MNI EUROPEAN MARKETS ANALYSIS: Yen Crosses Down With Equities

- Regional Asia Pac equities have struggled today, particularly those markets exposed to the recent US auto tariff hike. Hong Kong markets have also fallen, with the tech sub index now 10% off recent March highs.

- This has led JPY to outperform, particularly against NZD and AUD. The Tokyo March CPI was also above expectations, while the BoJ Summary of Opinions showed a conflicted board. JGB futures are stronger and near session highs, +26 compared to settlement levels.

- Looking ahead we have UK GDP revisions and retail sales. In the EU French and Spain CPI prints. For Canada, monthly GDP is out, for the US we have the PCE price index and the U. of Mich index final read for March. Fedspeak from Barr and Bostic is also on tap.

MARKETS

US TSYS: Cash Bonds Holding Richer Ahead Of Liberation (Tariff) Day

In today's Asia-Pac session, TYM5 is 110-18, +0-04+ from closing levels.

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session after yesterday's modest gains.

- The markets remain choppy amid all the noise around the myriad fiscal policy dynamics. Tariffs remain at the forefront after President Trump announced 25% tariffs on auto imports, starting next week, aftermarket Wednesday.

- The tariffs will start on April 2, with revenue starting to be collected from April 3.

- “Investors are reducing risk and holding cash ahead of next week's tariff announcements, preparing to take advantage of opportunities if they arise. Volumes in Treasuries have fallen as traders refrain from taking big positions, with some looking to options trades for insurance before President Donald Trump unveils so-called reciprocal levies next week.” (per BBG)

- Today’s US calendar will see Personal Income & Spending, PCE Price Index, Kansas City Fed Services Activity and U. of Mich. Sentiment data. We will also hear Fed Speak from Barr and Bostic.

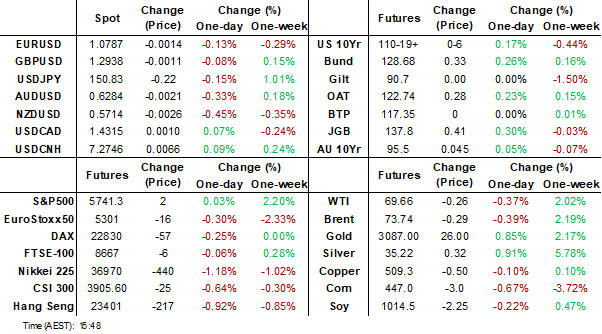

STIR: $-Bloc Markets Muted Over the Past Week Despite Tariff Headlines

In the $-bloc, rate expectations through December 2025 remained largely stable over the past week. Pricing firmed by 2–3bps in the US, Canada, and Australia, while New Zealand saw a 4bp softening.

- Ahead of next Tuesday’s RBA policy decision, February’s headline CPI (released Wednesday) rose 0.1% m/m (seasonally adjusted), bringing year-on-year inflation to 2.4%, down from 2.5% in January. Inflation has hovered around this level for the past three months.

- With various state and federal electricity rebates in effect, attention shifted to the underlying trimmed mean, which moderated by 0.1pp to 2.7% y/y. The Q1 inflation report is due on April 30, with the RBA forecasting core inflation at 2.7%. This outcome will be a key factor in the May 20 RBA decision.

- Elsewhere in the $-bloc, it was a relatively light week for data, though US fiscal policy dynamics, particularly tariffs, remained in focus. Ongoing expectations for two US rate cuts in 2025 continue to be driven by concerns that a collapse in sentiment could trigger a recession.

- Looking ahead to December 2025, the projected official rates and cumulative easing across the $-bloc are as follows: US (FOMC): 3.68%, -65bps; Canada (BOC): 2.28%, -47bps; Australia (RBA): 3.42%, -68bps; and New Zealand (RBNZ): 3.09%, -66bps.

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

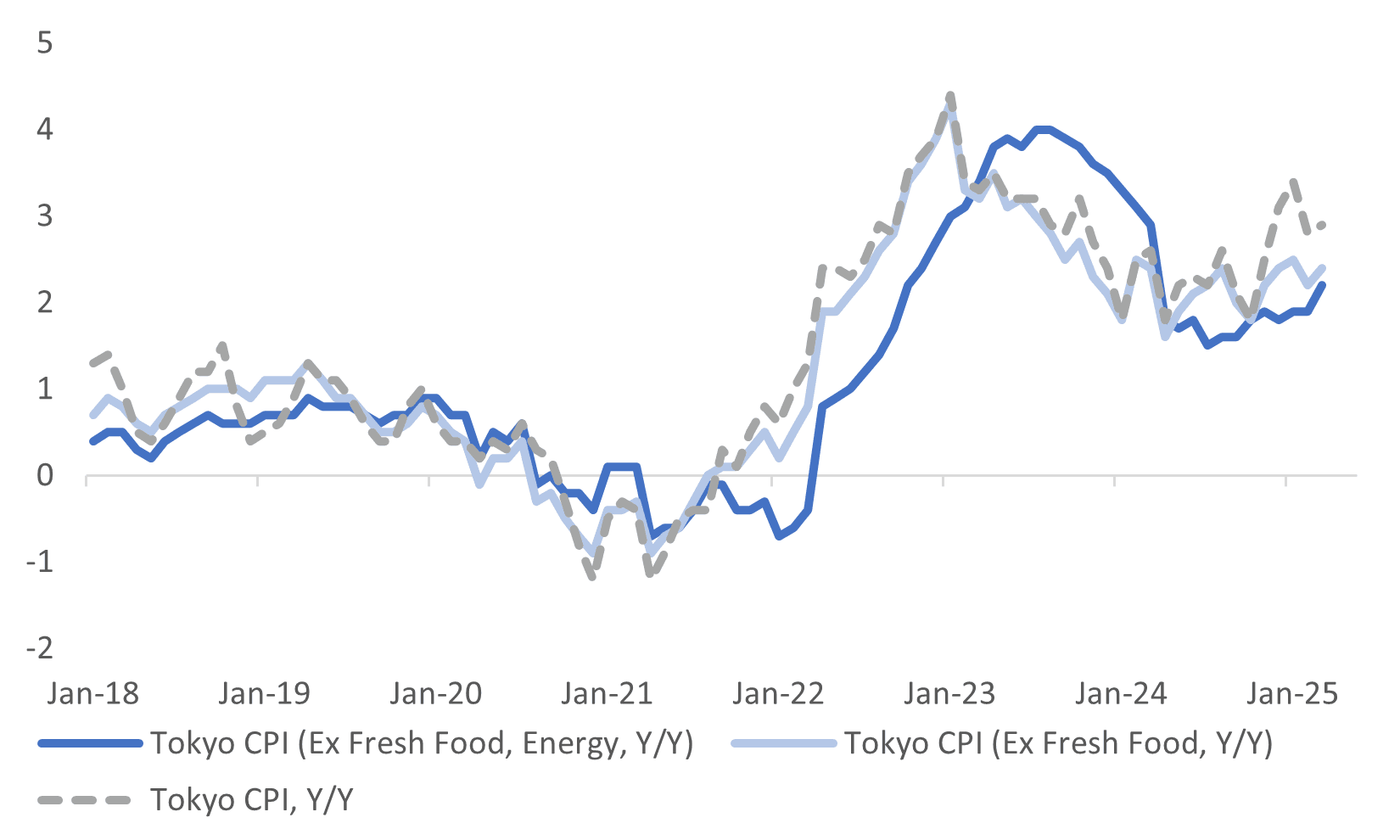

JGBS: Bull-Flattener, BoJ Members Have Mixed Views On Next Hike Timing

JGB futures are stronger and near session highs, +26 compared to settlement levels. The market gapped lower at the open after higher-than-expected Tokyo CPI data but reversed course following the release of the BoJ Summary Of Opinions for the March MPM

- At the March 18-19 meeting, BoJ board members showed mixed views on the optimal timing of the next rate hike in the face of improved underlying inflation but downside risks to the US economy.

- “Tokyo's March CPI data exceeded expectations, suggesting the underlying inflation trend may reach the Bank of Japan's 2% target by summer. The data supports the case for the Bank of Japan to raise rates further, with two more 25-basis-point rate hikes expected this year.” (per BBG)

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session. Today's US calendar will see Personal Income & Spending, PCE Price Index, Kansas City Fed Services Activity and U. of Mich. Sentiment data. We will also hear Fed Speak from Barr and Bostic.

- Cash JGBs have bull-flattened across benchmarks, with yields 1-5bps lower.

- Swap rates are 1-3bps lower.

- On Monday, the local calendar will see Jibun Bank PMIs alongside BoJ Rinban Operations covering 1-10-year and 25-year+ JGBS.

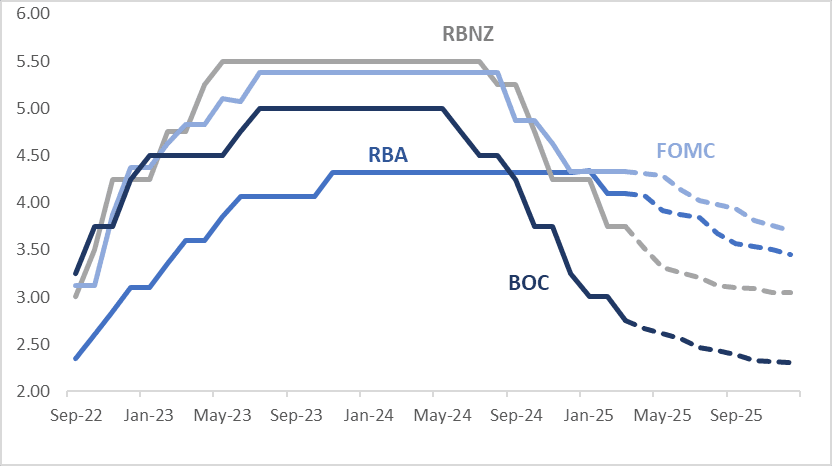

JAPAN DATA: Tokyo CPI Above Expectations, Services Inflation Edges Up

The Tokyo March CPI printed above market forecasts. The headline rose 2.9%y/y, versus 2.7% forecast. The prior month was revised down a touch to 2.8% (initially reported as a 2.9% rise). The ex fresh food measure was also above expectations at 2.4%y/y (2.2% was the forecast, which also the Feb read). The ex fresh food and energy measure rose 2.2%y/y, against a 1.9% forecast.

- The chart below plots these three metrics, all in y/y terms. The core print, ex fresh food, energy has been steadily rising and should add marginally to the BoJ's confidence around achieving its 2% target in the second half of the outlook period.

- In m/m terms, the headline rose 0.3%, while the core components were also positive m/m, reversing softer trends seen in Feb. Goods and services prices rose 0.3%m/m (seasonally adjusted). The core measure which excludes all food and energy was up 0.4%m/m, the firmest rise since August last year (but this data is not seasonally adjusted).

- By segment, food prices were up 0.3%m/m, after the Feb -0.9% fall. Fresh food prices were still down m/m. Other segments were mostly positive and firmer than Feb's pace. Notable was the 1.1%m/m rise in entertainment prices, while utilities rose 0.5%m/m, after Feb's sharp fall (due to govt energy subsidies). Clothing and footwear was up 1.6%m/m as well. Services prices increased 0.8% from the prior month's 0.6%.

Fig 1: Tokyo CPI Trends Y/Y - Firmer In March

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Richer & Dealing At Highs Ahead Of RBA Policy Decision (Tues)

ACGBs (YM +4.0 & XM +4.5) are richer and at Sydney session highs on a data-light session.

- Australia will hold a Federal election on May 3. The election is expected to be close, with cost of living issues the main focus point.

- (AFR) “With a helpful kick from the RBA’s first interest rate cut in February, Sydney and Melbourne house prices are climbing once again after modest recent declines.” (see BBG link)

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session.

- Cash ACGBs are 4-5bps richer with the AU-US 10-year yield differential at +11bps.

- Swap rates are 3bps lower.

- The bills strip has bull-flattened, with pricing flat to +5 across contracts.

- RBA-dated OIS pricing is flat to 4bps softer across meetings today. A 25bp rate cut in April is given a 4% probability, with a cumulative 64bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- On Tuesday, we will get the RBA's next Policy Decision.

- Next week, the AOFM plans to sell A$600mn of the 2.25% 21 May 2028 bond on Monday, A$800mn of the 3.75% 21 May 2034 bond on Wednesday and A$600mn of the 1.00% 21 November 2031 bond on Friday.

BONDS: NZGBS: Closed Richer & Near Session Bests, CC Weakened

NZGBs closed richer and near-session bests despite a late spike higher. Benchmark yields finished -3bps versus session bests of 4-5bps lower.

- Outside of the previously outlined consumer confidence and jobs filled data, there hasn't been much by way of domestic drivers to flag.

- The NZ-US 10-year yield differential finished a choppy week -3bps at +21bps and sits just below the widest level for the year and back at November 2024 levels.

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session. The markets remain choppy amid all the noise around the myriad fiscal policy dynamics. Tariffs remain at the forefront after President Trump announced 25% tariffs on auto imports, starting next week, aftermarket Wednesday.

- Today’s US calendar will see Personal Income & Spending, PCE Price Index, Kansas City Fed Services Activity and U. of Mich. Sentiment data. We will also hear Fed Speak from Barr and Bostic.

- Swap rates closed 2-3bps lower.

- RBNZ dated OIS pricing is little changed for 2025 meetings. February 2026 is 4bps softer. 24bps of easing is priced for April, with a cumulative 65bps by November 2025.

FOREX: Regional Equity Losses Drive A$ & NZD Weaker Against JPY

USD indices are little changed in the first part of Friday trade, with the BBDXY index last just under 1274. This has masked some divergent trends within the G10 space though, with yen outperforming, particularly against NZD and AUD.

- NZD/USD is the weakest performer, the pair back to 0.5710/15, off close to 0.50% for the session. This now puts NZD down for the week. Earlier we had weaker ANZ consumer confidence, along with barely positive hobs filled growth.

- Still, the major headwind for NZD appears to be coming from the slump in regional equities. It started with Japan and South Korean markets, where transport underperformed after the recent auto tariff announcement. It spread more broadly though, with Hong Kong markets unable to sustain early gains. Indeed the HSTECH sub index is now 10% off earlier March highs.

- For NZD/USD current levels are close to week to date lows and also the 50-day EMA support point. Earlier March lows were just under 0.5600. AUD/USD is also down, with similar drivers in play, the pair off 0.35%, last near 0.6280/85. The A$ is still up slightly for the week at this stage.

- Yen sentiment has been aided by equity weakness. Sentiment appears to be weighed by the upcoming reciprocal tariff announcement next week from the US.

- USD/JPY was last near 150.90, so still very close to the 50-day EMA level. Earlier offers were above 151.00. We had the March Tokyo CPI print come in stronger than forecast as well. Immediate yen reaction was limited though.

- AUD/JPY has been unable to sustain the recent test above the 50-day EMA, the pair last back at 94.80. NZD/JPY is also back sub its 50-day EMA, the pair around 86.20/25 in latest dealings.

- Looking ahead we have UK GDP revisions and retail sales. In the EU French and Spain CPI prints. For Canada, monthly GDP is out, for the US we have the PCE price index and the U. of Mich index final read for March. Fedspeak from Barr and Bostic is also on tap.

ASIA STOCKS: A Poor End to the Week as Tariffs Weigh Heavy

- Asian bourses were down today as the auto tariff news weighed heavy on the export orientated region.

- It’s not only the auto sector that is hurting, but tech stocks are down with Chinese and Hong Kong tech stocks nearing correction as sentiment turns down.

- President Xi is meeting with global business leaders in Beijing to boost investor sentiment in China amidst the trade war. Companies such as Samsung, FedEx, StanChart, Sanofi, AstraZeneca, Thyseenkrupp have their leaders attending (source: BBG)

- It was really a case of nowhere to hide for China’s stocks with the Hang Seng leading the falls, down -0.90%, CSI 300 down -0.55%, Shanghai Comp down -0.70% and Shenzhen down -0.70%. The Hang Seng is on track to fall -1.3% for the week, marking three straight weeks of falls.

- Following a generally poor week, the KOSPI fell hard today as Korean autos are hit by tariffs dragging the index down -2.00%. The index is on track to be down over 3% for the week.

- Malaysia’s FTSE Bursa KLCI is down modestly today by -0.25% making it one of the better performers of its regional peers. In spite of todays falls, the index is set for a strong week with gains of +1.7%

- Other better performers today were Singapore’s Straits Times which has held onto marginal gains of just +0.18% and on track for a weekly gain of +1.3% whilst the Philippines eked out marginal gains but will deliver a fall over -1.5% for the week.

- India’s NIFTY 50 has opened up with gains of +0.20% and is in the middle of a very strong run and set to rise over 1% for the week as foreign flows into the market dominate sentiment.

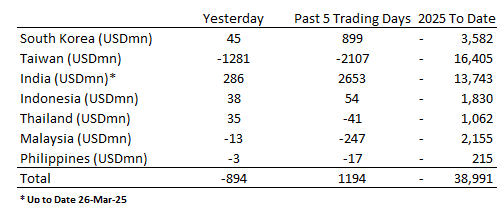

ASIA STOCKS: India Inflows Continue as Taiwan Exit Resumes

With tariff headlines challenging markets, a trade delegation quietly arrives in India during a period of strong inflows into Indian stocks. Taiwan enjoyed a short respite in flows, only for that to turn significantly negative again with moderate inflows into Indonesia continuing.

- South Korea: Recorded inflows of +$45m yesterday, bringing the 5-day total to +$899m. 2025 to date flows are -$3,582m. The 5-day average is +$180m, the 20-day average is -$57m and the 100-day average of -$91m.

- Taiwan: Had outflows of -$1,281m yesterday, with total outflows of -$2,107m over the past 5 days. YTD flows are negative at -$16,405. The 5-day average is -$421m, the 20-day average of -$617m and the 100-day average of -$239m.

- India: Saw inflows of +$286m as of the 26th, with a total inflow of +$2,653m over the previous 5 days. YTD outflows stand at -$13,743m. The 5-day average is +$531m, the 20-day average of -$77m and the 100-day average of -$155m.

- Indonesia: Posted inflows of +$38m yesterday, bringing the 5-day total to +$54m. YTD flows are negative at -$1,830m. The 5-day average is +$11m, the 20-day average is -$33m the 100-day average of -$34m.

- Thailand: Recorded inflows of +$35m yesterday, totaling -$41m over the past 5 days. YTD flows are negative at -$1,062m. The 5-day average is -$8m, the 20-day average of -$34m the 100-day average of -$18m.

- Malaysia: Experienced outflows of -$13m yesterday, contributing to a 5-day outflow of -$247m. YTD flows stand at -$2,155m. The 5-day average is -$49m, the 20-day average of -$56m the 100-day average of -$36m.

- Philippines: Saw outflows of -$3m yesterday, with net outflows of -$17m over the past 5 days. YTD flows are negative at -$215m. The 5-day average is -$3m, the 20-day average of -$1m the 100-day average of -$7m.

Oil Prices Steady but Strong for the Week.

- Oil prices tended sideways as headlines on tariffs dominated financial markets.

- WTI had opened at US$69.91 and did very little for most of the trading day, only to fall marginally in late afternoon trading to reach $69.82.

- For the week, WTI has delivered a strong gain of +2.2% - the best weekly return for the month

- Brent did very little as well opened at US74.03, and trended marginally lower to reach $73.91.

- Brent has had its strongest performance for March this week delivering gains of +2.4%

- A report from the US government indicates that the stockpile of oil in the country has fallen to the lowest in a month.

- Shipments of Venezuelan oil to China are set to rise to the highest levels since 2023 according to BBG.

- Sanctions on Iranian oil tankers appears to be working as ships remain off the cost of Malaysia, unable to dock since sanctions were announced (source BBG)

- Panama is looking to cancel the registration of over 100 ships sailing under its flag that were sanctioned by the US.

- Citibank analysts suggest that the oil market could be underpricing the risk of further tariffs on growth and commodity prices as BNP Paribas cuts its forecast for Brent for 2025 and 2026.

GOLD: The Party Continues as Gold Hits New Highs

- Gold prices hit new records overnight as US tariffs on autos rocked markets, with equities down and the momentum continued into the Asian trading day.

- As President Trump signed a ‘permanent 25% tariff on all cars not made in the US’ gold prices surged.

- Having touched a high of US$3,059.63 briefly, gold was unable to sustain the new highs dropping back modestly into the US close and opened in Asian trading at $3,057.29.

- The momentum gathered pace as gold soared to a new high of $3,073.15

- Gold has returned in excess of 17% this year as tariff fears, ETF demand and Central Bank demand has underpinned prices.

- Forecasters have been busy restating their forecasts with Goldmans the latest, upping their year end price guidance to $3,300.

PHILIPPINES: Exports Rise Whilst Imports Drop Significantly.

- Philippines February exports y/y were in line with market expectations, rising +3.9% (+6.3% prior)

- Naturally, agricultural products continue to lead exports, with a notable rise in manufactured goods and electronic products +2.5% y/y

- Imports unexpectedly declined in signs the domestic economy could be stalling.

- Imports contracted -1.8% y/y against an expectation of +9.7%y/y

- Imports had big falls from China, Japan, South Korea and Taiwan whilst increasing from US and Vietnam.

- The trade balance however was better than expected at US$3,155bn versus estimates of -$4.335bn

- The Central Bank (the BSP) meets next on the 10 April.

ASIA FX: USD Firms, USD/TWD To Fresh Highs Since 2016.

In North East Asian markets the USD has been supported, with equity losses large in some parts of the region. The majors have lost ground against the yen, except for JPY. Concerns around trade/tariffs ahead of next week's US reciprocal tariff announcement is weighing on broader sentiment (along with recent auto tariff increases).

- USD/CNH is back above 7.2700, with the softer local equity backdrop and decline in Hong Kong equities not helping sentiment. Indeed, the HSI tech sub index is 10% off its recent March highs. The USD/CNY fixing remained within recent ranges. Recent highs in USD/CNH are close to 7.2820, while on the downside, support may be evident near the 50-day EMA (close to 7.2660).

- Spot USD/KRW has drifted a little higher but remains sub near term resistance above 1470 (last near 1467.5). Onshore equities have slumped today but remain above recent March lows. Offshore investors have been buyers of local equities so far this week.

- USD/TWD is up around 0.20%, the pair last near 33.19. This is fresh highs back to early 2016. Unlike South Korea, Taiwan has seen on-going equity outflows this past week. March to date outflows are nearly $11.3bn.

ASIA FX: SEA FX Little Changed, INR Outperformance Continues

South East Asia currencies are little changed in the first part of Friday trade. Indonesia has some respite with onshore markets now closed until the 8th of April for Eid Al-fitr. Spot USD/IDR ended yesterday at 16560. SEA equities have mostly struggled, but losses haven't been as large as markets like Japan and South Korea (who are more exposed to US auto tariffs).

- INR has been a modest outperformer given a mostly stronger USD tone against the majors. Spot USD/INR was last near 85.60/65, after getting as low as 85.55 in the first part of trade. Recent lows in the pair rest at 85.49. Offshore equity flows have continued, which remains a source of support for the rupee. Note the 100-day EMA is back near 85.94.

- USD/PHP has been closed to unchanged, last in the 57.40/45 region. This is comfortably off recent highs at 57.75. Earlier data showed a much lower than expected trade deficit for Feb, at -$3.15bn (the prior read was -$5.12bn). This reflected much lower import growth, with exports near expectations and still positive. A sustain improvement in the trade deficit position will provide a tailwind to PHP.

- USD/THB is also little changed, the pair last close to 33.94. Feb IP growth in Thailand was negative at -3.91%y/y, which is lows back to early 2024.

- USD/MYR has drifted up a touch to 4.4340.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 28/03/2025 | 0700/0800 | * | GFK Consumer Climate | |

| 28/03/2025 | 0700/0800 | ** | Retail Sales | |

| 28/03/2025 | 0700/0700 | *** | Retail Sales | |

| 28/03/2025 | 0700/0700 | * | Quarterly current account balance | |

| 28/03/2025 | 0700/0700 | *** | GDP Second Estimate | |

| 28/03/2025 | 0700/0700 | ** | Trade Balance | |

| 28/03/2025 | 0745/0845 | ** | PPI | |

| 28/03/2025 | 0745/0845 | ** | Consumer Spending | |

| 28/03/2025 | 0745/0845 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | ** | KOF Economic Barometer | |

| 28/03/2025 | 0830/0930 | ECB de Guindos At Fed. of Female Professionals Conf | ||

| 28/03/2025 | 0855/0955 | ** | Unemployment | |

| 28/03/2025 | 0900/1000 | Business and Consumer confidence | ||

| 28/03/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 28/03/2025 | 1000/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 28/03/2025 | 1100/1200 | ** | PPI | |

| 28/03/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 28/03/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 28/03/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 28/03/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 28/03/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 28/03/2025 | 1615/1215 | Fed Governor Michael Barr | ||

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1930/1530 | Atlanta Fed's Raphael Bostic |