MNI EUROPEAN OPEN: Gold Volatility Continues, USD Steady

EXECUTIVE SUMMARY

- TRUMP OFFICIALS PUSH RUSSIA-UKRAINE PEACE DEAL AFTER VATICAN MEETING - RTRS

- ECB JUNE MEETING WILL ‘REALLY COMPLICATED,’ KNOT TELLS FD - BBG

- SHEIN HIKES US PRICES AS MUCH AS 377% AHEAD OF TARIFF INCREASES - BBG

- CHINA CAN MEET GOALS DESPITE UNCERTAINTY - NDRC - MNI BRIEF

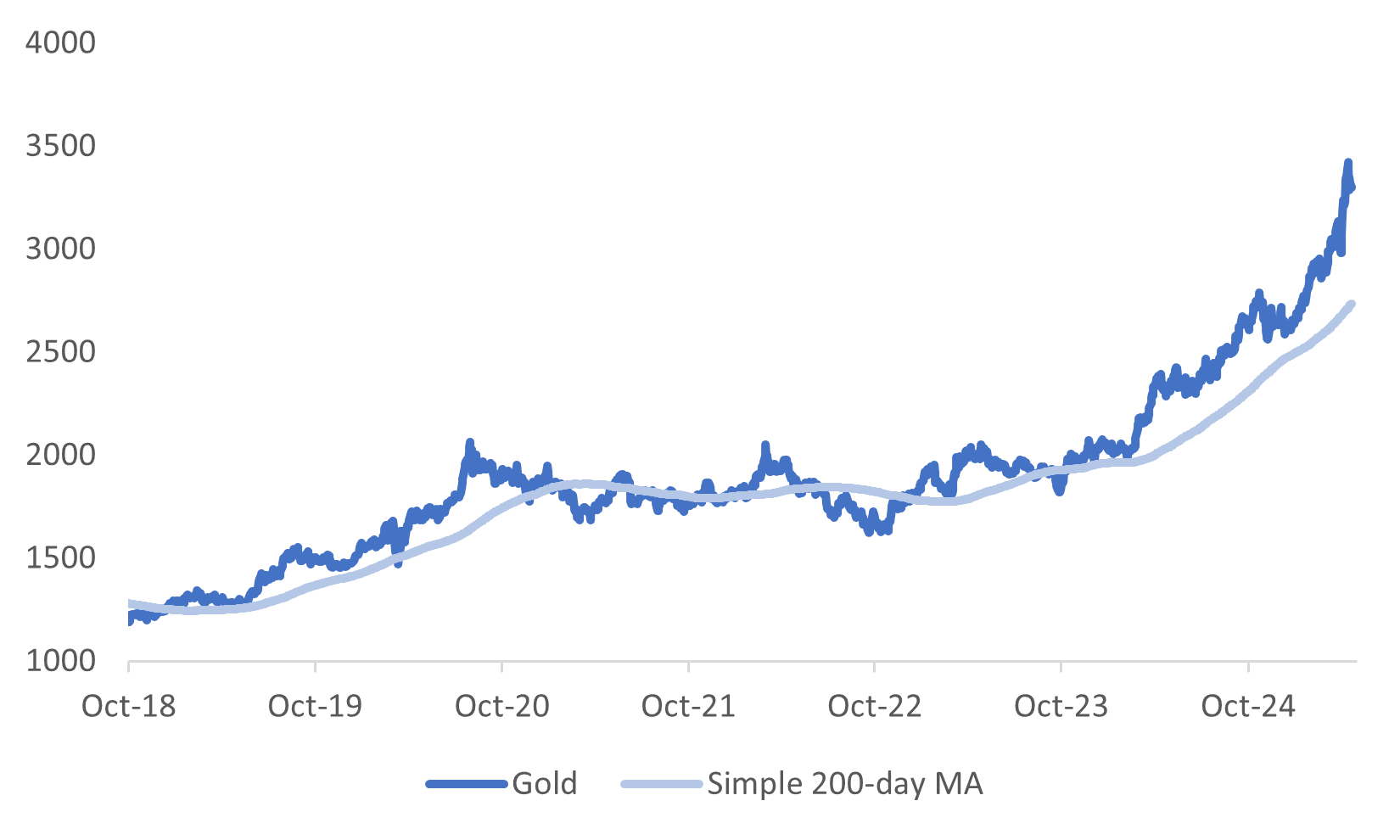

Fig 1: Gold Volatility Continues But Still Above Key Support

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

TRADE (BBC): “The UK's trade relationship with the EU is arguably "more important" than the one it has with the US, the chancellor has told the BBC.”

TRADE (POLITICO): “India has accepted that Britain will only offer minor changes to its visa regime as negotiations for a trade deal enter their final stages.”

UKRAINE (BBC): “Sir Keir Starmer and Volodymyr Zelensky agreed to "maintain momentum and continue working intensively" on efforts to end the war in Ukraine when they met in Rome after the Pope's funeral.”

POLITICS (RTRS): “Confidence among people in Britain about the economy over the next 12 months has fallen to the lowest on record, polling firm Ipsos MORI said on Sunday, with only a small number expecting improvement over the period.”

EU

ECB (BBG): “The European Central Bank should only lower interest rates into accommodative territory if the growth outlook deteriorates much further, according to Governing Council member Martins Kazaks.”

ECB (BBG): “US tariff policy coupled with European fiscal plans casts uncertainty over the European Central Bank’s next rate decision, according to Governing Council member Klaas Knot.”

GERMANY (BBC): “Germany's defence minister has warned Ukraine not to agree to a deal which involves sweeping territorial concessions in return for a ceasefire with Russia.”

FRANCE (POLITICO): “National Rally President Jordan Bardella confirmed on Saturday he will run in the 2027 French presidential election if his mentor Marine Le Pen — the three-time candidate and front-runner whose ambitions have been derailed by an embezzlement conviction — is barred from taking part.”

RUSSIA (BBC): “Russia's military says it has regained full control of the country's western Kursk region - a claim denied by Ukraine.”

UKRAINE (DW): “After claiming to have ended Ukraine's incursion into Kursk — with North Korean help — Russia says it is ready to hold peace talks with Kyiv. But President Trump has cast doubt on Putin's remarks and theatened sanctions.”

UKRAINE (FRANCE24): “North Korea on Monday confirmed for the first time it has sent troops to Russia to support its war against Ukraine.”

US

POLITICS (BBG): “Voter discontent with President Donald Trump’s economic stewardship is sinking his popularity as he approaches the symbolic 100-day mark of his second term, ratcheting up pressure on congressional Republicans to pass his tax plan."

RUSSIA/UKRAINE (RTRS): “Top officials in U.S. President Donald Trump's administration on Sunday pressed Russia and Ukraine to make headway on a peace deal following a one-on-one meeting between Trump and Ukrainian President Volodymyr Zelenskiy at the Vatican a day earlier."

UKRAINE (BBC): “US President Donald Trump has said he thinks his Ukrainian counterpart Volodymyr Zelensky is willing to give up Crimea to Russia as part of a peace deal - despite Kyiv's previous rejections of any such proposal.”

UKRAINE (BBC): “Donald Trump has questioned Vladimir Putin's willingness to end the war in Ukraine following his meeting with the country's leader Volodymyr Zelensky on the sidelines of Pope Francis's funeral.”

TRADE (POLITICO): “United States President Donald Trump said U.S. military and commercial ships should be allowed to travel free of charge through the Panama and Suez canals, two strategic routes for global trade and military operations.”

FED (MNI): The best way for the Federal Reserve to safeguard its independence is for policymakers to avoid expanding the institution's role over time, including wading into policy areas that are outside its core mission, former Fed Governor Kevin Warsh, a leading contender to replace Jerome Powell as chair next year, said Friday.

OTHER

DEFENCE (FRANCE24): “Worldwide military expenditure surged to $2.7 trillion in 2024, marking the sharpest annual increase since the Cold War, driven by escalating conflicts and geopolitical tensions, SIPRI reported Monday.”

CANADA (MNI BRIEF): Mark Carney stressed ahead of Monday's election that he will assert Canada's economic power in trade talks with U.S. President Donald Trump, who the former Bank of England and Bank of Canada Governor said is pushing the U.S. into a Brexit-style economic setback.

JAPAN (BBG): “Japan has a 10% consumption tax, which is reduced to 8% for food products, and the Constitutional Democratic Party has proposed eliminating levies on food. Households spend ~30% on food so tax cuts there could free up funds for spending elsewhere.”

AUSTRALIA (BBG): “S&P Global Ratings warned Australia’s prized AAA sovereign credit rating may be at risk if election campaign pledges result in larger structural deficits, debt and interest costs, highlighting fiscal pressures facing the next government.”

IRAN (BBC): “In Iran, mourning is turning to anger after a huge blast at its largest commercial port killed at least 40 people and injured more than 1,000. The explosion happened on Saturday morning at Shahid Rajaee port.”

CHINA

GROWTH (MNI BRIEF): China is confident it can achieve this year’s development goals no matter how the international situation changes, Zhao Chenxin, vice chairman of the National Development and Reform Commission, told reporters on Monday, when asked if the country can meet its 5% GDP growth target in 2025.

YUAN (MNI BRIEF): Recent U.S treasury and dollar exchange-rate volatility has had a limited impact on China’s FX reserves, and the People’s Bank of China will continue to ensure yuan stablility against external shocks, PBOC Deputy Governor Zou Lan told reporters on Monday in a briefing.

TARIFFS (BBG): “Fast-fashion giant Shein Group Ltd. raised US prices of its products from dresses to kitchenware ahead of imminent tariffs on small parcels, in an early sign of the potential effect of the trade war on American consumers."

TECH (WSJ/RTRS): “China's Huawei Technologies is preparing to test its newest and most powerful artificial-intelligence processor, hoping to replace some higher-end products of U.S. chip giant Nvidia (NVDA.O), opens new tab, the Wall Street Journal reported on Sunday."

POLICY (SECURITIES DAILY): “China will likely lower reserve requirement ratio for banks and interest rates in the second quarter to support the economy and counter external shocks, Securities Daily reports, citing experts.”

MARKETS (SECURITIES DAILY): “The Politburo’s pledge to boost technology and consumption may bring about investment opportunities to relevant stocks, Securities Daily reports, citing experts.”

CHINA (BBC): “The Chinese coastguard has seized a tiny sandbank in the South China Sea, state media has reported, in an escalation of a regional dispute with the Philippines.”

CHINA MARKETS

MNI: PBOC Net Injects CNY103 Bln via OMO Monday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY279 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net injection of CNY103 billion after offsetting the maturities of CNY176 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.5593% at 09:29 am local time from the close of 1.7130% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Sunday, compared with the close of 47 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Lower At 7.2043 Mon; -0.94% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.2043 on Monday, compared with 7.2066 set on Friday. The fixing was estimated at 7.2843 by Bloomberg survey today.

MNI: China CFETS Yuan Index Up 0.15% In Week of Apr 25

The CFETS Weekly RMB Index was 96.29 on Apr 25, up 0.15% compared with 96.14 as of Apr 18.

MARKET DATA

CHINA INDUSTRIAL PROFITS MAR. YTD 0.8% Y/Y; FEB. -0.3%

CHINA INDUSTRIAL PROFITS MAR. +2.6% Y/Y; FEB. +11.0%

MARKETS

US TSYS: Asia Wrap - Quiet Start

TYM5 has traded a little higher with a range of 111-18 to 111.22+ during the Asia-Pacific session. It last changed hands at 111-19, up 0.03 from the previous close.

- The US 10-year yield is a little higher, dealing around 4.24%, up from its close around 4.23%

- The US 2-year yield is up, dealing around 3.75%, up from its close around 3.748%.

- Risk has struggled to hold onto its gains leaking lower in Asia as the market gives back some of its gains made on Friday night.

- Bloomberg - “ Big tech earnings earnings estimates may be way too high, with analysts projecting an average of 15% profit growth for the magnificent Seven in 2025, despite recent market turmoil. Any hint of a shortfall in Microsoft, Apple, Meta and Amazon’s results this week will probably “cause a further selloff”.”

- US TSY: Block - Sell TYM5, SELL 3020 of TYM5 traded at 111-19+, post-time 01:36:55 BST (DV01 $193,162).

- The 10-year Yield, has put in a lower high around 4.40% and is attempting to break through the recent support around 4.25%. Should this give way the next support is towards the 4.10 area which should find supply once more as the market will continue to look for higher term premium while uncertainty remains elevated.

- Data/Events : US GDP, ISM Manufacturing, NFM payrolls the main events this week. Trump’s first 100 days in office speech tomorrow.

JGBS: Twist-Steepener, Market Closed Tomorrow, BoJ Decision Thursday

JGB futures are stronger, +16 compared to the settlement levels, hovering just below Tokyo session highs.

- (MNI) The BoJ board is expected to keep its 0.5% policy interest rate unchanged at the two-day meeting ending May 1, as policymakers monitor the economic and inflationary impact of recent U.S. trade policies and volatile markets.

- Greater clarity on the economic outlook – particularly regarding the U.S. economy and Fed policy – is expected by July, when the BoJ releases its updated medium- to long-term growth and inflation forecasts. Should the U.S. fall into recession, it would likely remove any chance of a BoJ rate hike this year.

- Cash US tsys are 1-2bps cheaper, with a flattening bias, in today's Asia-Pac session after Friday's solid gains. GDP, ISM Manufacturing and NFM payrolls are the main events in this week's US calendar. Trump's first 100 days in office speech is tomorrow.

- Cash JGBs are 1-2bps richer out to the 20-year benchmark and 1-3bps cheaper beyond. The benchmark 10-year yield is 2.1bps lower at 1.321% versus the cycle high of 1.596%.

- Swap rates are 1-3bps lower. Swap spreads are mixed.

- Tomorrow, the local market is closed for the Showa Day holiday.

AUSSIE BONDS: Richer A Data-Light Session, Q1 CPI On Wednesday

ACGBs (YM +3.0 & XM +5.0) are richer and near Sydney session highs on a data-light day.

- Cash US tsys are slightly mixed, with a flattening bias, in today's Asia-Pac session after Friday's solid gains.

- The focus of the week locally will be on Wednesday’s Q1 CPI, which is forecast to show the RBA’s preferred trimmed mean falling below the top of the 2-3% target band for the first time since Q4 2021. This should signal another 25bp cut on May 20. Retail sales are on Friday, and the Federal Election Saturday.

- Cash ACGBs are 4-7bps richer with the AU-US 10-year yield differential at -8bps.

- Swap rates are 6-8bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing -2 to +4.

- RBA-dated OIS pricing is flat to 5bps softer across meetings today. A 50bp rate cut in May is given a 12% probability, with a cumulative 118bps of easing priced by year-end.

- Tomorrow, the local calendar will see a speech from RBA Kent, Assistant Governor (Financial Markets) on Australia’s External Position and the Evolution of the FX Markets.

- The AOFM plans to sell A$1200mn of the 2.75% 21 June 2035 bond on Friday.

BONDS: NZGBS: Bull-Flattener As Local Market Plays Catch-Up

NZGBs closed showing a bull-flattener, with benchmark yields 4-9bps lower.

With the local calendar empty, today’s moves reflected US tsys’ strong close to last week. The local market was closed on Friday for the ANZAC Day holiday.

- Cash US tsys are little changed in today's Asia-Pac session. GDP, ISM Manufacturing and NFM payrolls are the main events in this week’s US calendar. Trump’s first 100 days in office speech is tomorrow.

- “RBNZ increased its foreign currency intervention capacity to a record NZ$26.7b at the end of March as it sold New Zealand dollars.” (per BBG)

- The NZ economy will expand 0.5% q/q in 1Q, according to the latest results of a Bloomberg News survey. The RBNZ’s OCR is forecast to drop from 3.50% to 3.25% by end-2025.

- Swap rates closed 4-6bps lower, with 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings. 27bps of easing is priced for May, with a cumulative 82bps by November 2025.

- Tomorrow, the local calendar will see Filled Jobs data and a Pre-Budget speech from Finance Minister Willis.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 4.50% May-30 bond, NZ$150mn of the 4.25% May-34 bond and NZ$50mn of the 5.00% May-54 bond.

FOREX: G10 Wrap - USD Has A Quiet session

The BBDXY has had an Asian range of 1225.84 - 1227.93, Asia is currently trading around 1226. The headlines from the PBOC press conference aimed at stabilizing the economy and supporting the jobs market didn’t shift market sentiment greatly. It still appears more monetary stimulus is on the way, but the authorities will enact such moves in a timely manner. Bloomberg - “ECB: Klaas Knot told FD the June meeting will be “really complicated” due to uncertainty over US tariff policy and European fiscal plans."

- EUR/USD - Asian range 1.1340 - 1.1367, Asia is currently trading 1.1363. Intra-day support is around 1.1300, should this area not hold demand should remerge on dips back to 1.1100.

- GBP/USD - Asian range 1.3280 - 1.3312,the market seems happy to accumulate GBP on dips but the risk of a short-term retracement remains. Buyers should reemerge back towards the 1.3000/3100 area.

- USD/JPY - Asian range 143.35 - 143.88, has traded sideways for most of the Asia session. On the day the 143 handle should still see some supply, then more importantly the 145/146 area should once more offer good levels for sellers to reengage.

- USD/CNH - Asian range 7.2878 - 7.2986, the USD/CNY fix printed at 7.2043. USD/CNH continues to trade sideways and find support towards 7.2800, as it weakens in the crosses.

- Cross asset : SPX -0.52%, Gold $3293, US 10yr 4.23%, BBDXY 1226, Crude oil $63.31.

Data/Events : Spain Unemployment, Retail sales, ECB’s Guindos and Rehn Speak, US April Dallas Fed Manufacturing Activity.

Fig 1: EUR/USD Spot Daily Chart

Source: MNI - Market News/Bloomberg

FOREX: Antipodean Wrap - AUD & NZD Drift Sideways

Risk has struggled to hold onto its gains leaking lower in Asia as the market gives back some of its gains made on Friday night. (Bloomberg) -- RBNZ increased its foreign currency intervention capacity to a record NZ$26.7b at the end of March as it sold New Zealand dollars, according to data released by the central bank Monday. (Bloomberg) -- S&P Global Ratings warned Australia’s prized AAA sovereign credit rating may be at risk if election campaign pledges result in larger structural deficits, debt and interest costs, highlighting fiscal pressures facing the next government.

- AUD/USD - Asian range 0.6373 - 0.6407, AUD has traded sideways most of the Asian session. Dips back to the 0.6250/0.6300 area should continue to find demand while the market continues to focus on a lower USD.

- AUD/JPY - Asian range 91.54 - 92.04. Price goes into the London trading around 91.80, testing the highs within the last 10 days range of 0.8950/0.9200. Goldman’s like AUDJPY as the best vehicle to tactically express JPY strength.

- NZDUSD - Asian range 0.5943 - 0.5968, going into London trading around 0.5960. Demand should return first around 0.5900, then around the 0.5850 area.

- AUD/NZD - Asian range 1.0717 - 1.0737, the cross has drifted sideways in the Asian session. Watch for supply to return on any bounce back towards the 1.0800 area.

ASIA STOCKS: A Positive Regional Day ahead of Earnings

The focus this week will be on major China bank earnings as investors see if tariffs are impacting companies yet as markets show signs that the tariff threats may not be the driving forces in the week ahead. With over 400 companies reporting this week, investors will be looking for firsthand evidence that the trade war is impacting profitability.

As the press conference in China reiterated its commitment to jobs and support to the economy the government indicated that contingency plans are in place and that they remain 100% confident of achieving 5% economic growth.

- China’s major bourses were mixed today with the Hang Seng barely gaining up +0.07% whilst the CSI 300 was flat. Shanghai was down -0.03% and Shenzhen -0.72%.

- The KOSPI had a quiet start to the week in a week with significant data releases, rising just +0.16%.

- The FTSE Malay KLCI rose +0.65% to add to last week’s modest gains.

- The Jakarta Composite was up +0.72% today following on from last week's strong week where it gained +3.74%.

- In Singapore, the FTSE Straits Times was down -0.43% whilst the PSei in the Philippines rose +0.39%.

- India’s NIFTY 50 is up +0.90% in Monday’s trading, following on from last week’s poor end to the week with losses on Thursday and Friday

Gold Softer Again as Profit Takers Move In.

- Gold has kicked off the week with a fall in Asian trading, down -0.80% today.

- Up over 25% year to date on trade war concerns, gold is one of the best performing assets in what is proving to be a volatile start to the year.

- Reaching a new all-time high of US$3,423.98 this month, gold has surged through most predictions at the beginning of the year.

- Gold started the trading week this week in Asia at $3,325.21 and fell to $3,292.74

- Key central banks globally have reported increases to their gold reserves, boosting demand for the precious commodity whilst China’s Gold Association reported a 6% decline in gold consumption in Q1.

- Data out from the CFTC last Friday showed that Hedge Funds have reduced the number of their gold longs to the lowest level in one year indicating that the rally for now may be stalled.

- For now, all major moving averages are pointing upwards: a sign that the bullish momentum remains in place but with the CFTC positioning data, it is possible we could see a modest week for gold should trade war headlines not dominate.

OIL: Geopolitical Uncertainty Clouding Oil Outlook

Oil prices are moderately higher during today’s APAC session as markets watch and wait for progress on US trade negotiations. WTI is up 0.5% to $63.34/bbl off the intraday low of $62.88/bbl and Brent is +0.3% to $67.10/bbl after falling to $66.70 earlier. The USD index is off its high to be little changed on the day.

- The oil markets looked through today’s China economic press conference which included a statement that rates and the RRR would be reduced and that the 5% 2025 growth target is expected to be met.

- Geopolitical uncertainty is at the fore with significant uncertainty around US tariffs, threats to increase sanctions on Russia if it doesn’t reach a deal on Ukraine and ongoing US-Iran talks on Iran’s nuclear programme. In addition, with a meeting on May 5 the outlook for OPEC production is also unclear after the larger-than-expected increase in April.

- Later US April Dallas Fed manufacturing and UK April Nationwide house prices are released. ECB’s de Guindos presents ECB’s 2024 Annual Report. Oil markets will be monitoring Friday’s US payrolls.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 28/04/2025 | 0600/0800 | ** | PPI | |

| 28/04/2025 | 1000/1100 | ** | CBI Distributive Trades | |

| 28/04/2025 | 1300/1500 | ECB's de Guindos Presenting 2024 Annual Report | ||

| 28/04/2025 | 1400/1000 | ** | housing vacancies | |

| 28/04/2025 | 1430/1030 | ** | Dallas Fed manufacturing survey | |

| 28/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 28/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 29/04/2025 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 29/04/2025 | 0600/0800 | * | GFK Consumer Climate | |

| 29/04/2025 | 0600/0800 | ** | Private Sector Production m/m | |

| 29/04/2025 | 0600/0800 | Flash Quarterly GDP Indicator | ||

| 29/04/2025 | 0600/0800 | ** | Retail Sales | |

| 29/04/2025 | 0700/0900 | ** | Economic Tendency Indicator | |

| 29/04/2025 | 0700/0900 | *** | HICP (p) | |

| 29/04/2025 | 0700/0900 | *** | GDP (p) | |

| 29/04/2025 | 0700/0900 | ECB's Cipollone On Financial and Trade Fragmentation | ||

| 29/04/2025 | 0800/1000 | ** | M3 | |

| 29/04/2025 | 0800/1000 | ** | ISTAT Consumer Confidence | |

| 29/04/2025 | 0800/1000 | ** | ISTAT Business Confidence | |

| 29/04/2025 | 0800/1000 | ** | ECB Consumer Expectations Survey | |

| 29/04/2025 | 0900/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 29/04/2025 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 29/04/2025 | 0940/1040 | BOE Ramsden At Innovate Finance Global Summit | ||

| 29/04/2025 | 1230/0830 | ** | Advance Trade, Advance Business Inventories | |

| 29/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 29/04/2025 | 1300/0900 | ** | S&P Case-Shiller Home Price Index | |

| 29/04/2025 | 1300/0900 | ** | FHFA Home Price Index | |

| 29/04/2025 | 1300/0900 | ** | FHFA Home Price Index |