MNI EUROPEAN MARKETS ANALYSIS: Yen Outperforms On Equity Slump

- Risk off has been the theme in Asia Pac markets on Monday. Tariff concerns, coupled with geopolitical fears, has weighed on equity sentiment. Regional markets are down sharply, along with with US futures. Gold has risen to a fresh record high.

- JPY and CHF have outperformed in the G10 space, while losses elsewhere are modest. Cash US tsys are 4-6bps richer across benchmarks, with a slight steepening bias.

- Later US March MNI Chicago PMI and Dallas Fed manufacturing print, as well as German February retail sales and German/Italian March preliminary CPI are released. ECB’s Panetta and Villeroy speak.

MARKETS

US TSYS: Cash Bonds Richer As Equity Futures Extend Declines

TYM5 is 111-18, +0-11+ from closing levels in today's Asia-Pac session.

- According to MNI's technicals team, Jun'25 10Y futures have breached initial technical resistance at 110-26 (Mar 25 high). The medium-term trend condition is bullish, the first key resistance is located at 111-17+, the Mar 20 high.

- Last week's strong risk-off tone has extended into today’s Asia-Pac session ahead of this week's Trump Tariff "Liberation Day" rollout on April 2 and Friday's employment data for March.

- Stocks have dropped from Sydney to Hong Kong, with the Nikkei-225 sinking to the lowest level in over six months. Equity index futures for the US and Europe also weakened. Gold touched a fresh record high and US tsy yields declined.

- Cash US tsys are 4-6bps richer across benchmarks, with a slight steepening bias, as concern over the health of the US economy fuels demand for haven assets.

JGBS: Belly Leads Market Richer, Labour Market Data Tomorrow

JGB futures are sharply higher and at session highs, +44 compared to settlement levels.

- Outside of the previously outlined IP and Retail Sales, Housing Starts printed +2.4% y/y in February vs. est. -2.2%.

- Cash US tsys are 4-6bps richer in today's Asia-Pac session as concern over the health of the US economy fuels demand for haven assets. On Friday, a strong risk-off tone pushed the US 10-year 11bp lower ahead of this week's Trump Tariff "Liberation Day" rollout on April 2, not to mention Friday's employment data for March.

- Cash JGBs are flat to 4bps richer across benchmarks out to the 30-year, with the belly leading. The benchmark 10-year yield is 3.2bps lower at 1.511% versus the cycle high of 1.596%.

- The 2-year yield is 1.8bps lower at 0.854% after today’s supply. The 2-year bond auction showed improved demand today. The low price came in slightly above the forecasted 100.055, according to a Bloomberg poll, while the cover ratio rose to 3.4085x from 3.1637x. The auction tail also shortened slightly compared to the previous month.

- Swap rates are 1-32bps lower. Swap spreads are mixed.

- Tomorrow, the local calendar will see the Jobless Rate, Job-To-Applicant Ratio, Tankan Survey and Jibun Bank PMI Mfg data.

AUSSIE BONDS: Richer Of Tomorrow’s RBA Policy Decision, No Change Expected

ACGBs (YM +8.0 & XM +9.5) are stronger but off session bests, aligning with a slight paring of early gains for US tsys in today’s Asia-Pac session. Currently, cash US tsys are 4-6bps richer after Friday’s strong risk-off-induced rally.

- Outside of the previously outlined private sector credit and MI inflation gauge, there hasn't been much by way of domestic drivers to flag ahead of tomorrow’s RBA Policy Decision.

- While a 25bp rate cut in April is given only a 5% probability, a cumulative 71bps of easing is priced by year-end. The market’s reluctance to price in a cut for tomorrow reflects the RBA’s cautiousness surrounding February's easing.

- Cash ACGBs are 7-9bps richer with the AU-US 10-year yield differential at +17bps.

- Swap rates are 6-7bps lower, after being 10-11bps lower early.

- The bills strip has bull-flattened, with pricing +4 to +8.

- Tomorrow, the local calendar will see Retail Sales ahead of the RBA Decision, with the market expecting a rise of 0.3% m/m in February after 0.3%.

- After today’s May-28 supply, the AOFM plans to sell A$800mn of the 3.75% 21 May 2034 bond on Wednesday and A$600mn of the 1.00% 21 November 2031 bond on Friday.

BONDS: NZGBS: Richer But Off Bests, BC Eases But Price Component Higher

NZGBs closed richer, but well off session bests, with yields 4-7bps lower and the 2/10 curve flatter. Early in the session, NZGBs were richer by 9-12bps lower.

- ANZ business confidence eased slightly in March to 57.5 from 58.4, while the activity outlook rose to 48.6, the highest since December. The series is off their Q4 highs but continues to signal that a gradual economic recovery continued in Q1. The price/cost components are trending higher, which will be monitored, but while inflation expectations ticked up they remain in the range seen since November.

- On a relative basis, NZBGs underperformed, with the NZ-US and NZ-AU 10-year yield differentials 7bps and 2bps wider respectively.

- Swap rates closed 5-7bps lower, with implied swap spreads slightly tighter.

- RBNZ dated OIS pricing closed flat to 5bps softer across meetings, with late 2025 leading / early 2026. 24bps of easing is priced for April, with a cumulative 70bps by November 2025.

- Tomorrow, the local calendar will be empty, ahead of Building Permits on Wednesday.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 0.25% May-28 bond, NZ$200mn of the 4.25% May-36 bond and NZ$50mn of the 5.00% May-54 bond.

NEW ZEALAND: Gradual Recovery But Costs/Pricing Rising Again

ANZ business confidence eased slightly in March to 57.5 from 58.4, while the activity outlook rose to 48.6, the highest since December. The series are off their Q4 highs but continue to signal that a gradual economic recovery continued in Q1. The price/cost components are trending higher, which will be monitored, but while inflation expectations ticked up they remain in the range seen since November.

NZ growth outlook

- Inflation expectations rose 0.1pp to 2.6% in March, still less than January, but pricing intentions rose 5 points to 51.3, the highest in almost two years. Costs rose to 74.1 from 71.3, likely pressured by the weaker NZD, and wages to 80.0 from 79.2. Q1 CPI prints on April 17.

ANZ business survey price/cost components

Source: MNI - Market News/Refinitiv

- The labour market remained soft moderating to 15.6 in March from 17.0, but the Q1 average was a point above Q4 signalling that it may have stabilised. Q1 employment data is released on May 7.

- There were improvements in the construction components, which may be signalling that the sector has troughed. Residential rose almost 22 points to 47.2, highest since February 2021, and commercial +3 points to 33.3.

- Exports were slightly softer in March at 17.3 but Q1 moderated over a point to 17.0 likely impacted by increased uncertainty over US tariffs and their impact on global demand. The US is NZ’s second largest merchandise export destination.

FOREX: Safe Havens Outperform Amid Weaker Equities & Lower Yields

Yen gains have dominated the first part of Monday trade, up 0.50% versus the USD. CHF has also risen against the USD, ensuring lower USD index levels. The BBDXY was last near 12740.4, off a little over 0.1%. Higher beta plays have struggled although losses haven't been large.

- The risk off tone in FX markets has been reflected in cross asset trends as well. Weekend news of Trump threatening Russia with tariffs (over the Ukraine peace deal), a potential strike on Iran and ahead of liberation day on Wednesday when reciprocal tariffs will be announced, is all contributing to the risk off move.

- US equity futures are down sharply, following Friday cash losses. Eminis were last off 0.60%, Nasdaq futures were off 1.15% (up from session lows). US Tsy futures have risen, while cash Tsy yields are off more than 5bps for some part of the curve. Gold has hit fresh record highs above $3110.

- Regional equities are down sharply, led by Japan and tech sensitive plays.

- USD/JPY got to lows of 148.73, but sits slightly higher now (last near 149.10/15). USD/CHF was tracking close to 0.8790. We had Japan data earlier on IP and retail sales, but sentiment wasn't shifted.

- AUD and NZD are ticking lower. NZD/USD was last near 0.5705/10, with dips under 0.5700 supported. AUD/USD was close to 0.6280, also near session lows. AUD/JPY was last near 93.60/65, just up from March 20 lows (near 93.15). NZD/JPY is back to 85.10/15, fresh lows since the middle of the month.

- Looking ahead, German February retail sales and German/Italian March preliminary CPI are released. ECB’s Panetta and Villeroy speak. In the US the March MNI Chicago PMI and Dallas Fed manufacturing print.

ASIA STOCKS: Equity Markets Reel as Tariffs Loom.

China Resource’s Gas Group shares are down by the most in over a year as net income missed estimates by 26% as a result of the property market malaise.

Thailand’s markets have re-opened as investors are assured that damage is limited to key infrastructure.

As China’s banks are to be recapitalized, the stock prices are providing a mixed reaction to the news of the US$67bn capital injection.

CK Hutchison’s shares are down almost 5% on rumours its sale of its Panama Canal ports may be delayed.

- China’s equity markets are down heavily today with the Hang Seng down -1.7%, CSI 300 down -1.00%, Shanghai down -0.95% and Shenzhen down -2.05%.

- The KOSPI is one of the worst regional performers, falling by -2.9% marking a horror three days of losses.

- Other markets in the region have no where to hide with the Taiwan’s TAIEX down -3.43% as outflows continue and Philippines down -0.47% with Malaysia, Singapore and Indonesia out.

- India’s NIFTY 50 has had a very strong few weeks, but as it opens up this morning it is weaker by -0.30%

ASIA STOCKS: India Inflows Intensify as Taiwan Goes the other Way.

With tariff headlines dominating, India is considering lowering tariffs on US agriculture products as strong inflows continue into the country. Taiwan and South Korea enjoyed a short respite in flows, only for that to turn significantly negative again with Indonesia and Malaysia out.

- South Korea: Recorded outflows of -$513m Friday, bringing the 5-day total to -$228m. 2025 to date flows are -$4,095m. The 5-day average is -$46m, the 20-day average is -$75m and the 100-day average of -$93m.

- Taiwan: Had outflows of -$1,028m Friday, with total outflows of -$2,607m over the past 5 days. YTD flows are negative at -$17,432. The 5-day average is -$521m, the 20-day average of -$614m and the 100-day average of -$255m.

- India: Saw inflows of +$947m as of the 27th, with a total inflow of +$3,231m over the previous 5 days. YTD outflows stand at -$12,796m. The 5-day average is +$646m, the 20-day average of -$14m and the 100-day average of -$144m.

- Thailand: Recorded outflows of -$67m yesterday, totaling -$121m over the past 5 days. YTD flows are negative at -$1,128m. The 5-day average is -$24m, the 20-day average of -$30m the 100-day average of -$18m.

- Philippines: Saw inflows of +$1m yesterday, with net outflows of -$34m over the past 5 days. YTD flows are negative at -$214m. The 5-day average is -$7m, the 20-day average of +$2m the 100-day average of -$7m.

OIL: Crude Monitoring Tariff Landscape Carefully

Oil prices are moderately lower during APAC trading after a very short-lived jump at the start of the session in response to US President Trump’s threat to impose primary and secondary tariffs on Russian and Iranian oil. Crude has trended down since then in line with the deterioration in risk sentiment. WTI is 0.4% lower at $69.10/bbl after a low of $68.81 and Brent -0.4% to $72.46/bbl following a drop to $72.28.

- Oil is likely to see a volatile week as it worries about the global demand impact of reciprocal tariffs to be announced April 2 but also the effect on supply if the US follows through on threats to Russia and Iran. Trump is proposing “secondary” tariffs on those who buy oil from Russia and Iran, which would have a significant effect on China. This warning has already been made on those who buy from Venezuela.

- Trump sounded more conciliatory earlier today though implying that measures against Russia weren’t imminent and that he trusted President Putin would not “go back on his word”, which brought oil prices off their intraday high. Trump and Putin are due to speak later this week.

- India and China have been buying discounted Russian crude since it invaded Ukraine in 2022. It is the world’s third largest producer and so further restrictions on its exports would push prices higher. According to Bloomberg, they reached a 5-month high in March.

- Later US March MNI Chicago PMI and Dallas Fed manufacturing print, as well as German February retail sales and German/Italian March preliminary CPI are released. ECB’s Panetta and Villeroy speak.

GOLD: Tariffs Drive Gold Through $3,100.

- Gold touched new highs last week and had opened up strongly touching a new high again in Asia trading this morning at US$3,088.80, only to continue to rally through to $3,110.12

- With all major moving averages upward sloping, gold remains above the 20-day EMA of $3,003.60

- Equity markets are under pressure in Asia today with some major bourses down over 3%.

- As we approach the deadline for tariffs, the markets will remain cautious, providing a good back drop for gold demand in the early part of the week.

CHINA: Gradual Recovery Continues with PMIs.

- The ongoing, gradual improvement in economic data was evident in today’s March PMI release.

- The Manufacturing PMI for March edged up to +50.5, from +50.2 in February, ahead of expectations.

- This was the highest reading since March last year.

- New orders were very strong, rising +51.8

- Large enterprises’ contribution was the biggest component.

- The employment component slipped to +48.2, from +48.6.

- The Non-manufacturing PMI improved also rising to +50.8, from +50.4 prior.

- Within the Non-manufacturing, the largest positive contributor was Business activity expectations which rose do +57.2, from +56.6.

- Employment contribution within non-manufacturing softened too from +46.5 in February, to +45.8.

- The data is consistent with the message coming from last week’s Boao Forum.

- The former deputy governor of the PBOC Hu Xiaolian to reporters that the “PBOC is spending more time to observe before cutting the reserve requirement ratio and rates.”

- Data has been slowly improving in China as the impact of stimulus measures is being felt.

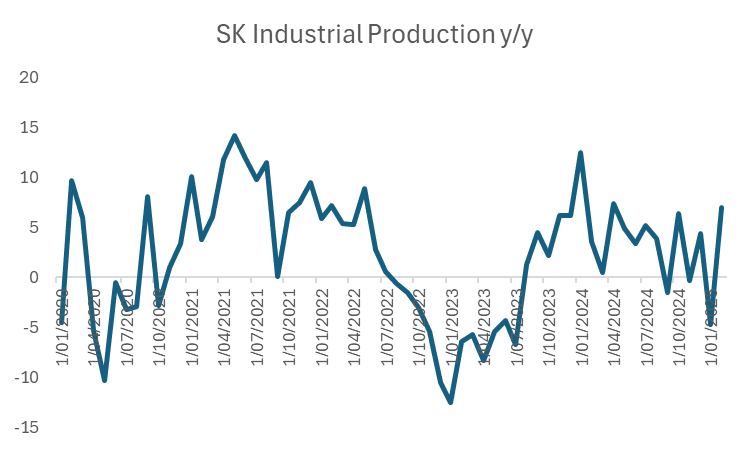

SOUTH KOREA: Industrial Production Surprises for February.

- February’s y/y Industrial Production release was one of the bigger surprises in some time.

- Following January’s revised contraction of -4.7%y/y, the market expected a decent expansion of +3.5%y/y

- The result of +7.0% y/y comes on the back of an improvement in exports post Lunar New Year holiday interruptions.

- The release likely underscores the bond market’s thinking at present.

- The last fortnight has seen the bond market re-price rate cut expectations for the upcoming meeting on April 17.

- On a three month time horizon, the bond market now has only 7bps of cuts priced in whilst the swaps market has progressively reduced the probability to less than 19% of a cut at the next meeting.

INDIA: Country Wrap: India Contemplates Lowering US Tariffs.

- Goods such as agricultural products could have their import duties significantly reduced as ongoing negotiations occur between the US and India (source BBG)

- India’s Ministry of Mines has provided its March update that shows Iron Ore output growing by +4.4% (source BBG).

- India and Sri Lanka are close to signing a defense pact as a potential counter to China’s rise in the region (source : BGG).

- India's NIFTY 50 has had a very strong few weeks, but as it opens up this morning it is weaker by -0.30

- INR: is one of the better performers of regional peers, gaining +0.35% this morning to be at 85.47.

- Bonds: India's government bond curve continues to rally following the injection of liquidity by the Central Bank. The IGB 10YR is now at lows in yield at 6.58% not seen since the financial COVID.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 31/03/2025 | 0600/0800 | ** | Import/Export Prices | |

| 31/03/2025 | 0600/0800 | ** | Retail Sales | |

| 31/03/2025 | 0800/1000 | *** | Bavaria CPI | |

| 31/03/2025 | 0800/1000 | *** | North Rhine Westphalia CPI | |

| 31/03/2025 | 0800/1000 | *** | Baden Wuerttemberg CPI | |

| 31/03/2025 | 0830/0930 | ** | BOE Lending to Individuals | |

| 31/03/2025 | 0830/0930 | ** | BOE M4 | |

| 31/03/2025 | 0900/1100 | *** | HICP (p) | |

| 31/03/2025 | - | DMO Quarterly Investors/GEMM consultation | ||

| 31/03/2025 | 1200/1400 | *** | HICP (p) | |

| 31/03/2025 | 1342/0942 | *** | MNI Chicago PMI | |

| 31/03/2025 | 1430/1030 | ** | Dallas Fed manufacturing survey | |

| 31/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 31/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 31/03/2025 | 1600/1200 | ** | USDA GrainStock - NASS | |

| 31/03/2025 | 1600/1200 | *** | USDA PROSPECTIVE PLANTINGS - NASS | |

| 01/04/2025 | 2200/0900 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 01/04/2025 | 2330/0830 | * | Labor Force Survey | |

| 01/04/2025 | 2350/0850 | *** | Tankan | |

| 01/04/2025 | 0030/1130 | ** | Retail Trade | |

| 01/04/2025 | 0030/0930 | ** | S&P Global Final Japan Manufacturing PMI | |

| 01/04/2025 | 0145/0945 | ** | S&P Global Final China Manufacturing PMI | |

| 01/04/2025 | 0330/1430 | *** | RBA Rate Decision | |

| 01/04/2025 | 0630/0830 | ** | Retail Sales | |

| 01/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0745/0945 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0750/0950 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0755/0955 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0815/0915 | BoE's Greene on ‘UK MP/macro conjuncture’ | ||

| 01/04/2025 | 0820/1020 | ECB's Cipollone At Croatian National Bank Meeting | ||

| 01/04/2025 | 0830/0930 | ** | S&P Global Manufacturing PMI (Final) | |

| 01/04/2025 | 0900/1100 | *** | HICP (p) | |

| 01/04/2025 | 0900/1100 | ** | Unemployment | |

| 01/04/2025 | - | *** | Domestic-Made Vehicle Sales | |

| 01/04/2025 | 1230/1430 | ECB's Lagarde At AI Conference | ||

| 01/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 01/04/2025 | 1300/0900 | Richmond Fed's Tom Barkin | ||

| 01/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (final) |