MNI EUROPEAN MARKETS ANALYSIS: USD/JPY Testing Sub 147.00

- There has been a strong risk off tone in the equity space in response to the reciprocal tariffs, which were mostly higher than expected. US Tsys, and gold, have seen safe haven demand. Oil is down on growth fears.

- The USD initially spiked higher, but has unwound all of these gains in index terms. Yen has been the strongest performer, up 1.5%.

- The ECB’s de Guindos and Schnabel appear today and the latest meeting accounts are published, there are also European March services/composite PMIs and February PPI data.

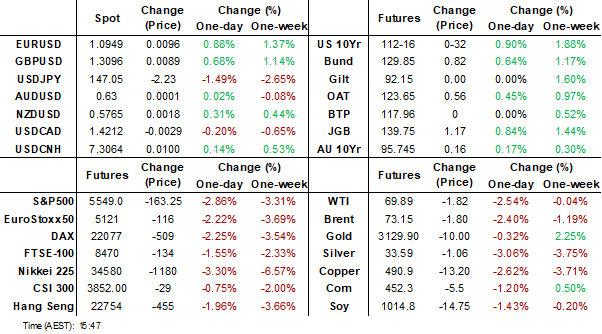

MARKETS

US TSYS: Cash Yields Gap Lower As Tariff Details Digested

US 10-year futures (TYM5) are dealing sharply higher in today's Asia-Pac session higher at 112-19, +1-02+ from closing levels.

- Cash Us tsys are dealing 5-8bps richer in today’s Asia-Pac session after finishing with modest gains yesterday following US President Trump's announcement on reciprocal tariffs.

- In early Asia Pac trading, there is a strong risk off tone, as markets digest the announcement. Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Yesterday, US tsys had been grinding cheaper going into the announcement but reversed direction to finish modestly richer. The US 2- and 10-year yields finished 2bps and 4bps lower respectively.

- Key US data tonight will be the ISM Services Index.

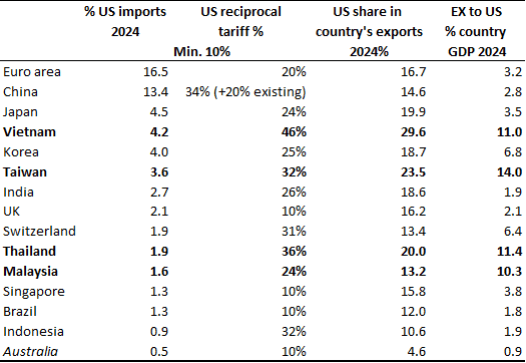

TARIFFS: Numerous Asian Countries To Be Hit Hard By US Tariffs

US President Trump announced reciprocal tariffs that will be a minimum of 10%, which was lower than feared, but some major trading partners will be hit badly. They are based on half of what the US faces including non-monetary measures, such as non-tariff barriers and currency manipulation. Of the 10 main providers of US imports, with the euro area counted as one, 7 are in the Asia region and merchandise exports are important to many of these economies. Trump said countries can reduce the penalty by cutting their barriers to the US.

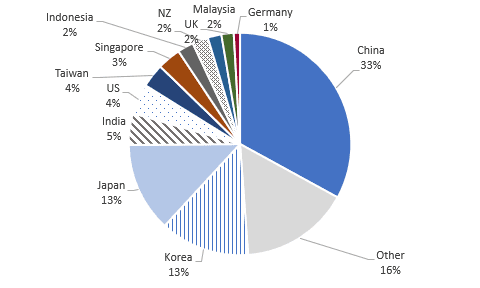

- The announcement included an additional 34% on China on top of the 20% already announced, which is the highest of all tariffs. China’s response will be watched closely. 13.4% of US goods imports come from China and they account for 14.6% of its exports in 2024 but only 2.8% of GDP. The impact on global growth of US trade policy may be more important to its economy and those countries that rely on it.

- Japan will face 24% on non-autos/parts and 25% on autos/parts (it is 2nd and 4th largest supplier respectively). This will hurt its exporting sectors but shipments to the US were only 3.5% of 2024 GDP.

- Korea is more exposed with exports to the US worth 6.8% of its 2024 GDP. It will face a 25% tariff. It is also the third largest supplier of imported private vehicles.

- Within Asia, Vietnam, Taiwan, Thailand and Malaysia are the most exposed and they will face significant tariffs which could hurt growth. Vietnam is one of the largest sources of US imports and production has shifted there from China recently but it is difficult to know how much is just passing through.

Exposure to US by country

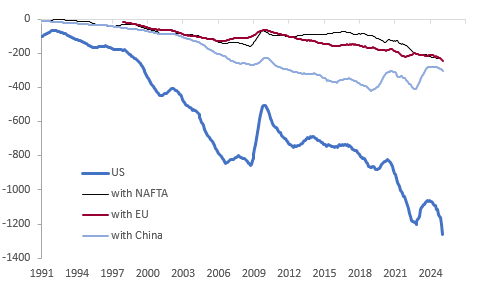

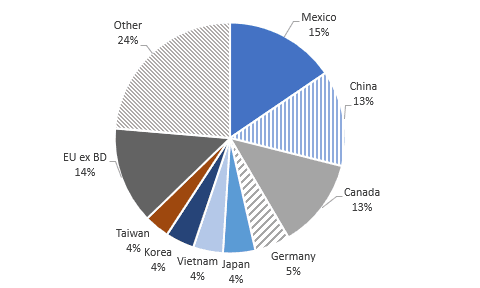

TARIFFS: Europe To Respond To US Later, Watching Pharma Developments

While Canada and Mexico were excluded from the US’ reciprocal tariffs, other non-Asian countries were targeted with rates above the minimum 10% set. USCMA compliant exports will continue to face 0% including autos and parts but non-compliant items face 25% and energy 10%. The EU provided 18.5% of US imports in 2024 and ran a surplus of $235.6bn rising $27bn from 2023 thus it isn’t surprising that it was targeted with a 20% tariff.

US merchandise trade US$bn 12m sum

- With the main sources of US imports facing an import tax of between 20% and 54%, imported inflation is likely to rise directly in the US and indirectly to others through supply chains. The question for central banks is if there will be second round effects.

- The euro area is the largest source of US imports with Germany the greatest provider. Around 16.7% of euro area exports went to the US worth 3.2% of 2024 GDP and tariffs will hurt specific sectors significantly, especially autos which will continue to face 25% (10.2% of 2024 US auto imports came from the EU). But the east coast of the US receives refined products from Europe and a 20% tax is likely to impact retail fuel prices materially.

- EU President von der Leyen will respond later today but some sectors including chemicals have requested that the region not retaliate. The group is likely to negotiate with the US and reduce some of its own barriers in a deal.

- Ireland is particularly exposed to pharmaceuticals accounting for almost 30% of US imports. The US said that tariffs on chips, pharmaceuticals, timber and copper are coming soon.

- The UK receives the minimum 10% as it runs a small deficit with the US but around 2% of GDP is exposed.

- Switzerland though faces 31%. This is likely to hurt the alpine economy with 13.4% of its 2024 exports going to the US worth 6.4% of GDP. It is also the second largest supplier of US pharmaceutical imports.

US imports by country % total 2024

JGBS: Sharply Richer Led By 7Y & 10Y, HH Spend Data Tomorrow

In Tokyo afternoon trade, JGB futures are sharply higher, +130 compared to settlement levels, and approaching session highs after paring gains into today’s 10-year auction.

- Today’s auction displayed mixed demand metrics, with the low price falling short of expectations at 99.87, according to the Bloomberg dealer poll. However, the cover ratio increased to 3.1475x from 2.6566x, the weakest since October 2021, and the tail shortened to 0.11 from 0.21.

- Nevertheless, futures have largely re-gained lost ground in afternoon dealing, assisted by cash US tsys, which are dealing 6-9bps richer in today's Asia-Pac session.

- There is a strong risk-off tone, as markets digest US President Trump's announcement on reciprocal tariffs. Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Cash JGBs are 6-14bps richer across benchmarks, with the futures-linked 7-year and 10-year leading. The benchmark 10-year yield is 13.0bps lower at 1.343% versus the cycle high of 1.596%, set last week.

- Swap rates are 7-13bps lower.

- Tomorrow, the local calendar will see Household Spending data.

AUSSIE BONDS: Sharply Richer, HH Spending & Nov-31 Supply Tomorrow

ACGBs (YM +17.0 & XM +15.5) are sharply higher and back near session highs.

- While the local calendar saw Trade Balance, Job Vacancies and PMI data, the focus has been abroad with markets digesting President Trump's reciprocal tariffs.

- Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Cash US tsys are dealing 6-8bps richer in today's Asia-Pac session. The US 10-year yield is currently at 4.05%, trading below the key 4.10% level, with the 3.60-3.80% zone as the next major support area.

- Cash ACGBs are 15-16bps richer.

- Swap rates are 13-15bps lower, with the 3s10s curve steeper.

- The bills strip has dramatically bull-flattened with pricing +7 to +17.

- RBA-dated OIS pricing is 4-17bps richer across meetings today. A 25bp rate cut in May is given a 91% probability, with a cumulative 86bps of easing priced by year-end.

- Tomorrow, the local calendar will see Household Spending alongside AOFM’s planned sale of A$600mn of the 1.0% Nov-31 bond.

AUSTRALIA DATA: Trade Surplus Trending Lower As Commodity Exports Fall

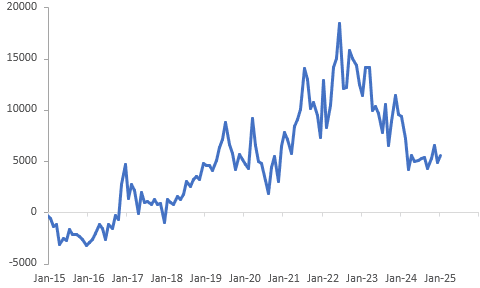

Australia’s merchandise trade surplus narrowed significantly more than expected to $2.97bn in February from $5.16bn as exports fell 3.6% m/m while imports rose 1.6%. This was the smallest surplus since August 2020 and after stalling in 2024, it appears that the downtrend may have resumed.

Australia merchandise trade balance $mn

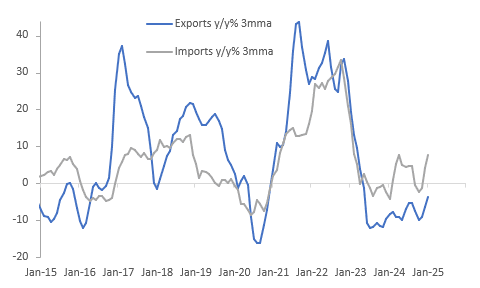

- Goods exports fell 6.6% y/y in February down from -3.6%. They have contracted for almost two years, predominantly driven by weak demand from China and a moderation in commodity prices.

- February’s drop in exports was due to a sharp fall in non-monetary gold, while rural goods saw a broad based increase of 4.4% m/m to be up 26.1% y/y. Non-rural goods fell 2.3% m/m and 16.2% y/y with key commodity shipments lower. The data is nominal.

- Import growth moderated to 4.2% y/y in February from 7.0%. The monthly rise was due to a 3.6% rise in capital goods, concentrated in the other component, which are now up 3.7% y/y. Consumer goods increased 1.8% m/m to be up 1.8% y/y. All major categories rose on the month except non-industrial transport equipment.

Australia goods exports vs imports y/y% 3-mth moving average

Source: MNI - Market News/ABS

AUSTRALIA DATA: Commodity Volumes Down, Exports To China Remain Weak

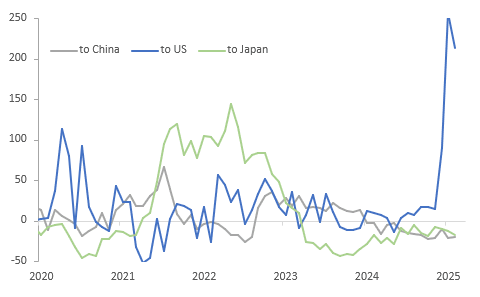

Australia’s merchandise exports remained soft to much of Asia while strong growth continued to the US and UK. There was a sharp rise in shipments to the US in Q1 as exporters aimed to beat the imposition of tariffs which take place from April 4.

- Australia will face the minimum universal 10% tariff, in line with Australia’s barriers to US goods according to Treasury calculations, with a possible ban on fresh beef in a tit-for-tat move.

- Exports to the US rose 213% y/y in February but the market accounted for only 4.6% of Australia’s 2024 exports worth less than 1% of GDP.

- The RBA this week didn’t seem concerned about the direct impact on Australia from US tariffs but was watching the effect on supply chains, and global & Chinese growth, Australia’s largest export destination, as well as any retaliatory measures. China will face 54% tariffs on its imports to the US.

- Australia’s goods exports to China fell 19.9% y/y in February, close to the October trough. Shipments to Japan fell 17.6% y/y and India was down 34.5% y/y due to lower gold purchases. Korea turned positive rising 6.7% y/y, NZ rose 4.8% y/y and the UK 64.7% y/y.

- Export volumes of Australia’s key commodities were lower in February, while unit values for coal and LNG were down but iron ore up. Quantities of coal were mainly driven down by India and Japan, while China and Japan bought less iron ore.

Australia goods exports y/y%

AUSTRALIA DATA: Vacancies May Have Resumed Downtrend

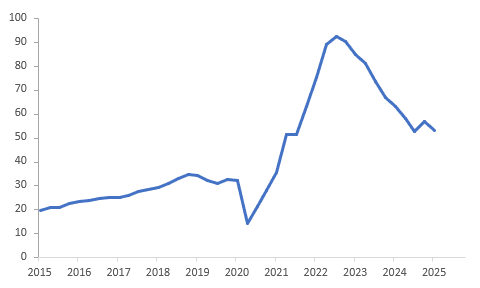

Q1 job vacancies fell 4.5% q/q following an upwardly-revised 5.2% q/q rise in Q4. It resulted in a 3.5pp drop in the vacancies/unemployment ratio, which signals an easing in the jobs market but it remains well above the historical average. The RBA said this week that “labour market conditions remain tight” and specifically mentioned “relatively low” underutilisation.

- The vacancy ratio fell to 53.4% from 57% in Q4, but was still above Q3’s 52.6%. It is now down almost 40pp from Q3 2022 peak of 92.7%. Q2 will indicate if the downtrend that stalled at the end of 2024 has resumed.

- Vacancies fell every quarter from Q3 2022 to Q4 2024 and the 4.5% drop in Q1 may suggest that was a blip. However, the RBA said in its April statement that surveys and its liaison “suggest that availability of labour is still a constraint for a range of employers”.

- The ABS said that the drop in February employment was due to fewer older workers returning to work. The fall in vacancies tentatively suggests that maybe some of their roles are not being refilled.

Australia job vacancies/unemployment %

BONDS: NZGBS: Closed Sharply Richer But Post-Tariff Gains Pared

NZGBs closed 6-11bps riche but well off session bests of 10-14bps richer. The move away from yield lows tracked the slight paring in gains by US tsys through today’s Asia-Pac session. Cash US tsys are currently dealing 5-7bps richer in today's Asia-Pac session.

- There has been a strong risk-off tone in today’s Asia-Pac session as markets digest US President Trump's announcement on reciprocal tariffs. That said, US equity futures are off their worst levels at the time of writing.

- Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Swap rates closed 6-10bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 2-6bps softer across meetings. 26bps of easing is priced for April, with a cumulative 77bps by November 2025.

- Tomorrow, the local calendar will be empty.

FOREX: USD Index Falls, Yen Outperforms, A$ & NZD Lag

The BBDXY opened just above 1270 and has quickly fallen to its lows around 1263, where we currently hover going into the London open. We are off around 0.60%. Dollar highs came not long after reciprocal tariffs were announced, which were generally above market expectations. China's total tariff rate will 54%, while the EU's is at 20%, Japan 24%. Lower US yields, coupled with sharp equity future falls, has further dented the US exceptionalism theme and weighed on the USD as the session progressed.

- JPY and CHF are the strongest performers. USD/JPY is down to 147.25/30 in latest dealings, 1.3% stronger in yen terms. USD/CHF was last near 0.8755/60, up 0.70% in CHF terms. For USD/JPY, downside focus may rest with 146.54 level, the Mar 11 low and bear trigger.

- Cross asset sentiment trades very poorly, with US equity futures around 3% down, huge demand for treasuries (cash yields down 6-8bps), while gold is continuing to make new highs.

- EUR and EU bloc currencies have also recovered strongly from earlier lows, while GBP is also up firmly.

- EUR/USD - after rejecting the initial move towards 1.0925 and moving back to 1.0805 as the true extent of the tariffs were unveiled, the EUR has spent most of the Asian session climbing back to once more challenge the 1.0925 area. An end to US exceptionalism, with hopes of further EU equity outperformance post the tariff news, may be a factor for EUR's rebound today.

- GBP/USD - goes into the London open trading at its highs around 1.03070

- AUD/USD - has not been able to challenge the highs it saw initially and trades someway off from 0.6341 to go into the London session around 0.6275, similarly with the NZD around 0.5740. Both currencies are being more challenged by some of their biggest export destinations being hit hardest by the tariffs, such as China.

- USD/CNH - a huge spike to print close to 7.3500 on the Tariff news, it has spent most of Asia giving back some of this move, no doubt helped by some smoothing by officials. China has committed itself to a stable currency and USD/CNH will continue to be managed to reflect that. The previous highs around 7.3650/3700 will be keenly watched. We were last near 7.3100, around +0.20% firmer versus end NY levels from Wednesday.

- Looking ahead, we get final PMI reads for the EU and UK. In the US, the ISM services print, along with initial jobless claims will be in focus. Country/region responses to the US reciprocal tariff announcement will also be a watch point.

ASIA STOCKS: Key Bourses Down on Tariff Announcement.

With the announcement of tariffs there was little place to hide for Asian stocks today with major bourses falling across eh region.

Gold stocks were one of the few bright spots with key gold stocks in Australia seeing gains of up to 5% whilst Gold related stocks in Hong Kong were up 4%.

The tariff announcement was worse than expected prompting a response from Chinese authorities vowing to enact measures in response.

- China’s key bourses were led lower by the Hang Seng which is down -1.5%, the CSI 300 down -1.3%, Shanghai down -0.50% and Shenzhen down -1.3%.

- Korea’s KOSPI is down for a second straight day. Having declined -0.6% yesterday, it has followed that up with a fall of -0.80% today.

- Malaysia’s FTSE KLCI Index had a very strong day yesterday after being closed for holidays but couldn’t back that up today falling -0.30%.

- In Singapore the FTSE Straits Times was one of the regions best performing bourses, down just -0.06%, whilst the Philippines fell heavily by -1.4% and after receiving some of the largest tariffs from the White House Vietnam’s index is down over -6%.

- India’s NIFTY 50 put in a strong day yesterday as ongoing speculation continues about a trade deal, but hasn’t been able to back that up in their morning trading session down -0.15%

ASIA STOCKS: Large Outflows from South Korea Dominate (amended)

As the world comes to grips with news of tariffs from the White House, flow data is disrupted at present due to South East Asian holidays, whilst outflows from Korea continue.

- South Korea: Recorded outflows of -$678m yesterday, bringing the 5-day total to -$2,629m. 2025 to date flows are -$6,255m. The 5-day average is -$526m, the 20-day average is -$110m and the 100-day average of -$112m.

- Taiwan: Had inflows of +$19m yesterday, with total outflows of -$3,124m over the past 5 days. YTD flows are negative at -$18,247. The 5-day average is -$625m, the 20-day average of -$505m and the 100-day average of -$256m.

- Thailand: Recorded inflows of +$46m yesterday, totaling +$12m over the past 5 days. YTD flows are negative at -$1,084m. The 5-day average is +$2m, the 20-day average of -$26m the 100-day average of -$17m.

- Malaysia: Recorded outflows of -$8m yesterday, totaling -$204m over the past 5 days. YTD flows are negative at -$2,249m. The 5-day average is -$41m, the 20-day average of -$53m the 100-day average of -$36m.

- Philippines: Saw outflows of -$5m yesterday, with net outflows of -$20m over the past 5 days. YTD flows are negative at -$214m. The 5-day average is -$4m, the 20-day average of +$2m the 100-day average of -$7m.

OIL: Crude Down Sharply On Global Growth Worries, Next Event US Payrolls

Oil prices are sharply lower today following the US announcement of reciprocal tariffs. Another 34% was added to the existing 20% tariff on China, the world’s largest crude importer. All US imports face a minimum 10% trade tax but US energy imports are exempt. Markets have been focussed on the impact of tighter sanctions on global oil supply but worries about the effect of tariffs on demand have returned with today’s statement. The USD index is down 0.6%.

- WTI is off its intraday low of $69.27/bbl reached early in the session but it is still down 2.4% today to $69.96 after breaking above $70 briefly. It has remained above initial support at $69.01, 20-day EMA.

- Brent troughed at $72.52/bbl earlier but has recovered to $73.24 to be down 2.3% on the day. The benchmark also remains above initial support at 72.29, 20-day EMA.

- Bloomberg reported that trading volumes during today’s APAC session have been above average across contracts for both benchmarks.

- With oil & gas exempt from US tariffs, the main impact on energy will be from slower global growth which will depend on any retaliatory measures. Some smaller countries, such as Malaysia, have said they won’t retaliate. The EU will negotiate but if that fails, it has a response planned. China has promised countermeasures but didn’t provide details. Despite the imminent implementation, it appears that major negotiations are ongoing.

- Supply uncertainty persists with OPEC saying it will be stricter on those exceeding quotas and Trump threatening both Russia and Iran.

- Later the Fed’s Jefferson and Cook speak and March Challenger job cuts, February trade, March services indices and jobless claims print. Given current heightened uncertainty, oil markets will focus now on Friday’s March payroll data.

- The ECB’s de Guindos and Schnabel appear today and the latest meeting accounts are published, there are also European March services/composite PMIs and February PPI data.

GOLD: Another Day, Another High for Gold.

- As the Federal Reserve left rates on hold and cautioned on inflation gold’s recent good performance continued, reaching new highs.

- Gold is up over 16% year to date and touched a new high of US$3,057.44, before giving up gains to finish at $3,044.89.

- Gold activity globally is heating up as the Swiss Federal Customs Administration released details of their exports to the US remaining elevated at 147.4 tonnes, over US$14bn in value whilst shipments to India and Hong Kong fell.

- Yesterday in China, the China Securities Journal ran an article warning retail investors on investing in gold as they expect prices to be volatile going forward.

CHINA: CAIXIN PMI Shows Services Growth Continued in March.

- CAIXIN PMI Shows Services Growth Continued in March.

- Activity in China’s services sector showed a market pickup in March from February.

- The CAIXIN PMI Services printed at +51.9, from +51.4 prior and above market consensus of +51.5.

- The Central Government has been very clear in making domestic demand their top priority with policies to revive consumption.

- Recent announcements include subsidized costs for childcare and measures aimed at boosting income.

- The employment component of the PMI fell again at a time when unemployment is at its one year peak.

- Further challenges within the release was prices charged continuing to fall.

ASIA: Tariff Calculations Suggest US Wants To Eliminate Trade Deficits

X is abuzz with various accounts pointing to the fact that the figure Trump has used to indicate tariff levels appear to reflect the US' trade deficit with a particular country divided by its imports from it. Our quick calculation shows this roughly aligns in for countries in EM Asia.

- It’s clear that Trump’s goal is tackling and eventually eliminating the trade deficit.

- South East Asian economies have been hit with relatively high reciprocal tariff rates. Headlines have crossed today from the Thailand PM around looking to negotiate with the US and that it is willing to incentivize the US to reach a deal (including lowering its trade surplus with

the US). - Malaysia has stated that it won’t launch retaliatory tariffs against the US.

- Vietnam wasn’t spared a spike in reciprocal tariffs, despite announcing earlier this week it would cut import tariffs.

Thailand has also said it would look to do the same today. - Vietnam equities are down sharply so far today, off nearly 6%. Losses are more modest elsewhere, but EM markets in SEA are

likely to remain a focus point. - They may not attract the same degree of flows like other markets do, such as the EU, if the market continues to price in an

end to US exceptionalism. The market may want to see how these economies fair

first and what can be negotiated. - Any weakness could also be exacerbated by traditional limitations in EM liquidity. These will be watch points for markets

as the fallout from Trump’s reciprocal tariffs continue to be assessed. It may also drive long lasting shifts in terms of economic alliances/trade and investment flows.

ASIA FX: USD Gives Back Some Of The Earlier Tariff Induced Gains

Focus has firmly been on fallout from the late Wednesday reciprocal tariff announcement from US President Trump. The USD is mostly higher, although moves have not been dramatic. Asian markets appeared to have suffered given mostly trade surpluses are run in the region against the US. Equity markets are down throughout the region, albeit not as dramatically as Japan markets or US equity futures (-2-3% weaker).

- USD/CNH rose to highs of 7.3484 through the NY/Asia Pac cross over. This followed headlines that China's reciprocal tariff of 34% would be on top of the 20% tariff level already imposed on China. We didn't see further upside though, with the pair mostly tracking lower since then. We were last near 7.3060. Upside focus in the pair is likely to rest around the 7.3500/7.3600 region. The China authorities spoke of retaliation, but no specifics were outlined. Local equities are lower, but losses are less than 1% at this stage.

- Spot USD/KRW opened above 1470 but quickly found selling interest. We were last near 1464.5, only down 0.15% in won terms for the session so far today. the authorities noted they would curb volatility/excessive market moves if necessary. We continue to see selling interest on moves above 1470 in this pair. Taiwan markets have been closed today.

- Spot USD/THB rose to fresh highs of 34.44, but sits back slightly lower now at 34.33, still down 0.50% in baht terms. Some catch up to USD gains were in play, while a high reciprocal tariff rate of 36% was also a likely headwind. The Thailand authorities vowed to support growth and negotiate with the US. A clean break above the 200-day EMA (34.36), which the pair couldn't sustain earlier, could see the high 34.00 region targeted.

- USD/MYR is also firmer, but at 4.4625, is only up 0.20% so far today and we remain within recent ranges.

- USD/PHP has actually drifted lower, the pair last near 57.10/15, close to March lows. The authorities noted its reciprocal tariff rate (17%) was lower than some other Asian peers.

INDIA: Country Wrap: Tariffs May Not Be A Setback - Commerce Ministry

- India's commerce ministry is analyzing the impact of the US's 26% reciprocal tariffs on imports, set to take effect in stages from April 5. While the tariffs are seen as a challenge, the government views it as a mixed situation and not a setback. India is negotiating a trade agreement with the US, aiming for a deal by fall 2025. (source: India Econ. Times)

- US President Donald Trump has imposed a 26 percent tariff on Indian imports, significantly impacting sectors like textiles, engineering goods, electronics, and gems and jewellery. The move is expected to erode margins for Indian exporters and prompt investors to shift funds to safer assets given the economic uncertainty. (source: India Econ. Times)

- India's NIFTY 50 put in a strong day yesterday as ongoing speculation continues about a trade deal, but hasn't been able to back that up in their morning trading session down -0.15%

- INR: the rupee is weaker in early trading by -0.15% at 85.64.

- Bonds: the bond market rally in recent weeks has been fueled by liquidity injection from the central bank. The market hasn’t reacted this morning to the market volatility with the IGB 10YR unchanged at 6.48%

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 03/04/2025 | 0630/0830 | *** | CPI | |

| 03/04/2025 | 0700/0300 | * | Turkey CPI | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0720/0920 | ECB's De Guindos On "Financial Stability In Uncertain Times" | ||

| 03/04/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0830/0930 | Decision Maker Panel data | ||

| 03/04/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 03/04/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 03/04/2025 | 0900/1100 | ** | PPI | |

| 03/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI | |

| 03/04/2025 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 03/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 03/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 03/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 03/04/2025 | 1630/1230 | Fed Vice Chair Philip Jefferson | ||

| 03/04/2025 | 1830/1430 | Fed Governor Lisa Cook | ||

| 04/04/2025 | 2330/0830 | ** | Household spending | |

| 04/04/2025 | 0545/0745 | ** | Unemployment | |

| 04/04/2025 | 0600/0800 | Flash CPI | ||

| 04/04/2025 | 0600/0800 | ** | Manufacturing Orders | |

| 04/04/2025 | 0600/0800 | *** | Flash Inflation Report | |

| 04/04/2025 | 0630/0730 | DMO announce Apr-Jun issuance operations | ||

| 04/04/2025 | 0645/0845 | * | Industrial Production | |

| 04/04/2025 | 0700/0900 | ** | Industrial Production | |

| 04/04/2025 | 0730/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 04/04/2025 | 0800/1000 | * | Retail Sales | |

| 04/04/2025 | 0800/1000 | ECB's De Guindos Gives Lecture In Barcelona | ||

| 04/04/2025 | 0830/0930 | ** | S&P Global/CIPS Construction PMI | |

| 04/04/2025 | 1230/0830 | *** | Employment Report |