MNI EUROPEAN MARKETS ANALYSIS: US$ Continues Downtrend

- The USD has traded very weakly across the board today in Asia driven by the USD/TWD. Asian holidays and thin liquidity have not helped but almost 8% in 2 days is an extreme event and you would expect buyers to reemerge sub 30.00.

- Several Asian regional currencies had very strong days today, with gains up over 1% as the ongoing thematic of USD weakness continued. Leading the way was the TWD which delivered over 4% of gains in one of its biggest gains in many years as equity flow data suggests that foreign flows are coming back. Taiwan's central bank to hold press conference on currency at 4.30pm local time.

- Oil prices are sharply lower today following OPEC’s decision on the weekend to increase output by more than 400kbd, close to the higher-than-expected amount in April.

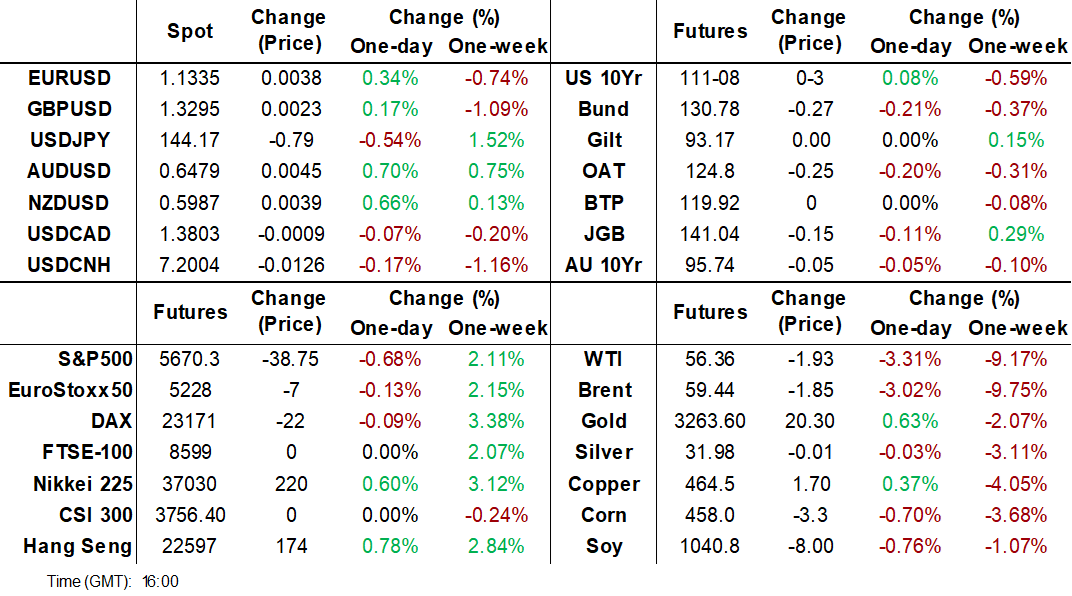

MARKETS

US TSYS: Asia Wrap - Futures Move Higher

TYM5 has traded higher within a range of 111-06+ to 111-13+ during the Asia-Pacific session. It last changed hands at 111-08, up 0-03 from the previous close.

- Futures are trading higher as another huge leg lower in USD/Asia driven by the USD/TWD drives price action in Asia. “Some speculation that Taiwanese life insurers hedging strategies for their US bond holdings may be responsible.”(per BBG)

- No cash market today with a holiday in Japan.

- Trump says - “NO PLANS TO TALK TO XI THIS WEEK, CHINA AND US OFFICIALS TALKING ABOUT 'DIFFERENT THINGS'”.(per BBG)

- Kato : “We are not considering the sale of US Treasuries as a means of Japan-US negotiations,” Kato spoke in Milan, Italy on Sunday, where he is attending the annual meeting of the Asian Development Bank.(per BBG)

- The 10-year Yield range seems to be 4.10% - 4.45%, with the pivot the 4.30% area for now.

- ISM Services data tonight will be important and will dictate price action tonight. Any move back towards a contraction will get the market worried about growth once more.

- Data/Events : US ISM Service PMI

AUSSIE BONDS: Cheaper, Bldg Apps & HH Spend Tomorrow

ACGBs (YM -5.0 & XM -5.5) are cheaper after a relatively subdued Sydney session. There was no cash dealing in US tsys in today's Asia-Pac session with a holiday in Japan. Today's US calendar will see the ISM Service PMI.

- Outside of the previously outlined ANZ job ads and MI inflation gauge, the local market has likely been digesting the weekend’s Federal Election. Opinion polls had underestimated support for the incumbent Labor (ALP) government.

- Cash ACGBs are 5bps cheaper.

- Swap rates are 5-6bps higher, with the 3s10s curve flatter.

- The bills strip has bear-steepened, with pricing -2 to -7.

- RBA-dated OIS pricing is flat to 7bps firmer across meetings today, with late 2025/early 2026 leading. A 50bp rate cut in May is given a 3% probability, with a cumulative 104bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- Tomorrow, the local calendar will see Building Approvals and Household Spending data.

- This week, the AOFM plans to sell A$300mn of the 4.75% 21 June 2054 bond on Tuesday, A$1000mn of the 3.75% 21 April 2037 bond on Wednesday and A$700mn of the 2.75% 21 November 2029 bond on Friday.

BONDS: NZGBS: Bear-Steepener To Start The Week

NZGBs closed showing a bear-steepener, with benchmark yields 3-6bps higher. NZGBs finished near cheaps on a domestic data-light session. There was no cash dealing in US tsys in today’s Asia-Pac session with a holiday in Japan. Today’s US calendar will see the ISM Service PMI.

- Trump says - “NO PLANS TO TALK TO XI THIS WEEK, CHINA AND US OFFICIALS TALKING ABOUT 'DIFFERENT THINGS'”.(per BBG)

- Kato : “We are not considering the sale of US Treasuries as a means of Japan-US negotiations,” Kato spoke in Milan, Italy on Sunday, where he is attending the annual meeting of the Asian Development Bank.(per BBG)

- Swap rates closed 3-4bps higher.

- RBNZ dated OIS pricing closed flat to 2bps firmer across meetings. 26bps of easing is priced for May, with a cumulative 76bps by November 2025.

- Tomorrow, the local calendar will see ANZ Commodity Price data.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 3.00% Apr-29 bond, NZ$175mn of the 4.25% May-36 bond and NZ$50mn of the 2.75% May-51 bond.

FOREX: G10 Wrap - USD/TWD Drives The USD Lower

The BBDXY has had an Asian range of 1219.84 - 1224.72, Asia is currently trading around 1221. Bloomberg - French PM Francois Bayrou plans to unveil a debt reduction and economic boost strategy, potentially seeking public approval through a referendum." The USD has traded very weakly across the board today in Asia driven by the USD/TWD. Asian holidays and thin liquidity have not helped but almost 8% in 2 days is an extreme event and you would expect buyers to reemerge sub 30.00.

- EUR/USD - Asian range 1.1297 - 1.1347, Asia is currently trading 1.1335. Intra-day support is around the 1.1250 area, should this area not hold demand should remerge on dips back to 1.1100.

- GBP/USD - Asian range 1.3260 - 1.3301, Asia is currently dealing around 1.3290. Intra-day support is around the 1.3250 area, then the pivotal 1.30/31 support is next.

- USD/JPY - Asian range 144.07 - 145.00, has drifted lower for most of the Asia session. Look for some support initially back towards 143.00, but we would probably need another catalyst to test below that again. Which probably makes a range of 143-147 for the week most likely.

- USD/CNH - Asian range 7.1893 - 7.2187, Chinese markets are shut for a holiday. The Longs in Usd/Asia are now capitulating, this was perceived to be the cleanest expression of the tariff trade but this move lower in USD/TWD is causing forced selling as stops are hit.

- Cross asset : SPX -0.75%, Gold $3257, US TYM5 111-08, BBDXY 1221, Crude oil $55.98.

- Data/Events : US ISM Services PMI

Fig 1: USD/TWD Spot Weekly Chart

Source: MNI - Market News/Bloomberg

BOJ: MNI BoJ Review – May 2025: Policy Unchanged With A Dovish Tilt

EXECUTIVE SUMMARY

- At its May 1 meeting, the Bank of Japan (BoJ) voted unanimously (9-0) to maintain its policy rate at 0.5%, citing increasing risks of a global economic slowdown, particularly in light of escalating US tariffs.

- In its Outlook Report, the BoJ downgraded its forecasts for real GDP growth and core inflation. The central bank also delayed its expected timeline for achieving its 2% inflation target.

- Despite the overall dovish shift, Governor Kazuo Ueda attempted to maintain a degree of flexibility in future policy moves. In his post-meeting press conference, Ueda emphasised that a delay in reaching the inflation target does not necessarily imply a delay in future rate hikes.

- The BoJ now appears to be in a more reactive posture, allowing for flexibility in response to global developments rather than committing to a predetermined tightening path.

- Reflecting the shift in the BoJ’s focus from domestic inflation to external risks, some market analysts have revised their expectations for the timing of the next rate hike. While earlier forecasts anticipated a move in the third quarter of 2025, this has now been postponed to the fourth quarter.

- In summary, the BoJ’s May meeting highlighted a more cautious and data-dependent approach amid mounting global uncertainties.

- Full review here:

FOREX: Antipodean Wrap - AUD & NZD Outperformance continues

The Asian session started off on the back foot with Trump commenting that he had “no plans to talk to Xi this week.” This weak start then got legs as we saw another huge leg lower in USD/Asia driven by the USD/TWD, which caused the USD to trade lower across the board. Asian holidays and thin liquidity have not helped but almost 8% in 2 days is an extreme event and you would expect buyers to reemerge sub 30.00.

- AUD/USD - Asian range 0.6434 - 0.6481, the AUD is currently dealing around 0.6460. The AUD popped up around 40 points on the USD/TWD open and has since drifted back off its highs as bids below 30.00 finally materialize in USD/TWD . The AUD looks to be building a solid bad base from which to move higher again, first target the 0.6600 area. A break below 0.6350 needed to negate this.

- AUD/JPY - Asian range 93.12 - 93.51, price goes into London trading around 93.25. AUD/JPY has had a powerful extension as shorts are pared back. Price is now moving towards testing the Weekly resistance seen between 94.00/96.00, sellers should remerge here.

- NZDUSD - Asian range 0.5940 - 0.5985, going into London trading around 0.5970. Like the AUD it benefited from the move lower in USD/TWD upon its open. On the day dips back to 0.5900 should continue to find support.

- AUD/NZD - Asian range 1.0814 - 1.0853, the Asian session currently trading 1.0825. Sellers have returned back towards the 1.0850 area.

Fig 1 : AUD/USD Spot Daily Chart

Source: MNI - Market News/Bloomberg

ASIA FX: Strong Day as USD Weakness Continues

Several Asian regional currencies had very strong days today, with gains up over 1% as the ongoing thematic of USD weakness continued. Leading the way was the TWD which delivered over 4% of gains in one of its biggest gains in many years as equity flow data suggests that foreign flows are coming back into the island nation. Taiwan's central bank to hold press conference on currency. Despite the KOSPI closed for public holiday the Won surged by +1.55% to 1,379.30 for the first time since October. The Malaysian ringgit delivered gains of +1.35% ahead of this weeks decision by the Central Bank and the Indian rupee has got off to a strong start on morning’s trade rising +.35% to be almost 2% higher over the last month as news of a potential trade deal with the US gives investors a boost. Missing out today despite the equity market being strong was the rupiah which languished where it started at 16,434

ASIA STOCKS: Mixed Day with Key Markets Closed

With the larger markets of South Korea and China out today for public holidays, those bourses open were mixed as currencies were the focus. Ongoing USD weakness saw regional currencies perform strongly with several up over 1% today.

- Despite a very strong day for the TWD, the TAIEX started the week on the backfoot down -0.75% today, following on from last week’s strong gains.

- In Malaysia, the FTSE Bursa Malaysia KLCI fell -0.45% following posting strong positive gains last week.

- The Jakarta Composite was up +0.50% following three successive weeks of very strong gains.

- Singapore’s FTSE Straits Times delivered modest gains of +0.10% as did the PSEi in the Philippines which rose +0.25%.

- India’s NIFTY 50 has enjoyed strong inbound FDI of late and lasts week rose +1.28% to mark three successive weeks of gains and has started this week off strongly up +0.50%

OIL: Crude Holds Onto Early Session Losses Following OPEC Decision

Oil prices are sharply lower today following OPEC’s decision on the weekend to increase output by more than 400kbd, close to the higher-than-expected amount in April. The market was already concerned about a surplus and then US tariffs were announced and now OPEC is adding more to supply. It appears to be now focused on increasing its market share rather than supporting prices and by allowing all members to increase output it is punishing overproducers.

- WTI is down 4.0% to $55.93/bbl in APAC trading off the intraday low of $55.30, below initial support at $56.39 but still above the bull trigger at $54.67. Brent is 3.7% lower at $59.03/bbl after falling to $58.50, holding above the bull trigger at $58.00 but below support at $59.30.

- Goldman Sachs has cut its oil forecast by $2-3/bbl in reaction to the further rise in OPEC production and Morgan Stanley has reduced its H2 2025 Brent projection by $5 to $62.50, according to Bloomberg.

- US President Trump said Sunday (ET) that there could be a number of trade deals completed this week. The main worry has been over the possibility of an agreement with China, the world’s largest oil importer, but Trump said that Chinese and US officials were talking about “different things”. He plans to travel to the Middle East this month.

- Later US services ISM/PMI data are released. The UK is closed.

GOLD: Gold Jumps on USD Weakness

- Gold jumps in Asian trading to deliver +0.45% gains as further USD weakness continued.

- Gold had its worst week since late February as news of potential trade agreements gave markets a boost and pushed some equity bourses back above pre tariff announcement levels.

- Gold was down -2.39% for the week, and opened today in Asia at US$3,239.76 rising to $3,255.46.

- South African miner Gold Fields Ltd will buy Gold Road Resources Ltd for a purchase price of A$3.7bn to conclude several weeks of negotiations.

INDONESIA: Broad Slowdown In Q1 Growth, Q2 Outlook Bleaker

Indonesian Q1 GDP was slightly weaker than expected, but well within the range of forecasts, falling 1% q/q nsa to be up 4.9% y/y down from Q4’s +5.0% y/y and the slowest since Q3 2021. With growth softening and inflation well within Bank Indonesia’s (BI) corridor, there is room to cut rates but only when it is confident of rupiah stability. President Prabowo is aiming for 8% growth.

- USDIDR is down 0.2% to 16395 today and 2.8% since the April 23 as the greenback has weakened but the BIS IDR NEER is up 0.7% since then signalling that, if sustained, the currency is moving in the right direction for BI to resume easing.

- Indonesia’s S&P Global manufacturing PMI fell sharply in April to 46.7 from 52.4, as US tariffs weigh on global trade and sentiment. Even if there is a deal to reduce the 32% US tariff on imports from Indonesia, the uncertainty since the April announcement is likely to weigh on Q2 growth.

- Private and public consumption growth slowed to 4.9% y/y in Q1 from 5.0% and -1.4% y/y from +4.2% respectively. GFCF was also weaker at 2.1% y/y after 5.0% in Q4.

Indonesia GDP y/y%

- Exports grew 6.8% y/y also slower than Q4 (+7.6%). Import growth fell to 4.0% y/y after 10.4%. Both fell on the quarter, not-seasonally adjusted though.

- February’s unemployment rate was relatively steady at 4.8% compared to a year ago, while the number of unemployed grew 1.1% y/y.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 05/05/2025 | 0630/0830 | *** | CPI | |

| 05/05/2025 | 0700/0300 | * | Turkey CPI | |

| 05/05/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 05/05/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI | |

| 05/05/2025 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 05/05/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 05/05/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 05/05/2025 | 1700/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 06/05/2025 | 0130/1130 | * | Building Approvals | |

| 06/05/2025 | 0145/0945 | ** | S&P Global Final China Services PMI | |

| 06/05/2025 | 0145/0945 | ** | S&P Global Final China Composite PMI | |

| 06/05/2025 | 0545/0745 | ** | Unemployment | |

| 06/05/2025 | 0645/0845 | * | Industrial Production | |

| 06/05/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 06/05/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 06/05/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 06/05/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 06/05/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 06/05/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 06/05/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 06/05/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 06/05/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 06/05/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 06/05/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 06/05/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 06/05/2025 | 0900/1100 | ** | PPI | |

| 06/05/2025 | - | FOMC Meeting | ||

| 06/05/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 06/05/2025 | 1230/0830 | ** | Trade Balance | |

| 06/05/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 06/05/2025 | 1400/1000 | * | Ivey PMI |