MNI EUROPEAN OPEN: Equity Losses Mount In Asia Pac

EXECUTIVE SUMMARY

- BARKIN SAYS FED SHOULD HOLD STEADY AMID FOGGY OUTLOOK - MNI

- THE BOJ BOARD IS LIKELY TO DISCUSS A POLICY HIKE AT MAY MEETING - MNI POLICY

- BOJ BOARD SPLIT ON RATE HIKE; US CONCERNS - OPINIONS - MNI

- JAPAN MARCH TOKYO CORE CPI RISES 2.4% VS. FEB 2.2% - MNI BRIEF

- MNI DISCUSSES THE RBA’S CASH RATE PATH WITH A FORMER OFFICIAL - MNI

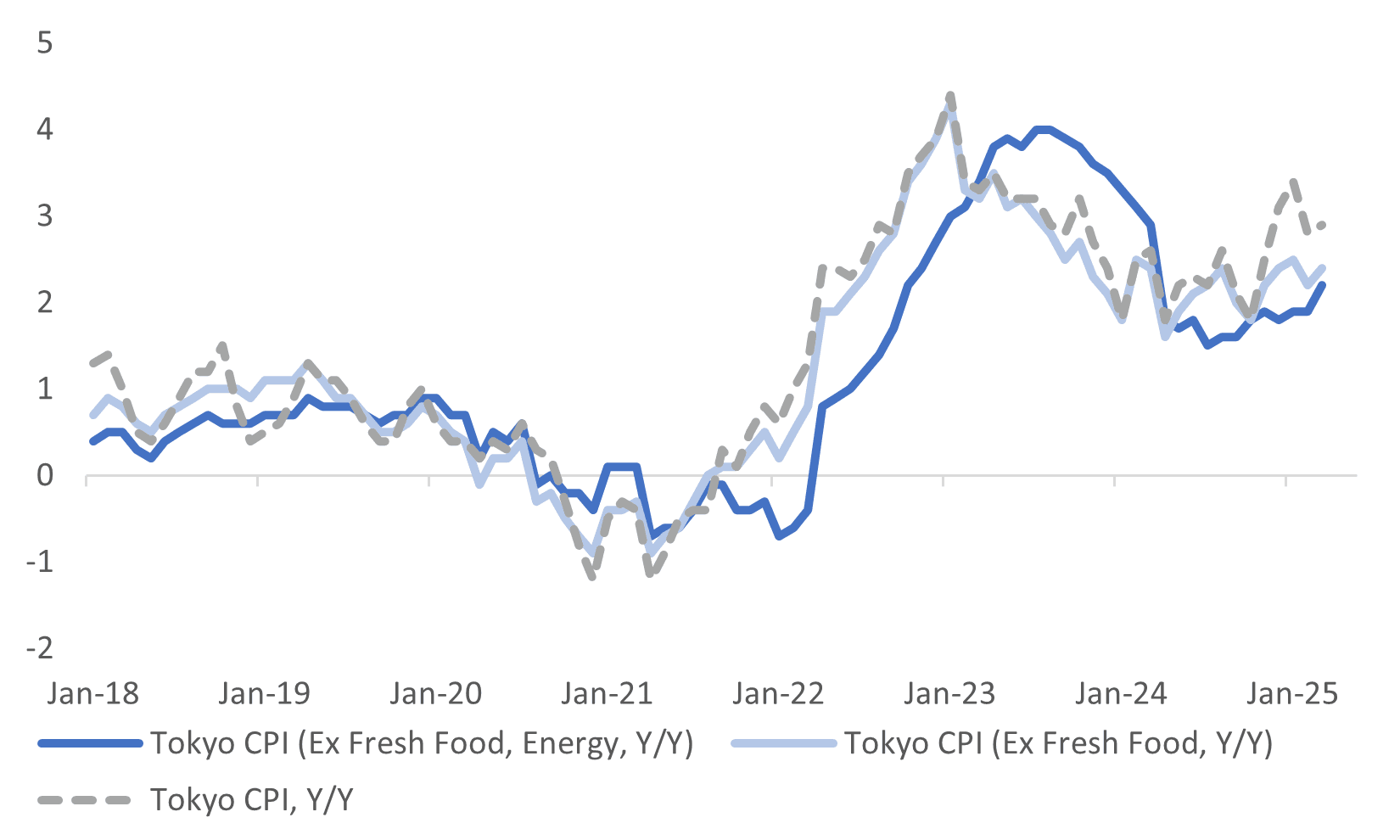

Fig 1: Tokyo CPI Trends - Y/Y, Improved In March

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

DEBT (MNI INTERVIEW): Short Gilt Shift On Cost And Risk Analysis -DMO

FISCAL (BBG): “UK Chancellor of the Exchequer Rachel Reeves boasted on Wednesday that she had restored her fiscal buffer to £9.9 billion ($13 billion). A day later, she had lost half of it.”

EU

UKRAINE (BBG): “The US is pushing to control all major future infrastructure and mineral investments in Ukraine, potentially gaining a veto over any role for Kyiv’s other allies and undermining its bid for European Union membership.”

RUSSIA (BBG): “A coalition of European leaders ruled out the possibility of easing sanctions on Russia, one of President Vladimir Putin’s demands to agree to a partial ceasefire with Ukraine.”

GERMANY (BBG): “President Donald Trump’s decision to slap 25% tariffs on all auto imports into the US is jeopardizing Germany’s recovery from years of stagnation, according to Bloomberg Economics.”

US

FED (MNI): Federal Reserve Bank of Boston President Susan Collins said Thursday she sees slower growth in the United States coupled with near-term inflation from tariffs before a return of disinflationary forces, leaving the central bank on hold for a longer time.

FED (MNI): Federal Reserve Bank of Richmond President Tom Barkin said Thursday the central bank has scope to hold its policy rate steady and wait until uncertainty diminishes around the outlook.

GEOPOLITICS (BBG): “Pete Hegseth arrived in the Philippines to start his first trip to Asia as Pentagon chief as he faces calls from Democrats to resign for sharing attack plans with other US officials over the Signal app.”

OTHER

CANADA (MNI BRIEF): Prime Minister Mark Carney on Thursday said Canada will retaliate against fresh U.S. tariffs on autos and said the relationship between two of the world's largest trade partners is now permanently damaged.

JAPAN (MNI): Bank of Japan board members were mixed over the next rate hike on the back of improved underlying inflation and the downside risk to the U.S. economy at the March 18-19 meeting, the summary of opinions released Friday showed.

JAPAN (MNI POLICY): The BOJ board is likely to discuss a policy hike at the May 1 meeting. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN (MNI BRIEF): The year-on-year rise in the Tokyo core inflation rate accelerated to 2.4% in March from February’s 2.2%, above the Bank of Japan's 2% target for the fifth straight month, data from the Ministry of Internal Affairs and Communications showed on Friday.

JAPAN (BBG): “ Japanese Prime Minister Shigeru Ishiba pledged to take thorough measures to protect local jobs from the Trump administration’s 25% tariff on US car imports, which he said will have a “very big” impact on the nation’s economy.”

AUSTRALIA (MNI INTERVIEW): MNI discusses the RBA's cash rate path with a former official. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA (BBG): “Australia’s Prime Minister Anthony Albanese has called an election for May 3, kicking off what’s expected to be a closely-fought campaign centered on cost-of-living pressures and a housing crisis in a sluggish economy.”

MEXICO (MNI WATCH): The Central Bank of Mexico signaled Thursday it will deliver at least one more 50-basis-point cut at its next meeting in May, following the decision to reduce interest rates by a half point to 9.00%. The dovish move came amid significant improvement in inflation and weakness in economic activity.

CHINA

MARKETS (BBG): "Chinese President Xi Jinping has met with a group of global business leaders in Beijing, in an effort to boost investor sentiment as rising tariffs fuel uncertainty for the economy and international trade."

LOCAL GOVT DEBTL (CSJ): " China’s efforts to reduce local governments’ debt burdens are showing initial effects, the China Securities Journal reports, citing bond issuance data and experts."

ECONOMY (PEOPLE'S DAILY): "China's 51.4% y/y growth in domestic excavator sales during January and February reflects a shift toward more diverse applications, in contrast to prior cycles driven by the real-estate and infrastructure sectors, according to Zhou Ershuang, a researcher at Dongwu Securities."

CHINA MARKETS

MNI: PBOC Net Drains CNY14.5 Bln via OMO Friday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY78.5 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net drain of CNY14.5 billion after offsetting the maturity of CNY93 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8358% at 09:49 am local time from the close of 2.0933% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Thursday, compared with the close of 45 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Lower At 7.1752 Fri; -0.41% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1752 on Friday, compared with 7.1763 set on Thursday. The fixing was estimated at 7.2639 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND MAR ANZ CONSUMER CONFIDENCE M/M -3.5%; PRIOR 0.6%

NEW ZEALAND MAR ANZ CONSUMER CONFIDENCE INDEX 93.2 PRIOR 96.6

NEW ZEALAND FEB FILLED JOBS M/M 0.1%; PRIOR 0.1%

JAPAN MAR TOKYO CPI Y/Y 2.9%; MEDIAN 2.7%; PRIOR 2.8%

JAPAN MAR TOKYO CPI, EX FRESH FOOD Y/Y 2.4%; MEDIAN 2.2%; PRIOR 2.2%

JAPAN MAR TOKYO CPI, EX-FRESH FOOD, ENERGY Y/Y 2.2%; MEDIAN 1.9%; PRIOR 1.9%

MARKETS

US TSYS: Cash Bonds Holding Richer Ahead Of Liberation (Tariff) Day

In today's Asia-Pac session, TYM5 is 110-18, +0-04+ from closing levels.

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session after yesterday's modest gains.

- The markets remain choppy amid all the noise around the myriad fiscal policy dynamics. Tariffs remain at the forefront after President Trump announced 25% tariffs on auto imports, starting next week, aftermarket Wednesday.

- The tariffs will start on April 2, with revenue starting to be collected from April 3.

- “Investors are reducing risk and holding cash ahead of next week's tariff announcements, preparing to take advantage of opportunities if they arise. Volumes in Treasuries have fallen as traders refrain from taking big positions, with some looking to options trades for insurance before President Donald Trump unveils so-called reciprocal levies next week.” (per BBG)

- Today’s US calendar will see Personal Income & Spending, PCE Price Index, Kansas City Fed Services Activity and U. of Mich. Sentiment data. We will also hear Fed Speak from Barr and Bostic.

JGBS: Bull-Flattener, BoJ Members Have Mixed Views On Next Hike Timing

JGB futures are stronger and near session highs, +26 compared to settlement levels. The market gapped lower at the open after higher-than-expected Tokyo CPI data but reversed course following the release of the BoJ Summary Of Opinions for the March MPM

- At the March 18-19 meeting, BoJ board members showed mixed views on the optimal timing of the next rate hike in the face of improved underlying inflation but downside risks to the US economy.

- “Tokyo's March CPI data exceeded expectations, suggesting the underlying inflation trend may reach the Bank of Japan's 2% target by summer. The data supports the case for the Bank of Japan to raise rates further, with two more 25-basis-point rate hikes expected this year.” (per BBG)

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session. Today's US calendar will see Personal Income & Spending, PCE Price Index, Kansas City Fed Services Activity and U. of Mich. Sentiment data. We will also hear Fed Speak from Barr and Bostic.

- Cash JGBs have bull-flattened across benchmarks, with yields 1-5bps lower.

- Swap rates are 1-3bps lower.

- On Monday, the local calendar will see Jibun Bank PMIs alongside BoJ Rinban Operations covering 1-10-year and 25-year+ JGBS.

AUSSIE BONDS: Richer & Dealing At Highs Ahead Of RBA Policy Decision (Tues)

ACGBs (YM +4.0 & XM +4.5) are richer and at Sydney session highs on a data-light session.

- Australia will hold a Federal election on May 3. The election is expected to be close, with cost of living issues the main focus point.

- (AFR) “With a helpful kick from the RBA’s first interest rate cut in February, Sydney and Melbourne house prices are climbing once again after modest recent declines.” (see BBG link)

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session.

- Cash ACGBs are 4-5bps richer with the AU-US 10-year yield differential at +11bps.

- Swap rates are 3bps lower.

- The bills strip has bull-flattened, with pricing flat to +5 across contracts.

- RBA-dated OIS pricing is flat to 4bps softer across meetings today. A 25bp rate cut in April is given a 4% probability, with a cumulative 64bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- On Tuesday, we will get the RBA's next Policy Decision.

- Next week, the AOFM plans to sell A$600mn of the 2.25% 21 May 2028 bond on Monday, A$800mn of the 3.75% 21 May 2034 bond on Wednesday and A$600mn of the 1.00% 21 November 2031 bond on Friday.

BONDS: NZGBS: Closed Richer & Near Session Bests, CC Weakened

NZGBs closed richer and near-session bests despite a late spike higher. Benchmark yields finished -3bps versus session bests of 4-5bps lower.

- Outside of the previously outlined consumer confidence and jobs filled data, there hasn't been much by way of domestic drivers to flag.

- The NZ-US 10-year yield differential finished a choppy week -3bps at +21bps and sits just below the widest level for the year and back at November 2024 levels.

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session. The markets remain choppy amid all the noise around the myriad fiscal policy dynamics. Tariffs remain at the forefront after President Trump announced 25% tariffs on auto imports, starting next week, aftermarket Wednesday.

- Today’s US calendar will see Personal Income & Spending, PCE Price Index, Kansas City Fed Services Activity and U. of Mich. Sentiment data. We will also hear Fed Speak from Barr and Bostic.

- Swap rates closed 2-3bps lower.

- RBNZ dated OIS pricing is little changed for 2025 meetings. February 2026 is 4bps softer. 24bps of easing is priced for April, with a cumulative 65bps by November 2025.

FOREX: Regional Equity Losses Drive A$ & NZD Weaker Against JPY

USD indices are little changed in the first part of Friday trade, with the BBDXY index last just under 1274. This has masked some divergent trends within the G10 space though, with yen outperforming, particularly against NZD and AUD.

- NZD/USD is the weakest performer, the pair back to 0.5710/15, off close to 0.50% for the session. This now puts NZD down for the week. Earlier we had weaker ANZ consumer confidence, along with barely positive hobs filled growth.

- Still, the major headwind for NZD appears to be coming from the slump in regional equities. It started with Japan and South Korean markets, where transport underperformed after the recent auto tariff announcement. It spread more broadly though, with Hong Kong markets unable to sustain early gains. Indeed the HSTECH sub index is now 10% off earlier March highs.

- For NZD/USD current levels are close to week to date lows and also the 50-day EMA support point. Earlier March lows were just under 0.5600. AUD/USD is also down, with similar drivers in play, the pair off 0.35%, last near 0.6280/85. The A$ is still up slightly for the week at this stage.

- Yen sentiment has been aided by equity weakness. Sentiment appears to be weighed by the upcoming reciprocal tariff announcement next week from the US.

- USD/JPY was last near 150.90, so still very close to the 50-day EMA level. Earlier offers were above 151.00. We had the March Tokyo CPI print come in stronger than forecast as well. Immediate yen reaction was limited though.

- AUD/JPY has been unable to sustain the recent test above the 50-day EMA, the pair last back at 94.80. NZD/JPY is also back sub its 50-day EMA, the pair around 86.20/25 in latest dealings.

- Looking ahead we have UK GDP revisions and retail sales. In the EU French and Spain CPI prints. For Canada, monthly GDP is out, for the US we have the PCE price index and the U. of Mich index final read for March. Fedspeak from Barr and Bostic is also on tap.

ASIA STOCKS: A Poor End to the Week as Tariffs Weigh Heavy

- Asian bourses were down today as the auto tariff news weighed heavy on the export orientated region.

- It’s not only the auto sector that is hurting, but tech stocks are down with Chinese and Hong Kong tech stocks nearing correction as sentiment turns down.

- President Xi is meeting with global business leaders in Beijing to boost investor sentiment in China amidst the trade war. Companies such as Samsung, FedEx, StanChart, Sanofi, AstraZeneca, Thyseenkrupp have their leaders attending (source: BBG)

- It was really a case of nowhere to hide for China’s stocks with the Hang Seng leading the falls, down -0.90%, CSI 300 down -0.55%, Shanghai Comp down -0.70% and Shenzhen down -0.70%. The Hang Seng is on track to fall -1.3% for the week, marking three straight weeks of falls.

- Following a generally poor week, the KOSPI fell hard today as Korean autos are hit by tariffs dragging the index down -2.00%. The index is on track to be down over 3% for the week.

- Malaysia’s FTSE Bursa KLCI is down modestly today by -0.25% making it one of the better performers of its regional peers. In spite of todays falls, the index is set for a strong week with gains of +1.7%

- Other better performers today were Singapore’s Straits Times which has held onto marginal gains of just +0.18% and on track for a weekly gain of +1.3% whilst the Philippines eked out marginal gains but will deliver a fall over -1.5% for the week.

- India’s NIFTY 50 has opened up with gains of +0.20% and is in the middle of a very strong run and set to rise over 1% for the week as foreign flows into the market dominate sentiment.

Oil Prices Steady but Strong for the Week.

- Oil prices tended sideways as headlines on tariffs dominated financial markets.

- WTI had opened at US$69.91 and did very little for most of the trading day, only to fall marginally in late afternoon trading to reach $69.82.

- For the week, WTI has delivered a strong gain of +2.2% - the best weekly return for the month

- Brent did very little as well opened at US74.03, and trended marginally lower to reach $73.91.

- Brent has had its strongest performance for March this week delivering gains of +2.4%

- A report from the US government indicates that the stockpile of oil in the country has fallen to the lowest in a month.

- Shipments of Venezuelan oil to China are set to rise to the highest levels since 2023 according to BBG.

- Sanctions on Iranian oil tankers appears to be working as ships remain off the cost of Malaysia, unable to dock since sanctions were announced (source BBG)

- Panama is looking to cancel the registration of over 100 ships sailing under its flag that were sanctioned by the US.

- Citibank analysts suggest that the oil market could be underpricing the risk of further tariffs on growth and commodity prices as BNP Paribas cuts its forecast for Brent for 2025 and 2026.

GOLD: The Party Continues as Gold Hits New Highs

- Gold prices hit new records overnight as US tariffs on autos rocked markets, with equities down and the momentum continued into the Asian trading day.

- As President Trump signed a ‘permanent 25% tariff on all cars not made in the US’ gold prices surged.

- Having touched a high of US$3,059.63 briefly, gold was unable to sustain the new highs dropping back modestly into the US close and opened in Asian trading at $3,057.29.

- The momentum gathered pace as gold soared to a new high of $3,073.15

- Gold has returned in excess of 17% this year as tariff fears, ETF demand and Central Bank demand has underpinned prices.

- Forecasters have been busy restating their forecasts with Goldmans the latest, upping their year end price guidance to $3,300.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 28/03/2025 | 0700/0800 | * | GFK Consumer Climate | |

| 28/03/2025 | 0700/0800 | ** | Retail Sales | |

| 28/03/2025 | 0700/0700 | *** | Retail Sales | |

| 28/03/2025 | 0700/0700 | * | Quarterly current account balance | |

| 28/03/2025 | 0700/0700 | *** | GDP Second Estimate | |

| 28/03/2025 | 0700/0700 | ** | Trade Balance | |

| 28/03/2025 | 0745/0845 | ** | PPI | |

| 28/03/2025 | 0745/0845 | ** | Consumer Spending | |

| 28/03/2025 | 0745/0845 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | ** | KOF Economic Barometer | |

| 28/03/2025 | 0830/0930 | ECB de Guindos At Fed. of Female Professionals Conf | ||

| 28/03/2025 | 0855/0955 | ** | Unemployment | |

| 28/03/2025 | 0900/1000 | Business and Consumer confidence | ||

| 28/03/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 28/03/2025 | 1000/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 28/03/2025 | 1100/1200 | ** | PPI | |

| 28/03/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 28/03/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 28/03/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 28/03/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 28/03/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 28/03/2025 | 1615/1215 | Fed Governor Michael Barr | ||

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1930/1530 | Atlanta Fed's Raphael Bostic |