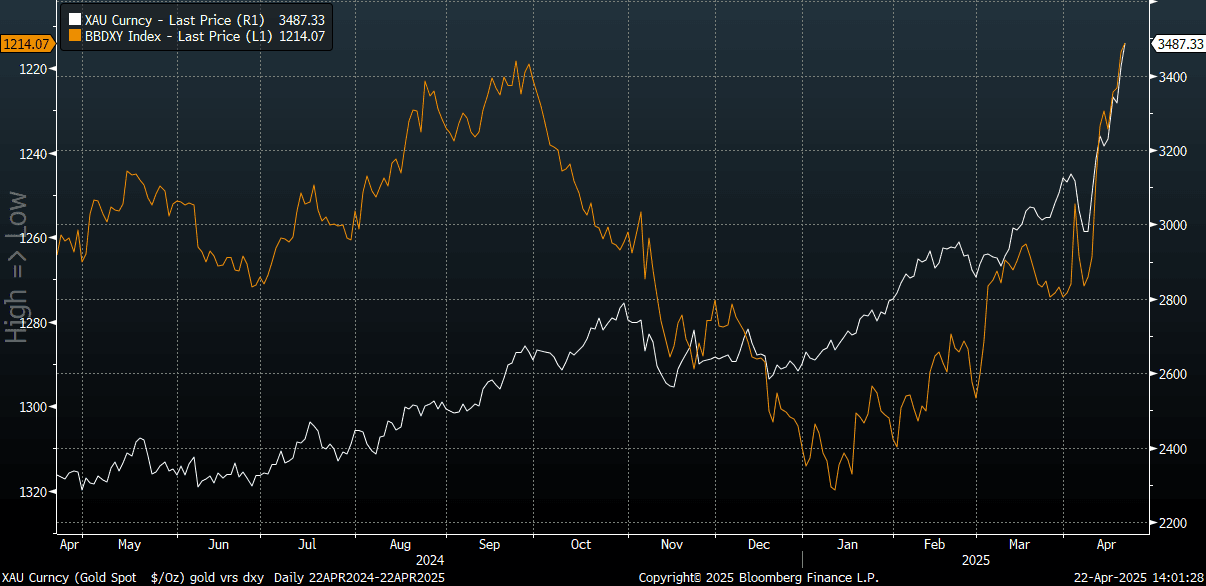

GOLD: Close To $3500, Moving In Line With USD Weakness

Gold is fast approaching the $3500 level. Session highs rest at $3494.8, while we were last near $3486/87, still up 1.8% for the session so far. Monday's gain for bullion was 2.92%.

- Gold is moving in lockstep with USD weakness, the chart below shows bullion plotted against the BBDXY index, which is inverted on the chart.

- The inability of the USD to sustain the earlier modest rebound has likely only added to gold's current bullish momentum. The USD remains firmly under pressure, with continued unwinding of US exceptionalism in focus.

- As we noted earlier, the RSI (14) on gold is comfortably into overbought territory, not at 79.6, but we are still under 2024 extremes for this metric.

Fig 1: Gold Spot Price & USD BBDXY Index (Inverse)

Source: MNI - Market News/Bloomberg

INDONESIA: MNI BI Preview-April 2025: Rupiah Keeps BI On Hold

Download Full Report Here

- Bank Indonesia (BI) meets on Wednesday April 23 and given recent volatility and USDIDR reaching new highs, it is likely to keep rates unchanged at 5.75%. Only 2 of 27 analysts surveyed by Bloomberg expect a 25bp cut.

- Given its FX stability mandate and IDR underperformance, it is likely to want to watch and wait and use other policy instruments apart from rates. BI continues to intervene in FX markets to support the rupiah but USDIDR is still over 2% higher than the March meeting.

- With inflation well contained, its focus is likely to remain on the currency especially given recent global developments, while it has the option to extend macroprudential policy if increased protectionism impacts growth.

- Confidence indicators turned down in March but remain robust but may deteriorate over coming months given that the US announced a 32% duty on imports from Indonesia. Talks are currently progressing, and Indonesian officials expect them to be completed within 60 days. Finance minister Indrawati said that the tariffs could reduce growth by up to 0.5pp.

ASIA FX: CNH Underperforming Continued USD Softness

In North East Asia FX, CNH has been a notable underperformer, particularly against key crosses like JPY. USD/KRW rose in early trade but found selling interest.

- USD/CNH has risen back above 7.3100, after opening around 7.2935. This is a CNH loss of nearly 0.30%. For USD/CNH we remain within recent ranges, as last week's high was near 7.3350. Still, with JPY up a further 0.50% so far today, it underpins CNH underperformance on key crosses against the yen and also EUR. Not helping CNH sentiment earlier was a modest uptick in the USD/CNY fix (despite Monday's further USD weakness). Implied CNH yields are also tracking lower, reducing costs to short the CNH. The 1 month was back to 1.25%, against recent lows under 1.0%.

- Spot USD/KRW got to highs of 1427.35 in the first part of trade, as the USD tried to find some support. However, this proved to be short lived, and we sit back at 1421/22 in latest dealings, little changed for the session. The Kospi is little changed for the session so far.

- Spot USD/TWD holds near 32.50 in latest dealings, slightly up for the session, but still close to recent lows (32.42 on April 15). The TWD, along with KRW, have outperformed a softer yuan trend so far in April, although the +6.5% gain in JPY has likely provided some offset. Local equity sentiment is still fragile, although the pace of outflow pressures from offshore investors has slowed compared to March.

- We have March export orders data later. The consensus expects the y/y print at 16.2% versus 31.1% prior. Recall yesterday we had the first 20-days of South Korean export growth slip into negative y/y territory. For TWD, a weaker export growth backdrop should be local currency negative, although current USD/TWD levels look to have already priced this to some degree.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 22/04/2025 | 0600/0800 | ** | Unemployment | |

| 22/04/2025 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 22/04/2025 | 1230/0830 | ** | Philadelphia Fed Nonmanufacturing Index | |

| 22/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 22/04/2025 | 1300/0900 | Fed Vice Chair Philip Jefferson | ||

| 22/04/2025 | 1330/0930 | Philly Fed's Pat Harker | ||

| 22/04/2025 | 1400/1000 | ** | Richmond Fed Survey | |

| 22/04/2025 | 1400/1600 | ** | Consumer Confidence Indicator (p) | |

| 22/04/2025 | 1700/1900 | ECB's De Guindos at MIT/ICADE Finance Club | ||

| 22/04/2025 | 1700/1300 | * | US Treasury Auction Result for 2 Year Note | |

| 22/04/2025 | 1740/1340 | Minneapolis Fed's Neel Kashkari | ||

| 22/04/2025 | 1830/1430 | Richmond Fed's Tom Barkin | ||

| 22/04/2025 | 2200/1800 | Fed Governor Adriana Kugler | ||

| 23/04/2025 | 2300/0900 | *** | Judo Bank Flash Australia PMI | |

| 23/04/2025 | 2301/0001 | * | Brightmine pay deals for whole economy | |

| 23/04/2025 | 0030/0930 | ** | Jibun Bank Flash Japan PMI | |

| 23/04/2025 | 0600/0700 | *** | Public Sector Finances | |

| 23/04/2025 | 0630/0730 | DMO remit revision following FY24/25 CGNCR | ||

| 23/04/2025 | 0715/0915 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0730/0930 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0730/0930 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (p) | |

| 23/04/2025 | 0800/1000 | ECB Wage Tracker | ||

| 23/04/2025 | 0830/0930 | *** | S&P Global Manufacturing PMI flash | |

| 23/04/2025 | 0830/0930 | *** | S&P Global Services PMI flash | |

| 23/04/2025 | 0830/0930 | *** | S&P Global Composite PMI flash | |

| 23/04/2025 | 0900/1100 | ** | Construction Production | |

| 23/04/2025 | 0900/1100 | * | Trade Balance | |

| 23/04/2025 | 1030/1130 | BOE's Pill speech at University of Leeds | ||

| 23/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 23/04/2025 | 1300/0900 | Chicago Fed's Austan Goolsbee | ||

| 23/04/2025 | 1330/0930 | St. Louis Fed's Alberto Musalem | ||

| 23/04/2025 | 1330/0930 | Fed Governor Christopher Waller | ||

| 23/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 23/04/2025 | 1345/0945 | *** | S&P Global Services Index (flash) |