MNI EUROPEAN OPEN: Sharp Equity Falls Continue In Asia Pac

EXECUTIVE SUMMARY

- TRUMP OPEN TO TARIFF CUTS IN RETURN FOR 'PHENOMENAL OFFERS - BBG

- FED’S JEFFERSON SAYS NO NEED TO RUSH INTO RATE CHANGE - MNI

- US SENATE REPUBLICAN PUSHES TO REQUIRE CONGRESSIONAL APPROVAL FOR NEW TARIFFS - RTRS

- WITKOFF, PUTIN ENVOY MEET IN WASHINGTON AS TRUMP GROWS IMPATIENT - BBG

- SOUTH KOREA’S PRESIDENT YOON OUSTED BY CONSTITUTIONAL COURT - RTRS

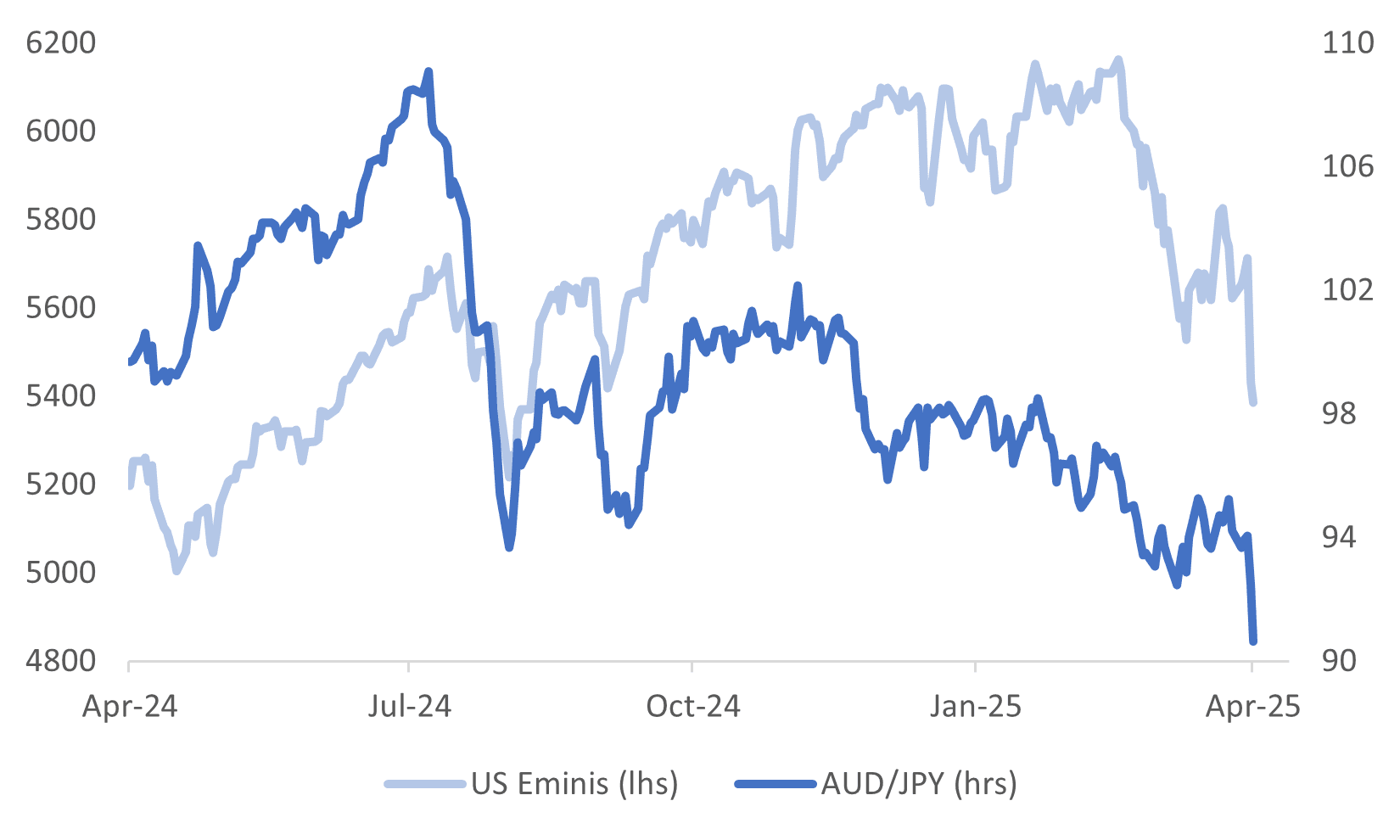

Fig 1: AUD/JPY & US Eminis Falling Sharply

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

TARIFFS (BBG): "US officials have told their UK counterparts they’ll discuss Britain’s proposal to reduce tariffs below 10%, but warned them President Donald Trump may decide that number is his permanent baseline for all countries, according to British officials familiar with the matter.

EU

US/RUSSIA (BBG): "US special envoy Steve Witkoff and a Russian negotiator met on Wednesday and Thursday in Washington, days after US President Donald Trump expressed frustration with Vladimir Putin over the lack of momentum on negotiations toward a ceasefire in the Ukraine war. "

FRANCE/US (RTRS): “French President Emmanuel Macron called on Thursday for European companies to suspend planned investment in the United States after U.S. President Donald Trump announced sweeping global tariffs on American imports.”

US

TARIFFS (BBG): "President Donald Trump said he was open to reducing his tariffs if other nations were able to offer something “phenomenal,” indicating that the White House was open to negotiations despite the insistence of some top officials."

ECONOMY (MNI INTERVIEW): Tariff Benefits Loom Despite Some Fallout-Miran

SERVICES (MNI INTERVIEW): Tariffs To Send Services Into Contraction-ISM

FED (MNI INTERVIEW): Powell To Defend Fed's Inflation Mandate -Tracy

TARIFFS (RTRS): “Republican U.S. Senator Chuck Grassley introduced a bill on Thursday that would require congressional approval for new tariffs, the day after President Donald Trump unveiled sweeping new taxes on a vast array of imported goods.”

FED (MNI): Federal Reserve Vice Chair Philip Jefferson said Thursday monetary policy is well positioned to respond to higher inflation or a weaker labor market and there's no urgency to adjust interest rates in an uncertain environment.

FED (MNI): Federal Reserve Governor Lisa Cook said Thursday the U.S. economy has entered a period of uncertainty and it will be appropriate to hold rates steady while keeping an eye on developments that could alter the outlook.

FISCAL (BBG): " Republicans are weighing the creation of a new bracket for those earning $1 million or more to offset some of the costs of their tax bill, a stark departure from decades of GOP opposition to tax increases, according to people familiar with the matter."

OTHER

CANADA (MNI BRIEF): Canadian Prime Minister Mark Carney said Thursday the government will match U.S. tariffs on automobiles but exclude parts that are vital to North America's integrated production lines, pledging further retaliation in coming weeks if Donald Trump moves further on what's he's called strategic industries like pharmaceuticals, lumber, semiconductors and farm products.

JAPAN (MNI BRIEF): Bank of Japan Deputy Governor Shinichi Uchida warned on Friday that U.S. tariffs could put downward pressure on the Japanese economy.

JAPAN (MNI BRIEF): Bank of Japan Governor Kazuo Ueda said on Friday that U.S. tariffs will put downward pressure on the global and Japanese economies but its impact on prices will be varied, and the bank cannot assess currently.

SOUTH KOREA (RTRS): “ South Korean President Yoon Suk Yeol was ousted by the Constitutional Court on Friday, which upheld parliament's impeachment motion over his short-lived imposition of martial law last year that sparked the country's worst political crisis in decades.With Yoon's ouster, a presidential election is required to take place within 60 days, according to the country's constitution.”

CHINA

CHINA/US (MNI): Trade negotiations between China and the U.S. are likely to start soon given President Donald Trump’s penchant for dealmaking, but a quick settlement looks difficult, with China calculating that the U.S. position will be weakened by a deterioration of its economy and markets, Chinese policy advisors told MNI.

CHINA/US (BBG): "Chinese and US defense officials had their first known formal contact since Donald Trump returned to the White House, in a meeting that partially coincided with Beijing conducting large-scale military drills around Taiwan."

MARKET DATA

AUSTRALIA FEB HOUSEHOLD SPENDING M/M 0.2%; MEDIAN 0.3%; PRIOR 0.5%

AUSTRALIA FEB HOUSEHOLD SPENDING Y/Y 3.3%; MEDIAN 3.2%; PRIOR 3.2%

JAPAN FEB HOUSEHOLD SPENDING Y/Y -0.5%, MEDIAN -0.8%; PRIOR 0.8%

MARKETS

US TSYS: Rally Extends As Risk-Off Remains

TYM5 is 113-08+, +0-20 from closing levels in today's Asia-Pac session.

- According to MNI's technicals team, today's move puts TYM5 above the key technical resistance at 113-05 (1.764 proj of the Jan 13 - Feb 7 - Feb 12 price swing).

- Cash US tsys 5-7bps richer in today's Asia-Pac session after finishing Thursday's NY session broadly richer, with yields 3-18bps lower.

- Attention now turns to today's US payrolls data and a speech by Fed Chair Powell.

- Nonfarm payrolls are seen increasing a seasonally adjusted 140k in March in the Bloomberg survey after 151k in February. The unemployment rate is seen holding at 4.1% after a surprise increase in Feb, although at 4.14% it can very easily round higher as some analysts are expecting. Its recent high was 4.23% in Nov whilst the median FOMC participant raised the 4Q25 forecast a tenth higher to 4.4% in last month's SEP.

- See MNI US Payrolls Preview here.

JGBS: Massive Rally Led By The Belly, 10YY Falls 40bps This Week

JGB futures are sharply stronger, +177 compared to settlement levels, aligning with US tsys.

- BoJ Governor Ueda said, “US tariffs have added uncertainty to the economic outlook and will weigh on growth, in comments that indicate the central bank may need more time to assess the impact of Donald Trump’s policies before lifting its benchmark rate.” (per BBG)

- “Bank of Japan Deputy Governor Shinichi Uchida said on Friday the central bank will keep raising interest rates if the chance of underlying inflation achieving its 2% target heightens. "We will examine at each policy meeting, without any preconception, whether our (economic and price) forecasts would be achieved" in deciding monetary policy, Uchida told parliament. “ (per RTRS)

- Cash US tsys 5-7bps richer in today's Asia-Pac session after finishing yesterday's NY session 3-18bps richer, with the curve steeper. Attention now turns to today's US payrolls data and a speech by Fed Chair Powell.

- Cash JGBs are 7-20bps richer across benchmarks, with the belly of the curve outperforming. The benchmark 10-year yield is 19.5bps lower at 1.176% versus the cycle high of 1.596%, set last week.

- Swap rates are 13-18bps lower. Swap spreads are mixed.

- On Monday, the local calendar will see Labor & Real Cash Earnings and Coincident & Leading Indices data.

AUSSIE BONDS: Bull-Steepener Ahead Of US Payrolls

ACGBs (YM +14.0 & XM +5.5) are holding sharply richer, with the curve steeper.

- Cash US tsys 5-7bps richer in today's Asia-Pac session after finishing yesterday's NY session broadly richer, with yields 3-18bps lower. Attention now turns to today's US payrolls data and a speech by Fed Chair Powell. Nonfarm payrolls are seen increasing a seasonally adjusted 140k in March in the Bloomberg survey after 151k in February. See MNI US Payrolls Preview here.

- Cash ACGBs are 3-11bps with the 3/10 curve steeper and the AU-US 10-year yield differential at +20bps.

- The bills strip has sharply bull-flattened, with pricing +8 to +16.

- Market expectations for RBA easing in 2025 have strengthened following President Trump's reciprocal tariff announcement late Wednesday. A 25bp rate cut in May is now priced at 118% probability, with a total of 103bps of easing expected by year-end (based on an effective cash rate of 4.09%).

- On Monday, the local calendar will see ANZ-Indeed Job Advertisements and Foreign Reserves data.

- Next week, the AOFM plans to sell A$400mn of the 4.25% 21 June 2034 bond on Tuesday, A$1000mn of the 2.75% 21 November 2028 bond on Wednesday and A$600mn of the 2.75% 21 June 2035 bond on Friday.

BONDS: NZGBS: Closed On A Strong Note As Global Bonds Extend Rally

NZGBs closed on a strong note, with benchmark yields 9-14bps lower.

- With the local calendar empty today, the market’s focus remains on the fall-out from President Trump’s announcement of reciprocal tariffs late Wednesday.

- Cash US tsys 5-7bps richer in today's Asia-Pac session after finishing yesterday's NY session broadly richer, with yields 3-18bps lower. Attention now turns to today's US payrolls data and a speech by Fed Chair Powell. Nonfarm payrolls are seen increasing a seasonally adjusted 140k in March in the Bloomberg survey after 151k in February. See MNI US Payrolls Preview here.

- NZ-US and NZ-AU 10-year yield differentials are little changed versus yesterday’s close.

- Swap rates closed 6-13bps lower, with the 2s10s curve steeper.

- Rate expectations across the $-bloc have softened sharply through December 2025. Since last Friday, markets have repriced significantly: US rate expectations have eased by 40bps, Australia by 37bps, New Zealand by 30bps, and Canada by 19bps.

- Looking ahead, the next key policy decisions in the $-bloc are the RBNZ on 9 April and the BoC on 16 April. Markets are currently more than fully pricing a 25bp cut from the RBNZ, while assigning only a 35% probability to a cut from the BoC.

FOREX: USD Index Ticks Down, AUD/JPY Falls 1.8% Amid Further Equity Risk Off

The BBDXY opened around 1250 in Asia and has drifted slightly lower going into the London session to open around 1248. We are still up from intra-session lows on Thursday (1244.84). The 10yr yield has broken the pivotal 4% and stocks remain under pressure.

- EUR/USD - Asia has had a range of 1.1037 - 1.1099, and is trading around 1.1085 going into the London open. For now though dips look likely to remain supported and buying interest is likely emerge anywhere back towards 1.1000 on the day.

- GBP/USD - very quiet day Asian session with a range of 1.3081 - 1.3110.

- AUD/USD - has traded for poorly in the Asian session, and is being sold across the board in the crosses. AUD remains a favourite as a risk proxy so expect it the headwinds to continue while stocks remain under pressure. AUD/JPY has hit fresh lows under 91.00. August 2024 lows rest at 90.15.

- USD/CNH - the Asian range has been 7.2450 - 7.2966, we are going into the London session trading heavy near the lows. This pair will continue to be managed but CNH is outperforming higher beta FX so far today. Note China and Hong Kong markets have been out today.

- USD/JPY - the Asian range has been 145.30-146.41. After bouncing back to 146.40 area into the Japanese fix, USD/JPY has drifted lower most of our session looking to open the London session around the lows at 145.40. Bounces will find eager sellers while risk remains under pressure. CHF has outperformed yen, USD/CHF back under 0.8530, fresh 6 month lows.

- Cross asset sentiment trades very poorly US equities down around 0.8%, and strong demand for treasuries breaking the 4% support area in terms of the 10yr yield. Commodities trade poorly as the market reevaluates what the events of this week mean for global growth going forward.

- Key US data tonight will be the NFP, along with Fed Chair Powell speak. For NFP the market may look through a better than expected outcome, but a downside surprise might drive further risk off.

ASIA STOCKS: Another Brutal Day for Asian Bourses

With China out today, eyes were on South Korea where the decision on President Yoon was pending. Korea's KOSPI held its breath leading into the decision but headed lower quickly after the court verdict to impeach Yoon results in an immediate removal and a presidential election within 60 days.

- The KOSPI moved lower quickly to be -1.80% on the day, capping off a challenging week in which the index has declined -4.5%.

- Malaysia's FTSE Bursa KLCI is down and in a week shortened by holidays is only down -0.50%.

- In Singapore, the FTSE Straits Times is down heavily today by -2.90%, marking its worst decline for the year and a -3.6% decline for the week.

- The Philippines reported weaker than expected CPI prompting forecasters to call for a rate cuts at the BSP's meeting next week as the PSEi declined -1.17% today, down.

- In India, the NIFTY 50 fell only modestly yesterday by -0.35% yet it opening up much weaker today to be lower by -1.23%.

Oil Slips Further During in Asia's Day

- Whilst the tariff announcement may have provided certainty on what was to be levied, the create uncertainty as to the outlook for the global economy; pressurizing oil prices.

- Add to this, OPEC+ decision to add 411,000 barrels of supply from May created a perfect storm for oil prices.

- Oil declined the most in two years with prices down over 6%.

- WTI had fallen -6.64% overnight to US$66.63 trading through all major moving averages.

- The falls didn’t end there with a decline -0.37% to $66.38, leaving it down almost 4% for the week.

- Brent fell -6.42% overnight $69.85 also trading through all major moving averages.

- The falls continued in Asia, sliding to $69.58 leaving it down 5% for the week

- With tariffs placed on India and China being more significant, the outlook for these two major crude importers is now uncertain and oil price movements have reflected this.

- The US Department of Energy is to announce the award of a contract in excess of $1bn for the management of the US Strategic Reserve, with an objective of restocking the depleted reserves. This could have significant implications for demand as the reserve has capacity of up to 700 million barrels and is less than half of that at present.

- Exxon Mobil says it may deliver a $2.7bn gain in quarterly profit as a result of higher prices last year.

GOLD: Even Gold Suffers With Tariffs

- Gold is ending the week with poor momentum, down -0.70% in Asia trading.

- With a new high in place at US$3,167.83 gold opened in Asia at $3,114.80 only to move lower throughout the trading day to be at $3,093.81.

- Gold has had somewhat of a more volatile week so far as profit takers emerge on new historic highs.

- Gold is holding on to a weekly gain standing at +0.30% at present, having recorded just one week of declines in 2025.

- The National Bank of Kazakhstan was a seller of gold last year as prices rose and had previously indicated that they would be a seller at USD$3,100 but for now the Deputy Governor prefers to wait given global uncertainty.

- The finalization of the tariffs from the US has brought to a halt an arbitrage in gold markets that has driven bullion demand for several months. For some time, New York prices traded at a premium to global prices, incentivizing the importation of gold into the US prior to tariffs. However, with tariffs now finalized this window has now closed.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 04/04/2025 | 0545/0745 | ** | Unemployment | |

| 04/04/2025 | 0600/0800 | ** | Manufacturing Orders | |

| 04/04/2025 | 0600/0800 | *** | Flash Inflation Report | |

| 04/04/2025 | 0630/0730 | DMO announce Apr-Jun issuance operations | ||

| 04/04/2025 | 0645/0845 | * | Industrial Production | |

| 04/04/2025 | 0700/0900 | ** | Industrial Production | |

| 04/04/2025 | 0730/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 04/04/2025 | 0800/1000 | * | Retail Sales | |

| 04/04/2025 | 0800/1000 | ECB's De Guindos Gives Lecture In Barcelona | ||

| 04/04/2025 | 0830/0930 | ** | S&P Global/CIPS Construction PMI | |

| 04/04/2025 | 1230/0830 | *** | Employment Report | |

| 04/04/2025 | 1525/1125 | Fed Chair Jerome Powell | ||

| 04/04/2025 | 1600/1200 | Fed Governor Michael Barr | ||

| 04/04/2025 | 1645/1245 | Fed Governor Chris Waller | ||

| 04/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 04/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 05/04/2025 | 0915/1115 | ECB's Schnabel At Economy and Finance Workshop |