MNI EUROPEAN OPEN: China Exports Surge In March

EXECUTIVE SUMMARY

- TRUMP SAYS CHIPS FROM CHINA WILL FACE NATIONAL SECURITY PROBE; FURTHER TARIFFS EXPECTED - RTRS

- TRUMP SAYS WILL ANNOUNCE SEMICONDUCTOR TARIFFS OVER NEXT WEEK - RTRS

- US TO SEEK CURRENCY COMMITMENTS - USTR GREER - MNI BRIEF

- BOJ TO MANAGE POLICY TIMELY FOR 2% TARGET - UEDA - MNI BRIEF

- CHINA’S MAR EXPORTS SURGE ON RUSH - MNI BRIEF

- CHINA MARCH M2 GROWS BY 7% Y/Y FOR THIRD MONTH - MNI BRIEF

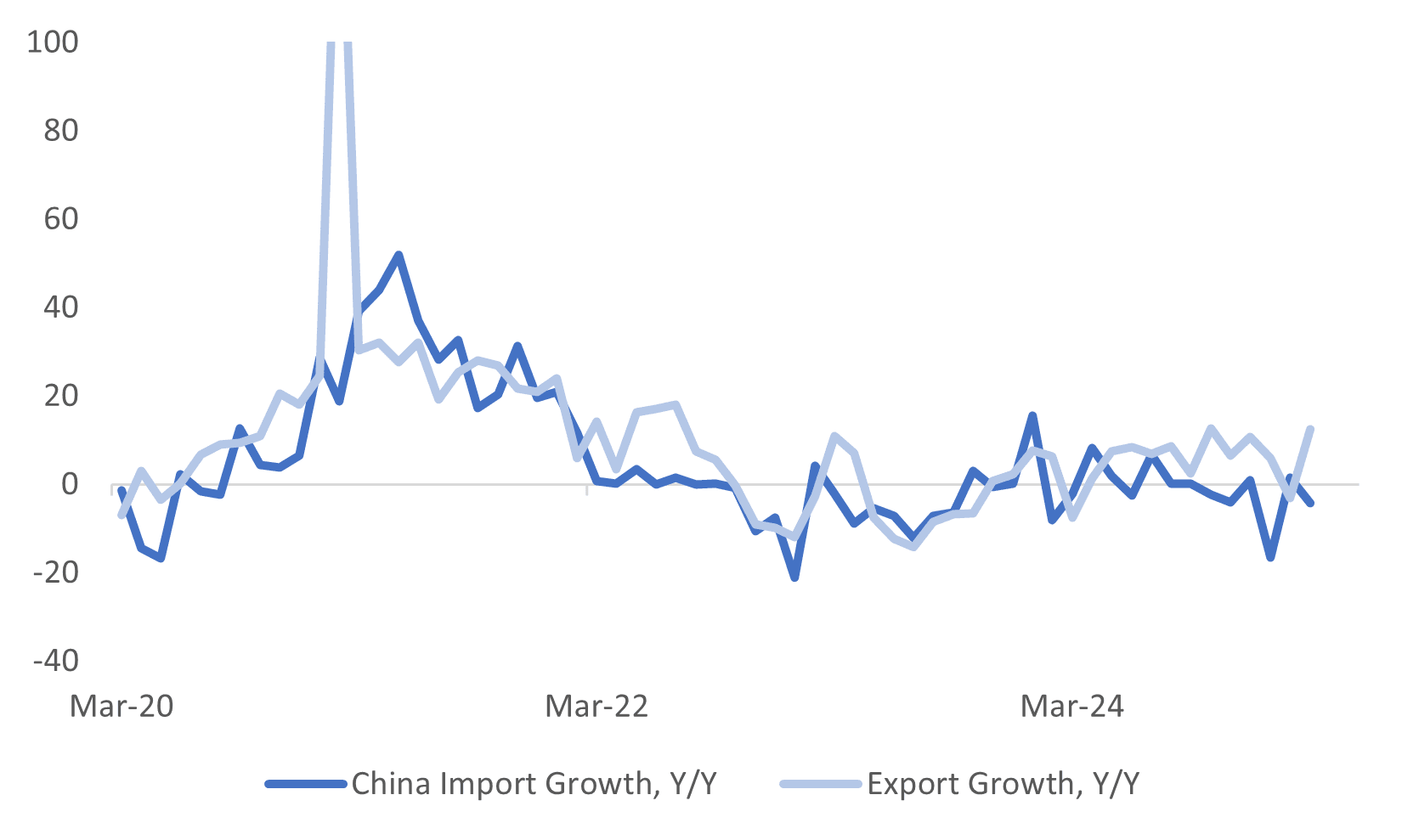

Fig 1: China Export Growth Bounces In March

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

PROPERTY (BBG): “London house prices will suffer the most from US President Donald Trump’s trade war, real estate agents warn, as a global demand slowdown risks hitting the city’s already struggling market.”

EU

FRANCE (BBG): “ France will need to find a further €40 billion in savings to reach its 2026 budget deficit target, Finance Minister Eric Lombard said.”

UKRAINE (RTRS): “Two Russian ballistic missiles slammed into the heart of the northern Ukrainian city of Sumy on Sunday, killing 34 people and wounding 117 in the deadliest strike on Ukraine this year, officials said.”

US

TARIFFS (RTRS): “U.S. President Donald Trump on Sunday bore down on his administration's latest message that the exclusion of smartphones and computers from his reciprocal tariffs on China will be short-lived, pledging a national security trade investigation into the semiconductor sector.”

TECH (RTRS): “U.S. President Donald Trump on Sunday said he would be announcing the tariff rate on imported semiconductors over the next week, adding that there would be flexibility on some companies in the sector.”

TRADE/FX (MNI BRIEF): The United States will be looking to see if other countries will be willing to include commitments not to lower the value of their currency relative to the dollar as part of various trade negotiations, U.S. Trade Representative Jamieson Greer said Sunday, adding that he expects "meaningful deals" with several countries in the "next few weeks."

INFLATION (MNI INTERVIEW): Federal Reserve officials find themselves in an increasingly tenuous position as a surge in inflation expectations to multi-decade highs coincides with worries about the labor market now at their worst since the Global Financial Crisis, Joanne Hsu, the head of the University of Michigan's Survey of Consumers told MNI.

FED (MNI BRIEF): Federal Reserve independence is very important because it delivers better results in terms of price stability and economic stability and that independence is protected by law, New York Fed President John Williams said Friday.

FED (MNI BRIEF): New York Fed President John Williams on Friday said new policies from Washington will have meaningful impacts on the economy in the short-run, but the Fed is absolutely committed to avoiding the deanchoring of inflation expectations that then could lead to a real stagflationary scenario.

OTHER

CANADA (MNI BRIEF): Prime Minister Mark Carney said Friday the global and Canadian economies are already showing weakness in response to this week's U.S. tariff announcements, noting the week before a central-bank rate decision that his country's job market is facing particular strain.

JAPAN (MNI BRIEF): The Bank of Japan will manage monetary policy appropriately to achieve the 2% price target in a sustainable and stable manner, Governor Kazuo Ueda told lawmakers Monday.

SINGAPORE (BBG): “Singapore eased its monetary policy settings for the second time this year and cut its economic forecasts as US tariffs cloud the outlook for global trade.”

CHINA

TRADE (MNI BRIEF): China's exports grew 12.4% y/y to USD313.91 billion in March, higher than the 4.4% y/y consensus, according to data released by China Customs on Monday. The month-over-month growth recorded a 46.0% surge, the second highest reading on record after the 47.5% increase in Mar 2023, when China first eased pandemic-related controls.

TRADE (MNI BRIEF): China’s imports fell 6% y/y in March in yuan terms as falling international commodity prices lowered the value of inbound shipments, Lu Daliang, spokesman of the General Administration of Customs told reporters on Monday.

SOUTH EAST ASIA (BBG): "President Xi Jinping’s first overseas trip of the year was meant to showcase China’s clout in the region. Now, President Donald Trump’s tariff threats have turned it into a push to keep Southeast Asian leaders from cutting deals at Beijing’s expense."

MONEY SUPPLY (MNI BRIEF): China's M2 money supply grew by 7.0% y/y for a third consecutive month in March, in line with market forecasts, as credit demand rebounded and government bond issuance increased, data released on Sunday by the People's Bank of China showed.

POLICY (SHANGHAI SECURITIES NEWS): “The People’s Bank of China will likely cut the reserve requirement ratio or interest rates in a timely manner should U.S. tariff hikes cause negative impact on the economy, said Yu Yongding, a former PBOC monetary policy committee member.”

GDP (YICAI): “The Chinese economy is expected to grow more than 5% in Q1, supported by accelerated recovery in consumption, with March retail sales estimated to grow an average 4.16% m/m, higher than the previous 4%, Yicai.com reported citing analysts.”

CHINA MARKETS

MNI: PBOC Net Drains CNY50.5 Bln via OMO Monday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY43 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net drain of CNY50.5 billion after offsetting the maturities of CNY93.5 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6270% at 10:03 am local time from the close of 1.6534% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Friday, compared with the close of 48 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Higher At 7.2110 Mon; -1.17% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2110 on Monday, compared with 7.2087 set on Friday. The fixing was estimated at 7.3185 by Bloomberg survey today.

MNI: China CFETS Yuan Index Down 1.42% In Week of Apr 11

The CFETS Weekly RMB Index was 97.35 on Apr 11, down 1.42% compared with 99.77 as of Apr 3.

The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, has decreased 4.06% this year, when compares with 101.47 on Dec. 31, 2024.

MARKET DATA

NEW ZEALAND MAR PMI SERVICES 49.1; PRIOR 49.0

NEW ZEALAND MAR CARD SPENDING TOTAL M/M -1.5%; PRIOR -0.1%

NEW ZEALAND FEB NET MIRGRATION 5430; PRIOR 2370

JAPAN FEB F IP M/M 2.3%; PRIOR 2.5%

JAPAN FEB F IP Y/Y 0.1%; PRIOR 0.3%

JAPAN FEB CAPACITY UTILIZATION -1.1%; PRIOR 4.5%

CHINA MAR EXPORTS Y/Y 12.4%; MEDIAN 4.6%; PRIOR -3.0%

CHINA MAR IMPROTS Y/Y -4.3%; MEDIAN -2.1%; PRIOR 1.5%

CHINA MAR TRADE BALANCE $102.64bn: MEDIAN $75.15bn; PRIOR $31.72bn

UK APR RIGHTMOVE HOUSE PRICES Y/Y 1.3%; PRIOR 1.0%

MARKETS

US TSYS: Richer After Last Week's Sell-Off

TYM5 has traded in a tight 109-17/109-31 range, going into the London open trading near its highs around 109-31,+0-07+ from its close on Friday.

- The 10-year yield has consolidated in a tight range of 4.4561 - 4.4876 in Asia.

- The market is starting to realise the FED will not be stepping in to rescue it by cutting rates, as long as it expects inflation to track higher on the back of Trump’s policies.

- This will be a big week for US tsys but it feels there has been some trust lost and there is more position unwind to come. Dips back towards 4.25/30% should now find supply, with the bigger 4.80/5.00% area now being targeted.

- Any move back to 5% and above would start to become problematic for equities.

- Data/Events: Powell and Waller to speak on Wednesday, Retail Sales 16/04

JGBS: Sharp Bear-Steepener Ahead Of Tomorrow's 20Y Supply

JGB futures are stronger, +8 compared to the settlement levels, sitting near the middle of today’s range.

- In the final report, Feb. industrial production was revised down to 2.3% m/m from 2.5%. Japan’s operating ratio fell to 104.1 in Feb. compared to 105.3 in the previous month.

- (MNI) The BoJ will manage monetary policy appropriately to achieve the 2% price target sustainably and stably, Governor Kazuo Ueda told lawmakers Monday. The BoJ will examine the future economy, prices and financial markets without precondition, he added.

- Cash US tsys are 2-3bps richer in today's Asia-Pac session. The US calendar is light this week, with the highlights being Retail Sales data and Fedspeak from Powell and Waller on Wednesday.

- Cash JGBs are flat to 11bps cheaper across benchmarks, with a steepener curve. The benchmark 20-year yield is 7.9bps higher at 2.407% ahead of tomorrow's supply. The current yield is 10-15bps higher than last month’s auction level.

- The swap curve has twist-steepened, with rates 2bps lower to 5bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar will be empty apart from 20-year supply.

AUSSIE BONDS: Bear-Steepener But Well Off Cheaps, RBA Minutes (April) Tomorrow

ACGBs (YM -6.0 & XM flat) are cheaper but sit well above Sydney session cheaps.

- With the local calendar light today, cash US tsys have proved to be the key driver of today’s local market fluctuations. Cash US tsys are 2-3bps richer, with a steepening bias, in today's Asia-Pac session after Friday's heavy session.

- Last week, the US 10-year yield rose almost 50bps in 5 days, one of the biggest moves in that number of days since 1998. The US calendar is light this week, with the highlights being Retail Sales data and Fedspeak from Powell and Waller on Wednesday.

- Cash ACGBs are flat to 6bps cheaper with the AU-US 10-year yield differential at -7bps.

- Swap rates are 2bps lower to 6bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -2 to -7.

- RBA-dated OIS pricing is 2-11bps firmer across meetings today. A 50bp rate cut in May is given a 39% probability, with a cumulative 118bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- Tomorrow, the local calendar will see the release of the RBA Minutes for the April Meeting.

- The AOFM plans to sell A$1000mn of the 3.50% 21 December 2034 bond on Wednesday.

BONDS: NZGBS: Closed Near Yield Lows, Curve Twist-Flattened

NZGBs closed showing a twist-flattener, with benchmark yields 4bps higher to 3bps lower. Nevertheless, all NZGB yields closed well off session highs after weaker-than-expected card spending data.

- Cash US tsys also assisted the move away from session yield highs. Cash US tsys are 2-3bps richer, with a steepening bias, in today's Asia-Pac session after Friday's heavy session.

- Last week, the US 10-year yield rose almost 50bps in 5 days, one of the biggest moves in that number of days since 1998. The US calendar is light this week, with the highlights being Retail Sales data and Fedspeak from Powell and Waller on Wednesday.

- Swaps closed mixed, with rates 3bps higher to 1bp lower. The 2s10s curve closed flatter.

- RBNZ dated OIS pricing closed 1-6bps firmer across meetings. 31ps of easing is priced for May, with a cumulative 79bps by November 2025.

- Tomorrow, the local calendar will see Food Prices and a speech from the RBNZ’s Chief Economist About Forecasting.

- On Thursday, the NZ Treasury plans to sell NZ$275mn of the 3.00% Apr-29 bond and NZ$225mn of the 4.25% May-36 bond.

FOREX: Antipodean Wrap - AUD & NZD Holding Onto Gains

The AUD and NZD have both held onto their respective gains from last week in tight Asian ranges. Broad USD weakness last week has seen an overhang of AUD and NZD shorts being pared back.

- AUD/USD - Asian range 0.6278 - 0.6314, AUD has traded sideways for the whole Asian session, albeit near the highs of last week. Shorts will be hoping for sellers to return but will be watching the 0.6400 area this week for signs of breaking to signal the next leg of position squaring.

- AUD/JPY - Asian range 89.57 - 90.81, AUD/JPY fell away early in the session moving down to the 89.60 area before buyers reemerged. Price goes into the London open around 90.00. AUD/JPY is trying to build a base as risk stabilises, but it remains to be seen if this will last. Expect supply once more back towards the pivotal 94.00 area.

- NZDUSD - Asian range 0.5819 - 0.5860, NZD has traded sideways the whole session but there is still no dip. NZD printing around 0.5850 going into London, the market is short and the price action poor. Watch a close above the 0.5850 area for the next potential level to trigger short covering.

- AUD/NZD - Asian range 1.0754 - 1.0830, the cross drifted lower in the Asian session before finding some buyers towards the 1.0760 area. The cross is going into London pretty directionless but the risk still feels that bounces will be capped as liquidity in the NZD dries up quicker than for the AUD on any move higher.

Fig 1: NZD Spot

Source: MNI - Market News/Bloomberg Antipodean Wrap - AUD & NZD Holding Onto Gains

FOREX: USD Bear Cycle Continues

Broad USD weakness over the course of last week as a rotation out of US assets seems to be gathering momentum. The BBDXY is down -0.18% in Asia today. The European Union is racing to clinch trade deals with countries around the globe in an effort to diversify away from an increasingly protectionist US.

- EUR/USD - Asian range 1.1318 - 1.1409, dipped initially on the early Monday open but has since traded bid to go into the London open around 1.1375. EUR/USD had been trading very closely with the 10 year rate differential, this relationship broke down completely last week. The market will be watching to see if this continues this week.

- GBP/USD - Asian range 1.3064 - 1.3128, trading just off the day's highs going into the London session.

- USD/CNH - Asian range 7.2786 - 7.3173, the USD/CNY fix was another higher one at 7.2110, this has seen USD/CNH bounce strongly from the 7.2800 area. USD/CNH goes into the London open near the session highs.

- USD/JPY - Asian range 142.25 - 144.06, was under pressure from the open once again. Falling back to last week's lows around 142.00 into the Japanese fix. It seems any paring back of positions done on Friday going into the weekend have quickly been re-established. Huge support level around 140, a break here could see the move accelerate.

- Cross asset : SP +1.02%, Gold 3230.00, US 10yr 4.46%, BBDXY 1232, Crude oil 61.20.

ASIA STOCKS: A Better Day on Tariff Pause Headlines.

Asia’s major bourses had a better day after President Trump paused import duties on consumer electronics giving a boost to investor sentiment across the region. Whilst the pause is temporary, it gives markets time to pause and focus on other areas in the global economy where risks are rising.

- In China the Hang Seng led the way today rising +2.4%, with the CSI 300 up +0.47%, Shanghai up +0.86% and Shenzhen up +1.5%.

- The Kospi had a solid day rising +0.91% in a week where the Central Bank meets.

- In Malaysia, the FTSE Malay KLCI is up +1.4% in a week where 1Q GDP is released.

- For Indonesia, the Jakarta Composite is putting in another day of solid gains rising +2.00% following stronger than expected FX Reserve data.

- In Singapore, the MAS eased policy and pointed to lower growth whilst the FTSE Straits Times rose +1.46%.

- India’s NIFTY 50 is very strong this morning, rising +1.9% ahead of this week’s CPI release where it is expected that inflation will continue to moderate.

OIL: US Energy Sec. Expects Lower Prices

- Iran and the US held indirect talks in Oman, discussing Iran's nuclear program and lifting of sanctions in a "constructive atmosphere" with "mutual respect".

- Oil opened Monday trading in Asia lower following the late surge on Friday stemmed the weekly losses.

- Oil’s surprise surge on Friday stemmed the downward movement of prices seen all week.

- WTI opened this morning at US$61.70 and weakened immediately to a low of $61.08 before steadying to $61.25

- Brent opened at $64.76 and reached a low of $64.35, before stabilizing at $64.54

- Oil markets are weighing the impact of the exemptions on tariffs on smartphones and other key electronic equipment.

- The US also indicated that ‘constructive’ conversations had occurred between the US and Iran over the weekend.

- Trump’s energy secretary Chris Wright says that under the Trump administration energy prices will be lower.

Gold Backs off From New Highs.

- Gold opened the week at US$3,237.61, a new high and rallied into the Asian trading morning to reach another new high of $3,245.75, before backing off to $3,230.70

- Goldman Sachs has raised it year end price target to $3,700, but warned in an extreme risk case, it could reach $4,500.

- Australia’s Northern Star Resources attempt to purchase the smaller De Grey Mining got a huge boost when Gold Road Resources (which owns 17% of De Grey) agreed to support the takeover (source BBG).

- Vietnam has discovered 12 new gold mines in the central region, containing more than 10 tonnes of gold and 16 tonnes of silver, following extensive geological surveys, the Mid-Central Geological Division said, VNExpress reported. (source BBG)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 14/04/2025 | 0430/1330 | ** | Industrial Production | |

| 14/04/2025 | 1230/0830 | ** | Wholesale Trade | |

| 14/04/2025 | 1500/1100 | ** | NY Fed Survey of Consumer Expectations | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 14/04/2025 | 1700/1300 | Fed Governor Christopher Waller | ||

| 14/04/2025 | 2200/1800 | Philly Fed's Pat Harker | ||

| 15/04/2025 | 2301/0001 | * | BRC-KPMG Shop Sales Monitor | |

| 14/04/2025 | 2340/1940 | Atlanta Fed's Raphael Bostic | ||

| 15/04/2025 | 0130/1130 | RBA Meeting Minutes | ||

| 15/04/2025 | 0600/0700 | *** | Labour Market Survey | |

| 15/04/2025 | 0645/0845 | *** | HICP (f) | |

| 15/04/2025 | 0800/1000 | ** | ECB Bank Lending Survey | |

| 15/04/2025 | 0900/1100 | ** | Industrial Production | |

| 15/04/2025 | 0900/1100 | *** | ZEW Current Expectations Index | |

| 15/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 15/04/2025 | 1215/0815 | ** | CMHC Housing Starts | |

| 15/04/2025 | 1230/0830 | *** | CPI | |

| 15/04/2025 | 1230/0830 | ** | Monthly Survey of Manufacturing | |

| 15/04/2025 | 1230/0830 | ** | Import/Export Price Index | |

| 15/04/2025 | 1230/0830 | ** | Empire State Manufacturing Survey | |

| 15/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 15/04/2025 | 1300/0900 | * | CREA Existing Home Sales |