MNI EUROPEAN OPEN: Markets Await US Tariff Announcement

EXECUTIVE SUMMARY

- USTR PREPS NEW TARIFF OPTION FOR TRUMP - WSJ

- TRUMP AIDES DRAFT TARIFF PLANS AS SOME EXPERTS WARN OF ECONOMIC DAMAGE - WAPO

- FED’S GOOLSBEE WARNS OF TARIFF-INDUCED PULLBACK IN SPENDING- FOX NEWS

- BOJ’S UEDA VOICES CONCERN OVER TARIFFS IMPACT - MNI BRIEF

- MNI DISCUSSES POTENTIAL INCOMING SUPPORT AIMED AT CHINA PROPERTY DEVELOPERS - MNI

- RBA TO ADJUST OMO PRICING FROM APRIL 9 - MNI BRIEF

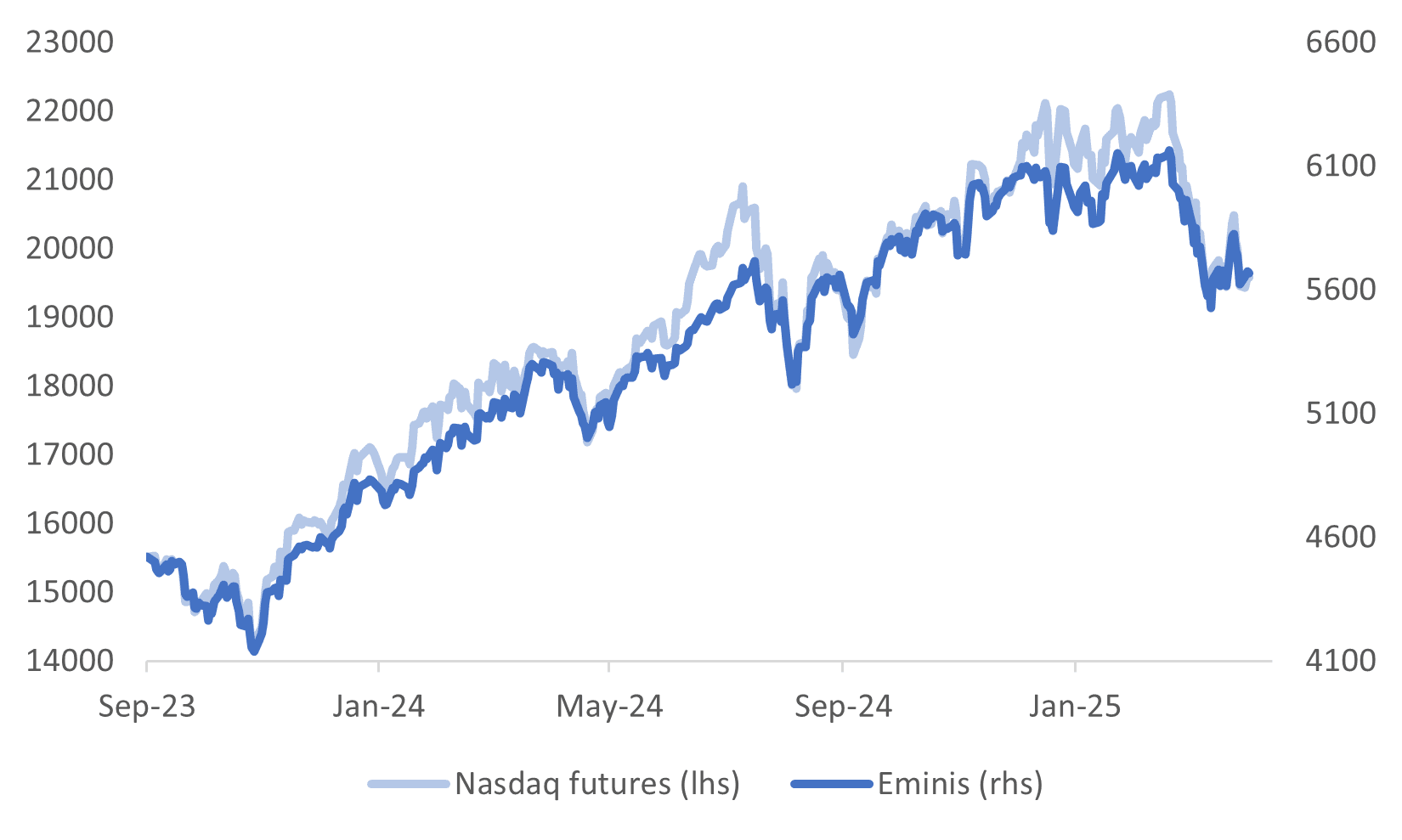

Fig 1: US Equity Futures

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

POLITICS (BBC): “The UK government is working with Mauritius to finalise a deal on the future of the Chagos Islands, Downing Street has said.”

EU

TRADE (POLITICO): “In an interview with POLITICO, Bank of Finland Governor Olli Rehn urged the European Union to prepare “proportionate countermeasures” to the United States president’s imposition of tariffs on imports from the bloc.”

EU (POLITICO): “The director of the European Anti-Fraud Office (OLAF), Ville Itälä, has defended his decision not to open a probe into Huawei’s alleged lobbying practices in the European Parliament, over a tip dating back to 2022, even though Belgian authorities have now decided to investigate the Chinese tech multinational over the same matter.”

EU (ECONOMIST): “On Wednesday Poland’s defence minister, Wladyslaw Kosiniak-Kamysz, will host his counterparts from across the European Union to discuss bolstering Europe’s security in the face of a new Russian threat.”

FRANCE (BBC): “French far-right leader Jordan Bardella has called on people to rally in the centre of Paris on Sunday in protest at a ruling that has banned Marine Le Pen from running for public office for five years.”

TURKEY (POLITICO): “Facebook parent company Meta has been fined a "substantial" amount for not complying with orders from Turkish authorities to limit content, a spokesperson told POLITICO. The Turkish government has been ordering the suspension of social media accounts sharing information on the widespread protests that have followed the arrest of President Recep Tayyip Erdoğan’s main political rival, Istanbul Mayor Ekrem İmamoğlu.”

HUNGARY/ISRAEL (ECONOMIST): “On Wednesday Binyamin Netanyahu, Israel’s prime minister, flies to Budapest for meetings with his Hungarian counterpart, Viktor Orban. The agenda reportedly includes Donald Trump’s plan to evict Palestinians from Gaza. This will be Mr Netanyahu’s first visit to a country that is a member of the International Criminal Court.”

US

TARIFFS (WSJ): “Trump's team in recent days has considered imposing a 20% universal tariff on virtually all imports, versus a reciprocal plan that would apply different tariffs to different countries. But the U.S. Trade Representative's office is preparing a third option-an across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option, according to people with knowledge of the plans.”

ECONOMY (WAPO): “The president’s team is exploring using trillions of dollars in new import revenue for a tax dividend or refund, people familiar with the matter said.”

POLITICS (BBG): “Republican Randy Fine won the Florida House seat left open by National Security Adviser Michael Waltz in a largely conservative area that includes Daytona Beach on the state’s northeast coast, according to the Associated Press.”

POLITICS (RTRS): “Wisconsin voters elected Susan Crawford to the state Supreme Court on Tuesday, maintaining the court's 4-3 liberal majority in a setback for President Donald Trump and his billionaire ally Elon Musk, who had backed her conservative rival.”

US/CHINA (WSJ): “ President Trump will be briefed Wednesday on the contours of a proposal to keep TikTok operational ahead of a pending U.S. deadline to sell or shut it down, according to people familiar with the matter.”

FED (FOX NEWS/BBG): “ Federal Reserve Bank of Chicago President Austan Goolsbee warned of the negative consequences of any slowdown in consumer spending or business investment due to tariff-related uncertainty. “

GREENLAND (WAPO): “The White House is preparing an estimate of what it would cost the federal government to control Greenland as a territory, according to three people with knowledge of the matter, the most concrete effort yet to turn President Donald Trump's desire to acquire the Danish island into actionable policy.”

OTHER

JAPAN (MNI BRIEF): Bank of Japan Governor Kazuo Ueda on Wednesday voiced concern that U.S. tariffs may have a significant impact on global trade, depending on their range and scale.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia from April 9 will increase the price of all new open market operation (OMO) repos by 5 basis points to 10bp over the cash rate target as it transitions to an ample reserve system, Chris Kent, assistant treasurer (financial markets) told an industry forum on Wednesday.

THAILAND (BBG): “Thailand expects its exports to the US to be lower by $7b-$8b if Trump administration raises tariffs by 11%, and the Southeast Asian nation will adopt a “holistic approach” to trade negotiation, according to an official.”

CHINA

PROPERTY (MNI): MNI discusses potential incoming support aimed at China's property developers. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

SERVICES (SECURITIES DAILY): “China’s services trade grew 9.9% y/y to CNY1.3 trillion in the first two months, with exports and imports growing 13% and 7.8%, according to data from the Ministry of Commerce.”

LOCAL GOVERNMENT FISCAL (YICAI): “China issued a record CNY2.85 trillion of local government bonds in Q1, up 80% y/y, of which new bonds reached CNY1.25 trillion, an increase of about 48% y/y, while refinancing bonds amounted to approximately CNY1.6 trillion, up 119% y/y, Yicai reported, citing China Bond Information Network data.”

CASH POOLING (CSJ): “China will promote a pilot cash-pooling service nationwide for multinational companies to integrate domestic and foreign currency management, according to a draft statement released by the People’s Bank of China.”

CHINA MARKETS

MNI: PBOC Net Drains CNY225.5 Bln via OMO Wednesday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY229.9 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net drain of CNY225.5 billion after offsetting the maturity of CNY455.4 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6810% at 09:30 am local time from the close of 1.8421% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Tuesday, compared with the close of 63 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Higher At 7.1793 Weds; -0.48% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1793 on Wednesday, compared with 7.1775 set on Tuesday. The fixing was estimated at 7.2678 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND FEB. HOME-BUILDING APPROVALS +0.7% M/M; JAN. +2.6% M/M

AUSTRALIA FEB. BUILDING APPROVALS -0.3% M/M; EST. -1.3%; JAN. +6.9%

AUSTRALIA FEB. PRIVATE-SECTOR HOME APPROVALS +1.0% M/M; JAN. +1.4%

JAPAN MARCH MONETARY BASE -3.1% Y/Y; FEB. -1.8%

JAPAN END-MARCH MONETARY BASE OUTSTANDING Y653.8T; FEB. Y655.3T

SOUTH KOREA MARCH CONSUMER PRICES +0.2% M/M; EST. +0.1%; FEB. +0.3%

SOUTH KOREA MARCH CONSUMER PRICES +2.1% Y/Y; EST. +1.9%; FEB. +2.0%

SOUTH KOREA MARCH CPI EX FOOD & ENERGY +1.9% Y/Y; EST. +1.8%; FEB. +1.8%

MARKETS

US TSYS: Cash Bonds Cheaper Ahead Of ADP Employment Data & Trump Tariffs

TYM5 is 111-16+, -0-08 from closing levels in today's Asia-Pac session.

- “Treasury 10-year futures are slightly lower in early Wednesday action but traders can see momentum building for a break above the 112 area and toward higher ground. The trigger is likely to be the fallout from the tariff announcements and responses from other nations.” (per BBG)

- Cash US tsys are ~2bps cheaper after yesterday's modest gains ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Trump's tariffs will take immediate effect after they are announced.

- The latest information includes: a CNBC reporter posting on X, citing Republican Rep. Kevin Hern, that the tariff rates announced Wednesday will be the highest they will go and countries can then take steps to bring the tariffs down.

- Today’s US calendar will see ADP Employment Change and Factory Orders data, and Fedspeak from Kugler on Inflation Expectations.

JGBS: Cash Bond Bull-Flattener Going Into US Liberation Day News

JGB futures are stronger and near session highs, +14 compared to settlement levels.

- Outside of the previously outlined monetary base date, BoJ Governor Ueda has stated that US tariffs could significantly impact trade activity in affected nations, depending on their size and area. Ueda expressed uncertainty about the overall picture of the policies, awaiting an official announcement, and will closely watch developments to grasp their economic impacts.

- “The Japanese government will continue to strongly urge the US to exempt Japan from tariff measures, while assessing the details and potential impact on the country, Finance Minister Katsunobu Kato says” (per BBG)

- Cash US tsys are ~2bps cheaper ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Trump's tariffs will take immediate effect after they are announced. Today's US calendar will see ADP Employment Change and Factory Orders data, and Fedspeak from Kugler on Inflation Expectations.

- Cash JGBs have bull-flattened, with yields flat to 3bps lower. The benchmark 10-year yield is -0.4bp at 1.495% versus the cycle high of 1.596%.

- Swap rates are little changed. Swap spreads are mixed.

- Tomorrow, the local calendar will see Weekly International Investment Flow and Jibun Bank Composite & Services PMIs data.

AUSSIE BONDS: Little Changed Ahead Of Trump Tariff Announcement

ACGBs (YM -1.0 & XM +1.0) are little changed after dealing in narrow ranges in today's local session.

- There was a small payback in February non-house building approvals. Nevertheless, looking through the volatility the total number is trending robustly higher.

- Cash US tsys are ~2bps cheaper ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Today's US calendar will see ADP Employment Change and Factory Orders data, and Fedspeak from Kugler on Inflation Expectations.

- Cash ACGBs have bear-flattened, with yields flat to 2bps higher, with the AU-US 10-year yield differential unchanged. At +22bps, the differential is approaching the top of the range that it has traded in since late 2022.

- The latest round of ACGB May-34 supply sees the weighted average yield print 0.35bps through prevailing mids, with the cover ratio of 3.9125x was significantly higher than at the previous auction.

- Swap rates are flat to 1bp lower, with EFPs tighter.

- The bills strip is little changed.

- RBA-dated OIS pricing is slightly softer today. A 25bp rate cut in May is given a 77% probability, with a cumulative 71bps of easing priced by year-end.

- Tomorrow, the local calendar will see S&P Global Composite and Services PMIs.

BONDS: NZGBS: Bull-Flattener Ahead Of Tariff News, May-32 Syn Tap

NZGBs closed mid-range, flat to 3bps richer, with the 2/10 curve flatter.

- Cash US tsys are ~2bps cheaper after yesterday's modest gains ahead of Wednesday afternoon's Liberation (tariff) Day announcement from the White House (1600ET est). Trump's tariffs will take immediate effect after they are announced.

- The NZ-US 10-year yield differential closed 3bps tighter +35bps after reaching the highest level since October last year yesterday.

- Today the NZ Treasury announced that an additional NZ$4.0bn of the nominal 15 May 2032 bond had been issued via syndicated tap. The bonds, which carry a coupon of 2.00%, were issued at a spread of 14bps over the 15 May 2031 nominal bond, at a yield to maturity of 4.3100%. Total book size, at final price guidance, exceeded NZ$18.3bn. There will be no further issuance of the bond prior to July 2025.

- Swap rates closed flat to 2bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed little changed. 24bps of easing is priced for April, with a cumulative 72bps by November 2025.

- Tomorrow, the local calendar will see CoreLogic Home Value and ANZ Commodity Price data.

FOREX: A$ & NZD Outperform Yen Ahead Of US Tariff Announcement

AUD and NZD gains, against both the USD and JPY, have been the main focus points in the first part of Wednesday trade G10 FX trade. The USD BBDXY index was last just under 1273, a touch below end Tuesday levels in NY. Focus remains firmly on the US reciprocal tariff announcement, later on Wednesday US time (4pm EST).

- We had a number of news wire stories related to tariffs towards the tail end of the US Tuesday session/early Asia Pac trade. To recap:

A CNBC reporter posted on X, citing Republican Rep. Kevin Hern, that the tariff rates announced Wednesday will be the highest they will go and countries can then take steps to bring the tariffs down. This reportedly followed a meeting with US Tsy Secretary Bessent. - The WSJ also noted earlier the USTR is preparing another tariff option for Trump: ""The U.S. Trade Representative's office is preparing a third option of across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option, according to people with knowledge of the plans."

- There was also a Washington Post article around the use of tariff revenue to support the economy, including options for a tax dividend or refund, but these plans are reportedly only in the very early stages.

- US equity futures re-opened higher, but positive momentum waned and we were last -0.10% for Eminis. US Tsy yields are higher across the benchmarks, up 2bps for the 10yr to 4.19%. This has likely helped nudge USD/JPY a little higher, but at 149.80/85 we are only marginally above end Tuesday levels. EUR/USD is holding under 1.0800.

- AUD and NZD have ticked up. AUD/USD last near 0.6300, while NZD/USD is back to 0.5720, slightly outperforming the AUD. Both currencies are firmer against the yen and challenging 20-day EMA resistance points. AUD/JPY was last near 94.35/40, while NZD/JPY was at 85.70/75.

- Looking ahead, apart from the US tariff announcement, the Fed’s Kugler speaks on inflation expectations and March US ADP employment and February orders are released. The ECB’s Lagarde, Schnabel and Lane talk.

ASIA STOCKS: China’s Bourses Hold on to Marginal Gains

Xiaomi’s stock has been under selling pressure today down over 3% as one of its vehicles equipped with smart driving software crashed, with people killed. This followed losses of over 5% yesterday.

Despite the pressure on Xiaomi, Chinese electric vehicle manufacturers shares rise as delivery data shows year on year growth.

Malaysia’s Petronas shares slumped 2% as a main pipeline leak caused a fire that damaged multiple homes in a KL suburb.

- China’s main bourses delivered gains today with the Hang Seng up just +0.06, CSI 300 up +0.15%, Shanghai up +0.25% and Shenzhen up +0.38%.

- Taiwan’s TAIEX was weaker today by -0.10%, following yesterday’s huge gains of +2.8%.

- The KOSPI made yesterday’s gains look like an anomaly and fell again by -0.70%.

- With Indonesia still out, after being closed for two days for holidays, Malaysia’s FTSE Bursa KLCI is up +0.57% in trading today, after Friday’s fall of -1.44%

- In Singapore, the Straits Times is down -0.28% whilst the Philippines is up +0.42%.

- India’s NIFTY 50 is opening stronger this morning following yesterday’s significant falls of -1.50%, to be stronger by +0.50% in morning trading.

OIL: Crude Range Trading Ahead Of US Tariff Announcement

Oil prices are little changed during APAC trading today as markets wait for details on US reciprocal tariffs due to be announced at 1600 ET or 0700 AEDT Thursday. Worries regarding the impact of increased trade protectionism on global oil demand have often driven prices lower this year and so the announcement will be important for energy markets. The reaction is likely to depend on markets’ assessment of the severity of the policy. The USD is 0.1% lower.

- WTI is flat today at $71.19/bbl off the intraday high of $71.34. It has remained below initial resistance at $71.83. Brent has also traded in a narrow range and is moderately higher at $74.50 close to today’s peak of $74.62. Initial resistance is at $75.04.

- US President Trump has said that the tariffs will take effect immediately, while Treasury Secretary Bessent stated that there will be a “cap” and that countries can negotiate to reduce the tariff they face below this. There could be a tiered tariff structure along with specific reciprocal taxes depending on what the US faces in other countries, according to Bloomberg.

- Other significant uncertainties include the outlook for Russia-Ukraine. A bipartisan group of 50 US senators tabled a sanctions plan on Russia and those who buys its fossil fuels, if Russia’s President Putin doesn’t honestly negotiate a truce and then stick to it.

- Bloomberg reported that there was a US crude stock build of 6mn barrels last week, according to people familiar with the API data. Product inventories continued to decline though with gasoline down 1.6mn and distillate 11k. Official EIA data is out later today.

- Apart from the US tariff announcement, the Fed’s Kugler speaks on inflation expectations and March US ADP employment and February orders are released. The ECB’s Lagarde, Schnabel and Lane talk.

GOLD: Buyers Re-Emerge as Gold Surges in Afternoon Trading.

- Having hit $3,149.00 yesterday, gold retreated as profit taking set in and traders squared their positions ahead of the tariff announcements.

- Opening in the Asian trading session at $3,113.38, gold did very little in the morning session before a surge in afternoon trading to a high of $3,135.71, before backing off to $3,125.09

- As the gold price hits levels that were (for many forecasters) a year end target, BofA is the first to flinch, suggesting that gold could reach US$3,500.

- Up 19% year to date, Gold has surged over 3% in three trading sessions, prior to the decline into the US market close.

- Demand for Gold ETFs remains strong with assets under management growing by over 5% this year.

- Gold’s rally is impacting markets globally with South African mining stocks putting in their best monthly performance on record in March.

- Wednesday in the US sees the President announcing wide ranging tariffs on ‘all’ of America’s trading partners, a move that inevitably will see counter measures and bring with it volatility.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 02/04/2025 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 02/04/2025 | 1030/1230 | ECB's Schnabel At SciencesPo Conference | ||

| 02/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 02/04/2025 | 1215/0815 | *** | ADP Employment Report | |

| 02/04/2025 | 1400/1000 | ** | Factory New Orders | |

| 02/04/2025 | 1405/1605 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 02/04/2025 | 2030/1630 | Fed Governor Adriana Kugler | ||

| 03/04/2025 | 2200/0900 | * | S&P Global Final Australia Services PMI | |

| 03/04/2025 | 2200/0900 | ** | S&P Global Final Australia Composite PMI | |

| 03/04/2025 | 0030/1130 | Job Vacancies | ||

| 03/04/2025 | 0030/1130 | ** | Trade Balance | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Services PMI | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Composite PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Services PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Composite PMI | |

| 03/04/2025 | 0630/0830 | *** | CPI | |

| 03/04/2025 | 0700/0300 | * | Turkey CPI | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0720/0920 | ECB's De Guindos On "Financial Stability In Uncertain Times" | ||

| 03/04/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0830/0930 | Decision Maker Panel data | ||

| 03/04/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 03/04/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 03/04/2025 | 0900/1100 | ** | PPI | |

| 03/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI |